In this research report, we will look at Wipro Share Price Target. We will look into its business, its results and its future growth prospect.

We will understand, what Wipro Ltd Products are ? In this report we will then see what company is doing next to grow in future.

Before that, Please subscribe to our newsletter, so you never miss an article from us when its published.

Company Overview:

Wipro is one of the leading global IT, consulting and business process services company. It is the fourth largest Indian player in the global IT services industry, in terms of revenue, after Tata Consultancy Services (TCS), Infosys Limited (Infosys) and HCL Technologies Limited (HCL).

They harness the power of cognitive computing, hyper-automation, robotics, cloud, analytics and emerging technologies to help their clients adapt to the digital world and make them successful.

Wipro was incorporated in 1945 as Western India Vegetables Product Limited and was predominantly a consumer care product manufacturer till 1980 after which it diversified into the IT services business.

With effect from April 1, 2012 (FY2013), the company demerged its other divisions (consumer care and lighting, medical equipment and infrastructure engineering) into a separate company called Wipro Enterprises Limited (WEL).

This was done to enhance its focus and allow both businesses to pursue their individual growth strategies. Wipro has over 220,000 dedicated employees serving clients across six continents

Services & Holding Details:

Services:

The company’s Key offerings under IT related products and Services are digital strategy advisory, customer centric design, technology consulting, IT consulting, custom application design, development, re-engineering and maintenance, systems integration, package implementation, cloud infrastructure services, analytics services, business process services, research and development and hardware and software design to leading enterprises worldwide.

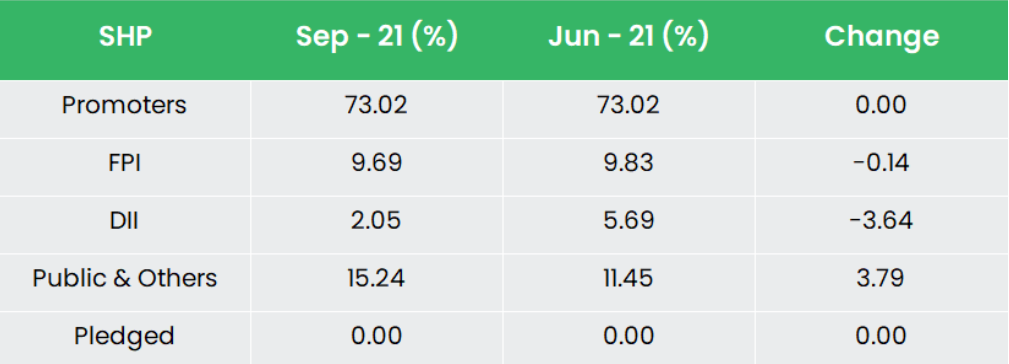

Holding Details:

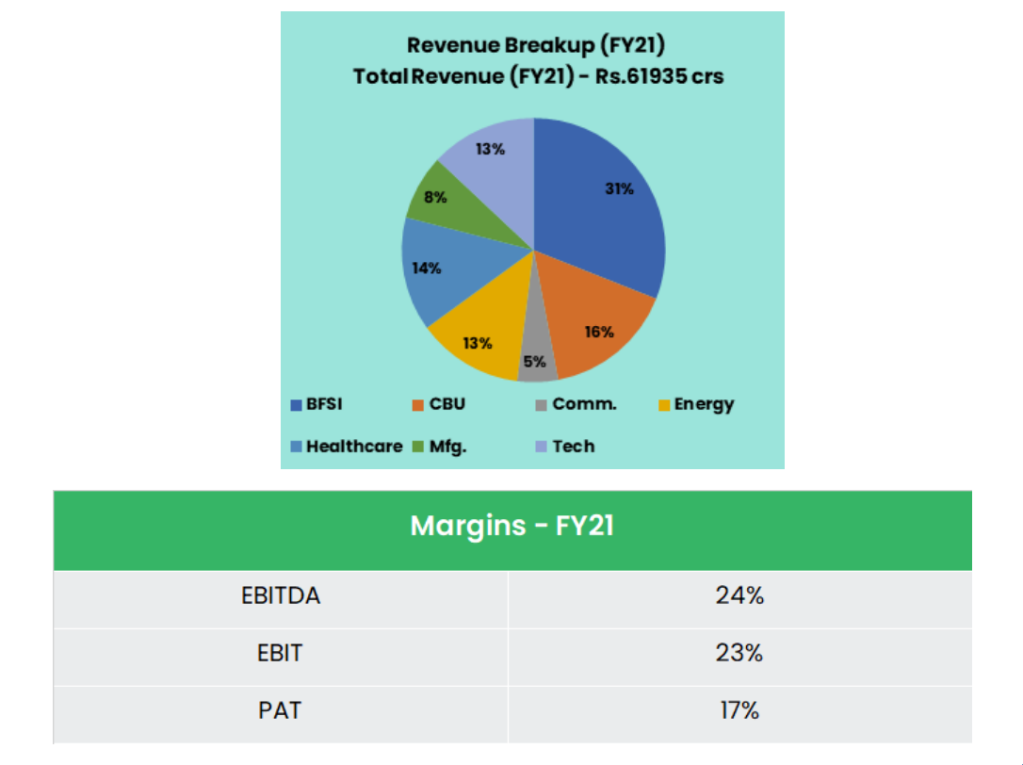

Subsidiaries & Margin:

The Company has 80+ subsidiaries as of Mar’22.

Key Rationale:

Strategic relationships with diversified with clientele:

Wipro has a strong base of 1,120 customers with 98.0% of the business generated from existing clients in FY2021. Company has added 280 new customers in FY2021 as against 240 customers in FY2020.

Clients in ‘More than USD 75 million’ bucket increased from 22 in FY2020 to 27 in FY2021. The company is witnessing healthy renewal of deals and adding new deals from existing clients in the field of digitization.

Going forward, Wipro is expected to maintain a diversified revenue stream across customers in various segments.

New Management:

Wipro appointed Mr. Thierry Delaporte as new CEO & Managing Director on the board. Thierry has a proven track record of building highly successful businesses, driving change, leading cross-cultural teams as well as conceptualizing and integrating mergers & acquisitions.

He was deeply involved in setting the group’s transformation agenda and was instrumental in executing several strategic programs across various business units.

Mr. Delaporte has focus on the following areas to:

1) Engage more with existing clients (to increase the wallet sharing)

2) Better leverage the relation with big technology firms.

3) Connect with top 70-80 clients to understand the needs of the clients.

4) Interact with various shareholders including employees.

Q3 FY22:

The company generated a revenue growth of 3.2% QoQ and 30% YoY in Q3FY22. The growth in revenues was led by BFSI (up 4.1% QoQ), Communication (3.8% QoQ) and Consumer Business Unit (up 5.2% QoQ) while Energy was a laggard where it reported 2.2% QoQ decline. This has also been seen in Wipro Share Price Target

The company completed two acquisitions during the quarter.

- It acquired Austin, Texas based Edgile for US$230 mn (US$44.1 mn revenue for CY20). The company operates in the information security consulting space providing professional services in cloud security and risk management.

- It acquired LeanSwift solutions for US$21 mn (US$18 mn revenue for CY20). The company is a Cloud ERP Alliance partner. It provides everything for Clients M3 implementations, upgrades and services .

Financial Performance:

The company has a strong balance sheet with a debt-to-equity ratio of 0.2 and a cash and equivalents of Rs.33120 crs as of H1FY22.

The company maintained a 20%+ EBITDA margins for many years historically.

Wipro’s cash flows are expected to remain robust with healthy cash accruals despite high cash pay-out for CAPCO acquisition of USD 1.45 billion in April 2021.

Going forward, the metrics are expected to be in line with past trends and remain healthy backed by revenue growth and healthy liquidity position.

Industry Analysis:

The global sourcing market in India continues to grow at a higher pace compared to the IT-BPM industry. India is the leading sourcing destination across the world, accounting for approximately 55% market share of the US$ 200-250 billion global services sourcing business in 2019-20.

The IT industry accounted for 8% of India’s GDP in 2020. According to STPI (Software Technology Park of India), software exports by the IT companies connected to it, stood at Rs. 1.20 lakh crore (US$ 16.29 billion) in the first quarter of FY22.

The IT & business service industry’s revenue was estimated at ~US$ 6.96 billion in the first half of 2021, an increase of 6.4% YoY.

The export revenue of the IT industry is estimated at US$ 150 billion in FY21. According to Gartner estimates, IT spending in India is estimated to reach US$ 93 billion in 2021 (7.3% YoY growth) and further increase to US$ 98.5 billion in 2022.

The BPM sector in India currently employs >1.4 million people, while IT and BPM together have >4.5 million workers, as of FY21. Indian software product industry is expected to reach US$ 100 billion by 2025.

Growth Drivers:

In August 2021, the Union Minister of State for Electronics and Information Technology, Mr. Rajeev Chandrasekhar, announced that the IT export target is set at US$ 400 billion for March 2022.

In addition, the central government plans to focus in areas, such as cybersecurity, hyper-scale computing, artificial intelligence and blockchain.

In Budget 2021, the government has allocated Rs.53,108 crore (US$ 7.31 billion) to the IT and telecom sector.

The computer software and hardware sector in India attracted cumulative foreign direct investment (FDI) inflows worth US$ 71.05 billion between April 2000 and March 2021.

The sector ranked 2nd in FDI inflows as per the data released by Department for Promotion of Industry and Internal Trade (DPIIT).

Outlook:

Large deal wins are largely net-new deals. The company’s investment in building a dedicated large deals team and competent senior level account executives for strategic accounts (~70% of revenue) is driving sales traction.

The management is focused on driving a turnaround with improving visibility in deal win success and growth acceleration.

Completion of organizational and leadership changes will bring the focus back to the business. Demand in Europe is particularly strong due to the adoption of cloud, digital transformation, and driving efficiencies in the core to optimize cost.

The company’s management has given Q4FY22 guidance of 2%-4% revenue growth in CC terms and its commentary continues to be positive in the verticals such as BFSI, Hi-tech Media, Life Sciences, and Communications.

The Retail vertical is expected to recover slowly across geographies in the near term. IT Services hiring continue to remain strong with a closing headcount at 2,31,671 to ensure timely delivery.

Valuation:

Over the years, Wipro has proactively built a resilient business. Furthermore, its EBITDA margins are likely to expand in the near term driven by long-term contracts with the world’s leading brands, depreciation in INR, lower travel cost, and lower on-site expenses.

Hence, we recommend a BUY rating in the Wipro Share Price Target with the price (TP) of Rs.748, 33x FY22E EPS. Timeframe for this Price is 1 Year.

Risks:

Forex Risk – Fluctuations in the USD-INR and GBP-INR and GBP-USD, as majority of the revenue comes from international territories. Fluctuation in the currencies will impact the revenue of the company.

Visa related Risk – Increase in Visa fees will increase the cost. Rise in the visa fees will lead to rise in the operating cost (Employee expenses) to IT industry. So it plays a major role in the IT industry.

Remuneration Risk – Salary hikes i.e., wage inflation may play as a spoil sport. Rising economic growth will create more jobs in the country. This will ultimately give rise to wages hikes.

Wage hikes will affect the operating margins of the company. So, fluctuation in the wages is considered to be significant risk in IT service Industry.

Hope you liked our Article on Wipro Share Price Target and company Overview , please read our other articles on “KPIT Share Price Target and Company Overview“