In this research report, we will look at IEX Share Price Target 2022. We will look into its business, its results and its future growth prospect.

We will understand, what IEX Ltd Products are ? In this detailed report we will see what company is doing next to grow in future which will also impact on IEX Share Price Target 2022.

Before that, Please subscribe to our newsletter, so you never miss an article from us when its published.

Company Overview:

IEX (Indian Energy Exchange) is India’s premier energy exchange providing a nationwide, automated trading platform for physical delivery of electricity, renewable energy and certificates including renewable energy certificates as well as the energy saving certificates.

The exchange platform enables efficient price discovery and increases the accessibility and transparency of the energy market in India while also enhancing the speed and efficiency of trade execution.

The Exchange is ISO Certified for quality management Information security management and environment management since August 2016.

IEX is a publicly listed company with NSE and BSE since October 2017. Company is approved and regulated by Central Electricity Regulatory Commission since 27 Jun 2008.

The exchange is having a robust eco system of 7000+ registered participants, 4400+ commercial & industries, 55+ Discoms, 600+ Generators, etc.

Products & Services:

The company has various types of products which are listed below:

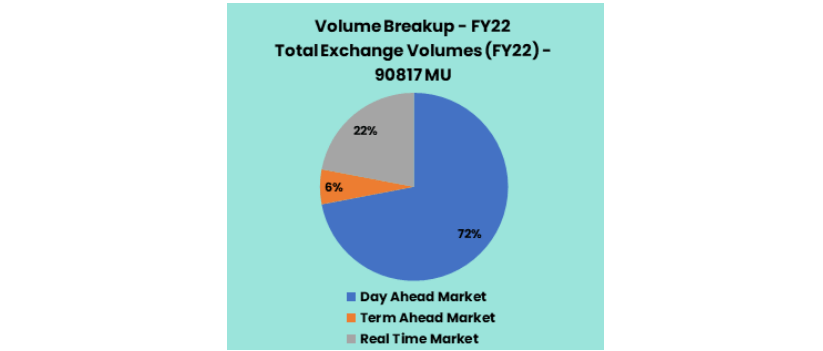

Day Ahead Market (DAM) – DAM is a physical electricity trading market for deliveries for any/some/all 15 minute time blocks in 24 hours of next day starting from midnight.

Term Ahead Market (TAM) – TAM provides a range of products allowing participants to buy/sell electricity on a term basis for a duration of up to 11 days ahead.

Real Time Market (RTM) – Electricity Delivery After 4-time blocks or 1 hour of delivery.

Renewable energy certificates – RECs are tradable, intangible energy commodities which represent the attributes of electricity generated from renewable resources.

Green Term Ahead Market – GTAM is a new market segment for trading in renewable energy following the CERC approval.

Subsidiaries & Holdings:

The company had only one subsidiary named Indian Gas Exchange Ltd which was divested now and no longer a subsidiary.

Key Rationale:

Strong Market Position:

IEX is the first and the largest energy exchange in India. It allows for trading of electricity on its platform just like NSE and BSE allow trading of stocks.

There are electricity generation companies (called gencos) like NTPC, Tata Power, Adani Power, etc. Then there are energy distribution companies (discoms).

IEX comes in between the generation and distribution companies. IEX’s primary revenue sources include transaction fees (about 84% of revenues) and annual subscription fees (5% of revenues).

Since the commencement of its business in 2008, the trading volume on its exchange has been increasing at a staggering rate of over 33% CAGR.

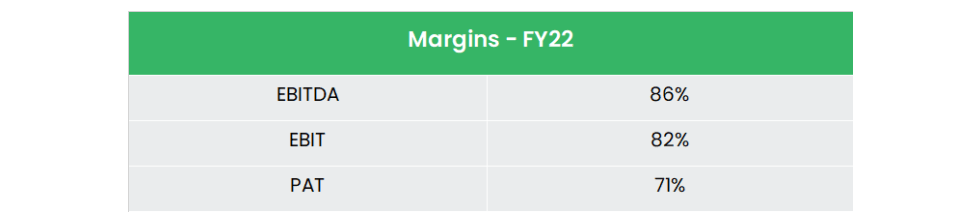

The company made a revenue growth of 19.4% YoY to Rs.112 crs, EBITDA growth of 23% to Rs.95 crs and PAT growth of 42% to Rs.88 crs in Q4FY22.

Strong Moat:

About 95% of electricity traded on the exchange is through IEX. IEX has been a dominant player in India’s duopoly market; PXIL is the other player.

Both players started operations almost at the same time in FY09. However, over the years, IEX has dominated the market and captured a 95% of market share.

PXIL is promoted by National Stock Exchange, NCDEX, Tata Power, PFC, GMR Energy, and Gujarat Urja Vikas Nigam.

PXIL currently is a loss-making entity with a market share of only 5%. IEX has a overall market share of 95% with 99% market share in DAM & RTM, 80% in Green power, 72% in REC and 97% in Energy Savings Certificates.

Divestment of Subsidiary:

IEX has entered into multiple strategic partnerships for its wholly owned subsidiary IGX. The recent partnership is with Indian Oil Corporation of India (IOCL), where IEX has sold around 4.93% stake.

Onboarding of IOCL as a strategic partner will help IGX and Indian gas market to align to the government’s vision of accelerating the share of gas in the energy mix to 15% by 2030.

With this transaction, IGX is no longer a subsidiary of the company. However, IEX and NSE (National Stock Exchange) are the promoters of IGX and other strategic investors include GAIL (India) Ltd, ONGC Ltd, Torrent Gas Pvt Ltd and Adani Total Gas Ltd.

Financial Performance:

The company has been completely debt free for the past 10 years with around Rs.1480crs of cash and cash equivalents (9% of the Market Cap.) making the balance sheet robust.

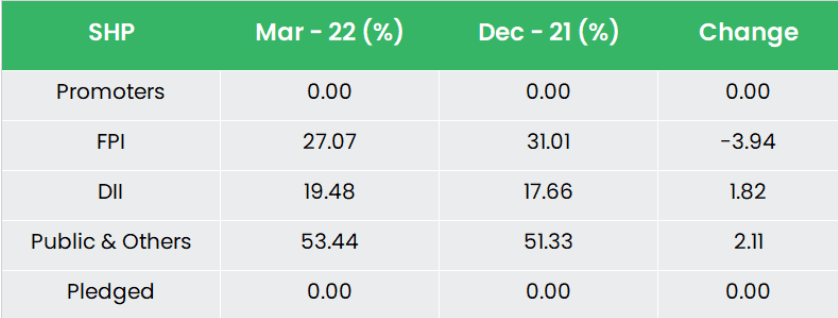

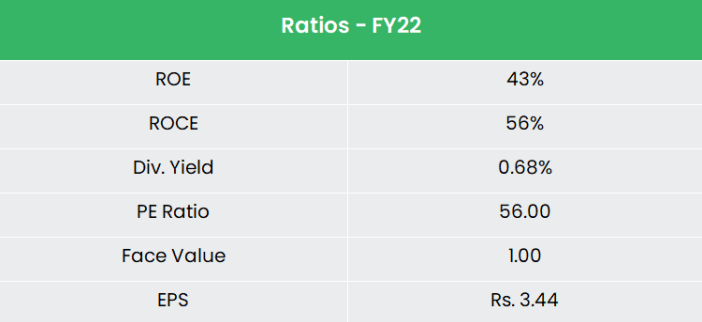

The Revenue and PAT CAGR of the company for the past 5 years is around 16% and 25% (FY18- FY22).

The 5-year Average ROE for the company is around 45% for the same period.

The company has made a operating cashflow of more than Rs.1000 crs in the past 3 years.

Industry Analysis:

India’s power sector is one of the most diversified in the world. Sources of power generation range from conventional sources such as coal, lignite, natural gas, oil, hydro and nuclear power to viable non conventional sources such as wind, solar, and agricultural and domestic waste.

India is also the third-largest producer and second-largest consumer of electricity worldwide, with an installed power capacity of 395.07 GW, as of January 2022.

As of January 2022, India’s installed renewable energy capacity stood at 152.36 GW, representing 38.56% of the overall installed power capacity.

Solar energy is estimated to contribute 50.30 GW, followed by 40.1 GW from wind power, 10.17 GW from biomass and 46.51 GW from hydropower.

The renewable energy capacity addition stood at 8.2 GW for the first eight months of FY22 against 3.4 GW for the first eight months of FY21.

For FY21, electricity generation attained from conventional sources was at 1,234.44 BU, comprising 1,032.39 BU of thermal energy; hydro energy (150.30 BU) and nuclear (42.94 BU). Of this, 8.79 BU was imported from Bhutan.

Growth Drivers:

Total FDI inflow in the power sector reached US$ 15.84 billion between April 2000-December 2021, accounting for 2.77% of the total FDI inflow in India.

The government is considering expansion of the size and reach of competitive power markets or spot trading with a view to buy 25% of the total electricity supply through power exchanges by the end of 2023-24.

As of last year, India’s per capita consumption of electricity was 1181 units. By 2025, it is expected to reach 1616 units, an increase of about 37%.

This potential increase in electricity consumption will have a direct, positive impact on the trading volumes in exchanges.

Outlook:

IEX enjoys a virtual monopoly in the power exchange segment; it has gradually increased its market share in overall short-term power market to 54% from 11% in FY10.

It has consistently grabbed market from other market participants, due to product offering (provide flexibility to the customer), transparency (low cost and assured supply) and payment security. Since 2010, the volume increased by a CAGR of 33%.

The existing products will help company to grow by 2-2.5x of growth in electricity consumption and the management has guided around 20-25% volume growth for the next year.

The newly launched products widened the immediate growth opportunities; 1) RTM (addressable market ~18-20 BU) and 2) gas exchange (40-45 mmscmd valued at Rs.2.5-3.0 bn), which started a meaningful contribution to the Revenue & EBIDTA and will accelerate more in the next 2-3 years.

Valuation:

IEX has been a pioneer of power trading in India and with the transformational journey. The Indian power market is headed towards ‘One Nation, One Grid and One Price.

The volumes on the platform have been on the rise over the last many quarters with new product addition and shift of volumes from traditional modes of transaction. IEX Share Price Target 2022 is below:

At CMP, the stock trades at 38x of FY24E EPS. We recommend a BUY rating in the IEX Share with the target price (TP) of Rs.230, 45x FY24E EPS.

Risks:

Regulatory Risk – IEX is regulated by CERC which is a key regulator of power sector in India. It also decides the per unit charge that exchanges charge on trading. It may pass regulations like introduction of new exchange or decreasing the per unit charge) that can harm the monopoly status and the margins which IEX enjoy.

Competitive Risk – Entry of any New exchange or any aggressive move by PXIL may impact the volume growth which results in a competitive risk.

Product Execution Risk – New product introduction would help market participants to optimize their energy requirement through combination of product mix and that would play a significant role in overall power sector development and power exchanges. Any delay in product launch may derail the growth momentum for the company.

Hope you liked our Article on IEX Share Price Target 2022 , please read our other Research Report on “Wipro Share Price Target 2022“