In this research report, we will look at Jubilant Food Share Price Target 2022. We will look into its business, its results and its future growth prospect.

We will understand, what Jubilant Food Ltd Products are ? In this detailed report we will see what company is doing next to grow in future.

Before that, Please subscribe to our newsletter, so you never miss an article from us when its published.

Jubilant Food Company Overview:

Jubilant Foodworks Limited is India’s largest foodservice company and is part of the Jubilant Bhartia group. Incorporated in 1995, JFL holds the exclusive master franchise rights from Domino’s Pizza Inc. to develop and operate the Domino’s Pizza brand in India, Sri Lanka, Bangladesh, and Nepal.

In India, JFL has a strong and extensive network of 1,495 Domino’s restaurants across 322 cities. In Sri Lanka, the Company operates through its 100% owned subsidiary which currently has 32 restaurants.

JFL also enjoys exclusive rights to develop and operate Dunkin’ restaurants in India and Popeyes restaurants in India, Bangladesh, Nepal and Bhutan. JFL currently operates 29 Dunkin’ restaurants across 8 Indian cities.

Jubilant Food launched its first Popeyes restaurant in Bengaluru, India. In 2019, JFL launched its first owned restaurant brand ‘Hong’s Kitchen’ in the Chinese cuisine segment which already has 14 restaurants across 3 cities.

Products & Services:

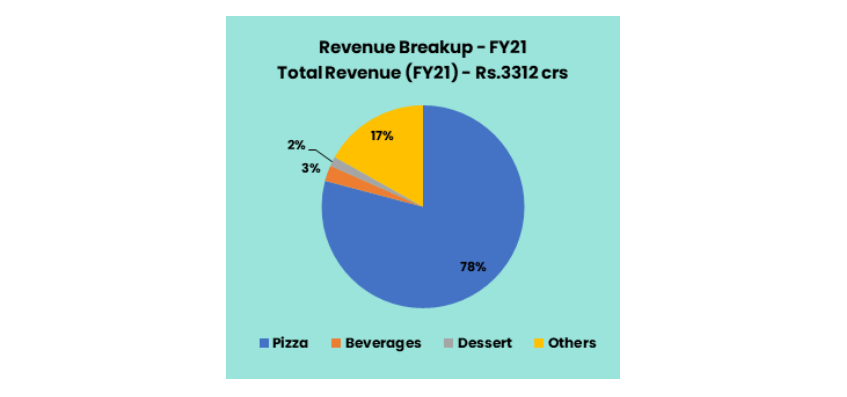

The company has various offerings under 5 brands namely Domino’s Pizza – Pizza Varieties, Dunkin Donuts – Donut Varieties, Hong’s Kitchen – Chinese cuisine, EkDum! – Biryani Varieties, Popeyes – Fried Chicken Varieties and Chefboss – Ready to cook products.

Subsidiaries:

As on 31st Mar 2021, the company has four subsidiaries namely Jubilant Foodworks Lanka (Pvt.) Ltd, Jubilant Golden Harvest Ltd., Jubilant Foodworks Netherlands B.V and Fides Food Systems Cooperatief U.A.

Key Rationale:

Strong Market Position:

JFL is a leading food service company in India with a dominant market share of 70% in the QSR pizza segment. Domino’s Pizza has managed to achieve the highest market share in terms of number of outlets (19% in FY21), driven by attractive value proposition, aggressive marketing and a strong home delivery network.

The company sees potential of ~3,000 Domino’s Pizza stores in India over the medium term, thereby indicating that there is headroom for ~1,500 more Domino’s stores.

In terms of Business model, Jubilant holds the master franchise for Domino’s Pizza and Dunkin’ in India which is kind of a Moat as it has the exclusive rights to appoint sub franchise in the given territory (India).

With its new foray into the biryani category (the highest consumed dish as per food aggregators), JFL has become part of India’s highest consumed cuisine. Although still at a nascent stage, the company’s entry will play a role in formalization of a highly unorganized space.

The company is indirectly exposed to the North Indian cuisine through its 10.76% stake in Barbeque Nation Hospitality Ltd.

In search of a successor:

The CEO of Jubilant FoodWorks (Jubilant), Mr. Pratik Pota, has announced his resignation. Mr. Pota will continue to serve as the CEO until 15th June 2022.

The company has appointed an external agency to search for a suitable replacement. The company is changing into a tech-enabled food company, the CEO replacement would be tech-focused as well.

Mr. Pota is quitting the company for quasi-entrepreneurial opportunities in a different industry.

Q3FY22 Results & Margins:

Net revenue was up 13% YoY (flat in Q3FY21, +37% in Q2FY22). Like for Like growth came in line at +7.5% YoY (-0.2% in Q3FY21, +29.4% in Q2FY22).

OLO (Online Ordering) contribution to delivery stood at 97.6% while app downloads stood at 8.2mn (the highest in a quarter). Dine-in + Takeaway is at 94%, vs. 78% in Q3FY21 (82% in Q2FY22).

Company remains on track to open its targeted 3,000 Domino’s stores in the domestic market. During Q3FY22, company opened 75 new stores taking the total count (as of 31st December, 2021) to 1,495, with system sales growing 112.9% on YoY basis owing to significant recovery in delivery and takeaway channels.

Its Dunkin’ network grew to 29, while the combined count of Hong’s Kitchen and Ekdum! went up to 22.

Financial Performance:

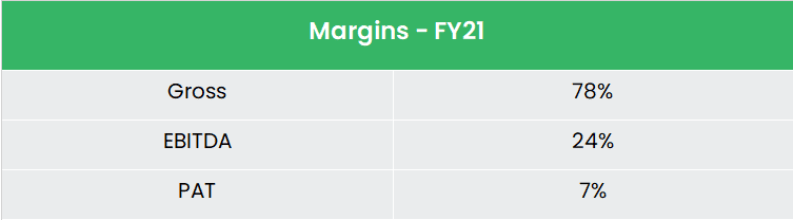

The company has been completely debt free since 2011 under the normal accounting.

The lease liabilities are treated as liabilities and the Debt-to-Equity Ratio is equal to 1 as of FY21.

It is not alarming since the company is having zero borrowings in the liabilities side since 2011. The revenue and PAT CAGR of the company for the past 10 years are 17% and 12% respectively.

Industry Analysis:

The Indian Food industry is valued at Rs.4.5 trillion and it is expected to grow at 9% till FY25. The organized space is growing faster at 15% CAGR and the same is gaining market share with 18% in FY10, 29% in FY15 and 38% in FY20.

The Quick Service Restaurant (a.k.a. QSR going forward) market grew at a rate of 17.27% from FY 2016 to FY 2020 and is expected to reach an enormous size of ~Rs.826.37 billion by FY2025.

While both chain and standalone QSR are set to contribute to the predicted growth equally, chain QSRs lead the market share with an occupancy of 54.2%.

The QSR segment is experiencing growth as a result of technological innovations as well, like improved Point of Sale (POS) systems, varied payment options, and improved geolocation to aid the delivery segment.

The take-away segment is expected to grow at 18.0%, and the home delivery segment is expected to grow at around 17.4% between FY 2021 and 2025.

Growth Drivers:

Online ordering has seen an unprecedented growth during the pandemic due to the lockdown. The Estimated size of India’s online food delivery market by 2026 is US$ 21.41 Bn from US$ 4.66 Bn in 2020.

The increasing likelihood of eating out without a special occasion and ease of access to multiple options is a driving force in getting the masses attracted to the new entrant (QSR) in the food industry.

India has one of the youngest populations versus other leading economies.

The median age in India in CY20 is estimated to be 28.7 years compared to 38.5 and 38.4 years in the United States and China, respectively.

The growing working age population has been a key factor contributing to the growth of the food business.

Outlook:

As pandemic has accelerated the push towards digitalization and thus the company has an endeavor to be Foodtech company, therefore the company is continuously focusing on growing its digital assets and made some change in its app to enhance user experience.

Moreover, the company introduced “Hello Domino’s” Toll-Free number to allow customers to call and use voice to place orders.

Management expects that the company’s growing strength in digitalization will enhance the customer engagement and will also improve its employee’s efficiency.

The Company also acquired exclusive master franchise rights to operate and sublicense the iconic Popeyes brand in India and in the neighboring countries which are Bangladesh, Bhutan, and Nepal.

Company will continue to invest in expanding its portfolio brands through Hong’s Kitchen, Popeyes, ‘Ekdum!’, Dunkin’ Donuts, etc., as management aim to own a much larger share of occasions.

Management expects that Popeyes will be an exciting addition to the Company’s portfolio of brands and is expected to become one of the key drivers of growth for the company in the coming years.

Valuation:

Company’s long term future growth prospects remain bright, as ongoing expansion of existing brand outlets, and introduction of Popeyes will continue to drive growth.

The CEO’s Exit is a short-term concern until the new successor arrives.

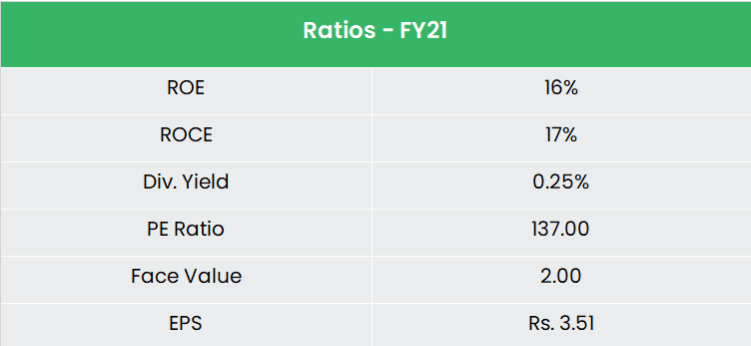

At CMP, the trades at 53x of FY24E EPS. We recommend a BUY rating with Jubilant Food Share Price Target 2022 with the price (TP) of Rs.575, 63x FY24E EPS

Risks:

Management Risk – The recent exit of the company’s CEO made a deep correction in stock price and an uncertainty situation in terms of the future business growth. The CEO was the important person for the growth story of the company. Any consistent exits at senior level will further add a question mark on the company’s ability to retain talent.

Competitive Risk – With 60% of the total food services industry (by revenue) being driven by the unorganized segment, the Indian food services industry remains highly fragmented. While the market fragmentation has facilitated international & domestic chains to grow at a fast pace, the appeal of the high growth potential of this industry is attracting more & more players, thereby leading to rise in competition for

the existing players.

Product Concentration Risk – JFL added 146 stores in FY21 (FY20:130; FY19:103), with 134 being Domino’s stores (123, 102). As JFL’s management plans to expand its brand portfolio, along with geographical diversification of operations, it may expose the company to execution risks.

Hope you liked our Article on Jubilant Food Share Price Target 2022 , please read our other Research Report on “Wipro Share Price Target 2022“