In this research report, we will look at Eicher Motors Share Price Target 2022. We will look into its business, its results and its future growth prospect.

We will understand, what Eicher Motors Ltd Products are ? In this detailed report we will see what company is doing next to grow in future which will also impact on Eicher Motors Share Price Target 2022.

Before that, Please subscribe to our newsletter, so you never miss an article from us when its published.

Company Overview:

Eicher Motors Limited (EML), incorporated in 1982, is the listed flagship company of the Eicher Group in India and a leading player in the Indian automobile industry.

On a standalone basis, EML manufactures and markets motorcycles under the iconic Royal Enfield brand, with its production facilities based in Chennai, Tamil Nadu. Additionally, the company operates as a holding company for investments in VE Commercial Vehicles Limited.

A joint venture of EML (54.4%) and AB Volvo (45.6%), VECV came into existence with effect from July 1, 2008.

The JV is engaged in EML’s truck and bus operations, auto components business and technical consulting services business and Volvo Group’s Indian truck sales and marketing functions, as well as service and spares network operations for both Volvo trucks and buses.

In 2020, VECV successfully integrated Volvo Buses India into VECV, including the manufacture, assembly, distribution, and sale of Volvo Buses in India.

Products & Services:

The company has various products under its two business segments:

Royal Enfield – The Company has models like Bullet 350, Classic 350, Meteor 350, Himalayan, Scram 411 and 650 Twins.

VECV – It consists of Heavy, Light & Medium Duty trucks, Buses, special applications like ambulances from Eicher and Volvo Brands. It also has Engine Business, Engineering component business and Powertrain business.

Subsidiaries:

As on 31st Mar 2022, the company has 5 subsidiaries, 2 Joint Ventures and 2 subsidiaries of Joint Ventures

Key Rationale:

Strong Market Position:

Eicher Motors (EML) is the market leader in the 250 cc premium motorcycle segment (market share ~90%+) through its aspirational models under the Royal Enfield (RE) brand, such as Bullet, Classic, Interceptor among others.

The same has a market share of 28.7% in the above 125cc segment. The VECV division has a overall CV market share of 16.6% with 29.3% in L&MCV, 6.6% in HCV, 21.6% in Buses, 83.9% in Volvo trucks India (High End premium Segment).

The dealer network of the Royal Enfield (2W Division) have grown 4x in 7 years from just 527 stores in FY16 to 2118 stores in FY22.

In that 2118 stores, 1055 belongs to studio stores and 1063 belongs to Large Size stores. These stores are spread across ~1750 cities in India.

New Launches:

Regular new launches and product variations underpin RE’s technical prowess. With launch of the Himalayan (early 2016), The Twins (FY2019) and Meteor (FY2021).

It has demonstrated its capability to develop new models from the ground up, incorporating new engines as well as a platform.

This has given the existing RE users a chance to upgrade and helped ramp up its presence in export markets. RE Classic 350 based on new J platform gained good traction in international market with Himalayan and scram created new category of budgeted adventure tourer.

Semiconductor shortage impacted sales of newly launched Scram 411.

Appointment of New CEO:

Subsequent to the Board of Directors meeting Eicher Motors announced the appointment of B. Govindarajan as Chief Executive Officer of Royal Enfield.

With this appointment, Govindarajan will now be CEO – Royal Enfield, and Whole time Director on the Board of Eicher Motors Ltd.

Govind has spent more than 23 years across Royal Enfield and Eicher Motors.

He has led the successful development and launch of several award winning motorcycles at Royal Enfield including the Himalayan, the 650 Twin platform and motorcycles, and more recently, the J-series platform with the all-new Meteor and Classic 350.

Financial Performance:

Consolidated revenues for Q4FY22 were at Rs.3,193 crore up 10.9% QoQ. Average Selling Price (Revenue per Unit) at Royal Enfield (RE), were up 2.9% QoQ to ~Rs.1.7 lakh/unit. RE sales volumes were at ~1.86 lakh units, up 9.5% QoQ.

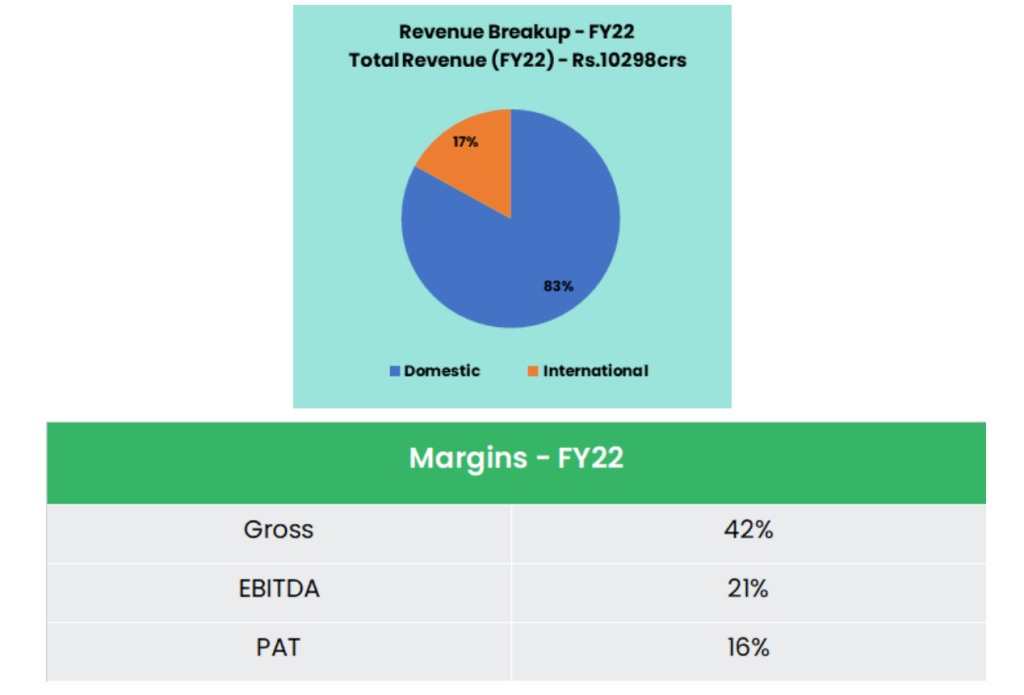

For FY22, overall revenues stood at Rs.10298 crs (18% YoY) with ASP at RE at Rs.165 lakh/unit. FY22 Volumes of RE at 6.02 lakh units and VECV at 57k units.

The balance sheet stands strong with Zero Debt to Equity ratio and a cash & equivalents of Rs.10450 crs (~14% of the company’s Market Cap.)

Industry Analysis:

The Indian automotive industry is expected to reach US$ 300 billion by 2026. India’s annual production of automobiles in FY21 was 22.65 million vehicles, and 13 million vehicles were produced between April October 2021.

The two wheelers segment dominates the market in terms of volume owing to a growing middle class, and a huge percentage of India’s population being young.

Moreover, the growing interest of the companies in exploring the rural markets further aided the growth of the sector.

For the calendar year (CY) 2021, all segments showed growth, and total sales increased by 5.8% to 18.49 million units, compared to 17.47 million units in January-December 2020.

In CY21, passenger vehicles sales increased by 26.6% to 3.08 million units, up from 2.43 million units in CY20. The total number of commercial cars sold was 677,119, up 34% from 505,102 in the previous year.

Automobile exports reached 4.13 million vehicles in FY21, growing at a CAGR of 3.47% during FY16-FY21. Two wheelers (79.38%), passenger vehicles (9.79%) and three wheelers (9.52%) made up the majority of exports from India.

Growth Drivers:

The automobile sector received cumulative equity FDI inflow of about US$ 30.78 billion between April 2000 and September 2021.

In the Union Budget 2022-23, the government introduced a battery-swapping policy, which will allow drained batteries to be swapped with charged ones at designated charging stations, thus making EV’s more viable for potential customers.

In September 2021, the Indian government issued notification regarding a PLI scheme for automobile and auto components worth Rs.25,938 crore (US$ 3.49 billion).

This scheme is expected to bring investments of over Rs.42,500 (US$ 5.74 billion) by 2026, and create 7.5 lakh jobs in India.

Outlook:

After witnessing severe headwinds over the last 2 years, the demand for RE is expected to improve going forward on account of new launches and ongoing expansion in the international markets.

The management indicated that the monthly booking run-rate remains healthy with a robust order book. Supported by the New Classic and Meteor, booking rates are improving on a MoM basis.

Volumes should recover in FY23 albeit of a low base. Supply side issues persist but RE is gradually ramping up production. It has also developed alternate suppliers for chips over the last year to combat the chip shortage.

Commodity costs will continue to weigh on margins in the near-term. While precious metals have cooled off, base metals prices continue to remain elevated.

Given strong ramp up of exports, freight costs have also gone up which is likely to continue in the near term.

Additionally, advertisement spends will also sustain at current levels under brand building exercise. As a result, other expenses are expected to remain at 12-13% of sales going forward.

Valuation:

The company continues to expand its addressable market via increasing its distribution network, new product launches, and personalization initiatives through the ‘Make it Yours’ (MIY) platform.

VECV is also expected to see a cyclical recovery in volumes and profits as the CV industry recovers.

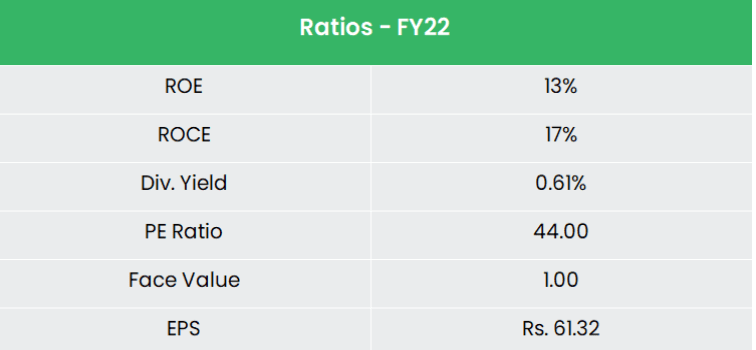

At CMP, the stock trades at 35x of FY24E EPS. We recommend a BUY rating in the stock with the target price (TP) of Rs.3150, 40x FY24E EPS.

Risks:

Dependency Risk – The company’s growth has been driven by the over 250-cc motorcycle sub segment in the last few years. It has no presence in the high volume (75-110 cc) sub-segments. Even in the over 250-cc sub segment, its Classic 350 model accounts for ~70% of total volumes. Strong competition to its leading model could significantly hurt its volumes.

Cyclical Risk – The VECV segment of the company is highly susceptible to the cyclicality of the Commercial Vehicle Industry which can impact the sales growth of the same segment.

Slowdown Risk – EML has negligible presence in the mass and mid-market 2-wheeler segment. A sustained slowdown in the economy could hamper the discretionary spending and can also result in downtrading across consumer categories which can impact growth of premium motorcycles in short to medium term.

Hope you liked our Article on Eicher Motors Share Price Target 2022 , please read our other Research Report on “Wipro Share Price Target 2022“