In this research report, we will look at MTAR Technologies Share Price Target 2022. We will look into company business, its declared results and its future growth prospect.

What MTAR Technologies Ltd Products are ? We will then see what company is doing next to grow in future which will also impact on MTAR Technologies Share Price Target 2022.

Before we go further, please subscribe to our newsletter, so you never miss an article from us when its published.

Company Overview:

MTAR started as a partnership firm in 1970 and was incorporated as a private limited company in 1999 by Late P. Ravindra Reddy, Sri K. Satyanarayana Reddy and Sri P. Jayaprakash Reddy.

The company’s plants are ISO 9001:2015 and AS9100C certified. The company currently operates through 7 manufacturing facilities, including an export-oriented unit (“EOU”).

These manufacturing facilities, each of which is situated in Hyderabad, Telangana, employ advanced equipment to undertake precision machining, assembly, testing and quality control, surface treatment, heat treatment, electroplating facilities and other specialized processes, leading to them being a one-stop solutions company for their customers.

The company incorporated a wholly owned subsidiary, Magnatar Aero Systems Private Limited (MASPL), in FY2020 to reach out to global OEMs who either have defense deals with India or have their business operations in India. However, till date there are no operations in the subsidiary.

Products & Services:

It primarily manufactures various machine equipment, assemblies, sub-assemblies, precious tools and spare parts for energy, nuclear, space, aerospace, defense and other engineering industries.

Nuclear & Space – Complex nuclear assemblies manufacturing such as fuel machining head, thimble package, top hatch beam, bridge and column and high-end defense products such as air frames, etc. and Liquid propulsion engines such as Vikas engine, cryogenic engines, semi cryo engine, space electro pneumatic modules in polar satellite launch vehicle (“PSLV”), etc.

Clean energy – Power units for supply to Bloom Energy.

Subsidiaries, Margin & Revenue

Magnatar Aero Systems Private Limited is the wholly owned subsidiary company of Company incorporated on 04.11.2019.

Key Rationale:

Precision engineering expertise:

The company has a legacy of over 50 years of manufacturing a wide range of mission critical precision components and assemblies with currently over 145 engineers on roll.

It has the ability to manufacture within 5-10 micron tolerance product through precision machining, assembly, specialized fabrication, heat treatment, surface treatment & others. Extensive & stringent testing & quality control mechanism undertaken at each stage through high precision quality inspection equipment.

Experienced personnel who undertake procedures and inspections at their non-destructive testing facilities and their capability in measuring and maintaining quality and measurement records at each level of the process is a key enabler.

Comfortable order book position

The order book as on Dec 31st 2021 is around Rs.478 crs (1.9x of FY21 Revenue) which will be executed in 12 to 15 months’ time.

The 21.2% of overall order book is from the nuclear sector, 28.7% consisting of orders from space and defense sectors, 49% of the order book is from the clean energy vertical. Largest single order of USD 29.82 Mn (~Rs. 220 crs) received in September 2021.

As on Feb 7th 2022, the order book stands at Rs.599 crs which is an increase of over Rs.120 crs in a month. Further, the company expects to receive large incremental orders over the next 12 months.

The company is adding new products to its portfolio and acquiring clients in various segments, which are expected to augment the revenues going forward.

Further, the favorable demand prospects across its end-user segments, given the Government’s thrust on indigenization of production, augur well for the company’s long-term growth prospects.

Q3FY22:

Revenue for Q3 FY22 stood at Rs.78.1 crs as compared to Rs.55.2 crs in Q3 FY21, a growth of 41.4% YoY. 9 Months FY22 revenues stood at Rs.223.4 crs, a growth of 26.0% YoY.

EBIDTA for Q3 FY22 & 9M FY22 stood at Rs.22.8 crs & Rs.66.7 crs respectively. EBIDTA growth for Q3 FY22 & 9M FY22 was 30.2% & 25.8% respectively on YoY basis.

PAT for the quarter stood at Rs.13.3 crs up by 50.4% YoY & PAT for 9M FY22 stood at Rs.41.1 crs as compared to Rs.28.1 crs in 9M FY21, a growth of 46.4%. PAT margins for Q3FY22 & 9M FY22 were 17.0% & 18.4% respectively.

Financial Performance:

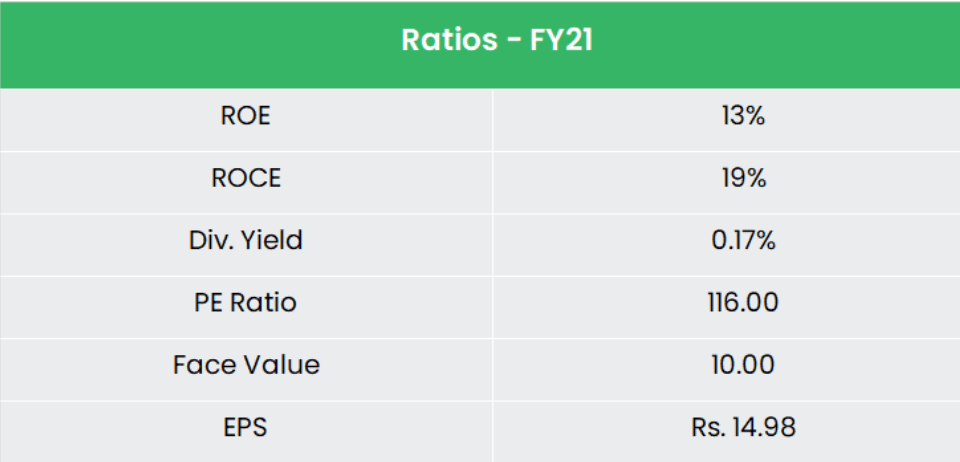

The company’s revenue and EBITDA CAGR stands at 16% and 37% for the period of FY19-FY21. The balance sheet is strong with a very low Debt/Equity ratio of 0.11x as of Sep’21.

The ongoing debt-funded capex of Rs.105 crs to set up a new sheet metal fabrication plant, which will be operational from Q1 FY2023, will enhance the company’s overall execution capability, expand the order book and boost sales growth.

This capex is to be funded through a mix of internal accruals and term debt (Rs.80 crs already sanctioned).

Industry Analysis:

India’s defence manufacturing sector has been witnessing a CAGR of 3.9% between 2016 and 2020. The Indian government has set the defence production target at US$ 25.00 billion by 2025 (including US$ 5 billion from exports by 2025).

Defense exports in India were estimated to be at US$ 1.29 billion in 2019-20. India’s defense import value stood at US$ 463 million for FY20 and is expected to be at US$ 469.5 million in FY21. Defense exports in the country witnessed strong growth in the last two years.

India targets to export military hardware worth US$ 5 billion (Rs. 35,000 crore) in the next 5 years. As of 2019, India ranked 19th in the list of top defense exporters in the world by exporting defense products to 42 countries.

The satellite manufacturing and launch systems market in India is estimated to reach Rs.46 bn – 48 bn by FY25, at a CAGR of 7- 8% in the forecast period.

Over the review period, India has been successful in attaining reliability and cost-effective launch service.

Growth Drivers:

India’s Defense budget for FY 2022-23 stands at Rs.4,05,470.15 crores after excluding the component of the Defense pensions and is primarily focused towards the upkeep and modernization of an operational Armed Forces.

The country plans to spend US$ 130 billion on military modernization in the next five years and is also achieving self-reliance in defense production.

Additionally, 100% FDI is allowed in the defense industry, wherein 74% is allowed the under automatic route and beyond 74% is through the government route.

India’s satellite launch services are highly cost-competitive and reliable. The launch rate success of PSLV is 96%. In the last five years, ISRO has launched satellites from 26 countries.

Commercial arrangement contracts with 10 countries have been signed in the past five years.

Outlook:

The company has developed long-standing client relationships with not only premier Indian institutions such as NPCIL (16 years), ISRO (30 years+) and DRDO (40 years+), but also leading global clean energy companies such as Bloom Energy (9 yrs).

Over the past 2 years, its order book has posted a 31% CAGR and is poised for robust 4x growth over the next 3 years on a) accelerated growth in its end user segments, led by technology change (clean energy), favorable government policies (nuclear energy) and capacity augmentation by the private sector (space) and b) strengthening of its product portfolio by entering new segments such as sheet metal fabrication, roller screws, electro-mechanical linear actuators, hydrogen boxes and electrolysers.

Given the nature of the industry, the company enjoys very high margins on its products. Gross margins have been consistently over 60% in the last three years whereas the company registered EBIDTA margin of 29%, 27% and 34% in FY19, FY20 and FY21 respectively.

Valuation:

We are positive on the stock taking cognizance of the huge growth opportunities for MTAR and a high margin business that would aid flow of profitability to the bottom-line.

The stock currently trades at 60x of FY24E EPS (High Margins demand premium valuation). We recommend a BUY rating in the MTAR Technologies Share Price Target 2022 with the target price (TP) of Rs.2000, 70x FY24E EPS.

Hope you liked our Article on MTAR Technologies Share Price Target 2022 , please read our other Research Report on “Wipro Share Price Target 2022“