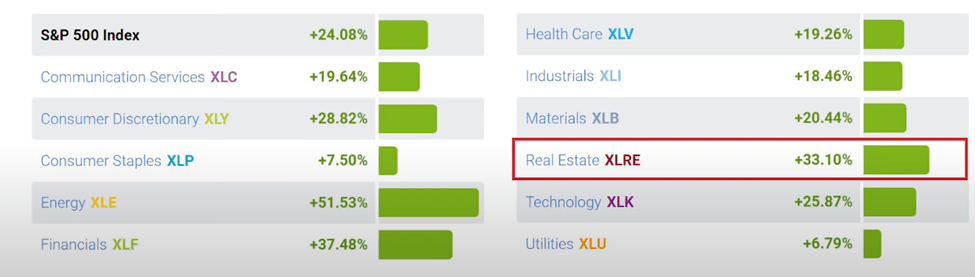

Real estate stocks are the third best performing sector this year, with a 33% return through October. Only energy stocks and financials have beaten REITs for that higher return. In this blog we will look at Best REIT Stocks to invest in 2022.

Overall return hides some big differences in property types. The National Association of REITs tracks 154 real estate investment trusts across 12 major property types and shows returns were as high as 56% through the first nine months of the year, but also as low as 7% for some types of real estate.

Real Estate can still make you money but getting those higher returns means understanding the trends and knowing which property types will outperform as well as the ones that will lose your money.

In this blog, I’ll show you the factors affecting real estate stocks and REITs in 2022, which property types to watch, and which ones to avoid, and then I will reveal 5 REITs to buy for outsized returns next year.

Factors affecting returns:

By far the biggest driver of returns not just in real estate but across stocks is going to be “INFLATION”.

Consumer prices have jumped by more than 6% over the past year, the highest rate of inflation in 30 years.

Every investor who needs to have some real estate exposure in their portfolio should know that increasing Inflation affects rent and this is how it affects property types.

REITs return is defined by how well those property owners are going to be able to increase their rents. For example, against the yearlong moratorium on rents, residential landlords couldn’t increase rents for fear of not getting paid at all.

The owner’s equivalent rents, a measure of rent prices across the US, increased just 2.5 percent over the year to January, while home prices increased by 20% over that same period.

What does jobs data tell us.

There are now more than 10 million job openings for just 7 million unemployed looking for those jobs.

More than 4 million Americans quit their job in August, a record high, and the great resignation is going to be a major theme throughout the year.

Of course, this is going to increase wages as employers fight for those workers, especially at the lower end of the income scale. That increase of $2 an hour is a lot more for someone making $12 an hour.

This wage increase will benefit some specific property types and real estate stocks.

Before I reveal the Best REIT stocks, we also need to watch consumer spending. It could surge in 2022 and take a handful of stocks with it.

JPMorgan estimates that households saved up as much as $1.7 trillion over the last 18 months, with the average savings balance up more than two grand over $6,000 locked down collecting those stimulus checks but not spending it.

That money could now come through in a wave of spending that benefits retailers, shopping malls, and the hotel segment property market, besides the individual real estate stocks.

Let’s look at Best Real Estate Stocks to invest in :

Number 1:

Our first real estate stock here is one I’ve been following for a while.

Medical Properties Trust ticker MPW provides Healthcare properties. It is the second-largest owner of hospitals in the world, with 442 properties and a rare international exposure for are operating in 34 US States and nine countries.

I like the company’s business model, it buys properties owned by those healthcare providers, then leases them back to them on 20-year terms for triple net payment. This frees the health care provider to do what they do best, providing that service.

MPW takes care of the property and has a long-term tenant triple net lease which means the tenant pays all property costs. This allows MPW to sit back and collect the check, making operational costs extremely low.

99% of the properties here have a built-in rent escalator based on inflation, so the company is covered on that front. MPW pays a 5.3% dividend yield the highest of the five stocks that we’ll cover and trade for just 12.2 times FFO.

Price to FFO(Fund from operations) is important here for real estate stocks because these companies take an enormous amount of depreciation off their income for tax purposes. Earnings aren’t a good measure of cash flow.

This also means you can’t use that price-to-earnings ratio as you do with other stocks. Instead, funds from operations or FFO are a better measure because it adjusts those earnings for that noncash expense typical of real estate companies.

FFO shows the true cash-generating power of the properties and is a critical measure of how expensive these stocks are, as well as the safety of that dividend.

Number 2:

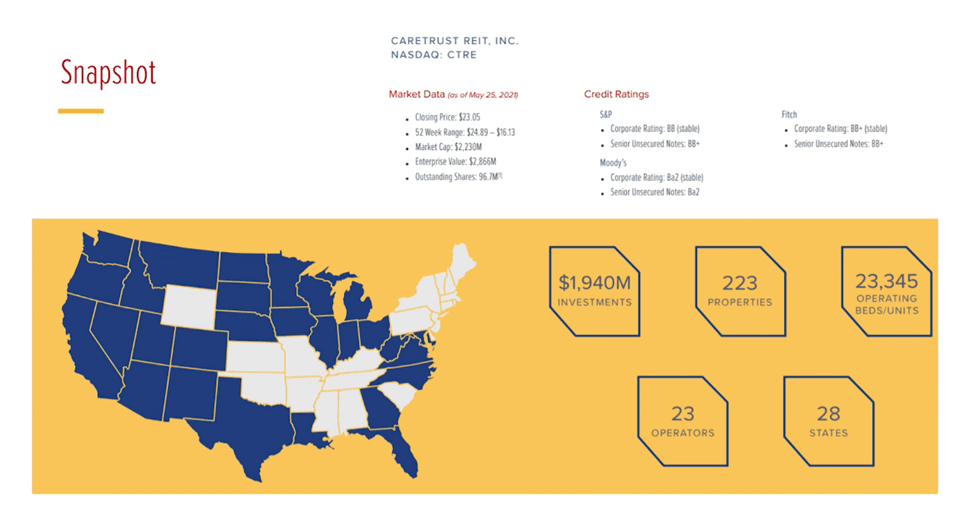

Another real estate stock to watch here, CARE Trust REIT- Ticker CTRE. It owns 223 properties managed by 23 operators across senior housing and acute care.

Many Baby boomers (a person born in the years following the Second World War) started turning 80 last year and with the average age of admittance into nursing homes at 79 years old, that means Care Trust is going to be right in that sweet spot for demand for more than a decade.

Covid hit this sector as hard as any, pushing Occupancy down from 78% to just 67% last January, but it started to recover and Occupancy was back up to 69%.

As of April, the company has the lowest debt to EBITDA ratio among 15 competitors at just 3.2 times. So plenty of flexibility here to push through that recovery.

Share pays a 5.1% dividend yield with a 9.3% annualized increase over the last five years. Even during that covered weakness, the stock trades for 14.4 times the FFO, so a little more expensive here. But FFO is expected to grow by 7% this year.

Number 3:

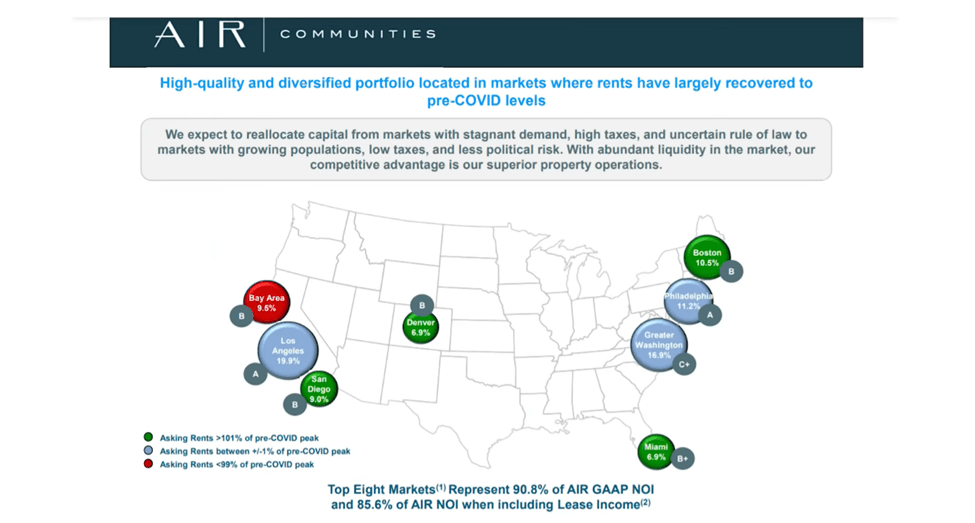

Real estate stocks in the residential space could have another great year as rents rise faster, catching up with that surge in home prices is our first residential plate is apartment income.

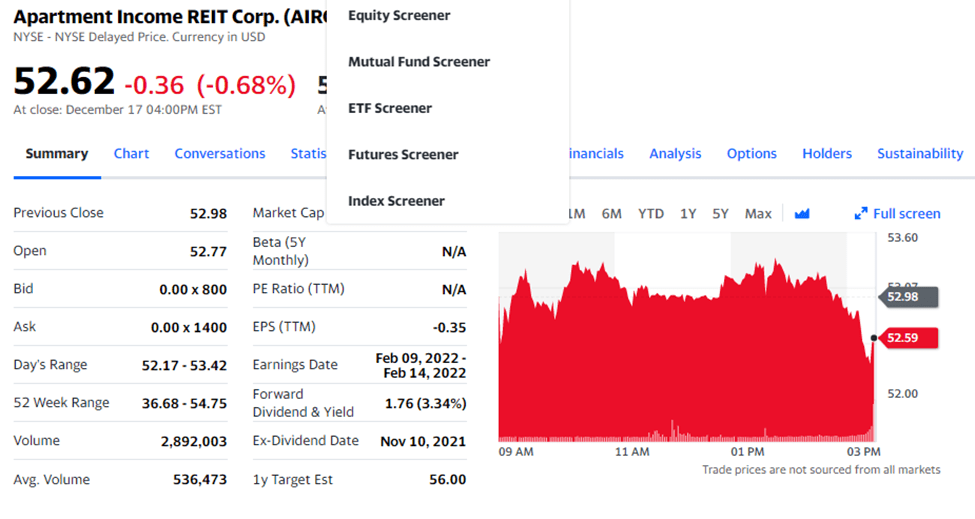

Third on our list is Apartment Income REIT Corp Ticker, an AIRC. It is a smaller company with 99 upscale communities in twelve States and DC focused on the largest Metro areas.

The higher rents collected on higher-income properties, the larger cities, as well as a great management team, make this one of the most efficient REITs out there, with a 72% margin on its net operating income.

Now that’s industry-leading for more than 17 quarters, the company reported average rents have rebounded to pre-Covid peaks by the first quarter, and shares pay a 3.3% yield. Now that profitability means shares are a little more expensive here at 24.5 times FFO, but those are funds are expected to grow by 12% next year.

Number 4:

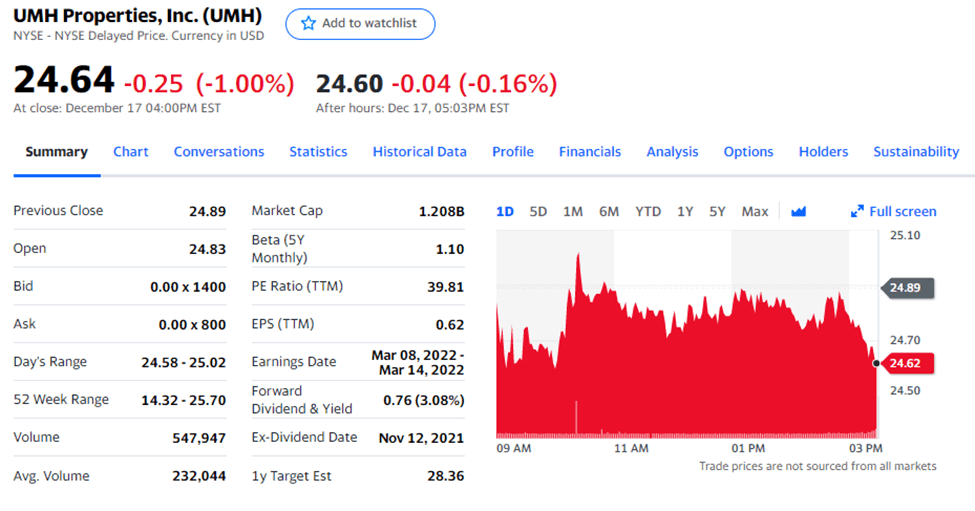

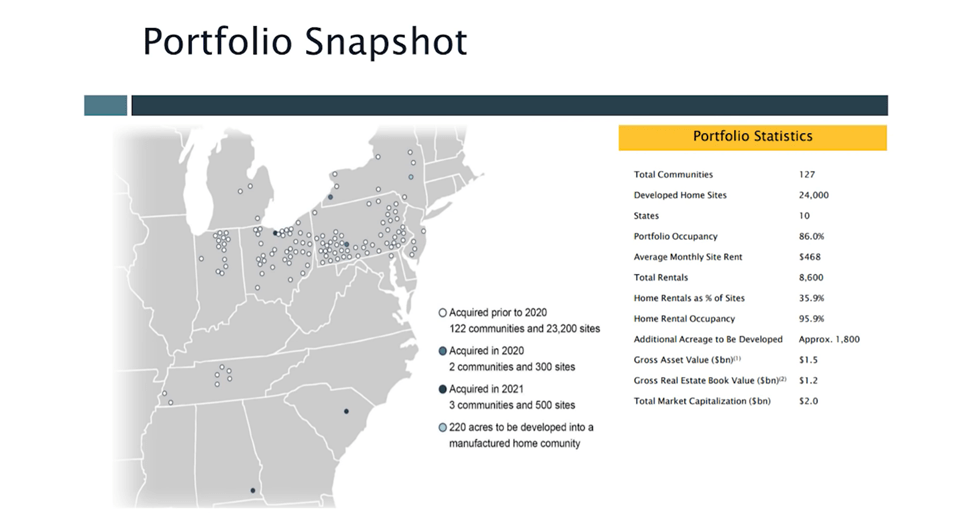

This next real estate stock in our list of Best REIT Stocks , UMH Properties Ticker UMH is a unique one in the residential space. UMH owns 127 manufactured home communities with approximately 24,000 developed homesites in 10 States.

It also owns over 1800 acres for development and a potential 7300 more lots. UMH stands to benefit from the strong jobs market and the wage increases over the next year. Collections are already up to 95% of July rent with 86% occupancy, so it’s largely already moved on from that covered impact on the business.

Shares pay a 3.1% dividend and trade for 24.1 times funds from operations. But this one has seen that strong growth with the FFO up more than 40% last year.

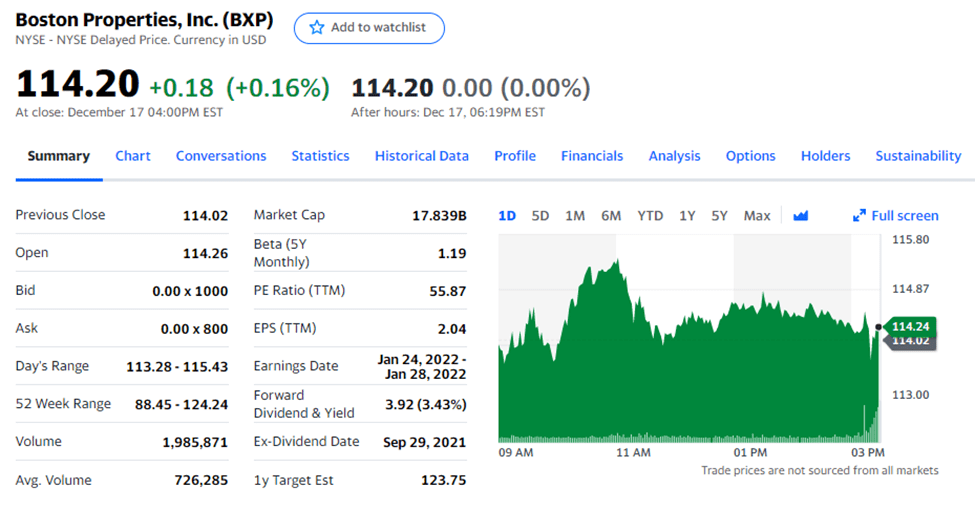

I’m making a contrarian call here on office space for 2022, that return could surprise higher and nobody expects office space to come back but companies still want people back in the office.

Even on a shift to some remote work, office demand could still be stronger than expected next year.

Number 5:

Boston Properties Ticker BXP is the last in our list of Best REIT Stocks . It is one of the larger office REIT stocks with 196 properties and 51.6 million sqft, including 4.3 million sqft of leasable space under development.

Beyond that potential recovery in office space. BXP has a growth segment in its life science of properties, adding diversification and growth to the portfolio. BXP Life Sciences has as of today 9.2M Sqft of current and future Tenant spaces.

Shares pay a 3.4% dividend yield with a 7.7% annualized growth over the last five years and trade for a relatively low 16.5 times on that price to FFO basis.

Now these are the property types and the real estate stocks that I’m watching for 2022.

Hope you liked article on “Best REIT Stocks to invest in”, please read our other article on “Best EV Stocks to invest in”