In this blog, we will look at “High Promoter Holding Stocks” but before that let’s understand what does Promoter means to a company and how investors can use High Promoter Holding for their gains.

Who are Promoters ?

Promoters or promoter groups are entities that hold a significant influence on the company. Promoters are usually the owners of the company. They often have a major stake in the company and hold top management positions.

What does High Promoter Holding mean ?

The stake in the company or the total percentage of shares that the promoters of a company holds is known as the promoter holding. So, if the company has as much as 40-50% shareholding with promoters, it shows the stability as well as the promoters’ confidence in their own business.

A high promoter holding shows that the promoters have faith in the company’s future and wish to benefit from that.

Criteria for Stock Selection:

- Low Debt to Equity – The companies with a low debt/equity ratio between 0 and 1 which is generally healthy.

- High Promoter Holding – The companies with high promoter holding of more than 60%.

- 5Y Average Return on Equity (ROE) – The companies with more than 20% of Average ROE over the period of 5 year

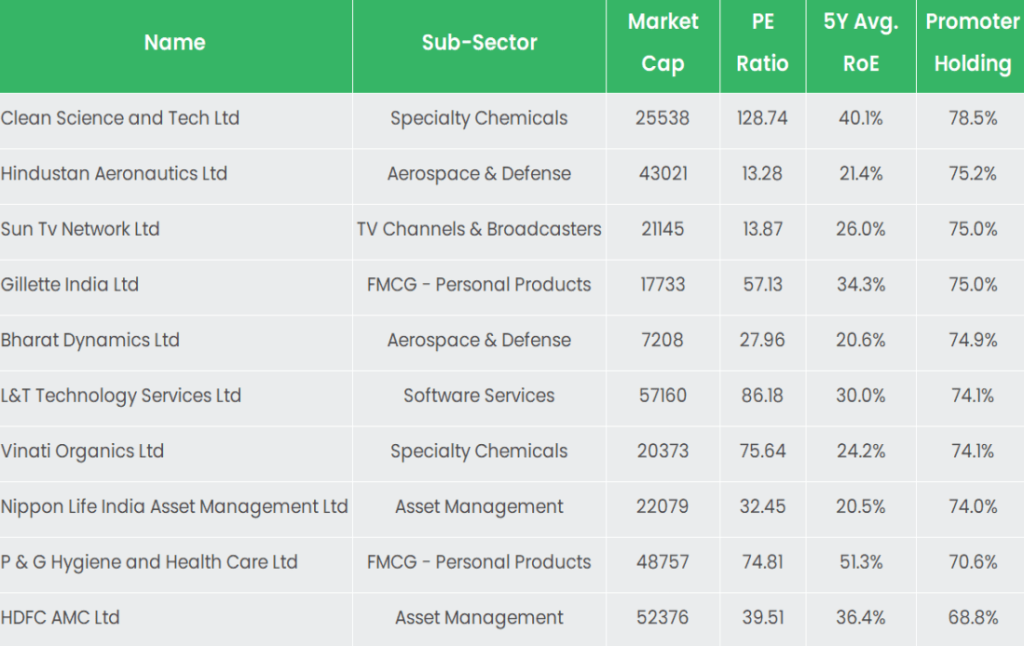

List of High Promoter Holding Stocks:

- Clean Science and Tech. Ltd – The company manufactures functionally critical Speciality Chemicals, Pharmaceutical Intermediates, and FMCG Chemicals. The differentiation in the process manufacturing between Clean science and peers assisted the company to offer products at a competitive price and thereby helped it gain meaningful market share across its product portfolio.

- Hindustan Aeronautics Ltd – The company manufactures aircraft under licenses such as the MiG-21, MiG-27, Jaguar, etc., and helicopters such as the Cheetah and Chetak. Further, the company has recently secured its largest-ever contract of 83 LCA Tejas Mk1A aircraft with MoD for Rs.36,486crs which further demonstrates its strong position in the defense avionics sector.

- Sun TV Network Ltd – Sun TV, in its key market of Tamil, has improved its prime-time fiction market share from 37% to 42% in the last three quarters, albeit it remains well below those earlier levels. The company envisages taking it to 50% in the medium term.

- Gillette India Ltd – The company is engaged in the manufacturing and sale of branded packaged FMCGs especially in the grooming and oral care businesses. It commands a 70% market share in the blades and razors segments (Mach-3) and 28% market share in the toothbrush segment (Oral-B). This company also maintained a zero-debt position for more than a decade.

- Bharat Dynamics Ltd – The Company has executed export orders of Torpedoes to a friendly country and is geared up to take further orders of other exportable products such as Surface-to-Air Missiles, Air-to-Air Missiles, Air-to-Surface Weapons, Anti-Tank Guided Missiles, and Counter Measure Systems, besides the Torpedoes.

- L&T Tech. Services Ltd – L&T Tech. Services Ltd (LTTS) is a global leader in Engineering and R&D (ER&D) services. LTTS’ customer base includes 69 Fortune 500 companies and 53 of the world’s top ER&D companies. The company repaid all the debt and acquired a zero-debt position in FY21.

- Vinati Organics Ltd – Ranked #1 IBB Manufacturer in the world with 65% market share and ATBS with a global market share of 65% as of FY21. The company generated 12% and 18% CAGR of Revenue and PAT for the past 10 years.

- Nippon Life India AMC Ltd – NIMF has built an industry-best suite of fixed income and equity products in this space and garnered an AUM of over Rs.37,000 crore. The company has gained 14 lakh new ETF folios in 2021 alone. NIMF has a 42% market share of the total industry ETF folios.

- P&G Hygiene and Healthcare Ltd – P & G Hygiene and Healthcare Ltd is engaged in the manufacturing and selling of famous branded FMCGs like Pampers, Ariel, Tide, Head & Shoulders, Pantene, Oral B. Whisper, Vicks & Old Spice, etc.

- HDFC AMC Ltd – HDFC Asset Management Company (HDFC AMC) is Promoted by HDFC Ltd (52.72% of share), is one of the largest AMCs in India with total assets under management (AUM) of 3,95,476 Cr. as of Mar 2021.

A high promoter holding shows that the promoters have faith in the company’s future and wish to benefit from that.

Hope you liked this article on “High Promoter Holding Stocks”, please read our other article on “Zero Debt Companies in India“