In this blog, we are going to talk about “Top 3 stock picks for semiconductor chip shortage” worth considering with the worldwide semiconductor shortage affecting multiple industries.

Some of the most popular stocks are companies that designs and market advanced chips like Nvidia, AMD, and Qualcomm just to name a few.

However, if you’re looking to add more allocation to the semiconductor industry as part of your portfolio, it’s a good idea to look at some of the other companies that manufacture chips or supply the equipment required.

Before we start with top semiconductor stocks, let’s discuss why investing in the semiconductor industry could be a good decision for the next five years.

Why invest in Semiconductor Industry:

Semiconductors are often considered a cyclical industry, they used to be affected by the PC or smartphone cycle, but nowadays you can find semiconductor chips everywhere.

It’s used in every industry affected by the digital transformation e.g. you can find these in a datacentre or server powering up, cloud computing, artificial intelligence, machine learning, wearable devices, electric vehicles, autonomous vehicles, video gaming, five genetics, crypto mining, and so on.

These industries are heavily dependent on semiconductor chips.

There are OEMs i.e. original equipment manufacturers, which include some of the largest technology companies in the world like Apple, Microsoft, Google, Amazon, and Tesla design their chips, this, in turn, increases the demand for semiconductor chips.

Global shutdowns due to the Covid pandemic and its various variants have made semiconductor chips a shortage.

The global economic shutdown has accelerated the digital transformation, causing the chip sources with surging demands.

Why consider Semiconductor Manufacturers and Equipment Companies?

First of all, manufacturing chipsets require design knowledge and are heavily capital-intensive. It has a very high barrier to entry.

These are likely the reason why many of the OEM companies like Apple, Microsoft, and Amazon, prefer to focus on the software to design their chip and have contracts with the various companies to manufacture. For many semiconductor equipment companies, there’s not much competition.

The companies that we are going to talk about are either in Monopoly, Duopoly, or Oligopoly.

This is also affected by the consolidation in the industry into a few key global payers over the years so there have been corrections to technology stocks.

Compared to software companies, many of the semiconductor equipment companies don’t fall as much from an all-time high, so they don’t grow as quickly. They have been growing consistently and the foundation is less expensive compared to software companies.

In addition, the chip shortage is predicted to continue through 2022 end, and it might expose to the following year, so there will be enough demand for these companies.

List of our Top 3 Stock picks for Semiconductor shortage:

Number 1 :

The first stock is the Taiwan Semiconductor Manufacturing Company – ticker symbol TSMC.

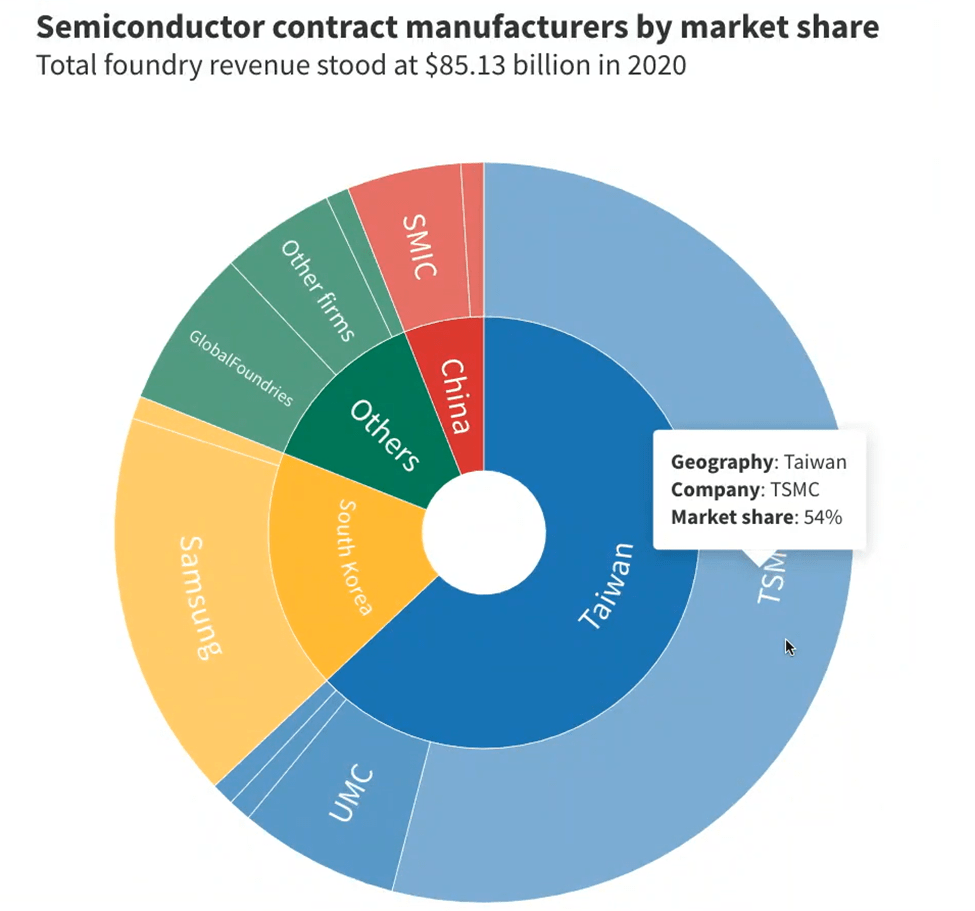

It’s arguably one of the most important companies in the semiconductor industry because they supply more than 54% of chip manufacturing contracts in 2020. It’s a dedicated semiconductor foundry and is the leading company in this area.

Taiwan Semiconductor Manufacturing Company may not be a household name, but with a market value of over $550 billion, it’s one of the world’s 10 most valuable companies. Now, it’s leveraging its considerable resources to bring the world’s most advanced chip manufacturing back to U.S. soil.

TSMC makes key components for everything from cell phones to F-35 fighter jets to NASA’s Perseverance Rover mission to Mars.

Earlier this month, it announced plans for a new factory in Japan, where it will produce chips with older technologies, for things like household devices and certain car components. TSMC is also Apple’s exclusive provider of the most advanced chips inside every iPhone currently on the market and most Mac computers.

Taiwan Semiconductor Manufacturing Company simply manufactured chipsets based on the blueprints provided by a client which includes companies like Apple, Nvidia, and Qualcomm.

So talking about semiconductor chips, you probably have heard of the word nanometre chip thrown a lot. It refers to the size of the transistor involved. The smaller the transistor is, the more you can fit it into a piece of silicone and the more powerful and complex the chip would be built from this transistor.

Taiwan Semiconductor figured out how to do this on a large scale and they even announced that they could do chip manufacturing with three-nanometer technology by 2022. TSMC company also has a 1.5% dividend yield which is not bad at all.

How they can produce chips at this scale, is very impressive.

Number 2 :

So the second stock is the LAM Research – ticker symbol LRCX. It’s one of the companies providing semiconductor manufacturing equipment to semiconductor chip manufacturers.

They provide the position machine and action equipment that are used to lay down transistors. They are the main suppliers of wafer fabrication equipment and services related to the semiconductor industry.

Its products are used primarily in front-end wafer processing, which involves the steps that create the active components of semiconductor devices like transistors, capacitors, and wiring.

The company also builds equipment for back-end wafer-level packaging (WLP) and related manufacturing markets such as microelectromechanical systems (MEMS).

Applied Material is the main competitor in this area and both are good companies.

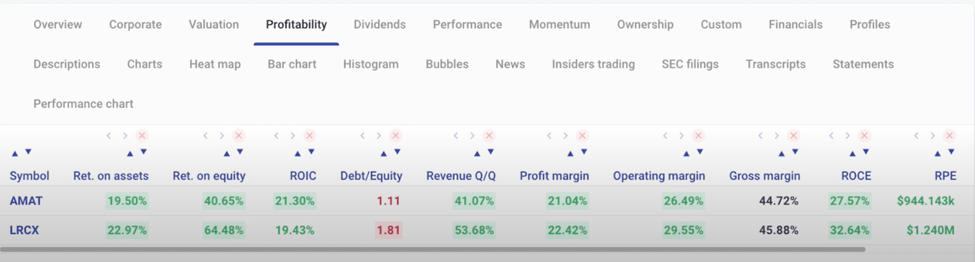

In my opinion, LAM Research has better financial and they have impressive gross margin and operating margin as well. Applied Material has more market share but LAM Research is likely in a good position to gain more looking at the research and investment they do.

Lam Research also pays a small dividend of 0.79% dividend yield.

Number 3 :

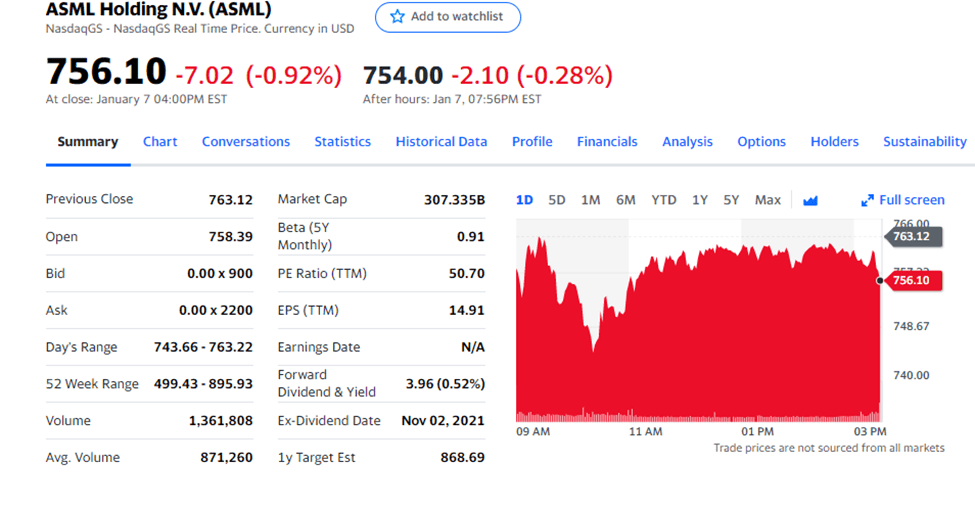

The third company is ASML Holding N.V – ticker symbol ASML.

ASML is one of the world’s leading manufacturers of chip-making equipment. They design and manufacture the lithography machines that are an essential component in chip manufacturing.

Many companies use their machines in ‘fabs’ microchip manufacturing plants to create microchips that are eventually used in many electronic devices, including smartphones, laptops, and much more.

The company has the largest market share in this area and is the only company that could harness extreme ultra field or EU light with a wavelength of just 17.5 mm.

This is a critical technology that allows chipmakers to fit more transistors onto the silicone.

This machinery could cost more than $12million and the revenue comes from selling this machine and servicing them.

The Semiconductor Equipment Wafer Fabrication industry is part of the Computer and Technology sector. Industry currently has a Zacks Industry Rank of 52, which puts it in the top 21% of all 250+ industries.

So with the monopoly of this technology, it would be fairly hard for anyone to compete and catch up with

These were the Top 3 Stocks to consider in this Semiconductor crisis which will go beyond 2022 if the pandemic continues.

Hope you liked our article, do read our other research articles on “Best REIT Stocks to Invest in”