In this blog, we’re talking about the differences between ETF Vs Mutual Fund Vs Index Fund.

For most Investors, these terms are not clear and they didn’t know the difference between these three funds, and oftentimes the terms are used interchangeably creating confusion among investors.

When you do know the difference between an index fund, a mutual fund, and an ETF, it’s going to save you a lot of money and hassle in the long-run returns.

I will explain this with some examples of these three funds as well as I will also tell you what I think is the best option for you to choose in your investment portfolio.

I can guarantee that after reading this blog, you’ll know the differences between these three funds and can make the right decisions with your investments.

Let’s first talk about the commonalities of these three funds.

The main commonality of all these funds i.e. ETF Vs Mutual Fund Vs Index Fund, is that by doing one transaction, you’re able to own a small percentage of all of its underlying assets. Assets here are the Stocks

So what do I mean by this?

Imagine that you have a candy jar and that jar is filled with a bunch of M&Ms. Pretend in this example that each M&M is a stock or an investment that grows over time.

In a perfect portfolio, you’d have a wide range of M&Ms. But if you only buy one M&M, you’re essentially putting all of your money or your investment into one basket, aka that one M&M, it’s incredibly risky.

So what you can do with an index fund, a mutual fund, or an ETF, is that you can buy the candy jar, and the candy jar itself has access to all of the M&Ms that are within the candy jar.

The difference is when you do buy this candy jar, you just get a small percentage of every M&M in that candy jar.

When you buy that one fund, you’re essentially just buying little bits and pieces of everything that it owns.

Benefits of this method of investment:

- This method of investment is convenient for investors as they do not need to individually track Stocks they want to own.

- It offers you a lot of diversification, diversification means that your risk is now distributed across all of the assets that you own.

So that’s the commonality of Mutual funds, ETFs, and Index funds, it allows you to make one transaction, but then you own a small percentage of everything that it has.

What are the differences between these funds?

Let’s talk about the differences between all these one by one.

The First fund I want to talk about is the Mutual Fund.

Mutual Fund offers a different type of investment strategy than Index Funds and ETFs do.

Mutual funds are typically a group of 40 to 100 stocks , but it’s professionally managed by a Fund/Portfolio Manager. That’s the main difference between index funds and ETFs. It uses an active management style.

This professional Fund manager is choosing which stocks and securities will go into the mutual fund and go out of the mutual fund as he or she please based on the research these guys do.

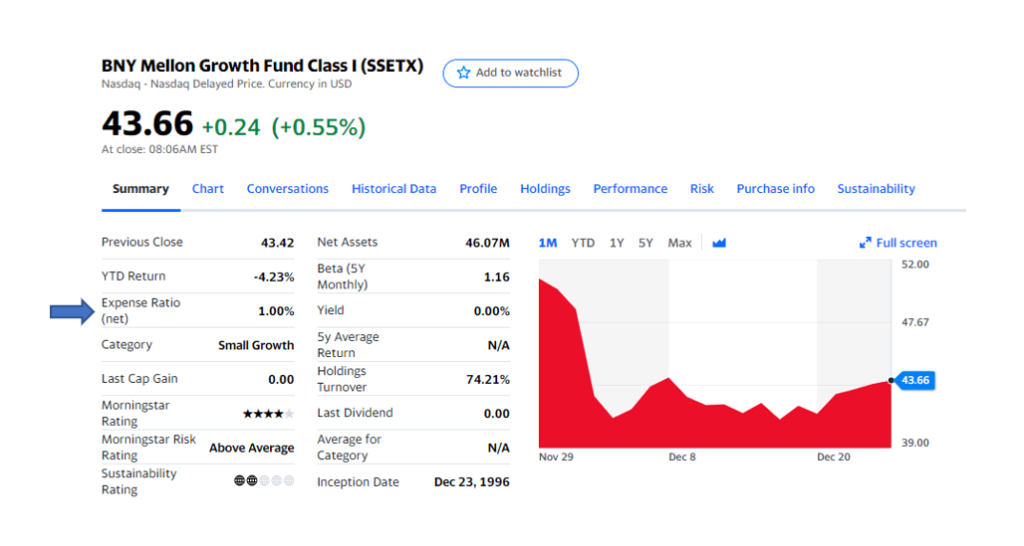

When you have a professional fund manager and an active management style, it needs to be compensated somehow. So basically, that’s the biggest difference here.

Mutual funds will charge typically higher fees to help compensate the portfolio manager and the research Analysts making all the decisions.

Mutual funds typically charge between 1% to 2% per year of what have been invested in the fund which is also known as expense ratio.

Now, I know a 1% fee doesn’t seem like a lot, but imagine you have $100,000 in one mutual fund that’s $1,000 per year that you’re paying just so that they can actively manage your investment.

Fund Manager’s sole aim is just to beat the return of the S&P 500 index or the Benchmark Index their fund is using. Some years they do beat the return, but some years they don’t beat the market.

Let’s now talk about the second one – Index Fund.

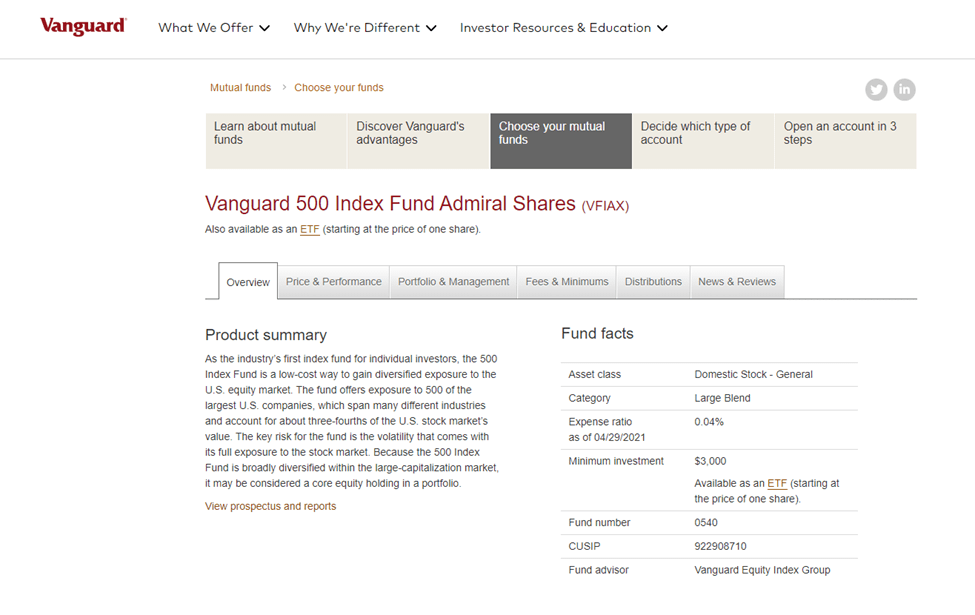

The main advantage that an index fund or an ETF has over a mutual fund is the fact that they have very low fees, sometimes even as low as 0.04%.

So how do those index funds and ETFs get such low fees when virtually it’s the same product?

The biggest difference of an index fund is that they have a passive management style.

Passive Management Style means, no active fund manager is managing these funds.

So you’re probably now wondering, well, who the hell picks the stocks?

Index fund is just constructed to match the return and the risk of its underlying index like the S&P 500.

In the below case with VFIAX, you can buy an index fund that tracks the entire S&P 500 for around $300. You get to own a small percentage of the entire index and its underlying stocks.

The whole theory is that index funds will outperform actively managed portfolios over a long period for the average investor.

Warren Buffett believes in this type of strategy. In 2007, he placed a million-dollar wager that his index fund approach would beat an actively managed hedge fund over 10 years . Guess what, he won.

So basically, an index fund offers passive management tracking a different type of market with a minimum fee. Typically, the S&P 500 is one such example of Index Fund or the Dow Jones Industrial Average is another example of one that you can buy.

What it does is, it typically offers you really low fees in exchange for the passive management style. It often looks to match the return and the risk of the market that it’s tracking.

It’s typically better for the average investor over a long period.

Now that we know what an index fund is, we know what a mutual fund is.

Let’s now look at the third one – ETFs:

So what is an ETF, and how could it be any more different than these two?

An ETF is very similar as it’s still a basket of securities. When you buy the ETF, you’re still getting a small percentage of the basket of securities.

The only difference with an ETF, which stands for exchange-traded fund, is it means that you can buy and sell an ETF just like you would stock on the market.

Because of this flexibility, it gives you a lot more control. Now, I didn’t mention this earlier, but an Index Fund only trades once per day, so there’s only one time a day you can buy and sell it.

If you buy an ETF on the market, you’ll have to pay any commission fees for using a brokerage service to buy the ETF.

The other difference with ETFs is especially with the new invention of all these online brokerages that are offering fractional shares, you can buy into an ETF for less than what it’s worth. You just get a portion of that share.

Now contrast that to an index fund, where typically they have minimum investment requirements. So a fund such as VFIAX like I mentioned earlier, actually has a minimum investment of $3,000.

Since ETFs do trade on the market, you’re able to buy and sell them as you please, which gives you a lot of flexibility.

If you’re just buying an ETF to track the market, I would either stick to an index fund or if you are going to do it through an ETF, just buy and hold it for a long period for better gains.

Which investment is the right one for you?

Out of these 3 ETF Vs Mutual Fund Vs Index Fund , I would like to go for an index fund because I prefer a very passive strategy where I’m not having to constantly manage or think about my investments.

If you’re able to meet the minimum requirements of an index fund, one of the benefits of having an index fund is automatically reinvested dividends. It’s kind of just a product where you just set it and forget it and come back to it in five or ten years.

You should buy an ETF:

- If you are interested in the underlying asset that ETF is tracking.

- When you just really want the flexibility of buying and selling it in the market.

- If just don’t have enough money to meet the minimum on an index fund just yet.

In any case, I don’t think you can go wrong with choosing between an index fund or an ETF.

I do think you can go wrong with a mutual fund, especially if the fees are too high for that fund or if you choose the wrong Mutual Fund which is not up to mark.

So as always, just make sure to keep an eye on the expense ratios and make sure that it makes sense for your investment.

If you guys found this blog on “ETF Vs Mutual Fund Vs Index Fund” at all helpful, please remember to comment and share it with your loved ones so they can also make better investments.

Subscribe to our newsletter for regular articles from us.

Please read our other Article on “Best REIT Stocks to invest in“