Before we discuss Best EV Stocks to Invest In, lets look into few interesting details below.

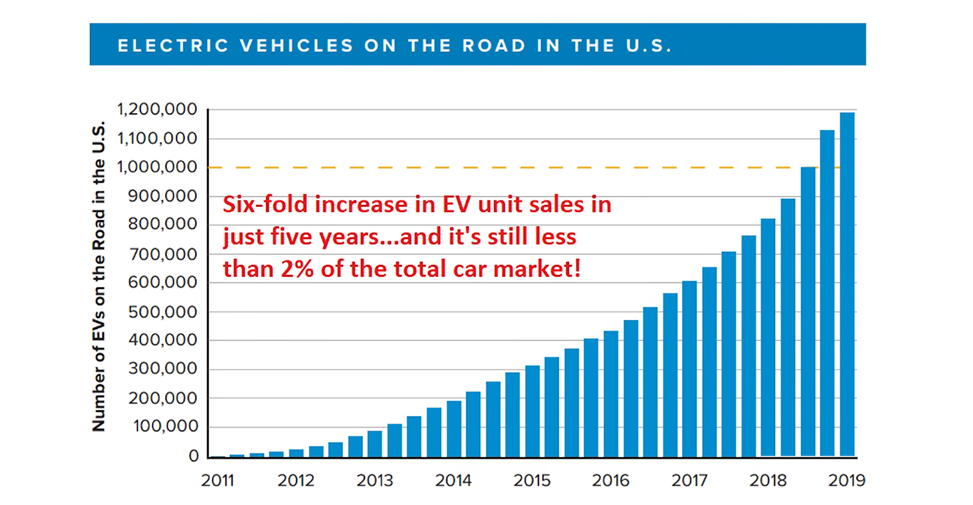

Electric vehicle sales were up sixfold in the last five years through 2019 and still represent just 2% of the light vehicle market. One look at shares of Tesla or NIO and you might think the EV stock trend is overpriced, but in reality it could just be getting started.

In this blog, I’ll show you why electric vehicle stocks could have further to run, how to find the best companies and then reveal 3 Best EV stocks to buy.

EV stocks and the potential in the electric vehicle market has been a huge theme for years, but it’s surprising how much growth this market still has left to run even on that sixfold increase in EV sales from just 200,000 cars in 2014 to 1.2 million in 2019. It’s still just 2% of the US car market, and sales in Europe and China are growing even faster.

A lot of companies have committed to all electric models within the next 20 years. The cost of the lithium battery technology and the cars themselves have come down to where it’s affordable for mainstream consumers.

That’s when you start seeing that exponential growth in sales. I want to show you how to find the best EV stocks to buy, how to start your list and find some of those undiscovered electric vehicle companies that you don’t hear so much about.

Do you think those EV stocks in the market are too expensive right now? And do you think the technology is going to live up to that hype with the high valuations on some of these stocks? I want to hear what you think. So scroll down and let us know in the comments below.

We have 95 companies in EV stock list, that we can then research to find the ones with the most potential.

Please remember, Investing in EV doesn’t mean stocking up on shares of Tesla or NIO. Besides the car makers, there are other ways to invest in this theme, like the battery suppliers, parts and the commercial vehicle segment.

Even some of those legacy car makers could be good investments in this theme. Ford and Chevy both have two cars in the top ten EV models by total sales now .

I think that diversification in segment and in business models is important when you’re doing your analysis, shares of those popular car makers have been bid up to amazing valuations. Even after growing earnings by 131% last year, shares of Tesla are still priced at over 1500 times their annual profits.

Before we go to “Best EV Stocks to Invest In” , lets also look the other ways of investments.

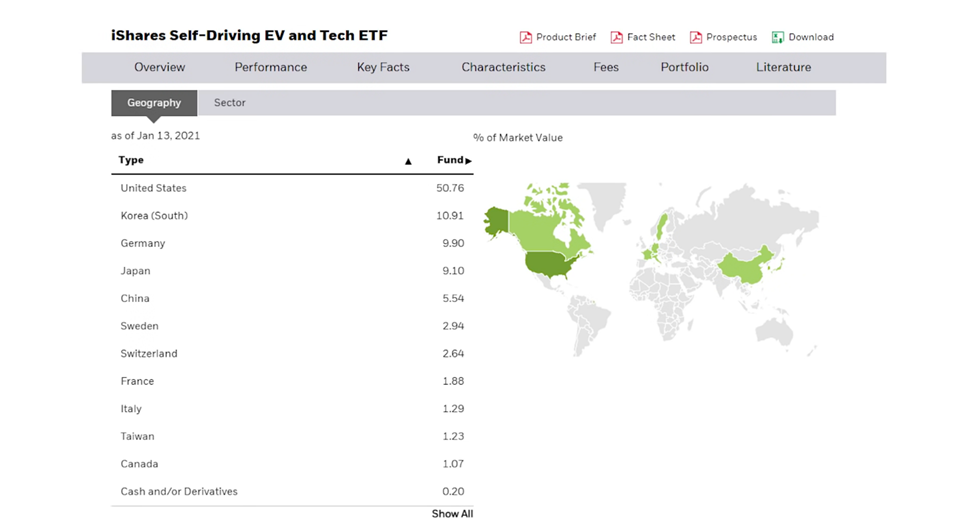

We might also want to check out the iShares Self driving, EV and Tech ETF that’s ticker IDRV.

The fund holds shares of 99 companies in the self-driving and electric vehicle theme and has produced a return of 58% over the past year.

Reason why I really like this fund, this fund besides giving exposure to both of those trends, self-driving and electric vehicles, it also includes a lot of the stocks that we can’t buy in the US market i.e. stocks like LG Chem, Alps & Alpine.

This fund is a great way to get that broad investment in the theme along with these individual stocks that we’ll talk about and is actually trading for 24 times on a P/E ratio of the companies in the portfolio. So not that expensive to consider for investment.

Let’s now see our “Best EV Stocks to Invest In”:

- Our first electric vehicle stock is Kandi Technologies Group, ticker KNDI.

I like this one for their product diversification. Not only does Kandi produces 3 miles of electric vehicles sold in China and the United States, but it also has a battery swap system. It’s parts are supplied to multiple OEMs, and it produces an all-terrain vehicle as well , that model brings in revenue from multiple sources, allowing it to leverage its technology not only in its own cars but in other segments as well.

Frankly, some segments aren’t as saturated as the car market.

The company launched its EV cars in the United States last year, one with a price tag of under $10,000 after tax credits and got over 700 presale deposits on the launch. This is definitely an undiscovered player in that electric vehicle stocks and trades for just four times on a price to sales basis. Now that’s a 1/7th of the 30X multiple you’re going to pay for shares of Tesla or NIO next year.

2. Second Stock, I wanted to include a stock with exposure to the lithium segment of the industry.

Now the lithium ion batteries are really where that bobble neck is happening right now in electric vehicles with production just not able to keep up with the demand. So I definitely want something in here .

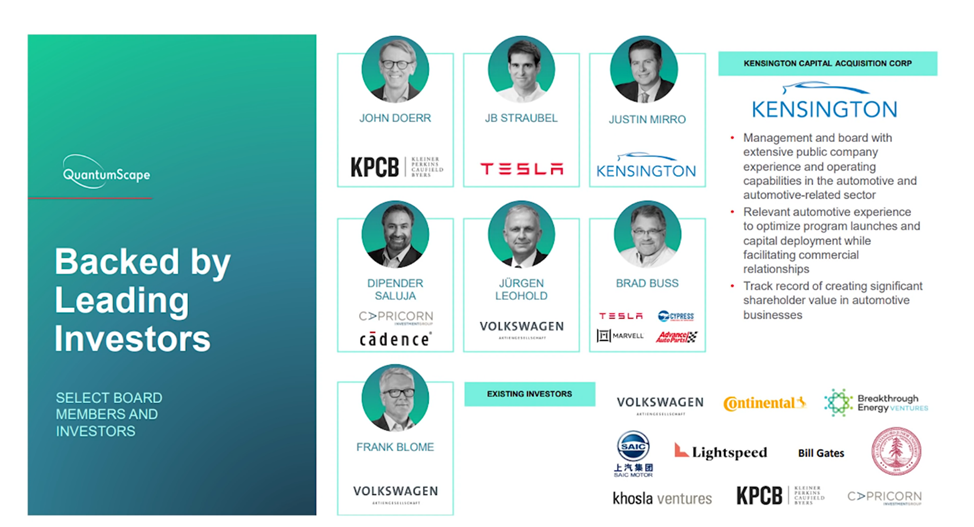

The biggest news in batteries came last year when QuantumScope Ticker Symbol QS went public through a SPAC acquisition.

The start-up was originally backed by Bill Gates and now counts Volkswagen as its largest shareholder. With a 300 million dollar investment. The European car company has plans to launch 70 EV models and produce 22 million EV cars by 2029 and is betting heavily on QuantumScope.

The company has demonstrated a solid state battery technology that enables 300 plus miles of charge and can recharge in less than 15 minutes. That compares to hours of recharging and most electric vehicle batteries stuck around that 200 miles capacity.

Now the company has only demonstrated this on a smaller battery model and still needs to prove it on those larger car size batteries. Revenue here isn’t expected until 2025, but this is next generation tech that could transform the industry. Sales are expected to start at $39 million in 2025 and rise nearly tenfold to 275,000,000 by 2026.

3. Third on the list : Workhorse Group Ticker WKHS isn’t quite as undiscovered or cheap as the other two on the list, but could still be one of your best investments in EV stocks. The global commercial vehicle market is a $1.3 trillion opportunity with annual growth of 7%. Workhorse is the market leader in the medium duty and cargo van market.

Development of electric vehicles here has been slower than that passenger segment because of the challenges to battery power and the time to recharge. That means there’s less competition for this technology and workhorse is the market leader in the medium duty and cargo van market.

The company is already partnering and selling to FedEx, Amazon and Walmart and has an $18 billion addressable market just in that last mile delivery market for the United States.

Workhorse designed its C Series truck with Ups and booked 1000 plus orders for those trucks.

These things have a 100 miles fully electrical range on less than 6 hours charging time.

The company is also developing the US Postal Service’s NextGen vehicle for a potential 165,000 vehicle deal and $6.3 billion in sales even beyond that last mile market the company is serving. Now, I think this technology transfers into that larger diesel and commercial market in the future for an even bigger market opportunity.

Hope these stocks and the details gave you an insight on EV segment.

Since you liked the article on “Best EV Stocks to Invest In” , please read our other article on ‘Best Growth ETF 2022‘ .