In this research report, we will look at Chemplast Sanmar Ltd Share Price Target by understanding company result and its future growth prospect .

We will look into company business, its declared results and risk if any which investors should know.

Before we go further, please subscribe to our newsletter, so you never miss an article from us when it’s published.

Company Overview:

Chemplast Sanmar Ltd., part of the South India based Sanmar Group, is among the leading PVC and specialty chemicals manufacturer in India where it started operations in 1967 with focus on specialty paste PVC resin and custom manufacturing of starting materials and intermediates for pharmaceutical, agro chemical and fine chemicals sectors.

CSL is one of India’s leading manufacturers of specialty paste PVC resin on the basis of installed production capacity and it is also the third largest manufacturer of caustic soda and the largest manufacturer of hydrogen peroxide in South India.

Pursuant to the CCVL Acquisition, it acquired 100.0% equity interest in CCVL that is the second largest manufacturer of suspension PVC resin in India and the largest manufacturer in the South India region.

It has four manufacturing facilities, of which three are in Tamil Nadu at Mettur (Mettur facility), Berigai (Berigai Facility) and Cuddalore (Cuddalore Facility) and one is in Puducherry at Karaikal (Karaikal facility).

Products & Services:

Products & Services: The company has three segments which produces products used for various applications.

Specialty Chemicals – Specialty Paste PVC resin comes under specialty chemicals which is used in multiple industries like Footwear, Automobile, Leather, Mats, etc. Custom Manufacturing division also comes under the same segment with end applications like Pharma, Agrochemicals, API, etc.

Non-Specialty Chemicals – Caustic Soda, Hydrogen peroxide, etc. used in the end industries like Paper, Textile, Disinfectants, Pharma, Refrigerants, etc.

Suspension PVC – This product comes under the subsidiary CCVL which is used in the Irrigation, Real Estate and other industries.

Subsidiaries: As on 31st Mar 2022, the company has only one subsidiary named Chemplast Cuddalore Vinyls Ltd (CCVL).

Key Rationale:

Strong Market Position

CSL’s business benefits from its established market position in India in the PVC (paste and suspension) segment and in the chloralkaline business in South India.

The company is the largest player in the domestic specialty paste PVC resin business (~80% market share basis production capacity and ~45% considering imports) and second largest player in the suspension PVC business (~20% market share basis production capacity and ~10% considering imports).

Revenues also benefit from diversity in product segments with ~66% of revenues derived from suspension PVC, ~20% from specialty paste PVC resin and balance ~14% from chemicals (chlor-alkali and custom manufactured chemicals).

In addition to Suspension PVC and specialty Paste PVC, CSL also manufactures caustic soda (8% of revenues) chloro-methane’s, refrigerant gases and hydrogen peroxide.

Besides, the company also undertakes complex custom manufacturing chemicals of starting materials and intermediates for consumption by life sciences and fine chemical sectors, adding to its business diversity.

Experienced Promoter Group

The Sanmar Group has been engaged in the manufacturing of chemicals and PVC sectors for over five decades. The Group also has presence in shipping and engineering sectors through other entities.

The promoters have scaled up the domestic PVC/chemicals business to over USD 500 million and is an established player in the domestic markets for its products.

The Sanmar group also ventured in the international markets through an acquisition in Egypt (TCI Sanmar S.A.E, TCIS) in 2007 and has expanded the entity to being a major PVC and chlor alkali player in the MENA region.

The group’s PVC/chemicals business has consolidated revenues of over USD 1 billion, making the group a major player in this space.

This has also enabled the Group to attract investments from marquee investors like Fairfax Group and same was also evident in the recently concluded IPO of CSL wherein it raised Rs.3850 crs.

Expansion:

The company is going to make a capex of around Rs.600-700crs for multiple expansions.

It is going to expand the installed production capacity of specialty paste PVC resin by 41 kt with a cost of around Rs.360crs followed by a multipurpose facility setup with 2 blocks at Rs.340crs where the 1st phase is slated to be completed by Q1FY24 and finally, the de-bottlenecking of suspension PVC resin capacity by 31 kt which expected to come fully Online by Q1’FY23.

Financial Performance:

The sales grew at a CAGR of 67% for the period of FY20-22 and the profit after tax grew at a CAGR of 75% for the same period.

The cash and equivalents nearly doubled from Rs.650 crs in FY21 to Rs.1230crs in FY22.

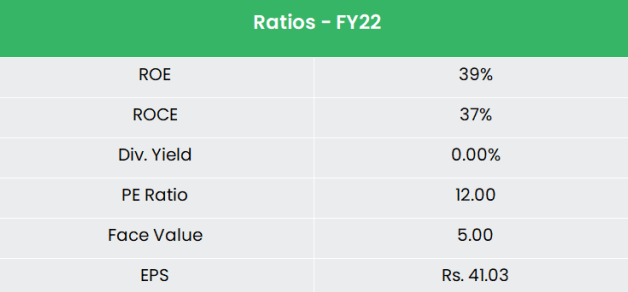

The ROE and ROCE of the company has improved on account of increase in profitability.

Industry Analysis:

Covering more than 80,000 commercial products, India’s chemical industry is extremely diversified and can be broadly classified into bulk chemicals, specialty chemicals, agrochemicals, petrochemicals, polymers and fertilisers.

Specialty chemicals segment clocked 8-9% CAGR in FY15-20, driven by an increase in domestic consumption from various end-user industries and rising exports.

Crisil Research expects this segment to clock 5-6% CAGR in FY20-25, driven by rising domestic consumption and exports. Exports accounts for 35 40% of revenue for key specialty chemicals players in India.

The specialty paste PVC resin market size in India was at 143 kilo tons per annum (KTPA) in FY20. The market has been growing at a CAGR of 3% in FY15-20, driven by growth in the leather cloth industry, which contributes to 78% of demand.

Demand is expected to grow at 5-7% CAGR between FY20 and FY25 to 182 KT. Global demand for S-PVC was 41 MMT in FY15, which increased at a 3.1% CAGR in 2015-19 to 46 MMT in 2019.

Growth Drivers:

100% FDI is allowed under the automatic route in the chemicals sector with few exceptions that include hazardous chemicals.

FDI inflows in the chemicals sector (other than fertilizers) reached US$ 19.09 billion between April 2000 to December 2021.

The US-China Trade war and Covid-19 pandemic have propelled companies across the globe towards adopting the “China plus one” strategy to diversify supply risk.

This has served as a great opportunity for Indian manufacturers in gaining cost advantage over their Chinese counterparts.

The Government of India is considering launching a production linked incentive (PLI) scheme in the chemical sector to boost domestic manufacturing and exports.

Outlook:

CSL continues to seek to develop or improve products and processes to meet demands of existing customers, further enhance the performance of specialty products and respond to increasing compliance requirements under environmental regulations.

It also believes that specialty products have high barriers to entry and as such provide better operating margins.

As a result, it also plans to leverage strong process chemistry and engineering skills to perform custom manufacturing for a range of multinational innovator companies and cater to customers across new industry verticals and in new geographies to grow the business.

Two out of the company’s three segments have backward integration facilities. CSL’s plant at Mettur for manufacturing of specialty paste PVC resin and chlor-alkalis is highly integrated with captive salt mines and captive power plant to meet requirements for its chlor-alkali business.

The integrated nature of operations enhances its operating efficiencies relative to its peers

Valuation:

Strong revenue growth and sustenance of operating margins at ~18-20%, supported by better revenue diversity and increased contribution from Custom Manufactured Chemicals segment, leading to higher than anticipated cash generation.

We recommend a BUY rating in the Chemplast Sanmar Ltd Share Price Target with the price (TP) of Rs.580, 14x FY24E EPS.

Hope you liked our Article on Chemplast Sanmar Ltd Share Price Target 2022, 2025 and company Overview , please read our other articles on “Dixon Technologies Share Price Target and Company Overview“.