In this blog, we’ll separate the wheat from the shaft and identify the most important variables you need to consider when buying a term insurance plan. This blog on “how to choose best term insurance plan” would definitely help you pick your perfect term plan.

Term insurance plans were introduced with a very basic structure. These plans would offer a death cover that will provide insurance cover for up to 75 years and premiums can be paid in multiple options provided e.g. monthly, quarterly, or yearly.

As more and more term insurance providers started offering online term insurance plans, things started to become a little complex.

Today there are a number of term insurance plans available like limited pay plans, increasing cover plans, staggered payout plans, return of premium plans, and dozens of combinations.

While this profusion of choices is good news, it is also becoming a problem as most millennials are unable to decide on which policy to buy.

How to Choose Best Term Insurance Plan:

Number One:

Identify your needs and the term insurance coverage you seek. Your term insurance coverage should broadly assess how much financial resources your dependents will need to have to provide for themselves if you would meet an untimely debt.

The best way to get started on this is to grab a piece of paper and do the following :

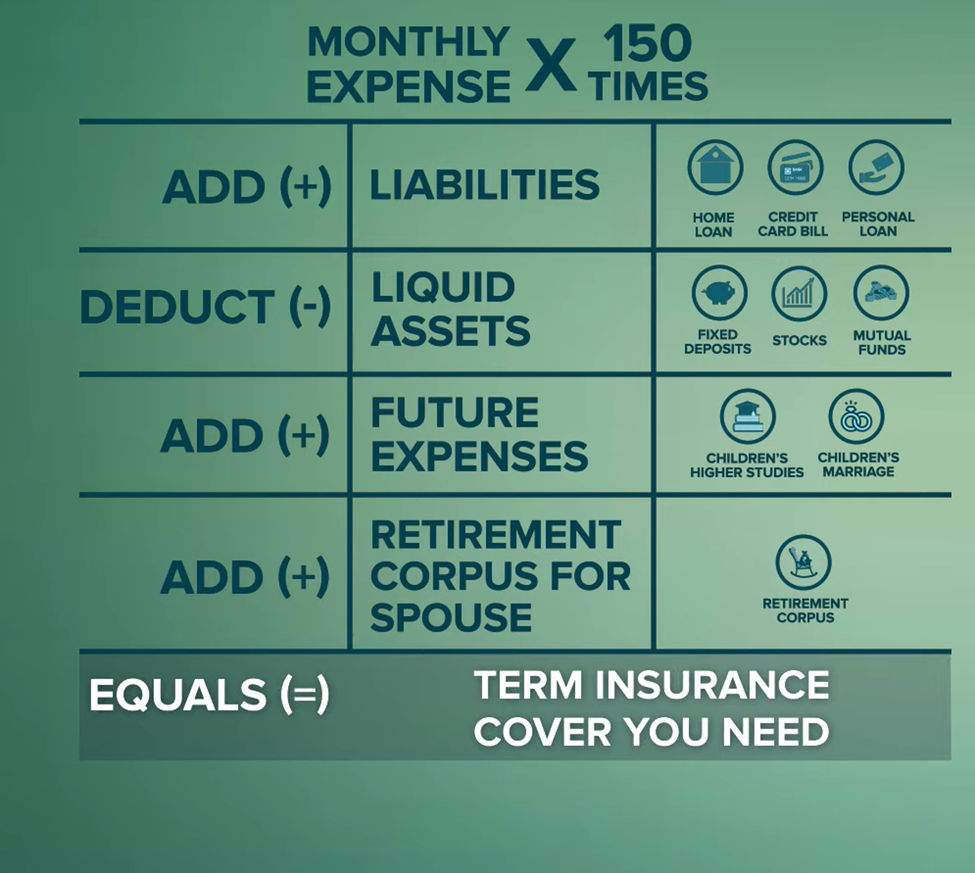

- Estimate your dependent family’s monthly expenses and multiply them by 150 times. This multiple of 150 factors future inflation and is a good way to start the process.

- Add your liabilities on account of home loans, credit card bills, personal loans, etc.

- Deduct any liquid assets that you already have, like fixed deposits, stocks, and mutual funds.

- Add your expenses plant on account of important life goals that are likely to happen in the next 15 odd years, like your children’s, higher studies or their marriage, etcetera.

- Finally, add the retirement corpus you want to leave for your spouse on his or her retirement.

The total of all these will help you arrive at how much term insurance cover one should be endeavoring for.

Number Two:

Determine the tenure of your plan once you know how much cover you need, it’s important to determine till what age you need the cover for.

You don’t want the tenure to be too little as your policy might lapse before you are done with your financial obligations. You also don’t want the tenure to be too high because the premium charge from you will be high on account of the higher tenure.

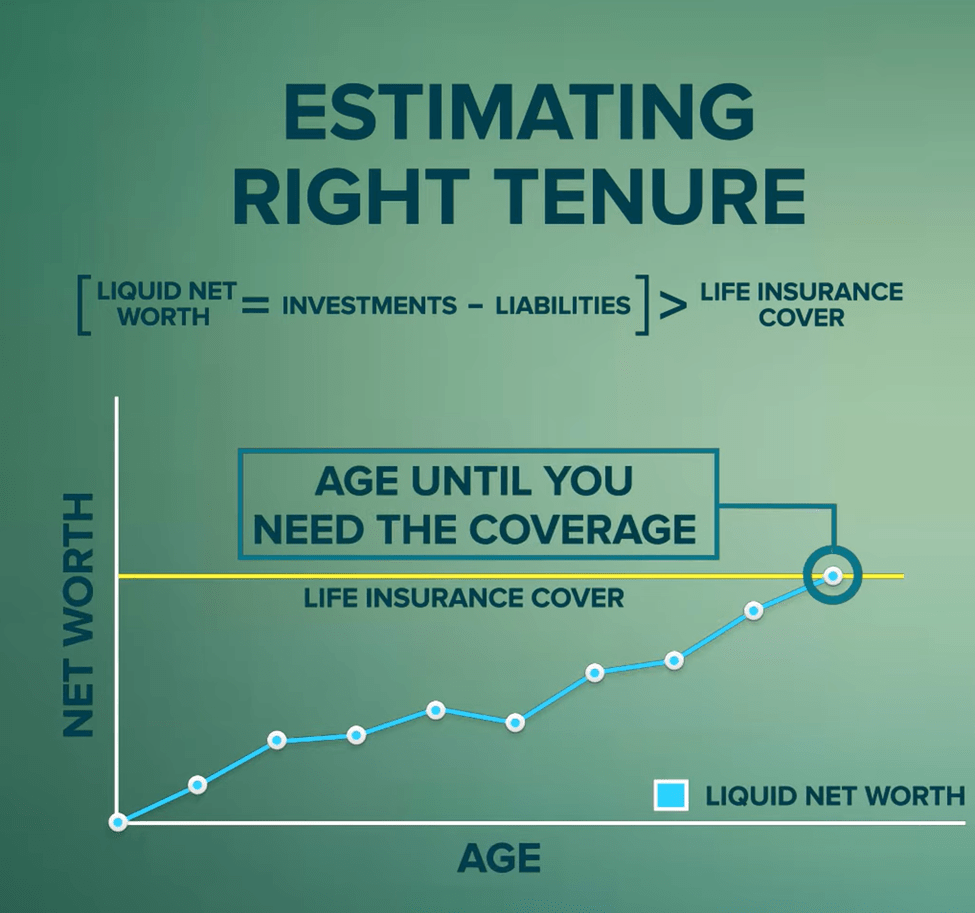

A very good and scientific way of estimating the right tenure for your term insurance plan is to determine by what year will your liquid net worth ( total investments that you have in Mutual funds, Provident Funds, stocks, etcetera ) after subtracting your liabilities will be more than the life insurance requirement we had calculated earlier.

The age at which these two numbers coincide will be the age until which you need coverage. Post that your assets will take care of your dependent upon your demise .

Number Three :

Target to achieve the highest peace of mind per rupee of premium paid .

Premium is one of the most important factors that need to be considered.

Your goal should be to get the highest peace of mind per rupee of premium. The reason, I use peace of mind rather than coverage per rupee of premium is that consumers often value some key intangibles in decision-making.

This can be things like the stability of the insurance provider or its reputation in the eyes of the policyholder.

Since term insurance is a long-term contract, often running into 30, 40, or 50 years, it is important for you to be happy with your decision of insurance provider, which will be a combination of premium and your perception of the insurer.

A useful tip here for most insurance companies, term insurance policies that are sold online on platforms are cheaper than policies sold offline in branches or their agents, so it makes more sense to purchase term insurance plans online as it gives you a clear premium advantage.

Number Four :

Choose your add-on wisely, term insurance plans offer riders at reasonable costs, which should certainly be considered by you even if it might not fit your requirements.

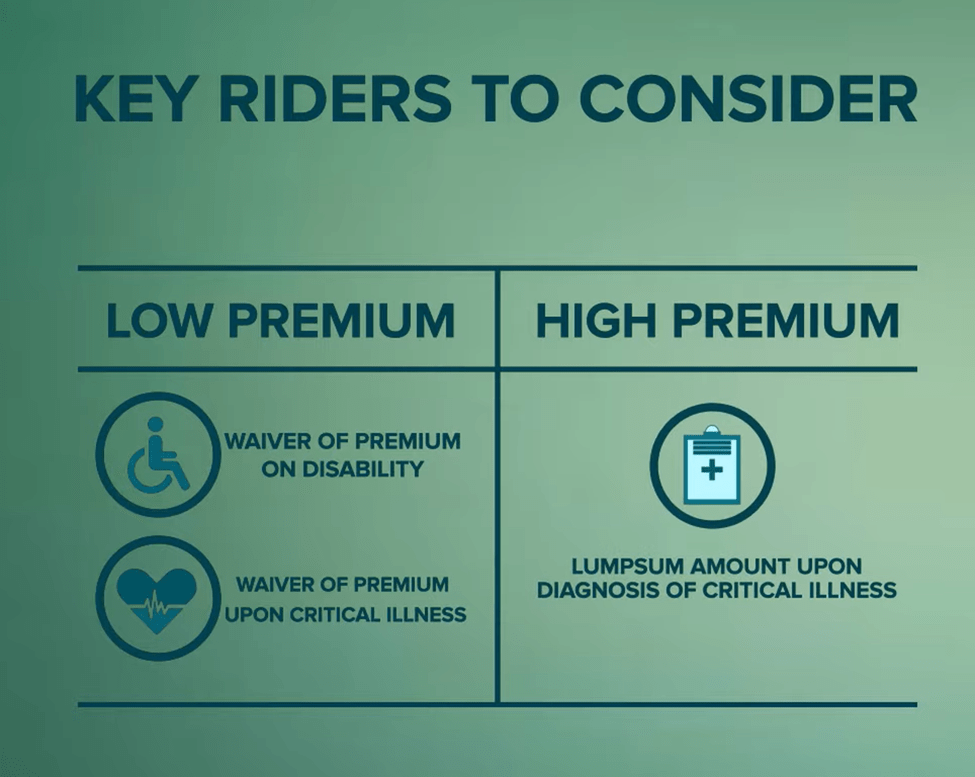

Four major riders are available, which are :

- Additional cover for death due to accident, where an amount in addition to your basic death cover shall be paid if you were to die in an accident.

- Critical illnesses cover where a lump sum amount is paid on the diagnosis of one of the listed critical illnesses with the life insurer

- Waivers of premium on disability where future premiums are waived off if the policyholder is rendered permanently disabled

- Waivers of premium upon critical illness where future premiums are waived off on diagnosis of a listed critical illness.

Of the four riders, the two waivers of premium riders come at low premiums, while the critical rider is generally the most expensive one, you have to run some permutations and combinations to see if the additional benefits match up with the premium charge.

Please don’t forget to read the fine print of all these add-on, which tend to be different for different insurance companies.

Number Five :

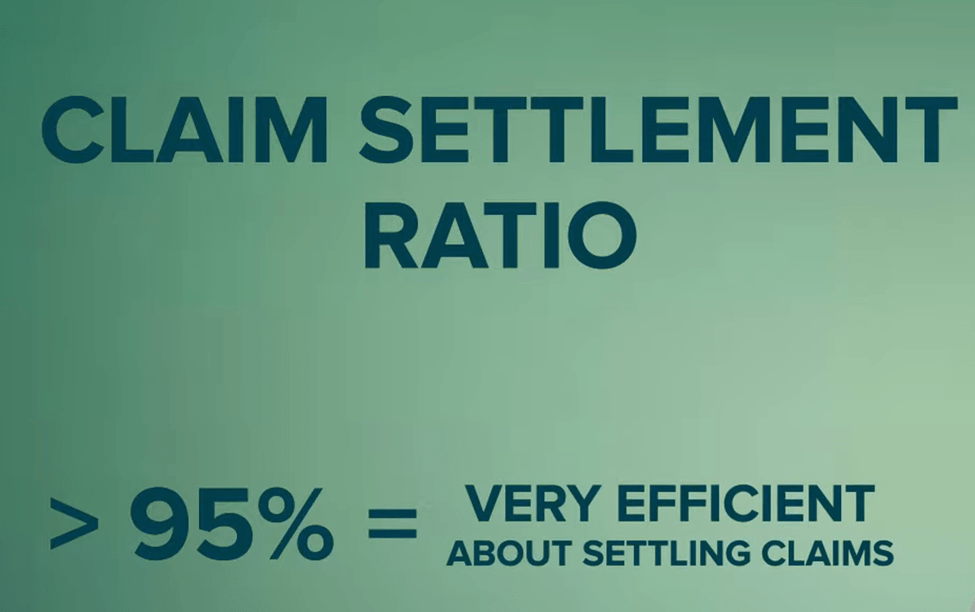

Broadly look at the claim settlement ratio. The claim settlement ratio attracts a lot of consumer attention as it indicates the efficiency at which the policies are being settled.

When you see several companies mentioning 95% in the claim settlement ratio column, it means 95 out of 100 claims reported to the insurance company were settled.

A word of caution here, the claim settlement ratio is merely an indication, and if this ratio is over 95%, then the company has been very efficient about settling claims. You don’t need to go much deeper into it to see who has a 99% ratio or who has a 98.5% ratio.

It is advisable to use the claim settlement ratio as a filter rather than key decision-making criteria.

Term insurance is a long-term contract that benefits your dependence. It is in your interest to identify the right plans for your family with the use of the five considerations explained in this blog.

I hope you found this blog on “How to Choose Best Term Insurance Plan” useful, If you like this blog and the details provided, please share this article with your friends and family.

Please read our other articles providing clarity on “ETF vs Mutual Fund vs Index Fund”. Hope you would get good information out of this article.