In this research report, we will look at Solar Industries India Ltd Share Price Target 2025 by understanding company result and its future growth prospect .

We will look into company business, its declared results and risk if any which investors should know.

Before we go further, please subscribe to our newsletter, so you never miss an article from us when it’s published.

Company Overview:

Established in 1995, Solar Industries India Ltd. (SIL) is the largest manufacturer of industrial explosives and explosive initiating systems in India and has the world’s largest manufacturing facility for packaged explosives.

The company has more than 25 years of excellence in the field of Explosives. With a licensed explosives capacity of over 300,000 MT/annum, the company has ~28% market share in India. Solar, with a 70% market share in exports from India, exports to 65 countries around the world with 34 manufacturing facilities worldwide.

Economic Explosives, a 100% subsidiary, manufactures detonators. Apart from India, the company has global manufacturing presence in 6 countries namely Nigeria, Zambia, South Africa, Turkey, Ghana and Australia.

The company further aims to expand to 10 countries in next 2-3 years. SIL also has interests in the coal mines (in Chhattisgarh) through two JVs.

Products and Services:

The company has various products under its two main segments such as Industrial explosives and Defense explosives:

Industrial Explosives – It consists of various products under Packaged explosives, Bulk explosives and Initiating systems. These products are used in several industries like Construction, Mining, Road, Quarries, Tunnelling, Hydro projects, etc.

Defense – Military explosives like TNT, RDX, Ammunitions, etc.; Bombs and warheads for rockets and missiles; warhead for drones and Initiating systems like Ignitors, detonators, etc. are manufactured under Defense explosives.

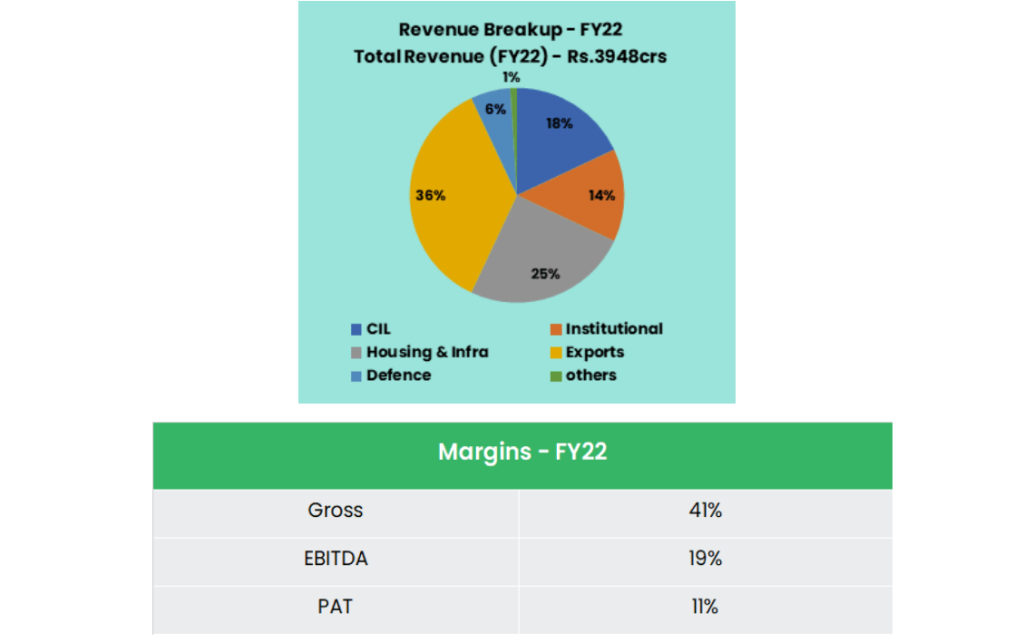

Subsidiaries & Revenue Break up

As on 31st Mar 2022, the Company has 6 (Six) wholly owned Subsidiaries and 18 (Eighteen) Step down subsidiaries

Key Rationale:

Robust Market Position:

With market share of around 28% in the explosives industry, the group is one of the largest manufacturers and exporters of explosives and initiating systems in India.

Its manufacturing unit in Nagpur is the world’s largest single-location cartridge plant. It is one of the few players with complete product range and capability to develop and supply customized products.

In addition to witnessing healthy growth in the domestic market, it has expanded significantly in the overseas market over the past few years. It is the largest supplier of explosives to Coal India Ltd.

The group entered the defense business in 2010 and gained competitive advantage by setting up high-energy explosives, delivery systems, ammunition, rocket/missile integration, pyros, igniters and fuse manufacturing facilities.

Limited shelf life of explosives, continuous consumption by the armed forces, Make in India focus and typical long-term defense contracts provide steady medium-term revenue visibility.

Solar Industries India Ltd Q4FY22

In Q4FY22, Explosives volume/realizations rose by 11%/69% YoY. The overall explosives revenue saw a robust growth of 89% YoY to Rs.790crs. The accessories revenues moderately grew by 5% YoY to Rs.120crs.

Defense & Non-CIL/Institutional sales registered a massive growth of 270% & 122% YoY to Rs.72crs & Rs.197crs. Coal India Ltd, the largest revenue contributor (20%), grew by 89% YoY to Rs.262crs.

The housing & infra, exports & overseas and others segment too reported strong growth in the range of 30%-60%.

Majority of raw materials (apart from ammonium nitrate) such as detonator components, emulsifiers, sodium nitrate and calcium nitrate are manufactured internally, leading to cost savings, quality control and stable operating margin of around 19-20% over the seven fiscals through 2022.

Also, all the bulk explosive manufacturing units are located in 50-60 km radius from major mining regions. The group has the ability to pass on fluctuations in raw material prices to customers through price escalation clause in the contracts.

Strong Guidance:

The management remains optimistic of FY23 in conjecture to continuance in all-round growth & thus, guided for a revenue growth of 30% & EBITDA margin of 18%-20% for FY23.

The management presumes volume & realization growth of 15% each to propel the revenue growth for FY23.

The company has a capex guidance of Rs.400-450 crore in FY23 out of which around Rs.160 crore will be in defense segment, Rs.100 crore will be in overseas segment and rest will be for geographical and product portfolio expansion in India.

Financial Performance:

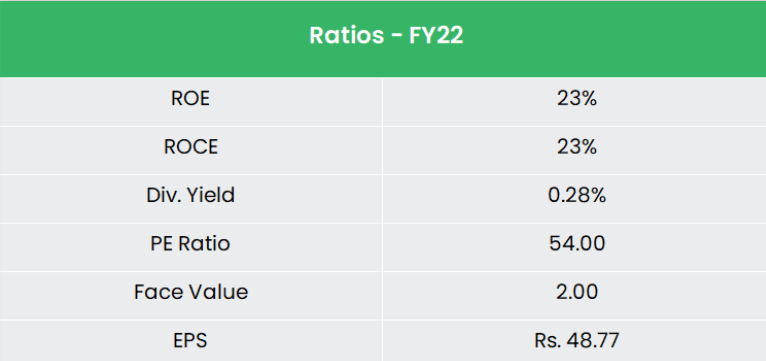

The sales grew at a CAGR of 20% for the period of FY17-22 and the profit after tax grew at a CAGR of 19% for the same period. The five-year average value of ROE and ROCE stand at 22% and 23% respectively.

Industry Analysis:

The Indian Defense sector, the second largest armed force is at the cusp of revolution. The Government has identified the Defense and Aerospace sector as a focus area for the ‘Aatmanirbhar Bharat’ or Self-Reliant India initiative, with a formidable push on the establishment of indigenous manufacturing infrastructure supported by a requisite research and development ecosystem.

The vision of the government is to achieve a turnover of $25 bn including export of $5 bn in Aerospace and Defense goods and services by 2025

India is positioned as the 3rd largest military spender in the world, with its defense budget accounting for 2.15% of the country’s total GDP.

Over the next 5-7 years, the Government of India plans to spend $130 Bn for fleet modernization across all armed services. India is the world’s second-largest coal producer as of 2021.

The total domestic coal production in 2022-23, as of May 31, 2022, is 137.85 MT, which is 28.6 per cent more as compared to the production of 104.83 MT in the same period of last year.

India is expected to become the world’s third largest construction market by 2022.

Growth Drivers:

In the FY23E Budget, the government earmarked Rs.1.52 lakh crore of capital outlay in defense, which has grown at 11% CAGR over FY20-23E.

Finance Minister Nirmala Sitharaman spelt out plans to take the Gati Shakti national master plan forward to spur the logistics infrastructure.

The plan has received its first outlay of Rs.20,000 crore for 2022-23. The Government of India opened the defense industry for private sector participation to provide impetus to indigenous manufacturing.

Outlook:

SIL has orderbook of Rs.2980crs as of FY22 end. The breakup of current order book stands at Rs.475 crs for defense and Rs.2500crs for CIL (Coal India Ltd)/SCCL (Singareni Collieries Company Ltd.).

Defense segment is set to achieve a revenue of Rs.400-450 crs in FY24. SIL processed ~40% of the Rs.410crs multi-mode hand grenade order (10lakh pieces) with remaining 60% targeted to be completed in FY23.

Government initiative like Housing for All, Gati Shakti, Aatmanirbhar Bharat, indigenization of defense products and better performance from mining and infra are also expected to boost the company’s performance.

The company has set a target of 18-20% EBITDA margin in FY23 due to rising commodity prices and disruption in freight charges but in FY24 it is expected to reach 20-21%.

The company will pass on some part of higher raw material prices to its customers in coming quarter. Currently export and overseas is contributing ~36% of revenues and is expected to achieve 40% in coming quarters.

Defense segment will contribute around 15- 18% of revenue in coming quarters as the company has added 20 new products in its portfolio, which includes ignitors, rockets, fuses and missiles.

Valuation:

SIL has been one of the consistent compounders in the Indian explosives’ basket.

Its earnings grew at 16% CAGR during FY12-22 and the momentum is expected to continue given the strong inherent growth catalysts of business moat, leadership position, rising opportunities in defense sector, geographical expansion & higher margin profile.

We recommend a BUY rating in the Solar Industries India Ltd Share Price 2025 with the target price (TP) of Rs.4260, 50x FY24E EPS

Risks:

Raw Material Risk – Any prolonged volatility in raw material (Ammonium Nitrate) prices, along with the inability to completely pass on higher prices due to stiff competitive intensity, can impact overall profitability.

Demand Related Risk – Mining and infrastructure are the two key customer segments for SIL. Any continued slowdown in these could impact the growth in revenues. These two customer segments also face regulatory risks in terms of Govt.’s changing policies.

Forex Risk – Exports and overseas segment contributes the highest with 36% of the overall revenue from 50+ countries. So, Foreign exchange fluctuations i.e., any volatility in the currency rates will impact the financial position of the company.

Hope you liked our Article on Solar Industries India Ltd Share Price Target 2022, 2025 and company Overview , please read our other articles on “Chemplast Sanmar Share Price Target and Company Overview“.