In this research report, we will look at L&T Infotech Share Price Target 2022. We will look into company business, its declared results and its future growth prospect.

What L&T Infotech Ltd Products are ? We will then see what company is doing next to grow in future which will also impact on L&T Infotech Share Price Target 2022.

Before we go further, please subscribe to our newsletter, so you never miss an article from us when it’s published.

Company Overview:

LTI (Larsen & Toubro Infotech Ltd.) is a global technology consulting and digital solutions company helping more than 495 clients succeed in a converging world.

With operations in 33 countries, the company go extra mile for its clients and accelerate their digital transformation with LTI’s Mosaic platform enabling their mobile, social, analytics, IoT and cloud journeys.

Founded as L&T Information Technology Ltd in December 1996, LTI is a wholly owned subsidiary of Larsen & Toubro (L&T).

During 2001–2002 the company’s name was changed from L&T Information Technology Limited to Larsen & Toubro Infotech Limited.

Each day, the team of more than 46,000 LTItes enable their clients to improve the effectiveness of their business and technology operations and deliver value to their customers.

LTI has offshore delivery centres in Mumbai, Pune, Bengaluru, and Chennai; global development centres in the US, Canada, Europe, South Africa, the Middle East, and Singapore; as well as various sales office

Products & Services:

LTI provides IT services, including Application, Development, Maintenance, Enterprise Solutions, Infrastructure Management Services, Testing, Analytics, AI & Cognitive and other services.

Subsidiaries:

As on Mar 31, 2022, the Company had a total of 27 subsidiaries.

Key Rationale:

Strong Parentage:

The IT service business has been increasingly critical to the L&T group in recent years.

As against the earlier stance of focusing on infrastructure and capital-intensive segments, the L&T group is now focusing on the service business, which includes financial and IT services.

Over the years, the contribution of service business, both in terms of revenue and profitability has been improving, additionally, L&T has also been leveraging the capabilities of the services segment to augment its core business.

The acquisition of Mindtree by L&T in 2019, the initiation of the strategic initiative called L&T Nxt in the same year (taken over by Mindtree in July-2021), as well as recent amalgamation announcement of Mindtree with LTI bodes well for the information technology business in general and services business in particular information.

Being an L&T group company, LTI also benefits from the strong brand and domain expertise available within the group, resulting in better penetration and acceptability in the market.

Treasury operations are supported by L&T Treasury, and critical treasury decisions are taken by the treasury committee, which consists of members from the parent and LTI.

Q1FY23 Result:

LTI’s reported revenue for Q1FY23 in rupee terms stands at Rs.4523 crs which is a growth of 5.1% QoQ and 30.6% YoY.

Net Income stands at Rs.634 crs which is a -0.5% QoQ and 27.7% YoY. In terms of CC growth, BFS and insurance reported strong growth of 6.3% and 3.9% QoQ, respectively while utilities, hi-tech & CPG reported muted growth at 1.9%, 0.5% & 0.2% QoQ, respectively.

Manufacturing reported a steep decline of 12.6% on account of seasonal weakness. The company has also won 4 large deal wins during the quarter with net new TCV of US$79mn.

LTI added 29 new logos in 1QFY23, the highest in the past nine quarters. It also added four Fortune 500 clients in 1QFY23.

Merger:

Larsen and Toubro Infotech Ltd (LTI) and Mindtree Ltd, the two publicly traded units of India’s largest engineering company, agreed to merge to form India’s fifth most valuable software company.

Shareholders of Mindtree will get 73 shares of LTI for every 100 held.

The amalgamation process of Larsen & Toubro Infotech (LTI) and Mindtree is likely to be completed by December, and during this period, both the companies will continue to operate independently.

The name of the combined entity will be ‘LTIMindtree’.

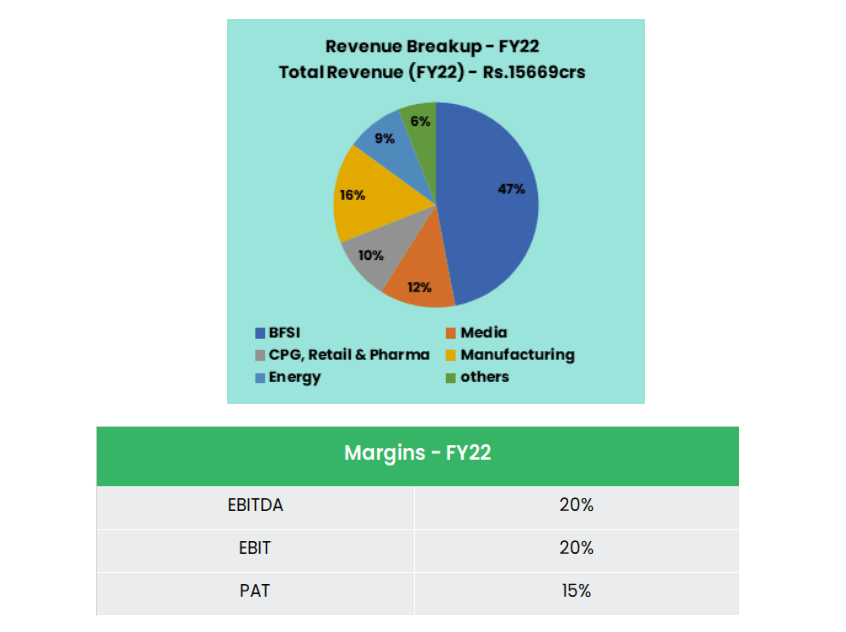

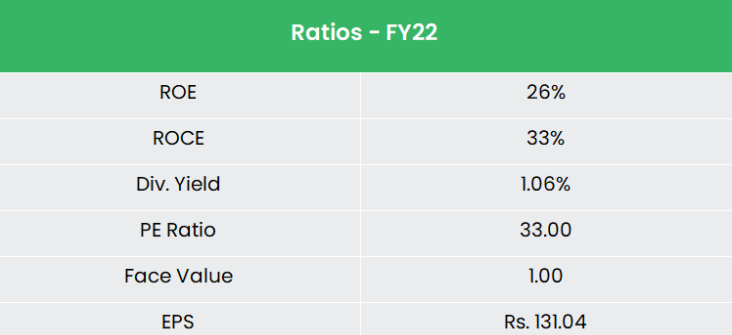

Financial Performance:

The sales grew at a CAGR of 17% for the period of FY12-22 and the profit after tax grew at a CAGR of 19% for the same period.

The five-year average value of ROE and ROCE stand at 31% and 40% respectively. The company has a strong promoter holding of more than 70% with a minuscule debt to equity ratio of 0.09x.

The cash and equivalents of the company stands at ~Rs.4250crs strengthening the balance sheet.

Industry Analysis:

According to the National Association of Software and Service Companies (Nasscom), the Indian IT industry’s revenue is expected to touch US$ 227 billion in FY22 from US$ 196 billion in FY21.

According to Gartner estimates, IT spending in India is expected to increase to US$ 101.8 billion in 2022 from an estimated US$ 81.89 billion in 2021.

Indian software product industry is expected to reach US$ 100 billion by 2025. Indian companies are focusing to invest internationally to expand global footprint and enhance their global delivery centres. Exports from the Indian IT industry stood at US$ 149 billion in FY21.

Export of IT services has been the major contributor, accounting for more than 51% of total IT export (including hardware). BPM and Engineering and R&D (ER&D) and software products exports accounted for 20.78% each of total IT exports during FY21.

ER&D market is expected to grow to US$ 42 billion by 2022. The IT industry added 4.5 lakh new employees in FY22 (as of February), the highest addition in a single year. Women accounted for 44% of the total new employees.

Growth Drivers:

New IT-based technologies such as Tele-medicine, remote monitoring, etc. are expanding and boosting the demand in the digital economy.

The roll out of fifth-generation (5G) communication technology, growing adoption of artificial intelligence, Big Data analytics, cloud computing and the Internet of Things (IoT) will further expand the size of the IT industry in India.

The government introduced the STP Scheme, which is a 100% export-oriented scheme for the development and export of computer software, including export of professional services.

The computer software and hardware sector in India attracted cumulative foreign direct investment (FDI) inflows worth US$ 81.31 billion between April 2000 and December 2021.

Outlook:

Revenue is expected to grow steadily at 12-15% annually over the medium term. Operating profitability should benefit from efficiency on account of improvement in employee utilization and balanced offshore component.

Furthermore, the company’s financial profile continues to be strong, supported by healthy cash generating ability and a debt free balance sheet.

The management has guided PAT margins to remain in the 14%-15% range for FY23 and they will try to recover some wage hike related cost.

Company believes that, BFS sector need to modernize their business to stay competitive and because of covid, insurance businesses have become a direct distribution platform which led them to invest significantly in digitisation.

The management said the deal pipeline remains strong and should see good deal announcements in 2QFY23. It is confident of industry-leading growth in FY23. LTI plans to hire 6.5k freshers in FY23.

L&T Infotech Share Price Target 2022:

LTI is likely to maintain a healthy and efficient business profile over the medium term which is mainly led by steady revenue growth and sound operating efficiency.

Its financial profile is also expected to remain strong over the period due to healthy cash accruals, debt free balance sheet and only moderate capital spending.

We recommend a BUY rating in the stock with the target price (TP) of Rs.5020, 30x FY24E EPS.

Risks:

Geographical concentration Risk – North America contributed 66.5% to the revenue, in fiscal 2022. Any regulatory changes in the region could have a significant impact on operations.

Competitive Risk – The business environment for the IT industry continues to be challenging. IT players in India will need to consistently scale up their operations, primarily on account of intense competition among themselves and from multinational corporations that are expanding their offshore operations in India.

Forex & Attrition Risk – INR appreciation against the USD, pricing pressure, retention of the skilled headcount, strict immigration norms and rise in visa costs are key concerns.

Hope you liked our Article on L&T Infotech Share Price Target 2022 and company Overview , please read our other articles on “KIMS Share Price Target and Company Overview“.