In this research report, we will look at Tata Motors Share Price Target 2022. We will look into company business, its declared results and its future growth prospect.

We will see what company is doing next to grow in future, which will also impact on TATA Motors Share Price Target 2022.

Before we go further, please subscribe to our newsletter, so you never miss an article from us when it’s published.

Company Overview:

Incorporated in 1945, Tata Motors Limited is India’s largest automobile company and the market leader in the domestic CV industry and one of the top three manufacturers of PVs in India.

Part of the illustrious multinational conglomerate, the Tata group, it offers a wide and diverse portfolio of cars, sports utility vehicles, trucks, buses and defence vehicles to the world.

TML has six manufacturing plants in India at Pune (Maharashtra), Lucknow (Uttar Pradesh), Jamshedpur (Jharkhand), Pantnagar (Uttaranchal), Dharwad (Karnataka) and Sanand (Gujarat).

In addition, the company’s key subsidiary, JLR, operates three manufacturing facilities and two design centres in the UK, and has also commenced manufacturing operations at Slovakia.

Moreover, as a Group, TML operates assembly operations at multiple locations around the globe through its subsidiaries and JVs.

Products & Services:

The company several products under three segments namely Jaguar LandRover (JLR), Tata Motors Passenger Vehicles (PV) and Tata Motors Commercial Vehicles (PV):

Jaguar Land Rover (JLR) : – Jaguar F-Pace, Jaguar I-Pace, Jaguar E-Pace, Jaguar F-Type, Jaguar XE,

Jaguar XF, The New Range Rover, The New Range Rover Sport, Range Rover

Velar, Range Rover Evoque, New Discovery, Discovery Sport, Defender.

Tata Motors Passenger Vehicles (PV) – Tata Tiago, Tigor, Altroz, Punch, Nexon, Harrier and safari comes under

PV Internal combustion engine (ICE) division. Tata EV portfolio contains Tigor EV,

Xpres-T EV, Nexon EV and Nexon EV Max.

Tata Motors Commercial Vehicles (PV) – Tata Signa, 407, Prima, Ultra, Ace, Yodha, Intra, Winger, StarBus, Ultra EV bus, Magic.

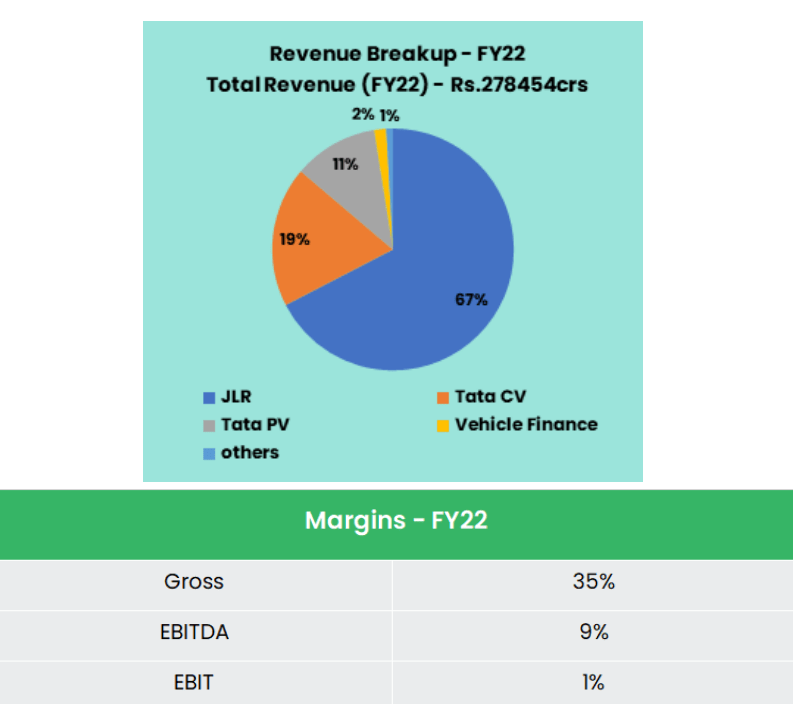

Subsidiaries & Margins :

As on 31st Mar 2022, the Company has 86 subsidiaries (14 direct and 72 indirect), 10 associate companies, 4 joint ventures and 2 joint operations.

Key Rationale:

Strong Volumes from Tata Motors:

Tata Passenger vehicles segment continued its strong momentum with wholesales at 130,327 vehicles, up 102% vs Q1FY22. Demand for passenger vehicles continued to stay strong in Q1FY23 even as the supply side remained moderately impacted.

Tata Nexon continues its place in top 10 selling cars in the July month too. Commercial Vehicles segment also witnessed a strong sales growth of 101% in Q1FY23 at 1,00,921 vehicles vs Q1FY22.

Company has delivered ~100 electric buses in Q1FY23, with now ~715 e-buses running on Indian roads with cumulative coverage of >40 million Kms.

The Market share of CV and PV division of Tata motors stands at 42.5% and 14.3% as on Q1FY23.

Draggy JLR Business :

Jaguar and Land Rover are iconic brands with a rich heritage in the premium luxury segment.

JLR’s product development capabilities enabled successful launches and expansion into new segments, thus enhancing its product portfolio.

New product launches in Land Rover segment such as Defender and refreshed version of Range Rover have gained good traction driving the overall sales.

While Jaguar has been a drag on profitability, the company is looking to modernise the brand, scale down loss-making sedans and make it all-electric from 2025.

JLR’s performance in Q1 was impacted by chip crunch, rising inflation and weak product mix led Range Rover changeover.

JLR’s management has guided for a 90k units wholesales’ in Q2FY23 (82.5k in Q1Y23, incl CJLR) and production is expected to improve every quarter.

Demand continues to be strong with a order book 200k units vs 168k units, sequentially.

Market Leader in EV:

Powertrain mix for PV was 64% petrol, 18% diesel, 7% EV, 11% CNG.

Tata Motors continues to be the market leader in EVs with a market of ~88% in Q1FY23. EV sales had a solid growth of 433% YoY at 3507 vehicles in Jun’22 vs 658 in Jun’21.

The EV sales in Jul’22 generated a new high with 4022 vehicles which is a growth of 566% YoY. During the quarter, TML presented two new, future oriented, sustainable mobility concepts – ‘Curvv’ and ‘AVINYA’.

While the ‘Curvv’, will be launched first as an EV and thereafter with internal combustion engine, ‘AVINYA’ is a vision of pure electric vehicle packed with new age technology.

They launched the Nexon EV Max in Q1 FY23 and are seeing a robust demand for this extension of India’s best-selling EV.

Financial Performance:

In Q1 FY23, JLR Revenue went down 11.3% compared to Q1FY22. CV revenue up 107.2% and PV revenue went up 122.5% on YoY basis.

Consolidated total operating income was down 8.3% QoQ in at Rs.71,935 crs in Q1FY23. EBITDA margins were at 8.2%, down 650 bps QoQ for the same period.

Consolidated loss after tax stood at Rs.5,007 crs. The company has a cash and equivalents of Rs.40669 crs as on FY22.

The management reiterated the target of net debt free status in FY24.

Industry Analysis:

India’s annual production of automobiles in FY22 was 22.93 million vehicles. The two wheelers segment dominates the market in terms of volume owing to a growing middle class and a huge percentage of India’s population being young.

The India passenger car market was valued at US$ 32.70 billion in 2021, and it is expected to reach a value of US$ 54.84 billion by 2027, while registering a CAGR of over 9% between 2022-27.

The electric vehicle (EV) market is estimated to reach Rs. 50,000 crore (US$ 7.09 billion) in India by 2025.

According to NITI Aayog and the Rocky Mountain Institute (RMI), India’s EV finance industry is likely to reach Rs. 3.7 lakh crore (US$ 50 billion) by 2030.

The Indian auto industry is expected to record strong growth in 2022-23, post recovering from effects of COVID-19 pandemic.

Electric vehicles, especially two-wheelers, are likely to witness positive sales in 2022-23.

A report by the India Energy Storage Alliance estimated that the EV market in India is likely to increase at a CAGR of 36% until 2026.

Growth Drivers:

In February 2022, Mr. Nitin Gadkari, Minister of Road Transport and Highways, revealed plans to roll out Bharat NCAP, India’s own vehicle safety assessment program.

In February 2022, 20 carmakers, including Tata Motors Ltd, Suzuki Motor Gujarat, Mahindra and Mahindra, Hyundai and Kia India Pvt. Ltd, were chosen to receive production-linked incentives (PLI) as part of the government’s plan to increase local vehicle manufacturing and attract new investment.

The 20 automobile companies have proposed a total investment of around Rs.45,000 crs (US$ 5.95 billion).

The industry attracted Foreign Direct Investment equity inflow (FDI) worth US$ 32.84 billion between April 2000-March 2022, accounting for 6% of the total equity FDI during the period.

Outlook:

The company had announced last October that TPG Rise Climate shall invest Rs.7500 crs in compulsory convertible instruments to secure between 11% to 15% stake in its EV business.

The company has received its first tranche of Rs.3750 crs. A new subsidiary named Tata Passenger Electric Mobility Ltd has been incorporated for the same.

Medium and long term JLR guidance maintained to achieve ~5% EBIT margin at JLR and £1 billion positive free cash flow in FY23. Management expects supply constraints to improve gradually; with improving conditions in China.

Management also expects ramp-up in production with wholesale target of 90k units at JLR front for Q2FY23 (excl- China JV).

The Refocus program has achieved £250m cash and cost improvements for Q1FY23 & remains on track to achieve the guided cashflows of £1b+ for FY23.

In India CV space, market share dipped 240 bps QoQ at 42.5% largely led by M&HCV space however management expect to recover the same through 15+ new products & 25+ variants launched in Q1, including ACE EV.

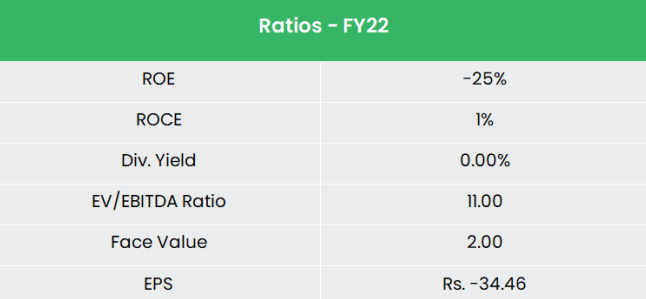

Valuation:

The Robust booking pipeline, strong market share, low channel inventory, upcoming launches and the available capacity to ramp up EV to act as growth triggers for Tata Motors.

We recommend a BUY rating in the stock with the target price (TP) of Rs.574 on the basis of 6x FY24E EV/EBITDA.

Risks:

Chip Shortage Risk – Though the chip shortage issue is easing overall, the rising geopolitical tensions between Taiwan and China recently may again resume the issue which will result in a major impact on car production.

Lockdown Risk – The JLR’s China operations has heavily impacted due to covid related lockdown and it led some dealerships in parts of China to temporarily close. Any new lockdown in the near future will again impact the same.

Competitive Risk – JLR is exposed to stiff competition from bigger and established brands such as BMW, Daimler and Volkswagen. JLR with its niche presence in premium SUVs (sport utility vehicles), has relatively low market share in the world luxury car segment. Domestic PV business too is facing the stiff competition but the Brand is maintaining its position in the Top 3 for the past 8-10 months.

Hope you liked our Article on TATA Motors Share Price Target 2022 and company Overview , please read our other articles on “L&T Infotech Share Price Target and Company Overview“.