In this Research Report, We will look at Dr Lal PathLabs Ltd result, understand its business model and its business future prospect. We will then look at the Target Price of Dr Lal PathLabs Ltd Stock for investors.

Please subscribe to our newsletter, so you never miss an article and research reports from us.

Company Overview:

Dr Lal PathLabs Ltd (DLPL), established in 1949, is a leading diagnostics chain, supported by its robust “hub and spoke” business model.

The company has an integrated nationwide coverage with its 231 clinical labs (including National Reference Lab, at Delhi and Regional Reference Lab at Kolkata), 3,705 Patient Service Centers (PSCs) and 9,247 Pick-up Points (PUPs) as on FY21.

Dr Lal PathLabs Ltd has built strong economies of scale, which helped it to further expand its offerings and network.

Company network is present across India, including in major cities such as New Delhi, Mumbai, Bengaluru, Hyderabad, Chennai and Kolkata, which have fully-integrated centralized information technology platform.

The company also has operations in Nepal, Bangladesh and Kenya and operates through hospital tie-ups and global associate partners.

Dr PathLabs receives samples from international location like Bhutan, Sri Lanka, Myanmar, Malaysia, Nigeria, Saudi Arabia, Maldives, Qatar, Kuwait, and UAE, for testing in India.

Products:

The company provides almost all Diagnostics services prescribed by physicians in India. The company is engaged in carrying out pathological investigations of various branches of biochemistry, hematology, histopathology, microbiology, electrophoresis, immuno-chemistry, immunology, virology, cytology, other pathological and radiological investigations

Subsidiaries , Revenue and Margins:

Subsidiaries:

As on March 31, 2021, the company has 11 subsidiaries in which 8 are within India and 3 are outside India

Revenue:

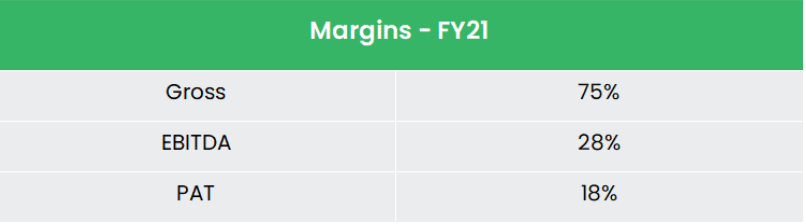

Margins:

Key Rationale:

Business Model:

Asset Light Business Model – DLPL has a robust hub and spoke model, especially in north and east markets as it has strategically positioned its clinical laboratories, patient service centers (PSCs) and pick-up points (PUPs).

The business model is asset light and scalable as most of the patient service centers (collection centers) operate under the franchisee model and most of its diagnostic equipment is sourced through reagent rental agreements.

The company’s hub and spoke model (centralized diagnostic testing and clinal laboratories) offers economies of scale and future expansion opportunities, along with large network PSCs and PUPs, thereby enhancing the company’s purchasing power with suppliers.

Additionally, DLPL continues to focus on improving the ratio between collection centers and labs, by focusing on building franchise infrastructure (light asset and consuming less apex).

Business Segment:

Strong B2C segment – Dr. Lal PathLabs is one of India’s premier diagnostic players that has a heavy business to-consumer (B2C) presence. DLPL continues to actively invest in consistently improving customer experience, which is a key imperative of B2C strategy.

The company’s focus in providing patients with quality diagnostic healthcare services at reasonable costs has earned it the reputation of being amongst the most trustworthy and reliable pathology labs in India.

Customer walk-ins account for the highest share of revenues and speaks volumes about DLPL’s leading market position and established brand value.

Various promotional health check-up packages targeted at different gender and age groups alongside online initiatives to provide access to information are being undertaken to grow the retail segment.

Growth of B2C/retail (walk-ins, home collection and corporate) customers translating into higher realization per sample/patient is very vital for company’s organic growth and profit margins.

Financial Performance:

DLPL’s Q3FY22 revenue rose 9.8% YoY to Rs.497 crs, largely led by higher volumes of patients (+21.1% YoY to 6.6mn).

However, revenues from COVID and allied portfolio declined 46.8% YoY to Rs.59 crs. Realization per patient stood at Rs.747 (as against Rs.824 for Q3FY21) due to reduction in COVID RT-PCR realizations.

On the contrary, non-COVID business witnessed strong trajectory following ease of mobility restrictions across the country with revenue growing to Rs.438 crs (+28.1% YoY) with ‘Swasthfit’ contributing 15% to total revenues.

The company generated a Revenue and PAT CAGR of 21% and 26% over the period of 10 years (FY12-21).

The company maintained an average EBITDA Margin of 25%+ for the same period of 10 years. The company’s balance sheet is strong with Zero Debt and a cash equivalents of Rs.1126 crs.

The company’s 5 year Avg. CFO/PAT is strong at 1.2x which indicates that DLPL is strong at converting profit into cashflow.

Industry Analysis:

Healthcare has become one of India’s largest sectors, both in terms of revenue and employment. The industry is growing at a tremendous pace owing to its strengthening coverage, service and increasing expenditure by public as well private players.

The healthcare market can increase three-fold to Rs.8.6 trillion (US$ 133.44 billion) by 2022. In Budget 2021, India’s public expenditure on healthcare stood at 1.2% as a percentage of the GDP.

The diagnostic industry has emerged as an attractive play in India’s growing healthcare sector and is one of the fastest growing service segments in the country.

The domestic industry is estimated at USD 9.5bn and is expected to grow at a compounded annual growth rate (CAGR) of 11% over the next five years, largely driven by increase in healthcare spending by aging population, rising income levels, rising awareness for preventive testing, advanced healthcare diagnostic tests offerings, and central government’s healthcare measures.

Growth Drivers:

Inflows in sectors such as hospitals and diagnostic centers and medical and surgical appliances stood at US$ 7.40 billion and US$ 2.22 billion, respectively, between April 2000 and June 2021.

The Government is planning to increase public health spending to 2.5% of the country’s GDP by 2025. The share of healthcare in GDP is expected to rise 19.7% by 2027.

The Indian government is planning to introduce a credit incentive program worth Rs.500 billion (US$ 6.8 billion) to boost the country’s healthcare infrastructure.

The program will allow firms to leverage the fund to expand hospital capacity or medical supplies with the government acting as a guarantor and strengthen COVID-19-related health infrastructure in smaller towns.

Outlook & Valuation:

Outlook:

The Company’s sales growth has been in line with volume growth of Patients and samples. The business doesn’t require any debt to grow as the model itself is an asset light and it also generates good amount of cash consistently which is enough for expansion.

Fixed Assets have hardly grown in the last 5 years, again indicating the low capital intensity of the business. Cash and cash Equivalents have grown 30%+ YoY for the last 5 years barring FY20 which represents the business as a cash generating machine.

The company has become a negative net working capital business. This has happened in the last 3 years when payables have increased significantly.

Since the business is capital light and has no debt, increase in payables only indicates high bargaining power of the company with its suppliers.

Company’s enhanced focus on driving volumes while maintaining prices, coupled with tactical penetration in West and South through modular cluster city approach is playing out well.

Also, its focus on strengthening the omnichannel approach in cities and pursuing hub lab infrastructure in tier 2 and 3 towns is expected to drive future growth for its more sustainable, non-COVID business.

Valuations:

Dr Lal PathLabs has an asset light model with its collection centers majorly operating under a franchisee model and most of its diagnostic equipment sourced through reagent rental agreements.

With its strong network presence, we believe the company is poised to deliver higher volume growth. Hence, we recommend a BUY rating in the stock with the target price (TP) of Rs.3130, 75x FY23E EPS.

Disclaimer: Before taking any call, please get in touch with your Financial Advisor

Hope you liked our Research Report, Please read our other Research Report on “HDFC AMC Research Report“