In this Article, we will learn about Balaji Amines Ltd business and look at its detailed research report along with Share Target Price. Investors will get clear idea on company’s business and its future business and growth prospect.

Please subscribe to our Newsletter and never miss an article from us. These detailed reports will be delivered right to your email when its published

Company Overview:

Established in 1988, Balaji Amines Ltd (BAL) is one of India’s leading manufacturers of aliphatic amines and its derivatives, speciality chemicals and pharma excipients. It is a manufacturer of derivatives, which are downstream products for various Pharma/Pesticide industries apart from user specific requirements.

It is also a sole producer for few specialty chemicals. The company’s end-product selection policy is based on import substitution. Its diversified portfolio includes over 25 products, which has global presence.

BAL`s state-of-the-art manufacturing facility is located at Tamalwadi Village, near Solapur (Maharashtra State, India).

As of March 2021, the company operates manufacturing plants with an aggregate capacity of about 201,000 Metric Tonnes Per Annum (MTPA).

BAL’s subsidiary, BSCPL, manufactures specialty chemicals such as ethylene diamine (37,350 MTPA) and its by-products piperazine (about 4,050 MTPA), diethyl triamine (about 3,150 MTPA) and a mixture of Amines (780 MTPA)

Products:

The company’s product portfolio consists of three segments namely Amines, Amine derivatives and Specialty & other chemicals.

- Amines – Mono Methyl Amine, Di-Methyl Amine, Tri-Methyl Amine, Mono-ethyl Amine, etc.

- Amine Derivatives – Mono-Methyl Amine Hydrochloride, Di-Methyl Amine

- Hydrochloride, Tri-Methyl Amine Hydrochloride, etc. Specialty & Others – Morpholine, Acetonitrile, Dimethylformamide, Gamma

Butyrolactone, etc.

Subsidiaries of Balaji Amines Ltd:

Balaji Speciality Chemicals Private Limited (BSCPL) is the only subsidiary of the Company as of Jan’22.

Key Rationale:

Leadership Position in Oligopolistic Amines Industry :

Balaji Amines Ltd (BAL) is the largest manufacturer of aliphatic amines and their derivatives in the country. The industry structure is oligopolistic. It is in line with the global industry structure, with only few manufacturers catering to the demand in a particular region.

Balaji Amines Ltd is the sole producer for a few speciality chemicals, it is insulated from the existing competition in the market. The company uses indigenous technology to manufacture amines, leading to lower manufacturing costs.

Stellar Performance:

Balaji Speciality Chemical’s (Subsidiary) revenue more than doubled on YoY basis and rose 11% QoQ to Rs.130 crs during the quarter, largely driven by higher realizations (+113% YoY and +36% QoQ).

While volumes of 3,887 MT in Q3 as against 3,640 MT in same quarter last year, thereby taking the 9MFY22 capacity utilization to about 52%. BSC posted the highest ever EBIT margin of 36.4% (up +832bps YoY and 1,190bps QoQ), resulting in stellar (+195% YoY and +65% QoQ) growth in EBIT to Rs.47 crs.

BSC continues to witness substantial demand as well as robust price realization. Given the high demand and scarce availability of the products associated with subsidiary, its OPM for 9MFY22 stood at somewhat 35%, marked higher when compared with that in the corresponding period in the prior year.

The bottlenecks in the availability of key raw material ethylene oxide (EO) are easing off and may result in volume growth in the upcoming quarters.

The management anticipates revenue of Rs.475–500 crs in FY22 and improvement in margin owing to ramp-up of production.

Capex:

Construction of the DMC plant at Unit 4 is nearing completion and the management expects it to commence operations in Q1FY23. With MTPA capacity of 10,000–12,000, BAL will be the sole supplier of DMC in India. After some debottlenecking exercises, DMC capacity can be increased to 15,000 MTPA.

The current domestic annual demand stands at 8,000–9,000 MTPA, which is completely fulfilled by imports.

As DMC is also used in preparing premixes utilized in EV battery, the management expects DMC demand to increase with EV battery manufacturing plants being set up in India.

In the same DMC plant, a facility is also available to manufacture propylene glycol, which will increase the total available capacity to 25,000–30,000 MTPA with total revenue potential of Rs.200 crs.

Total capex as of now is Rs.236 crs undertaken in Phase 1 of Greenfield expansion and additional Rs.15–20 crs will be expensed to complete the DMC plant.

Financial Performance:

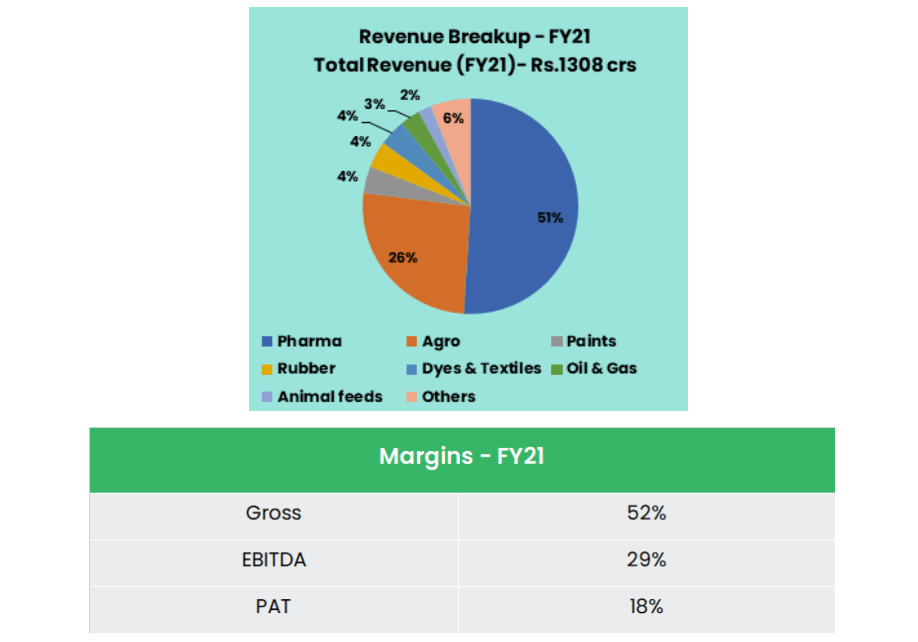

The company generated a Revenue and PAT CAGR of 15% and 33% over the period of 5 years (FY17-21). The company maintained an average EBITDA Margin of 22%+ for the same period of 5 years.

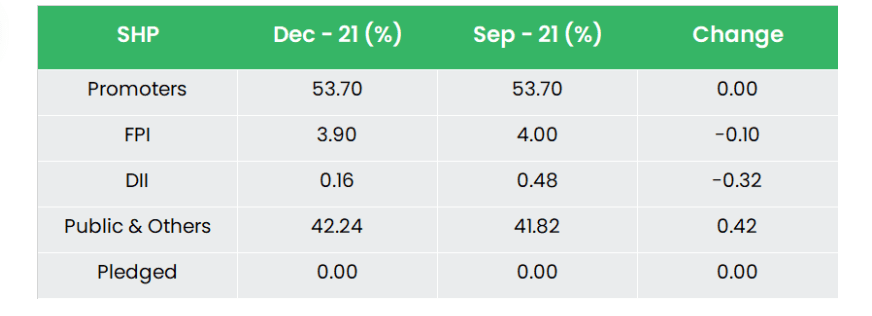

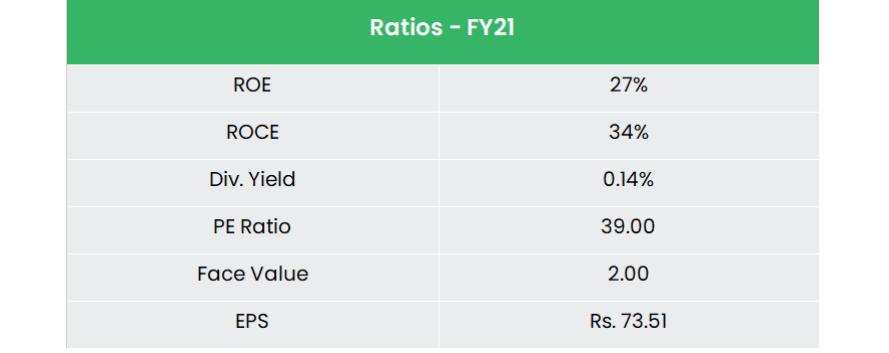

The company’s balance sheet is strong with a low Debt/Equity of 0.15x. Average 5 year ROE is around 25% for the same period.

Industry Analysis:

The Indian chemicals industry stood at US $178 billion in 2019 and is expected to reach US $304 billion by 2025 registering a CAGR of 9.3%. The demand for chemicals is expected to expand by 9% annually by 2025.

The chemical industry is expected to contribute US$ 300 billion to India’s GDP by 2025. The specialty chemicals constitute 22% of the total chemicals and petrochemicals market in India.

The demand for specialty chemicals is expected to rise at a 12% CAGR in 2019-22.

Indian manufacturers have recorded a CAGR of 11% in revenue between FY15 and FY21, increasing India’s share in the global specialty chemicals market to 4% from 3%.

A revival in domestic demand and robust exports will spur a 50% YoY increase in the capex of specialty chemicals manufacturers in FY22 to Rs. 6,000-6,200 crore (US$ 815-842 million).

Revenue growth is likely to be 19-20% YoY in FY22, up from 9-10% in FY21, driven by recovery in domestic demand and higher realizations owing to rising crude oil prices and better exports.

Growth Drivers:

100% FDI is allowed under the automatic route in the chemicals sector with few exceptions that include hazardous chemicals. Total FDI inflow in the chemicals (other than fertilizers) sector reached US$ 18.69 billion between April 2000 and June 2021.

The US-China Trade war and Covid-19 pandemic have propelled companies across the globe towards adopting the “China plus one” strategy to diversify supply risk. This has served as a great opportunity for Indian manufacturers in gaining cost advantage over their Chinese counterparts.

The Government of India is considering launching a production linked incentive (PLI) scheme in the chemical sector to boost domestic manufacturing and export.

Outlook & Valuation:

Balaji Amines derives much of its competitive advantage from vertical integration; wide basket of finished products, cost efficiencies from specialization of products; bulk sourcing of materials and harnessing low-cost

technology.

Based on its strong performance in 3QFY22, BAL’s management revised upwards its FY22 revenue guidance to Rs.2,000 crs+ and expects Rs.2,500cr+ of revenue and EBITDA margin of 25-26% in FY23.

It will be driven by the speedy ramp-up of the DMC plant owing to strong demand from the EV market and import substitution.

The company’s long-term growth is based on

- Increase in contribution from better margin products such as DMF and

acetonitrile following debottlenecking

- Commercialization of DMC and propylene glycol capacity by Q1FY23.

- Strong demand for BSC’s products leading to improvement in utilization and realizations.

- Anticipation of more capex announcements (such as capacity expansion of methyl amines, DMF, DMC plant) in the coming quarters.

Company is available at a discounted multiple compared to its peers from the long-term perspective taking into consideration its leading position in aliphatic amine manufacturing. It has strategic investments towards products which are substantial imports or products with limited competition. Hence, we recommend a BUY rating in the stock with the target price (TP) of Rs.3375, 39x FY23E EPS.

Hope you liked our Article on Balaji Amines Ltd, Please read our article on “Dr Lal PathLabs Research Report and Share Target Price“