What is DFI? Can I use it to earn interest in my cryptocurrency holdings? Is it risky and will it change the future of finance as we know it? Well, in today’s blog, we’ll tackle these questions and learn more about What is DeFi in the Crypto world.

Before we begin, don’t forget to subscribe to our newsletter, so you’ll immediately get notified when a new article comes out.

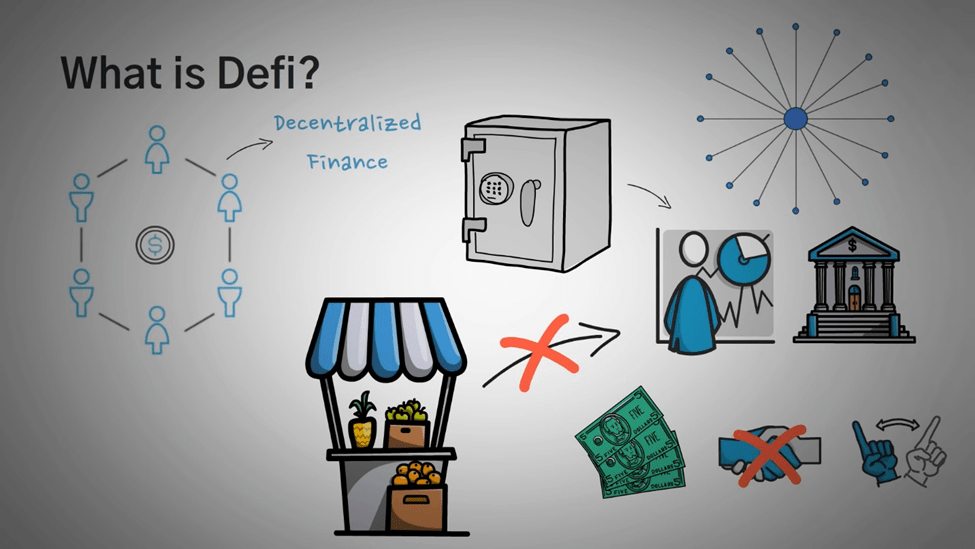

Decentralized Finance or DeFi.

If you have read this article on “What is Cryptocurrency and how it works”, you already know that cryptocurrency like Bitcoin is a form of money that isn’t controlled by any central bank or government.

Cryptocurrencies can be transferred to anyone from anyone around the world without the need for a bank or a financial institution.

Bitcoin is decentralized money, however, transferring money is only the first of many building blocks in the financial system.

Aside from sending money to one another, there are a variety of services we use today. For example, loans, savings plans, insurance, and stock markets are all services that are built around money and together create our financial system.

Today, our financial system and all of its services are completely centralized. Banks, stock markets, insurance companies, all have someone in charge, whether it be a company or a person that controls and offers these services.

This centralized financial system, or CFI for short, has its risks mismanagement, fraud, and corruption, to name a few.

But what if we could decentralize the financial system as a whole in the same way that Bitcoin decentralized money?

What is DeFi ?

The Defi is a term given to financial services that have no central authority or someone in charge using decentralized money.

There are certain cryptocurrencies that can be programmed for automated activities.

We can build exchanges, lending services, insurance companies, and other organizations that don’t have an owner and aren’t controlled by anyone.

Confused? Don’t worry, we’ll break it down for you.

Main Things Running DeFi System:

Three Main things that run the DeFi systems:

- CryptoCurrency

- Blockchain

- Smart Contracts.

To create a decentralized financial system, the first thing we need is an infrastructure for programming and running decentralized services.

Luckily for us, Ethereum does just that. Ethereum is a “Do it Yourself” platform for writing decentralized programs, also known as decentralized apps or DApps.

What is Ethereum? This article on Solana vs Ethereum explains the details of Ethereum in great detail, but for now, we’ll just look through the use of Ethereum.

We can write automated code, also known as smart contracts that manage any financial service we’d like to create in a decentralized manner.

This means that we can determine the rules as to how a certain service will work.

Once we deploy those rules on the Ethereum network, we no longer have control over them. They are immutable. Once we have a system in place, like using Ethereum for creating decentralized apps, we can start building our decentralized financial system.

Building Blocks:

Let’s now take a look at some of the building blocks that comprise it.

The first thing any financial system needs is, of course, money.

You may be thinking why not use Bitcoin or Ether, which is Ethereum’s currency?

Well, as for Bitcoin, while it is indeed decentralized, it has only very basic programmable functionality and is not compatible with the Ethereum platform.

Ether, on the other hand, is compatible and programmable. However, it’s also highly volatile.

If we’re looking to build reliable financial services that people will want to use, we’ll need a more stable currency to operate within this system.

StableCoins:

This is where stablecoins come in. Stablecoins are cryptocurrencies that are pegged to the value of a real-world asset, usually some major currency like the US dollar.

We’ll want to use a stable coin that doesn’t use Fiat money reserves for maintaining a peg since this will require some sort of central authority.

This is where Dai comes into play. Dai is a decentralized cryptocurrency pegged against the value of the US dollar, meaning one Dai equals $1.

Unlike other popular stablecoins whose value is backed directly by US dollar reserves, Dai is backed by crypto collaterals that can be viewed publicly on the Ethereum blockchain.

Dai is over collateralized, meaning if you lock up in a deposit of one dollar’s worth of ether, you can borrow $0.66 worth of Dai.

As soon as you want your ether back just pay back the Dai you borrowed and the ether will be released.

If you don’t have any ether to lock up as collateral, you can just buy Dai on an exchange because Dai is over collateralized even if Ether’s price becomes extremely volatile, the value of the locked ether backing Dai in circulation will most likely remain at 100% or more.

In essence, the Dai stablecoin is also a smart contract that resides on the Ethereum platform. This makes Dai truly trustless and decentralized stablecoin, which cannot be shut down or censored.

Hence, it’s a perfect form of money for other DeFi services.

Decentralised Exchanges or Dex :

Now that our decentralized financial system has stable, decentralized money, it’s time to create some additional services.

The first use case that we’ll discuss is the decentralized exchange or Dex.

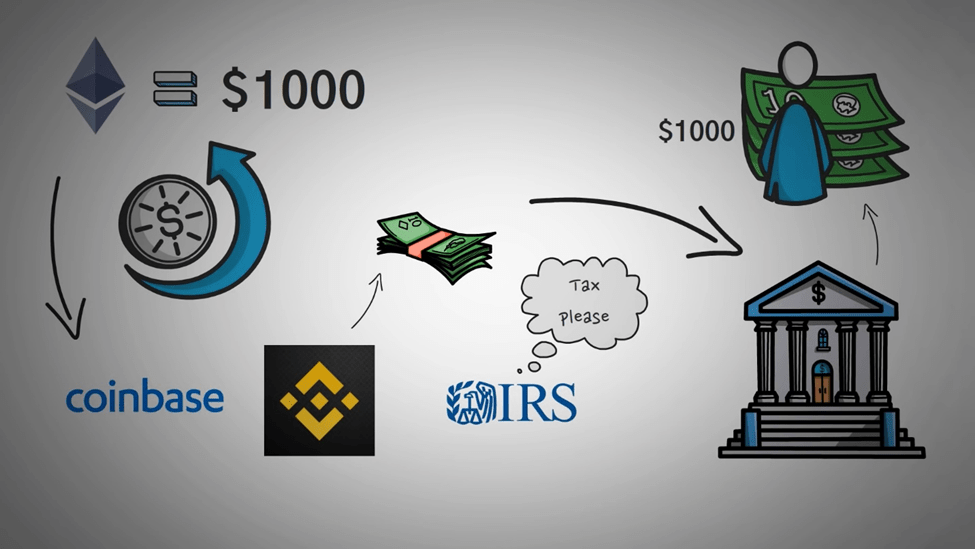

DEXes operate according to a set of rules, or smart contracts that allow users to buy, sell or trade cryptocurrencies.

Just like Dai, they also reside on the Ethereum platform, which means they operate without a central authority.

When you trade on a deck, there is no exchange operator, no signups, no identity verification, and no withdrawal fees.

Instead, smart contracts enforce the rules, execute trades, and securely handle funds when necessary. Also, unlike a centralized exchange, there’s often no need to deposit funds into an exchange account before conducting a trade.

This eliminates the major risk of exchange hacking, which exists for all centralized exchanges. But the range of decentralized financial services doesn’t stop there.

Now, Let’s move on to decentralized money markets, services that connect borrowers with lenders.

Lending and Borrowing:

The compound is an Ethereum based borrowing and lending DAPP, you can lend your crypto out and earn interest on it.

Alternatively, maybe you need some money to pay the rent or buy groceries, but the only funds you have are cryptocurrencies.

If that’s the case, you can deposit your crypto as collateral and borrow against it.

The Compound platform automatically connects the lenders with the borrowers, enforces the terms of the loans, and distributes the interest.

The process of earning interest on cryptocurrencies has become extremely popular lately, giving rise to yield farming, a term given to the effort of putting crypto assets to work while seeking to generate the most returns possible.

Insurance:

So now we have decentralized, stable coins, decentralized exchanges, and decentralized money markets. How about decentralized insurance?

All of these new financial products entail some risks, which we will cover shortly.

So why not create a service that ensures my funds in case something goes wrong?

Well, how about a decentralized platform that connects people who are willing to pay for insurance with people who are willing to insure them for a premium?

While everything happens autonomously, without any insurance company or agent in the middle, DeFi services work in conjunction with one another, making it possible to mix and match different services to create new and exciting opportunities.

This kind of resembles how you can use different Lego blocks and get creative with whatever it is you want to build.

Hence the term money Legos has been coined to refer to DeFi services. For example, you can build the following service from different money Legos.

You start by using a decentralized exchange aggregator to find the exchange with the best rate for swapping ether for Dai. You then select the decks you want and conduct the trade. Then you lend the Dai you received to borrowers to earn interest.

Finally, you can add insurance to this process to make sure you’re covered in case anything goes wrong. That’s just one example. Out of the many opportunities different offers, by now, you can probably imagine what advantages you get.

Outlook:

DeFi presents transparency, interoperability, decentralization, free for all services, and flexible user experience, to name just a few.

However, there are also some risks you should be aware of. The most important risk is that DeFi is still in its infancy, and this means that things can go wrong.

Smart contracts have had issues in the past where people didn’t define the rules for certain services correctly, and hackers found creative ways to exploit existing loopholes to steal money.

If you decide to test out any of the existing DeFi services, make sure to do it with the amount of money you can afford to lose in case anything goes wrong.

Additionally, you should remember that a system is decentralized only as its most central component.

This means that some services may be only partially decent centralized while still keeping some centralized aspects that can act as an Achilles heel, it’s important to understand exactly how a product or service works before investing in it.

DeFi revolution has reached its early adopter stage and the coming years will tell if it manages to cross the chasm into mainstream adoption.

There is no doubt that a decentralized financial system can benefit a huge portion of the population that faces financial discrimination because of high fees and inefficiencies in managing their funds.