In this blog, we will look at the superior business model of PI Industries Ltd . We will understand how the business model will help PI Industries Ltd grow and look at the future price that investors can expect.

Please subscribe to our newsletter so that you never miss an article from us when its published.

Company Overview:

PI Industries Ltd was set up in 1946 as an edible oil refinery by the late Mr. P P Singhal. The company later entered the agrochemical formulations business.

In the mid-1990s, PI diversified into CSM exports for global agrochemical innovator companies. PI currently operates in the domestic agricultural inputs and

CSM exports segments.

It is a leading player in the domestic agricultural inputs sector, primarily dealing in agrochemicals and plant nutrients.

In the CSM exports segment, its business interests include dealing in custom synthesis and contract manufacturing of chemicals, which constitutes techno-commercial evaluation of chemical processes, process development, lab and pilot scale-up, as well as commercial production.

The PI group has three agrochemical formulation plants and five multipurpose plants in Panoli, Gujarat, three multipurpose plants in Jambusar, Gujarat, and an R&D unit in Udaipur, Rajasthan. In December 2019, PI acquired IAPL. IAPL’s manufacturing facility is located in Panoli and Ahmedabad, Gujarat.

Products:

PI Industries Ltd has a wide range of chemical products in categories like Insecticides, Herbicides, and Fungicides. It also has some products in the Speciality division.

Apart from those, the company provides CSM (Custom Synthesis and Manufacturing Solutions) which involves research to commercialization.

Subsidiaries: As of March 31, 2021, PI Industries Ltd has seven (7) Wholly owned subsidiaries and two (2) Joint Ventures with leading Japanese Companies.

Key Rationale:

- Growing presence in CSM exports – The CSM export segment is marked by a significantly de-risked business model, which provides healthy revenue visibility and stable profitability. The PI Industries Ltd group is one of the pioneers of CSM in the agrochemical space in India. The group, which has been engaged in this business for over a decade, has built a strong reputation, based on its sound research capabilities. Its clientele includes some of the largest agrochemical innovator companies in the world. The group has invested significantly in enhancing manufacturing capacities over the past five fiscals and has commercialized 37 molecules up to fiscal 2021.

- Established position – A presence of over five decades in the domestic agricultural inputs business, a healthy product mix, leadership in several generic product segments, and an increasing number of launches through the ILCM (in-licensing and co-marketing) route have helped the group establishes itself as one of the top 10 players in this space. Apart from fiscal 2020, where delayed monsoon and erratic rainfall during the year impacted sales, domestic business has witnessed steady growth over the last 5-To 6 fiscals led by the introduction of new molecules and increased market penetration

- Pharma space – The QIP issue of Rs.2000 crore in fiscal 2021, bolstered liquidity. The company’s liquidity is expected to moderate in the near term. A sizeable portion of the QIP proceeds was planned to utilize for the acquisition of ISLL’s API business early, but since it ended a failure, the company is looking for further M&A opportunities that are aligned to it strategic direction with the intention to create a differentiated scale play in Pharma.

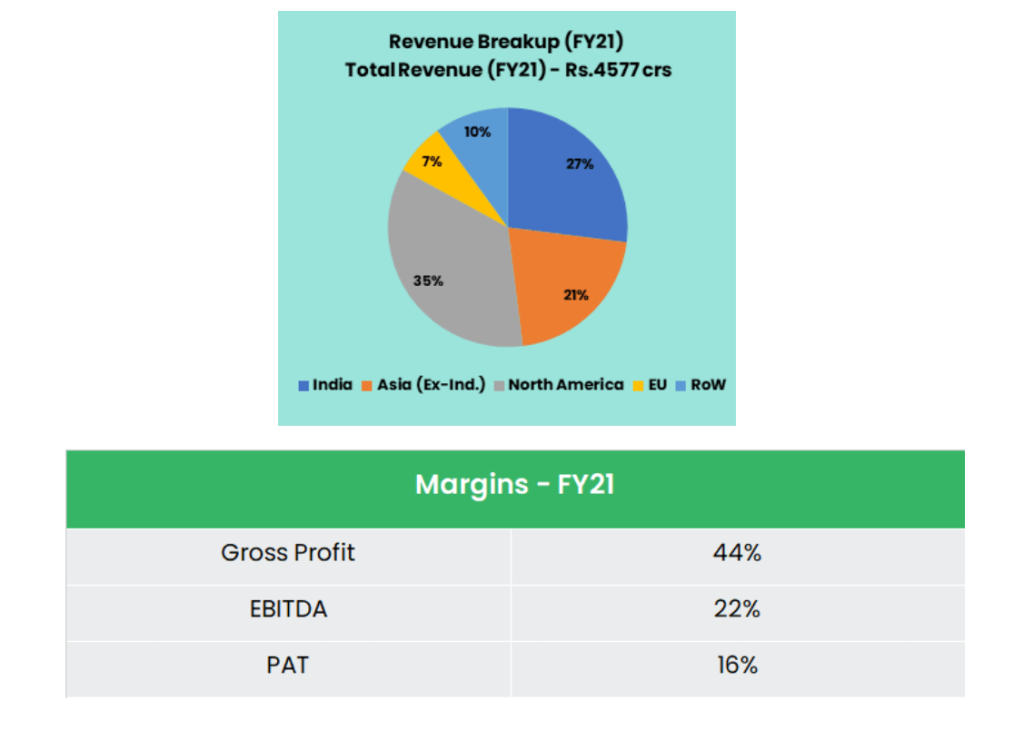

- Financial Performance – Financial risk profile is healthy, marked by strong net worth and low debt, along with healthy operating profitability ensures robust debt metrics. Capital spending is expected at Rs.600 crores per annum. With healthy annual cash generation, cash surpluses are expected to improve to sizeable levels again over the medium term. CSM business’s revenues registered a healthy CAGR of around 30% between fiscals 2012 and 2021 on the back of regular launches of new products, and notwithstanding tepid demand for agrochemicals in the European market in fiscals 2019 and 2020.

Industry Analysis:

Agriculture is the primary source of livelihood for about 58% of India’s population. India is the world’s second-largest producer of rice, wheat, sugarcane, cotton, groundnuts, and fruits & vegetables.

It also produced 25% of the world’s pulses, as of last decade, until 2019. Gross Value Added by agriculture, forestry, and fishing was estimated at Rs.19.48 lakh crore (US$ 276.37 billion) in FY20.

The share of agriculture and allied sectors in gross value added (GVA) of India at current prices stood at 17.8 % in FY20. Consumer spending in India will return to growth in 2021 post the pandemic-led contraction, expanding by as much as 6.6%.

The total agricultural and allied products exports stood at US$ 41.25 billion in FY21. India is among the 15 leading exporters of agricultural products in the world. Agricultural export from India reached US$ 38.54 billion in FY19 and US$ 35.09 billion in FY20.

The Indian agricultural sector is predicted to increase to US$ 24 billion by 2025. The private sector’s share in seed production increased from 57.28% in 2017 to 64.46% in FY21.

Growth Drivers:

Prime Minister of India launched the Pradhan Mantri Kisan Samman Nidhi Yojana (PM-Kisan) and transferred Rs. 2,021 crore (US$ 284.48 million) to bank accounts of more than 10 million beneficiaries on February 24, 2019.

As per the Union Budget 2021-22, Rs. 65,000 crore (US$ 8.9 billion) was allocated to Pradhan Mantri Kisan Samman Nidhi (PM-Kisan).

With a budget of US$ 1.46 billion, the ‘Production Linked Incentive Scheme for Food Processing Industry (PLISFPI)’ has been approved to develop global food manufacturing champions commensurate with India’s natural resource endowment and to support Indian food brands in international markets.

Between April 2020 and June 2021, FDI in agriculture services stood at US$ 2.31 billion.

Outlook :

A strong order book of USD 1.5 billion in the CSM segment from the existing product basket, improving contributions from recent new launches in the domestic market, and new molecule additions in both business segments, support revenue visibility.

Besides, agrochemical demand is expected to remain healthy in the domestic and European markets, overall leading to revenue growth of ~12-15% for PI over the medium term. The improving scale of operations and stronger product portfolio, along with healthy operating efficiencies, should translate into the sustenance of operating margins of 21-22%.

Valuation

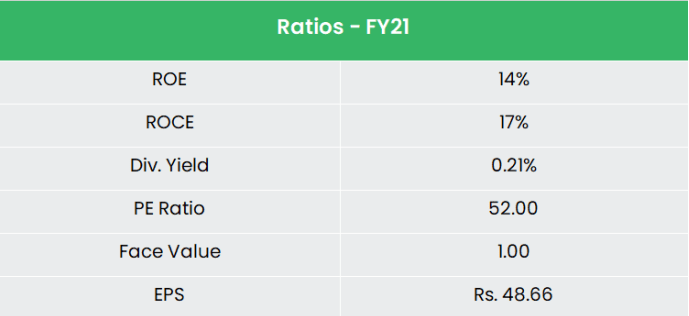

The company has invested Rs.23.5bn in CAPEX over FY14-21 and sustained average ROCE of 27% for the same period. The balance sheet remains strong with a debt-to-equity ratio of just 0.06x as of FY21.

While a significant part of the current surplus cash will be utilized for the upcoming acquisition (still searching for a pick), strong cash generation of Rs.900-1100 crore per fiscal will be sufficient to fund the company’s organic CAPEX plans as well as incremental working capital needs.

Surplus cash is expected to gradually improve to Rs.800-1000 crore by end of fiscal 2023

The company is expecting to increase its share in the API CDMO space post its maiden entry in the Pharma space.

Since the market opportunity is large and PI has already delivered strong growth in the Agri CSM segment, we expect it to also garner potential scale in the pharma space.

Hence, we recommend a BUY rating in the stock with the target price (TP) of Rs.2910, 52x FY22E EPS.

Hope you liked our article on PI Industries Ltd, Please read our article on “Private Equity vs Hedge Fund“.