In this blog, we will go into detail about the Business overview of Cummins India Ltd. We will understand the business model and look at the Target Price.

Please subscribe to our newsletter so you never miss an article from us when its published.

Company Overview:

Cummins India is India’s leading manufacturer of diesel and natural gas engines. It is a 51% subsidiary of the Cummins Group, the American multinational which is the world’s largest independent designer and manufacturer of diesel engines above 200 HP.

The company was incorporated in 1962 with the name Kirloskar Cummins Ltd, with Kirloskar Oil Engines Ltd and Cummins Inc., the USA promoting the company. The company started its operations in Pune.

In 1997, Kirloskar Oil Engines, sold their stake in the partnership to Cummins, leading to the formation of Cummins India Ltd. The company has a country-wide network with 20 dealerships, 450 service points catering to 2,20,000+ customers.

The company also has 3200+ employees across India with 23% gender diversity. It has a strong market presence servicing 6,27,000+ engines in the field.

Products: The company’s business is classified into 3 units; Engine, Power Systems, and Distribution.

Engine – Manufactures engines from 60 HP for low, medium, and heavy-duty on-highway commercial vehicle markets and off-highway commercial equipment industry spanning construction and compressor.

Power Systems – Designs and manufactures high horsepower engines from 700 HP to 4,500 HP for marine, railways, defense, and mining applications as well as power generation systems comprising of integrated generator sets in the range of 7.5 kVA to 3750 kVA including transfer switches, paralleling switchgear and controls for use in standby, prime, and continuous rated systems.

Distribution Business – provides products, packages, services, and solutions for uptime of Cummins equipment.

Subsidiaries: The Company has only one subsidiary, two JV’s, and one associate company as of Mar’21.

Key Rationale :

Demand Recovery– In pursuit of making India a $5 Trillion economy, the government of India, during its Union Budget of 2021 announced various capital expenditure initiatives in an attempt to revive the economy. Sectors like construction, railways, roadways, shipping, ports, etc. were allotted hefty budgets.

Cummins caters to the power generation needs of all these sectors and expects demand to recover as execution picks up in the post-pandemic scenario.

With the BS-VI emission norms being adopted for all vehicles, India is now gearing to adopt the BS-IV Construction Equipment Vehicle (CEV)/Central Pollution Control Board (CPCB) IV emission norms for non-highway power generation products.

Cummins, through its parent, has access to the latest technologies in diesel, gas, electric as well as hydrogen power generation assets.

Introduction of New tech – Cummins’s cutting-edge battery-electric technology has been developed to meet the same standards as their traditional power technology. From energy storage to control software, all of their battery electric solutions are put to the test.

This holds true from initial design to lab validation and finally to field use. Systems are integrated for superior performance and reliability from every configuration of the technology. Cummins offers the most advanced hydrogen fuel cell technology, powering everything from mobility applications to backup generators.

The company is continuously assisting fuel cell programs around the world with equipment, testing and implementation, and systems integration. Their low-pressure, non-humidified cell power modules deliver unrivaled reliability, fuel efficiency, quiet operation, and easy maintenance.

Robust Q2FY22 – Cummins India reported a healthy set of quarterly performance led by a strong recovery in economic activity and exports market. In the domestic market, Powergen and industrial witnessed strong demand revival as economic activity picked up.

Exports market revenue growth is mainly led by strong growth in China and North America, while other geographies like ME and Africa are witnessing early signs of recovery.

The company recorded the highest ever quarterly revenue of Rs.1730 crs growing by 48% YoY and 45% QoQ on the back of a strong recovery. Domestic sales at Rs.1,250 crs improved by 68% YoY and by 46% QoQ. Exports Sales at Rs.439 crs improved by 10% YoY and 43% QoQ.

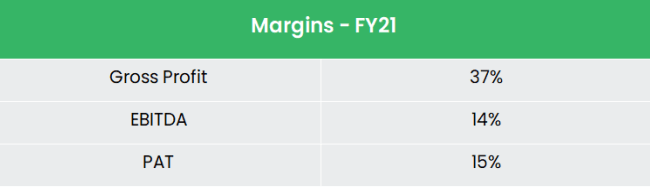

Financial Performance – The company has a strong balance sheet with virtually zero debt and cash and equivalents of Rs.1686 crs as of H1FY22. The company is expected to give good quarter results and it gave a strong result for the past 2 quarters.

The company’s overall P&L is in the recovery mode from the significant decline in the past 2 years due to the covid-19 pandemic. The dividend payout stands at 65% as on FY21.

Industry Analysis

Engineering is one of the largest industrial sectors in India. It accounts for 27% of the total factories in the industrial sectors and represents 63% of the overall foreign collaborations. Increasing industrialization and economic development drive growth in the capital goods market.

Turnover of the capital goods industry was estimated at US$ 92 billion in 2019 and is forecast to reach US$ 115.17 billion by 2025. The construction equipment industry’s size is estimated to reach $5 billion by FY21 from around US$ 4.3 billion in FY18.

As per the latest data available, the industry manufactures various turbines in the range of 800-7000 MW per annum and generators ranging from 0.5 KVA to (ones even higher than) 25000 KVA. India’s energy requirement is expected to grow from 1,290.02 in FY20 to 1,566 BU in FY22 and further to 2,047

BU in FY27.

The growing energy requirement will require the enhancement of installed power capacity. As per the National Electricity Plan 2018, the total installed power capacity is projected to increase from 356.10 GW in FY19 to 479.42 GW in FY22P.

Growth Drivers

100% FDI is allowed through the automatic route, with major international players looking for growth opportunities to enter the Indian engineering sector.

In the Union Budget 2021, the government has given a massive push to the infrastructure sector by allocating Rs.233,083 crore (US$ 32.02 billion) to enhance the transport infrastructure.

As per Economic Survey 2018-19, India needs to spend US$ 200 billion on infrastructure to become a $10 trillion economy by 2032.

Outlook & Valuation :

Cummins India is a well-established player in the diesel power generation market. The company is backed by a strong parentage that enables it to bring forth the latest and greatest technologies in the power generation industry.

The company is well equipped to meet the new emission norms which are expected to come into play in the next couple of quarters, as well as with more futuristic technologies like battery packs, electric power generation, and hydrogen fuel cells.

Further, the company has launched its new products in Powergen (4 in HHP, 2LHP, and 1 MHP), Industrials (Railway Mining, construction, pumps, etc), distribution (3 products), and exports markets (Industrial and Powergen) which would help to maintain its market leadership across segments.

Though management is optimistic about demand recovery in FY22, it has refrained from giving any guidance considering the possible disruption due to the third wave of Covid

We continue to remain positive on Cummins India Ltd on account of new product offerings, global consolidation and increased investment in clean techwork , the start of a new Capex cycle globally, and exports ramp-up, given global economies are on the path to recovery. Hence, we have a BUY rating in the stock with the target price (TP) of Rs.1150, 43x FY22E EPS

Disclaimer: This is no Financial or Investment Advice. Our Website is a free personal-finance-related resource page.

Hope you like our article on “Cummins India Ltd”, please read our other article on “Private Equity vs Hedge Fund“