In this blog, we will understand HDFC AMC Ltd.’s business, its growth potential and look at the target of HDFC AMC share price.

Company Overview:

HDFC Asset Management Company Limited (HDFC AMC) is Investment Manager to HDFC Mutual Fund, one of the largest mutual funds in the country.

It was incorporated under the Companies Act, 1956, on 10th December 1999 and was approved to act as an Asset Management Company for HDFC Mutual Fund by SEBI on 3rd July 2000.

It has other SEBI licenses viz. PMS/AIF. The company currently has over 70k impaneled distributors which include MF (Mutual Fund) distributors, National Distributors, and Banks.

They serve customers and distribution partners in over 200 cities through their network of 227 branches and 1203 employees.

HDFC AMC has been in a consistent position as one of India’s leading asset management companies driven by their comprehensive investment philosophy, process, and risk management.

Products & Services:

The company offers a large suite of savings and investment products across asset classes where mutual fund schemes are their main product. It includes 23 equity-oriented schemes, 90 debt-oriented schemes, 2 liquid-oriented schemes, and 7 other schemes. The company also provides Portfolio Management & separately managed account services to HNIs, family offices, domestic corporates, trusts, provident funds, and domestic and global institutions.

Key Rationale:

Market Leader:

HDFC AMC is one of India’s largest mutual fund managers with an AUM of Rs.4.4 lakh crore (AUM market share of 11.6%) as of December 31, 2021.

AUM in actively managed equity-oriented funds i.e., equity-oriented AUM excluding index funds stood at Rs.1.97 lakh crore as of December 31, 2021, with a market share of 11.4%.

As of December 31, 2021, 59% of the company’s total monthly average AUM is contributed by individual investors compared to 55% for the industry.

Market share of 12.6% of the individual monthly average AUM in the industry, making the company one of the most preferred choices of individual investors.

Q3FY22 Revenue :

Q3FY22 revenue from operations grew 14.1% YoY to Rs.550cr, as AUM surged to Rs. 4,36,700cr (+7% YoY), aided by an increase in gross inflow from equity-oriented funds to 33.3%, along with a remunerative mix of a higher percentage of equity AUM.

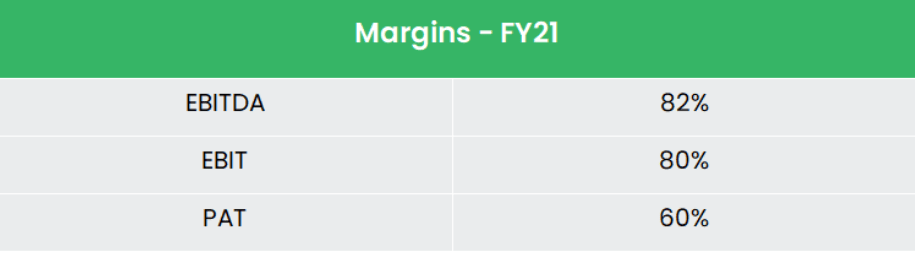

This was offset by dilution in margins in some of the schemes. EBITDA grew to Rs.414cr (+7.3% YoY), although EBITDA margin contracted to 75.0% (-460 bps YoY) which was directly impacted by ESOP expenses to the tune of Rs.17cr. Profit after tax dipped slightly to Rs.360cr (-2.4% YoY) due to lower other income (-23.8% YoY to Rs.86cr) and higher taxation (+10.6% YoY to Rs.125cr).

HDFC AMC Launched two NFOs in the quarter – Multicap fund (AUM of Rs.4353 crore as of December 31, 2021) and Nifty Next 50 fund. About 100 users login in every minute on their portals and 3 new users onboarded every minute in the last quarter.

Call Highlights:

Management indicated that former CFO Piyush Surana would resign by the end of January 2022 and Naozad Sirwalla will take charge as new CFO.

HDFC AMC plans to launch a subsidiary in Gift City named HDFC AMC IFSC, which will act as investment manager to the schemes launched under Alternative Investment Funds. The company has got approval for nine ETFs. Looking to launch debt and silver ETF.

Further, it plans to launch sectoral, ETF, index, and thematic funds in the coming months. Also have few funds in the pipeline in the thematic category. Total live accounts were at 96 lakh as of December 31, 2021.

Unique customers as identified by PAN or PEKRN are now at 57 lakh as of December 31, 2021. HDFC AMC plans to add more manpower on technology, products as well as in marketing side.

Financial Performance:

The company is financially strong with zero debt. It has a good return on equity (ROE) track record with 5 Years avg. RoE of ~30% +.

The company also pays a healthy dividend for the investors consistently. The company’s revenue has been stable in the pandemic period too.

Industry Analysis:

Over the last five years, the mutual fund industry AUM has seen a CAGR of 20.6%, and equity-oriented AUM has grown at a CAGR of 25%. Assets under management (AUM) of the domestic mutual fund industry, excluding domestic fund of funds (FoF), surged further in 2021 to close at a record Rs. 37.73 lakh crore.

The industry added Rs.6.70 lakh crore – a record absolute asset gain for any calendar year on record, with the previous peak being Rs.4.80 lakh crore in 2017, followed by Rs.4.5 lakh crore in 2020. In percentage terms, the industry gained 22% compared with ~17% in 2020.

The Indian Mutual Fund Industry is highly under-penetrated and has the potential to grow exponentially

The industry logged net inflows of Rs.1.14 lakh crore in 2021 through systematic investment plans (SIPs), crossing the Rs.1 lakh crore mark for the first time in any calendar year since AMFI started declaring this data.

The Association of Mutual Funds in India (AMFI) is targeting nearly five-fold growth in AUM to Rs. 95 lakh crore (US$ 1.47 trillion) and more than three times growth in investor accounts to 130 million by 2025.

Growth Drivers:

India has more than 50 crore income tax permanent account numbers, but only 3 crore mutual fund investors as of Dec 2021.

Despite the high growth, India’s mutual fund AUM to GDP ratio remains significantly low at 15%, as compared to a global average of 75% which shows a huge headroom.

India’s personal wealth by 2022, is forecast to reach US$ 5 trillion at a CAGR of 13%. It stood at US$ 3 trillion in 2017.

Outlook:

Over the last decade (FY11-20), the company registered a 15% CAGR growth in total AUM. Given the massive under-penetration of financial products and inclusion in India, there is enough scope for AMCs like HDFC AMC to continue to expand profitably.

The industry will continue to benefit from the shift of household savings towards mutual funds from physical assets and bank deposits.

Players with strong brand equity and brand recall can gain market share in tougher times, and hence consolidation of assets within the top few players could continue for some time.

A change of the product mix strategy could bring higher margins for the company in the future. The company’s expansion towards B-30 locations would open up new scope for growth. Aiming at accelerating AUM growth and gaining market share, a slew of products launches (thematic funds) are

underway.

Valuation:

We remain positive on the strong brand franchise, entry into international markets, and efficient operational strength but have near-term concerns over losing market share and increasing competitive pricing pressure. Hence, we recommend a BUY rating in the HDFC AMC Share price with the target of Rs.2560 which is 36x FY23E EPS.

Disclaimer– Our content is intended to be used and must be used for information purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances.

Hope you liked our Article on HDFC AMC Share Price, please do read our other article on “Top 3 Stock pick for Semiconductor Shortage“