In this blog, we would try look at Private Equity vs Hedge Fund differences and answer some of the questions that common investors want to know about :

- What do Private Equity Firms and Hedge Funds do

- Which are the different types of strategies they pursue.

Before that, please subscribe to our newsletter so you never miss an article from us when its published.

What is Private Equity Fund?

Private Equity are actively managed Funds and these are funds that are mainly interested in acquiring private companies that have not been listed on a stock exchange and equity.

After all, PE funds are exclusively focused on equity investments.

What about Private Equity Firms specialization?

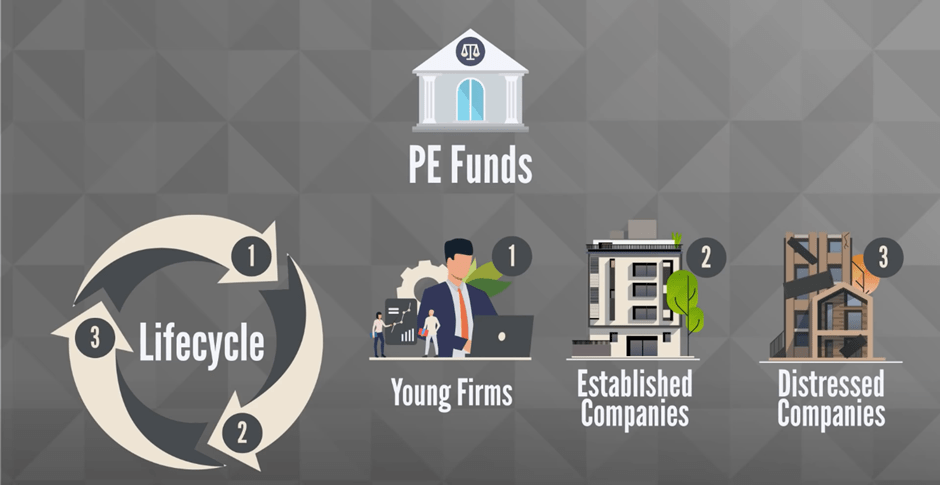

Most private equity firms specialize in deals with a specific types of targets based on the lifecycle stage of these targets.

Some PE Funds are interested in young firms with high growth perspectives and a promising management team, while others are focused on established companies with stable cash flows, leveraged buyout transactions.

What is a Hedge Fund?

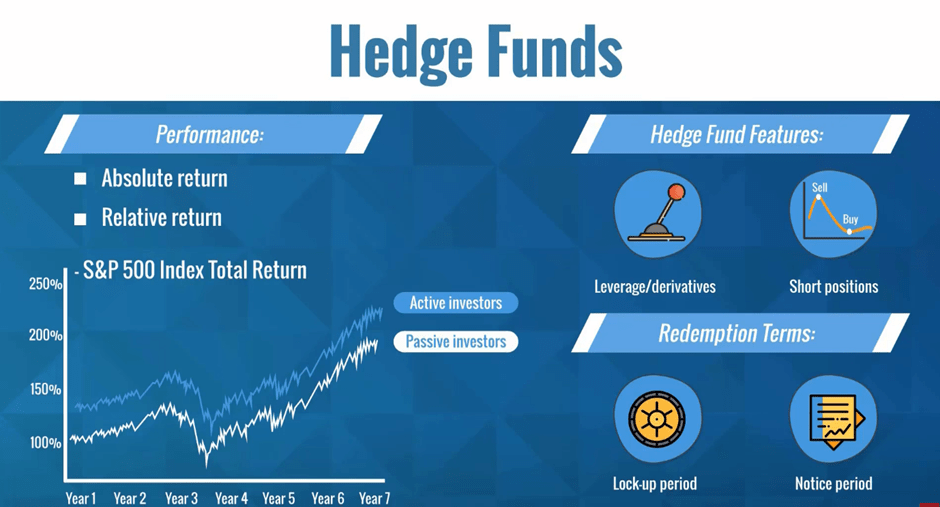

A hedge fund is considered an institutional investment, it focuses on high-risk high-return investments. They are subject to far fewer regulations, unlike Mutual Funds.

Hedge Funds focus on more return and would need a lot of money as initial investments, unlike Retail investors.

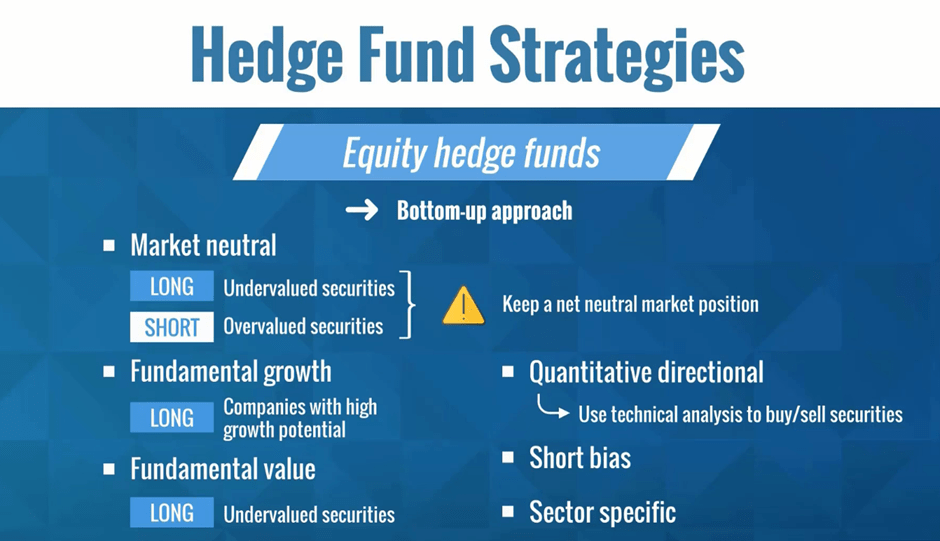

What about Hedge Fund specialization?

Hedge Fund Managers prefer to take more risks compared to mutual Fund Managers Hedge Fund Managers can short sell Stocks, deal in Futures markets, cryptocurrency, and Distressed investments.

Not everyone can invest in Hedge Funds as the initial investment amount is huge and the money is locked for a specific period due to risks taken by Hedge Fund Managers.

Hedge Funds prefer High Returns for their customers and would need a high fee in return.

A hedge fund is an actively managed investment fund that pools money from investors, typically those with higher risk tolerances. These investors mainly are HNIs (High Net-worth Individuals ) having lots of money. They don’t care if these Millions of Dollars are invested somewhere with a High Risk. What Matters to them is the higher returns they want out of their Investment.

Hedge funds are not subject to many of the regulations that protect investors as other securities, so they tend to employ a variety of higher-risk strategies for potentially higher returns, such as short selling, derivatives, or arbitrage strategies.

A private equity fund on the other hand is also a managed investment fund that pools money, but they normally invest in private, non-publicly traded companies and businesses.

Investors in private equity funds are similar to hedge fund investors in that they are accredited and can afford to take on greater risk, but private equity funds tend to invest for the longer term.

Let’s Look at Private Equity vs Hedge Fund differences

Number 1:

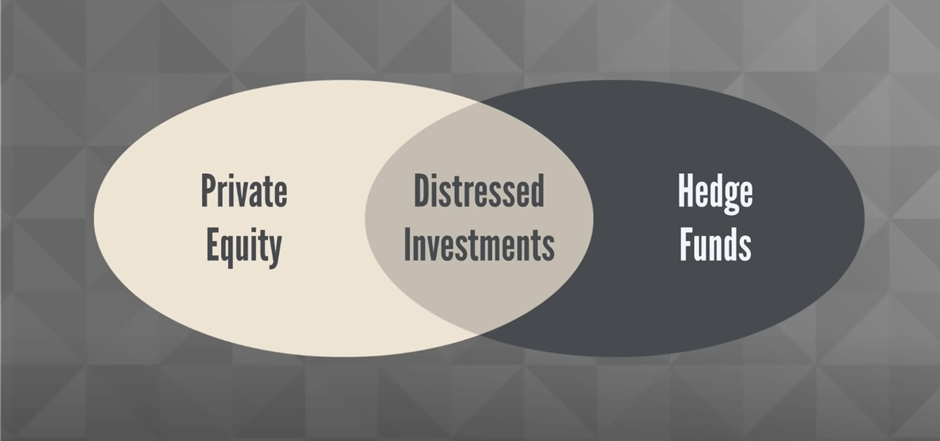

Distressed investments are one area of activity where there is some overlap between private equity and hedge funds.

Both types of funds could invest in a distressed company, which is public.

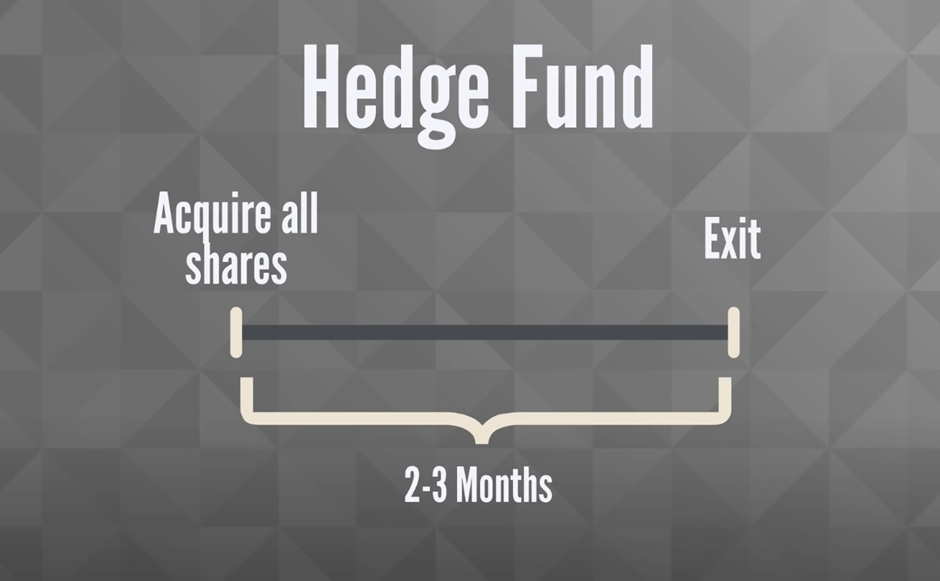

Hedge funds are unlikely to engage with a non-public company, however, the difference is their investment horizon.

Private equity would typically try to acquire the entirely of shares of the target, delist it, change management, introduce measures oriented towards improving financial performance, and then be patient for at least a couple of years before exiting the investment through a sale or a new listing.

A hedge fund investment, on the other hand, would likely have a very short-term duration. The hedge fund would buy the securities of distressed companies when they believe that there is a good chance of reselling these securities at a profit in the near term no longer than two to three months.

This comparison provides a pretty good insight into what most private equity deals try to achieve. Acquire a large stake in a business, preferably 100%, but not less than 50%, position the business for growth through active involvement, advisory and, if necessary, management rotations and substitutions have the patience to grow the business, improve its profitability, and then exit the investment in a five to ten year period.

Of course, the art of the private equity profession is to bet on the right companies and then successfully provide guidance to optimize their chances of being successful.

Number 2:

Method of Investments differs in Hedge Funds and Private Equity Funds.

Private Equity Funds Invest to earn Highers return with a longer period horizon, on the other hand, Hedge Funds invest with a motive of higher return with a shorter period.

Hedge Funds use all Methods of Trading to earn high returns in a shorter period e.g. short selling, hedging positions, trading in the F&O market.

Private equity funds use the money to buy stocks or companies to earn returns in a longer period.

The returns earned in private equity funds are free from the implications of tax, whereas the returns earned in hedge funds are subjected to be tax implications

Private equity funds will require the investors to invest the capital whenever required or asked for, whereas, in the case of hedge funds, investors will need to make a single-time investment only.

The investors in a private equity fund are actively involved as compared to the investors in a hedge fund that enjoy passive status.

Number 3 :

Hedge funds are open-ended investments meaning investors can withdraw or add in their investment when they want, just like Actively Managed Mutual Funds.

Private Equity on the other hand is closed-ended investments meaning investors can’t withdraw or add in their investment. Investors are supposed to wait till the time the investment locked-in period is over. This period can range from 5 years to 10 years and depends on individual funds.

There is a substantial difference in risk level between hedge funds and private equity funds. While both practice risk management by combining higher-risk investments with safer investments, the focus of hedge funds on achieving maximum short-term profits necessarily involves accepting a higher level of risk.

Both hedge funds and private equity typically require a large amount of money as an initial investment amount, which can range anywhere between $100,000 to a million dollars or more.

Hedge funds may or may not lock those funds up for a period of months to a year, preventing investors from withdrawing their money until that time has elapsed.

Most Hedge Funds are open Ended but the risk taken to generate higher returns demands them to restrict investors for a little longer period. During which they cant allow investors to pull out their money.

The lock-up period for a private equity fund will be far longer between 5 Years to 10 Years. This is because a private equity investment is less liquid.

This needs time for the company being invested in to turn around.

These are the main difference between Hedge Funds and Private Equity Funds.

Hope you liked our article on Private Equity vs Hedge Fund, please read our other article on “Hedge Fund vs Mutual Fund”

Great Article, easy to understand

LikeLike