These ETFs pay out a generous dividend, and they allow you to tap into the Canadian real estate market with as little as $20. You don’t need $100,000 as a down payment on a house. Instead, just buy a few shares of these ETFs and you’ll collect reliable passive income every single month and you’ll gain a diverse exposure of the entire Canadian real estate market. Let us discuss about “Best REIT ETF Canada” in more detail.

Why Buy ETF?

ETF is a way to buy hundreds of stocks within one single fund. So instead of putting all your eggs in one basket by investing in one company, you’re diversifying your portfolio by investing in a little piece of hundreds of companies all at once.

A REIT is similar, but for real estate, REIT is a real estate investment trust, and this is a large company that owns hundreds of properties and rents them out for a profit. So instead of putting all your money into one house, you can buy shares of a REIT, and then you own a little piece of hundreds of properties and you collect your share of the rent every single month. A REIT ETF takes this diversification one step further. A REIT ETF contains dozens of roots, each of which contains hundreds of properties.

With REIT ETF, you’ll be investing in thousands of properties across many different sectors, including retail properties, industrial, residential, and many more. That’s the true power of REIT ETFs. You get instant diversification of the entire real estate market, all while earning great dividends every single month.

Let’s jump into the Best REIT ETF in Canada. Up first,

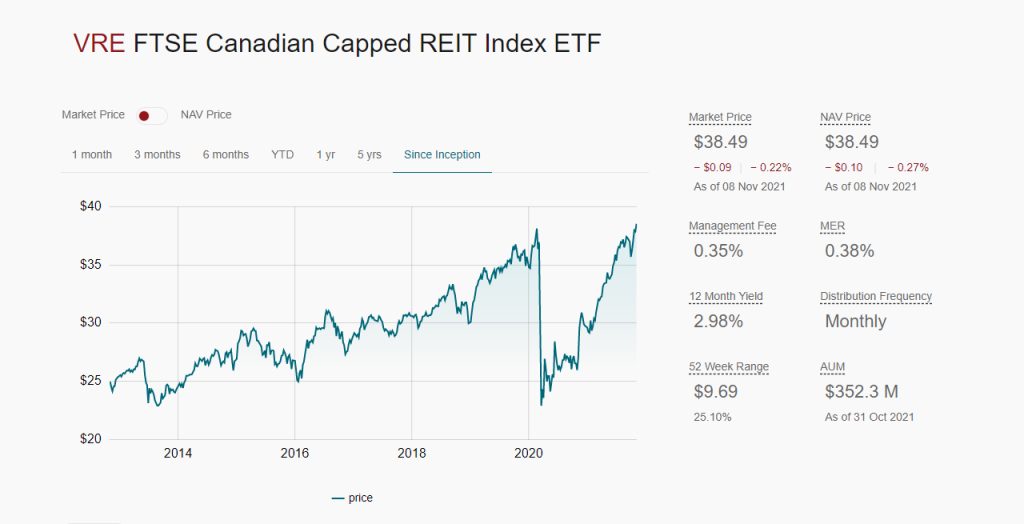

VRE tracks the largest REITs in Canada across many sectors, and as a Market Cap based Index ETF, it focuses heavily on the larger and more established REITs. This ETF contains the 15 largest REITs in Canada, most of which pay out a generous dividend. Overall, VRE pays out a solid dividend yield of 2.81% paid out monthly. This dividend yield is definitely lower than usual since the share price has grown significantly as businesses opened back up.

The dividend hasn’t changed since last December, and so we can definitely expect a dividend increase very soon. Usually, VRE has a dividend yield above 4%. Vanguard is famous for offering the cheapest ETFs, and since this is passively managed, this has the lowest management fee on this list with an MER of 0.38%. If you have $1,000 invested in VRE, it will only cost you $3.80 a year in management fees. That’s almost nothing and a fraction of what you would pay for a mutual fund.

Remember, with ETFs, you’ll never see this management fee taken out as a transaction. This fee is built into the share price that you see. Another way to consider the effect of the management fee is to subtract it away from the dividend yield. So if our dividend yield is 2.81%, but we pay 0:38% in management fees, then our net income is 2.43% for the year. Of course, this doesn’t include capital gains as the value of the ETF grows.

2. ZRE the BMO equal weights REIT ETF

ZRE is a little different because instead of focusing on the largest REITs in Canada, they spread out their fund equally among 22 REITs, so the smaller REITs have just as much exposure as the large ones, giving you a truly diversified mix of the Canadian market. This ETF also pays out a higher dividend yield of 3.91%, paid out monthly. With ZRE , dividend has been consistent since February of 2020, so in this case, the TTM yield and the forward yield are identical. This ETF is a bit actively managed, and hence is more expensive with an MER of 0.61%.

These management fees are on the higher side, but the diverse portfolio makes up for it . If you invest $1,000 with ZRE, it will cost you $6.10 a year in fees. This fee is built into the share price, but I like to take it off of the dividend income. So with a dividend yield of 3.91% and an MER of 0.61%, we have an annual net income of 3.3% and with a higher dividend yield is much easier to qualify for a trip.

Let’s look at the holdings of ZRE. ZRE contains 21 REITs across all sectors of real estate.

The heaviest sector is retail with 27.25%, followed by residential with 22.75%. Industrial is 18%. Diversified REITS are 13%, office properties at 9% and finally healthcare with 9%. You’ll notice that this ETF doesn’t contain any exposure to real estate services like VRE. Instead, this ETF focuses more on industrial and healthcare

This balanced approach gives extra exposure to the smaller and less established rates, which have great potential for growth but can be more volatile. Looking at the share price over the past five years, we see a very similar story with short term volatility but strong overall growth.

In the long run. We saw a massive drop in the crash of March of 2020, where real estate across the board was devastated. But with every drop, this ETF was able to recover very quickly and if you were lucky to buy it at this discount, you would already be seeing huge capital gains all while collecting that reliable passive income every month. Along the way.

XRE is similar to VRE since it’s a market cap based ETF, it focuses heavily on the largest REITs in Canada, but it does have some exposure to small cap and midcap REITs as well. This is the oldest REIT ETF in Canada. It’s actually twice as old as the other two on this list. XRE is also the largest by far in terms of assets under management, so it’s definitely the industry leader in the Canadian market. This ETF contains 19 REITs spread out across all sectors and it currently pays out a dividend yield of 2.91% paid out monthly.

This yield is lower than usual since the share price has grown so much over the past year, but it usually has a dividend yield above 4%. XRE is an example of an ETF which doesn’t have the most consistent dividends. It can vary throughout the year. XRE’s dividend was reduced in April and then increased in July. So for XRE definitely used the TTM yield, not the forward yield.

Since the dividend was recently increased, the forward yield is higher, but it’s less meaningful. Just like ZRE’s, this ETF is on the more expensive side with a MER of 0.61%. So if you invest $1,000 into XRE, you’d be paying $6.10 every year in fees so with the TTM yield of 2.64% and MER of 0.61%, you’ll be getting an annual net income of 2.03% plus long term capital gains. To qualify for a drip with XRE, you’ll need about $9,500 invested.

Conclusion:

For all these ETFs, make sure you hold them in your tax sheltered accounts to avoid paying taxes on those monthly dividends and capital gains. Since these are reached ETFs, their dividends are actually called distributions, and so they are taxed differently than regular dividends.

Those are the best reach ETFs in Canada.

VRE has the lowest fees and it’s the only one to focus on reach services.

ZRE is the only ETF that is equally balanced, giving investors an exposure to the smaller Canadian REITs.

XRE is the oldest and largest ETF in this group and its holdings and sector exposure are a bit of a mix of the other two

Even though there’s a bit of overlap between them, it’s important to diversify and gain exposure of the entire Canadian REITS Market.

Hope you liked our Article on “Best REIT ETF Canada” , please read out other article https://equitygyan74899394.wordpress.com/2021/11/04/bmo-etf-vs-ishares/