Before we give our list of “Top Nifty 50 Equal Weight ETF” , let us understand about Nifty 50 Equal Weight Index in detail and how it will change the way we invest and earn.

There are two methods of Index Formation :

1. Market Capitalization Based, where Sector-wise stocks are given higher weightage

2. Equal Weight Index.

Traditional methods of market capitalization-weighted portfolios have been favorites of Portfolio Managers for asset allocation. While Creating ETFs on Market Cap Based Index, passive fund managers simply replicate the index portfolio which is weighted based on the market capitalization of stocks.

NIFTY 50 Equal Weight Index:

The NIFTY 50 Equal Weight Index is another weighting index strategy compared to a market capitalization-weighted index, the NIFTY 50. This index includes the same companies as NIFTY 50, however, Stocks in this Index are weighted equally.

Highlights –

- NIFTY 50 Equal Weight Index has a base date of November 03, 1995, and a base value of 1000

- All Stocks forming part of the NIFTY 50 should be part of the NIFTY50 Equal Weight Index

- Equal weightage of 2% is given to all the companies in the Index

- If there are multiple Stocks of the same company in the index, the company will then be equal-weighted in proportion to market capitalization.

- Index is rebalanced quarterly where stock weightage is rebalanced back to equal

- In case of any Stock which was earlier part of Nifty 50 but now ceases to form part of the index due to suspension, delisting, or scheme of arrangement ad-hoc rebalancing and reconstitution of the index may be initiated.

Performance:

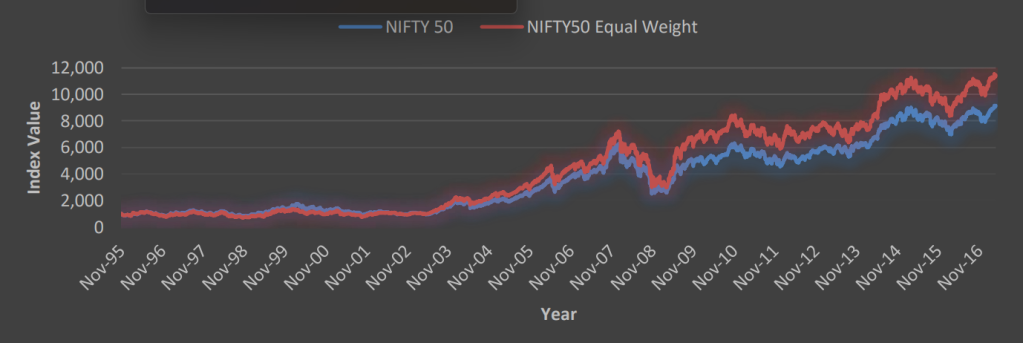

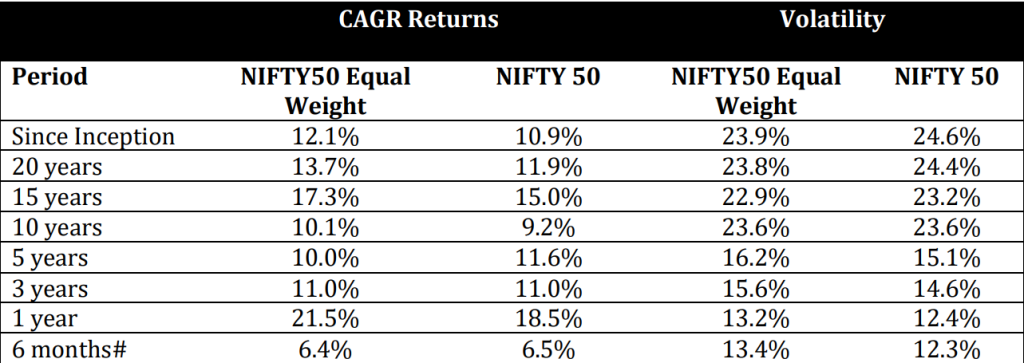

On a Long Term Horizon, the Equal-weight index strategy has outperformed the traditional market capitalization-based index strategy i.e. Nifty 50.

The below graphs show how the Nifty 50 Equal Weight Index has outperformed its Parent Nifty 50 Index and by a huge margin.

Weightage of Stocks:

Both the strategies have the same stocks at any point in time. The main difference is the allocation of weightage to stocks. In the equal weight index strategy, all stocks irrespective of market cap are treated equally. 49th or 50th Company in Nifty 50 list is also held in the same proportion as the larger ones.

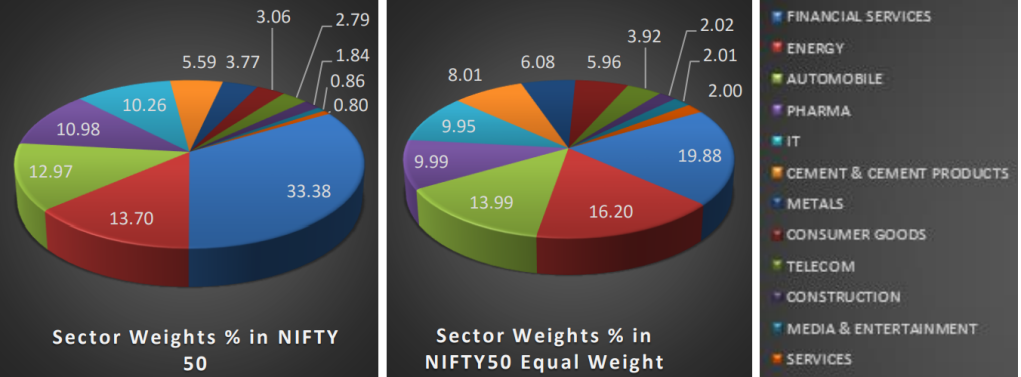

Equal weight strategy also benefits from different sector exposure as compared to the market cap-based index. NIFTY 50 having sector weight is tilted towards stocks with large market capitalization but in the Case of NIFTY 50 Equal Weight Index, the weight of each stock is independent of the Market but is rather a Flat 2%.

NIFTY 50 Equal Weight Index also depends on sector weightage which is determined by the number of stocks in each sector.

Sector exposure of the two indices.

Can equal weight index strategy be the future?

- Market cap weightage can result in a large part of the portfolio concentrated towards the top few securities. Equal weight index strategy, on the other hand, has a lower concentration of individual stocks and gives us better diversification of Stock Coverage.

- Equal Weight Index Strategy has more sector exposure which limits the risk of overdependent in any particular sector.

- Equal weight strategy is unbiased and doesn’t just rely on a few top market cap stocks

- Since equal weight strategy is not affected by the rise and fall of certain stocks. This under dependence on top market capitalized stocks has helped equal weight index strategy to return more than traditional market cap-based index strategies.

- Equal weight index strategy can see higher turnover due to frequent rebalancing of stocks

- Equal weighted index strategy has outperformed its market capitalization based Index on longer term.

Our Top Nifty 50 Equal Weight Index List:

Majority of the Funds are recently launched in Indian Market after the much transaction gained by Equal Weight Index.

Our Pick is based on the AMC and how it has handled the ETFs earlier.

- DSP NIFTY 50 Equal Weight ETF(dsp-nifty50-equalweight-etf) : This is a recently launched ETF and is handled by Industry leaders. DSP Group is known to give better returns than few of the other AMCs.

- HDFC NIFTY50 Equal Weight Index Fund : This Fund is also a recent entrant in Equal weight ETF arena. Being a part of HDFC Group and run by market renowned Fund Manager , this should be another pick.

Conclusion:

An equal-weighted index strategy is a smart investment idea. This simply helps to generate higher returns than traditional market capitalization-based index strategies. This is main the reason why equal weight index strategy funds are popular worldwide.

Investors also need to understand that an equal weighting index strategy creates a different set of risk factor exposures. It leads to higher turnover and relatively higher exposure to small stocks in the Index increasing higher Risk.

Please read our Other Article https://equitygyan74899394.wordpress.com/2021/11/06/best-sp-500-index-fund-in-india/