In this research report, we will look at Meghmani Finechem Ltd 2022. We will look into company business, its declared results and its future growth prospect.

We will see what company is doing next to grow in future, which will impact Meghmani Finechem Ltd Share Target 2022.

Before we go further, please subscribe to our newsletter, so you never miss an article from us when it’s published.

Company Overview:

Meghmani Finechem Ltd (MFL), part of the Ahmedabad-based Meghmani group, was incorporated in September 2007 as a subsidiary of Meghmani Organics Ltd (MOL), to establish a captive source of caustic soda and chlorine derivatives.

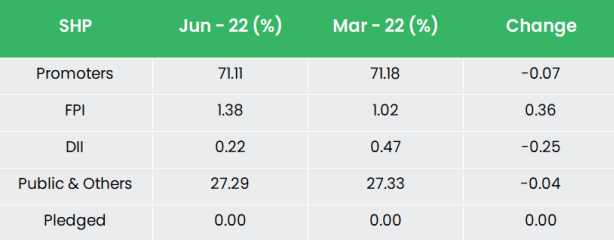

Pursuant to NCLT approval for demerger, MFL was listed on the stock exchanges with the promoters currently holding 71% of the equity stake with balance being held by public.

MFL started operations from July 2009 with an installed capacity for manufacturing 119,000 tonne per annum (tpa) of caustic soda. MFL is an ISO 9001 and ISO 14001 certified company founded in 2007 and well recognized in global markets as one of the leading producers of chlor alkali and its derivatives.

The company has state-of-the-art manufacturing facilities in Gujarat’s Dahej, a leading petroleum, chemicals, and petrochemicals investment region (PCPIR) region in the country.

MFL’s Dahej facility is a fully integrated complex with well established infrastructure and captive power plants.

Products & Services:

Meghmani manufactures Caustic Soda, Caustic Potash, Chlorine, Hydrogen, Chloromethane and Hydrogen Peroxide. The relevant end user industries are Alumina, Textiles, Crop Protection, Refineries, Pharmaceuticals, Paper & Pulp, Soap & Detergent, etc

Subsidiaries:

As on 31st Mar 2022, The Company has only one Subsidiary viz., Meghmani Advanced Sciences Limited incorporated on 27th Jan, 2021.

Revenue & Margins 2022 :

Key Rationale:

Leading Manufacturer:

MFL is a well known brand in the Indian chemical market serving domestic customers for last 12 years.

The company in India is a leading producer in the Chlor-alkali segment and value-added derivatives and is now expanding its product base to include value-added derivatives products like ECH (Epichlorohydrin) and CPVC (chlorinated polyvinyl chloride) which are a key raw material for multiple end user industries.

The company has the 4th largest Indian capacity of Caustic Soda at 2,94,000 TPA, 3rd largest Indian capacity of Caustic Potash at 21,000 TPA.

It has 5th largest capacity of Chloromethanes at 50,000 TPA, 3rd largest capacity of Hydrogen Peroxide at 60,000 TPA.

Company has largest capacity of CPVC Resin of 30,000 TPA and India’s First ECH Plant of 50,000 TPA.

This makes Meghmani FineChem one of the leading company in this sector.

Q1FY23:

The Company has achieved its highest ever turnover of Rs.533 crs in Q1FY23 which is a growth of 84% YoY basis. The higher capacity utilization across the divisions and better realization attributed to this growth of 84%. In absolute term EBITDA has doubled at Rs.187 crs.

The EBITDA margin has significantly improved 35% in Q1FY2023 against 32% in Q1FY2022. Overall plant utilization increased to 94% in Q1FY2023 compared to 88% in FY2022.

Capacity utilization of caustic and hydrogen peroxide stood at 94% while chlorotoluene stood at 105%. The utilization of caustic soda and caustic potash is up by 104% and 130% respectively.

The ROCE improved to 33% in Q1FY2023 from 19% in Q1FY2022. The debt to EBITDA has improved to 1.6x Q1FY2023 from 2.0x in Q1FY2022.

The ratio improved due to absolute growth in the EBITDA even on the increased debt due to capex.

The ROE improved to 48% in Q1FY2023 from 22% in Q1FY2022. For Q1FY23, the company spent Rs.57 crs on capex against estimated budget of Rs.180 crs for the year as a whole.

Newly Commissioned Plants:

Meghmani announced the successful commissioning of Epichlorohydrin (ECH) Plant of 50,000 TPA capacity.

Meghmani Finechem Ltd is the first company in India to commission an ECH plant – a currently fully imported product.

MFL’s entry into this product is in line with the Government’s initiative of Aatmanirbhar Bharat and Make in India.

This will reduce the dependence of ECH consumer on imports thereby helping the country save its foreign exchange reserves.

The company also successfully commissioned its CPVC Plant (one of the largest in India) with a capacity of 30,000 tonnes per annum (TPA).

CPVC is a high value product which is used in the manufacturing of CPVC pipes and fittings.

Financial Performance

The sales grew at a CAGR of 32% for the period of FY17-22 and the EBITDA grew at a CAGR of 29% for the same period.

The five year average value of ROE and ROCE stand at 29% and 27% respectively. The company’s EBITDA margin is maintained more than 30% for the past 6 quarters.

Industry Analysis:

The Indian chemicals industry comprises more than 80,000 commercial products; the industry is diversified across bulk chemicals, specialty chemicals, agrochemicals, petrochemicals, polymers and fertilizers.

The size of the Indian chemicals industry was valued at USD 178 Bn in FY 2018-19 and is expected to reach USD 304 Bn by FY 2024-25, growing at a 9.2% CAGR.

The Chlor-Alkali market was estimated at USD 84 Bn in 2021 and expected to grow at a CAGR of 5.41% between 2022 and 2031.

The global consumption of Caustic Soda in 2021 was estimated at 92 million Tons per annum.

The Indian Chlor-Alkali industry possessed an installed capacity of 4.7 Mn Tons (Caustic Soda) towards the end of FY 2021-22 in comparison to 4.5 Mn Tons towards the end of FY 2020-21.

Growth Drivers:

The population of India stands at 1.39 Bn in 2021 and is expected to surpass that of China by 2027, which could have a positive effect on the Indian chemical sector.

100% FDI is allowed under the automatic route in the chemicals sector, with a few exceptions made, including hazardous chemicals.

The FDI inflow in the chemicals sector was estimated at USD 605.14 Mn in FY 2021-22.

The present customs duty levels of 7.5% imposed on Caustic Soda has restricted imports and resulted in a rise in the production of Caustic Soda in India.

Outlook:

The Management has indicated that the Volumes will be picking up in the ECH and CPVC plants from Q3FY23.

Along with those two, the caustic soda expansion will also produce volumes which will be commissioned by the end of Q2.

These expansions are expected to strengthen MFL’s risk profile over the medium term with increased product diversification and higher share of revenues coming from downstream products thereby mitigating the volatility in margins brought about by the purely commoditized nature of caustic soda.

The Optimum capacity utilization from the ECH and CPVC plants will be reached in FY24 and then around 45-50% of the revenues will be contributed by derivatives and Speciality segments.

Considering the capex done in the last two years, the Management is confident to meet their revenue guidance of 50% growth in FY23. This justifies the company’s long-term growth of achieving Rs.5000 crs of revenue by FY27 with a strong ROCE.

By FY2027 almost 60% of the revenue would be coming from the value-added derivatives and the specialty chemical segment.

Valuation:

MFL revenue and operating performance will gradually improve on the back of being a leading manufacturer of chlor-alkali business, new products capacities and diversifying its business more towards value-added products.

Further its stable financial performance, robust demand, capacity expansion and timely project completion provides visibility for the long term.

We recommend a BUY rating in the stock with the target price (TP) of Rs.1800, 20x FY24E EPS.

Risks:

Slowdown Risk – Textiles, Alumina, Paper & Pulp and Dyes are among the key user industries of caustic soda. Hence, any significant slowdown in these key industries would impact product pricing.

Raw Material Risk – Profitability of caustic manufacturing companies depends on the prevailing ECU prices. Cyclical downturns or adverse variability in demand-supply balance, may drag down realisations for caustic soda players.

Competitive Risk – The chlor alkali industry is intensely competitive and dominated by large players such as Gujarat Alkali’s and Chemicals Ltd, DCM Shriram Ltd, Grasim Industries Ltd, and Reliance Industries Ltd. The top 7 players together hold 40-50% of the market share. Nevertheless, with addition of new downstream products, dependence on caustic soda revenues will gradually decline over the medium term.

Hope you liked our Article on Meghmani Finechem Ltd Target 2022 and company Overview , please read our other articles on “TATA Motors Share Price Target 2022 and Company Overview“.