In this blog, we will look at the detailed research report on SBI Card Share Price and look at business and future its prospect.

Get the current NSE Price of SBI Card here .

Company Overview

SBI Cards and Payment Services Limited is a non-deposit accepting systemically important nonbanking financial company registered with the RBI. The Company is engaged in issuing credit cards to consumers in India.

It is a subsidiary of India’s largest commercial bank, the State Bank of India. SBI Card was launched in 1998 by the SBI and GE Capital.

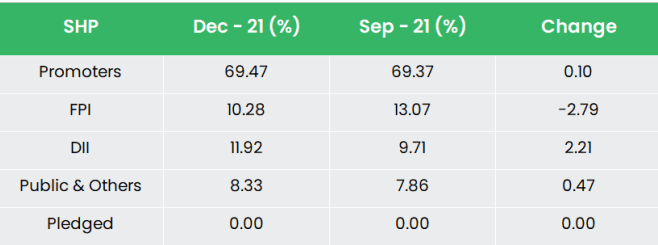

In December 2017, State Bank of India and The Carlyle Group acquired GE Capital’s stake in the co, post which SBI held 74% while Carlyle held 26% in the Company.

SBI Cards and Payment Services offers extensive credit card portfolio to individual cardholders and corporate clients which includes lifestyle, rewards, travel & fuel and banking partnerships cards along with corporate cards covering all major cardholders’ segments in terms of income profile and lifestyle.

The brand has a wide base of over 13 million cards in force as of Q3 FY22. It has diversified customer acquisition network that enables to engage prospective customers across multiple channels.

Products & Services:

The Co. has a portfolio of 8 types of core cards namely SBI Card Elite, SBI Card PRIME, Simply CLICK SBI Card, Simply SAVE SBI Card, Doctor’s SBI Card, SBI Card Elite Business, Shaurya Select SBI Card and SBI Card Unnati targeting different consumer segments.

The Company. has entered the super-premium segment credit card by the launch of “AURUM”.

SBI Card is India’s largest co-brand credit card issuer with 23 partners across industries (BPCL, Big bazaar, Etihad Airways, Vistara, IRCTC, Lifestyle retail, Federal Bank, and others).

Subsidiaries & Market Share:

As on March 31, 2021, the company does not have any subsidiary.

Key Rationale:

Strong Parentage support

SBI Cards houses the credit card business of SBI, and hence, is strategically important to the parent. The company receives strong financial, managerial and branding support from SBI on an ongoing basis.

It benefits from SBI’s strong customer franchisee, commanding a premium in the co branded card segment. In the past, SBI has infused growth capital in SBI Cards.

As on Dec 30, 2021, SBI held 69.20% stake in the company and will continue to hold majority stake over the medium term. SBI deputes its senior management in SBI Cards, as well as guides strategic decisions and monitors operations.

However, the company has substantial autonomy in decision-making because of the dynamic nature of the business.

Q3FY22 Profit

SBI Cards reported NII growth of 9.8% YoY and 8.4% QoQ at Rs 996 crs. This was largely driven by 18% YoY uptick in loans as the margin performance was subdued.

Other income was up 36% YoY to Rs.1866 crs, driven by 32% rise in fee income and 46% rise in business development incentive.

Net profit for the quarter was up 83% YoY, 11.9% QoQ to Rs.386 crs. Spends growth recovery continued 47% YoY and 27% QoQ.

Retail spends were up 36% YoY and 21% QoQ while corporate spends reported sharp increase of 93% YoY and 53% QoQ.

The company has also benefitted from spend growth during the seasonally strong period. Currently travel and entertainment are the only two categories, which are below pre-Covid levels.

Of the total pool of 45 crore banca customers, eligible customers were at 20 crore, of which SBI Cards had issued cards to 0.6 crore customers. Thus, significant opportunity persists in this space.

Position in Market

SBIC also offers multiple corporate cards to corporate clients (including MNCs). Some of the corporate credit cards are provided free of annual fees, while it charges annual fee on other corporate credit of up to Rs.499.

While low on fees, these cards spur spends. Such cards make up 25% of its total spends, despite being less than 1% of the card base and they help build a strong customer base and open up cross selling opportunities.

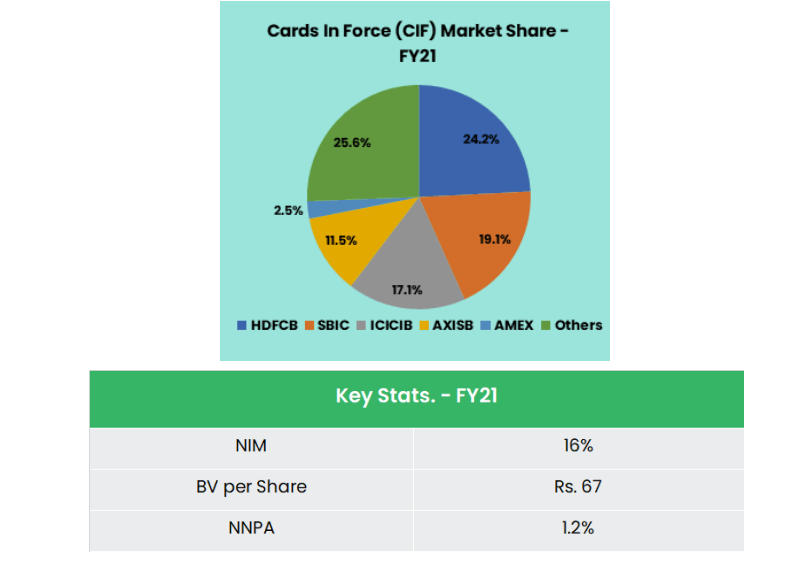

Company’s market share on Cards in Force as on FY21 improved to 19.1% as against 18.3% as on FY20. The market share of cardholder spends improved to 19.4% for FY21 as against 17.9% in FY20.

Financial Performance

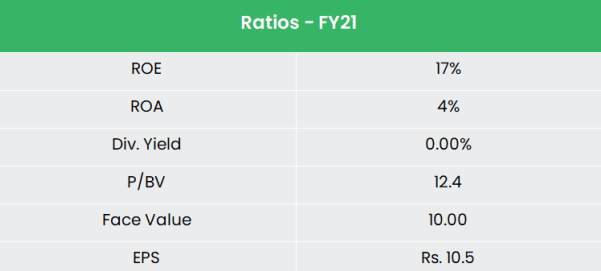

RoA averaged 4.6% over the past five fiscals supported by healthy net interest and strong fee income.

RoA rose to 4.6% in the first half of fiscal 2022 from 3.8% in fiscal 2021 (5.5% in fiscal 2020).

The second wave of the pandemic resulted in intermittent lockdowns and localized restrictions, impacting collections again.

Although the impact has been moderate compared to the past fiscal, asset quality deteriorated with gross non-performing asset (GNPAs) increasing to 4.99% as on March 31, 2021, from 2.01% a year earlier.

Gross/net NPA stands at 2.4%/0.83% in Q3FY22.

Industry Analysis

Credit card issuance has grown significantly in India at a compound annual growth rate (CAGR) of 20% in the last four years.

The number of credit cardholders increased from 29 million in March 2017 to 62 million in March 2021. It has further grown by 26% and 23% respectively in 2019 and 2020.

However, the COVID-19 pandemic affected the growth rate of India’s credit card industry and it grew by only 7% in 2020–21.

The growth rate is expected to improve marginally in FY21–22 but will remain slow due to the restrictions on card issuance by some large banks and payments networks.

Similarly, credit card transactions were growing at a CAGR of 16% till 2019–20 but went back to the 2018–19 levels in FY20–21. The growth rate was low during the first half of 2020–21 though it gained momentum during the second half.

A total of 31 card issuers in India have issued approximately 62 million cards till now. Out of the 31 issuers, the top six have a market share of around 81% while the rest account for the remaining 19%.

Growth Drivers

India is a highly under penetrated market, with average card ownership per 100 people being 4, compared to 105 in Brazil, 26 in Russia, 53 in China, 79 in Australia, 92 in UK and 331 in USA.

This represents a huge potential to increase credit card penetration in India. As entire cities and towns came under lockdown in 2020 and 2021, the dependence on online shopping grew, even in non-metros.

Consequently, the demand for credit cards from the non-metros continued to peak. The rise of e-commerce in the recent past has given a huge impetus to credit card usage.

The Indian e-commerce industry is projected to surpass that of the US to become the second largest ecommerce market in the world by 2034.

Outlook & Valuation:

The company is the market leader in terms of open market sourcing and is the largest co-branded card issuer in India. It has access to parent SBI’s vast network of 22k branches and customer base of 450m, along with strong open market sourcing capabilities.

Also, on account of robust distribution and co-branded channels, SBIC is well-placed to capitalize on growth opportunities, as the market remains significantly underpenetrated.

SBIC will sustainably command a high premium valuation as it:

- Offers a unique opportunity in a niche operating segment

- Delivers industry-leading return ratios sustainably

- Strong management imbued with execution excellence

- Unwavering focus on risk management

SBIC’s unique proposition wherein its cards-issuing business (highly profitable businesses) separately sits from merchant acquisition business (loss-making, sitting with SBI) gives it a huge advantage.

This along with difficult to replicate moats and high barriers to entry would ensure that SBIC continues to be an attractive compounding story.

BIC’s unique business model and underlying/difficult-to-replicate moats will help it generate superior RoA/RoE of >6%/25% in the near to medium term, a feat only few can boast.

In spite of peak Covid impact, SBIC turned in RoA/RoE of 3.9%/17% in FY21, vindicating the resilience of its business model and hence, SBI Card Share Price has seen good returns last year.

Hence, we recommend a BUY rating in SBI Card Share Price with the target price (TP) of Rs.964, 12.4x FY23E BVPS.

Hope you like our research article on “SBI Card Share Price”, Please read our other article on “HDFC AMC Ltd“