In this Article we will talk about Tactical Asset Allocation ETF .

What is Tactical Asset Allocation.

Tactical Asset Allocation Portfolios are types of portfolios where they just require a little bit more effort than regular ones. Rebalancing in Tactical Asset Allocation portfolio usually happens once a month or once every couple of months but they produce a good double digit return where in the normal portfolios usually you need to re balance them every quarter six months or a year .

In Tactical Asset Allocation investment style , the asset inside a portfolio is dynamically adjusted every month . These are good for investors with the horizon of 10 years or more.

The main difference between normal portfolios and tactical asset allocation portfolios , normal portfolios or lazy portfolio as the name suggest you don’t need much maintenance so every quarter or six months , you just need to re balance the percentages that was set initially at beginning of investment while TAA folios are dynamically adjusted every month so sometimes you need to sell an asset and bring a new asset or just keep the same as beginning of investment but re balance them.

Tactical Asset Allocation ETF require more maintenance monthly also usually produces better returns than Normal Portfolios.

This Strategy has been profitable from 100 years and more. It doesn’t need a lot of research and it doesn’t need you to pay hedge fund manager or bank professional, you can really do it easily in any account because it’s always long , so it would be very easy to implement either through a tax sheltered account or in normal margin account .

Market now a days is going up and all the indicators show that we are in a bubble, of course I believe that we are in bubble , but how long that will last nobody knows.

Buffet Indicator .

Remember , Stock market can be overvalued for long term , even today we are 2 standard deviations above this indicator from where it should be .

That’s why its really an excellent timing to start your investment in TAA portfolio because these portfolios are designed to go through these period and still perform. Whether there is a Bubble or no Bubble , these are made to perform. When the Bubble burst these portfolios usually perform much better than any stock market index . It’s really a good time to invest in them and you should do it really fast because anytime now this bubble could burst .

Tactical Asset Allocation portfolios are constructed from the same assets basically the stocks, bonds, precious metals, commodities and real estate . You can also go deeper and pick sectors and sub categories.

All these asset and sub category assets are usually nowadays represented by an ETF . In Fact all these ETFs are liquid ETF so that you can get in and out very easily .

Models:

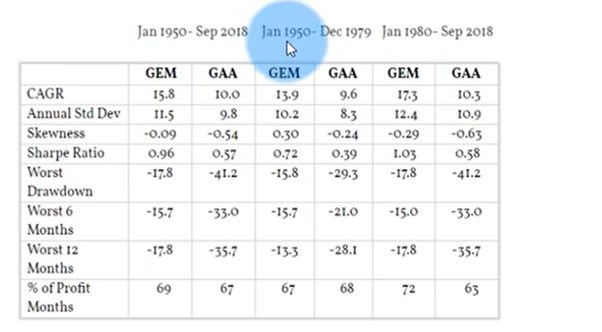

GEM ( Global Equities Model ), its a dual momentum model in which it holds US and Non US Stock Indices and also uses Bond as a coverage of weak Equity Market. Many Hedge Funds uses this method.

GAA ( Global Asset Allocation ) where its designed to keep 45% in US Stocks, 28% non U.S. stocks and 27% in 5 years Bonds .You can check the performance , it’s always beating the index .

Many tactical asset allocation portfolios are free , for some of them we have to pay but you can just implement the free ones . A Portfolio is always better than a single asset.

A portfolios would always produce better returns than a single Asset assuming they have not correlated return stream . You should not combine, let’s say the dual momentum portfolio of ETF with dual momentum portfolio of Mutual Funds , obviously that’s not going to work because they are highly correlated .

Anyways Tactical Asset Allocation Portfolio you pick you will not go wrong with it and you will have your money working for you 365 days a year. Your money will work for you 24 hours a day , you don’t need to worry about news , about the stocks splits or about stock market bubbles . These portfolios managed all weathers and all storms. It’s like you’re investing in hedge fund because you have the best managers giving you decades of experience by designing these portfolios so you cannot go wrong with them .

I highly advise that you invest all of these portfolios instead of all investing in the S&P 500 fund. TAA are excellent portfolios to invest in ,It requires very little effort like about 15 min to half an hour a month to invest in them and they produce double digit returns regardless of the variation

You can start the investment as its very easy to open an account as all these ETF’s are treated like stocks . Just follow the signals and that’s it .

Keep Investing.

Do Read our other articles https://equitygyan74899394.wordpress.com/2021/11/05/ishares-etf-vs-vanguard/