There’s a very famous saying that never put all your eggs in one basket. Or else if the basket falls, you will fall along with it. Likewise, I don’t want you to put all your money in one crypto. You should always diversify your portfolio. And by diversification, I don’t mean you invest in 100 different Currency. We need to have a strategy for investment and will know “How to invest 100K in Crypto” .

In this Blog, we will see on how to invest, where to invest, and which platform do we use to invest.

How do you invest 100K in Crypto

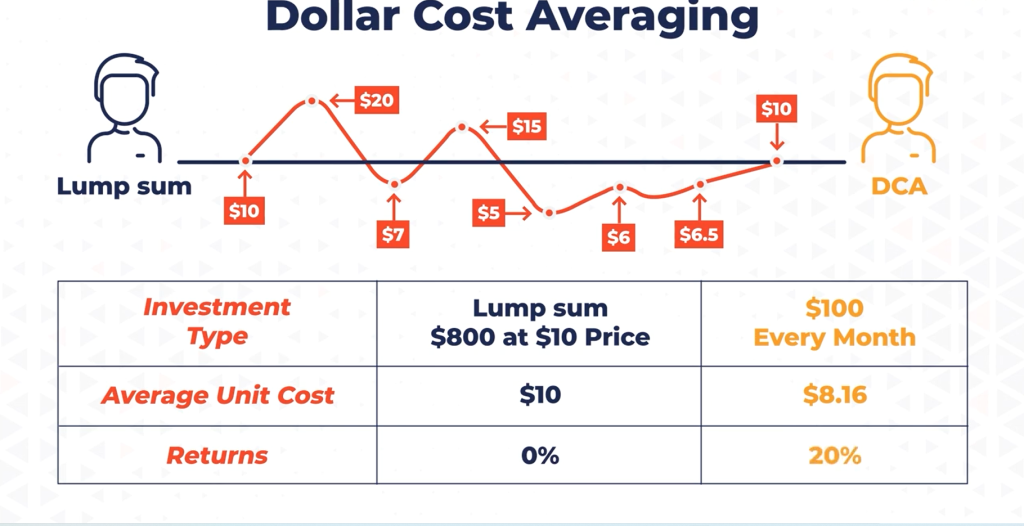

Basically there are two ways of investing. One is lump sum and the other one is DCA (Dollar Cost Averaging).

Let’s talk about lump sum first. In Lumpsum investment , people tend to do most simple Mistake , They try to time the market. This is the biggest mistake that investors do. Never ever Time the Market.

Let’s now talk about DCA. (Dollar cost averaging).

When you start investing small chunks of money at regular intervals, that is nothing but dollar cost averaging . You average out your buying Price. This is sometimes also called as systematic Investment plan in terms of Mutual Funds.

Now let’s look at this with a very simple example.

We have two people, First person who is doing a lump sum investment, and the second person who is doing the dollar cost averaging investment.

First Person did Lumpsum Investment of 100K Dollars , Whereas the second person he’s doing dollar cost averaging, he is investing $10 first month, $20 in Second Month and so on. He was investing like a robot.

If you see the picture above, In case of Market Going Down, you will see the person who did lumpsum investment made 0% profit whereas the person who was doing dollar cost averaging, he came out with 20% profit.

Likewise, cryptocurrency market is very volatile.

Whenever there’s a Bull run, we have seen almost 80% correction when it comes to Bitcoin and more than 90% correction in all coins. If you are planning to invest in lump sum, you would get wrecked. Always try and make sure that you’re following the protocol.

You will have to have a set protocol on how you invest. Only then you would be able to earn some money.

Now let’s talk about where to invest.

Please make sure that this is not a financial advice. And for example, we will take 100K.

So your first 100K should have a good exposure to a Bitcoin because Bitcoin is limited in nature. There’s only 21 million bitcoins . I would like to dedicate 40% of my total portfolio for Bitcoin.

40% is 40,000. Does this mean, you will do Lumpsum, No, you should start investing it every week or every month or every 15 days according to your wish.

Second, invest in Ethereum. We all know that Ethereum has a lot of the apps running on its platform and it is decentralizing the whole Internet. We should have good exposure of a portfolio for Ethereum as well.

I would like to dedicate 15% of my portfolio in Ethereum. So once Ethereum 2 comes, I will decide on what to do, whether I should increase my portfolio value or decrease it, but for now, let’s keep 15%. That is, we will invest $15,000. Again, we will do dollar cost averaging.

Third. let’s invest in DeFi projects . DeFi projects are decentralized finance projects which have no middle person.

For example, you can take a loan without signing on your documents. It’s all on the Internet without any paperwork.

Two Types of DeFi . One is lending projects. Other one is Dex projects (DEX – Decentralised Exchanges)

Lending projects, for example AAVE ,COMPOUND. This is Just Example Not a Promotion. Dex projects like UNISWAP , PancakeSwap. There are so many projects that you can go and explore and then plan your Key portfolio , which one out of decentralized exchanges should you include.

But if crypto has to have mainstream adoption, Centralized exchanges will also have to do good. If you think that crypto has great future and centralized exchanges have great future, you can invest 10% of your portfolio for centralized exchanges.

e.g. Centralized exchanges like Binance, Huobi, FTX, KuCoin like these , there are so many other projects which you can consider.

You need to go research about them and then invest only invest if you really think that centralized exchanges are the future. Definitely decentralized exchanges are going to be more popular. But suppose if you have to bring your grandmother, she wouldn’t be able to understand how to use a decentralized exchange. Right? She would maybe understand the centralized exchange much for better.

I think centralized exchanges will do good in the long run.

Let’s look how much we have invested . Till Now we have invested 40% in Bitcoin, 15% on Ethereum, 15% for DeFi projects and 10% in centralized exchanges.

Now let’s also allocate some percentage for all the platforms which are trying to compete with Ethereum.

I’m talking about Smart Contract Projects, smart contract projects like CARDANO, Polkadot Solana, and so many more.

So we will put 10% of our portfolio towards these platforms because apparently they are having better value propositions than Ethereum. But let’s wait and watch what happens with Ethereum 2. If that is something which is disrupting the whole market, then we will change our allocation accordingly.

After this ,we are now left with only 10%.

Let’s invest 5% in NFD projects. I’m investing only 5% because NFT is still developing and we still do see it’s huge potential. There are a lot of NFT projects. You can definitely go and do your research.

E.g. Decentraland Mana,Chiliz, Axie Infinity . There are a lot of other projects which you can research and invest.

Now we are remaining with 5%.

Do not invest more than 1% of your portfolio and 1% of 100K is 1000 in ShitCoins and MemeCoins. This way you wouldn’t have sleepless nights. We all know that ShitCoins and MemeCoins are very volatile in nature.

Now , We’ve understood why diversification is important. What are the ways of investment? Lump sum and dollar cost averaging? Where to invest? What are the cryptocurrencies that you can invest?

What are the ways that you can invest? Make sure this is not a financial advice.

Now let’s understand which platform do you use to invest and make your “How do you invest 100K in Crypto?”

I would strongly suggest you to check out coin CoinDCX. It’s the simplest platform where you can start investing with as little as $100.

You can use my referral Link for opening Account with CoinDCX https://join.coindcx.com/invite/5yM2

Disclaimer : These examples are for knowledge gathering , Please consult your advisor before investing.

Hope you liked our Article on “How to invest 100K in Crypto” , Please do read our other articles on https://equitygyan74899394.wordpress.com/2021/11/05/tactical-asset-allocation-etf/