For individual investors attempting to build and develop a portfolio of stocks, it can be hard to isolate valuable information among the litany of stock picks and tips crowding the market. Here is our list of Top 3 Stocks to buy in Australia.

To help highlight potential opportunities, we sifted through the recent portfolio movements of rated funds to discover notable buys by reputable management teams.

The aim is to uncover investment ideas that both equity analysts and top investment managers find attractive, in a manner timely enough for investors to gain value.

Criteria to select Stocks:

For a stock purchase to make it onto the list, it needed to meet several criteria:

These ratings indicate the funds are expected to perform in line with, or outperform, their benchmark index.

Once the funds are collated, stock purchases from the most recent portfolio reporting date—in this case February 28, 2023— are flagged if they are deemed either ‘new-money’ buys or ‘high-conviction’ buys.

We think of high-conviction purchases as occasions when managers have made meaningful additions to their portfolios, as defined by the size of the purchase in relation to the portfolio’s size. New-money buys are where a manager purchases a stock that did not exist in the fund’s portfolio in the prior period.

Finally, the resulting stocks are eliminated if they are deemed overvalued.

This is to ensure any stocks on the list are also regarded as fairly or under-valued by our analysts and are therefore considered good value for money for investors.

It should also be noted that depending on the time between disclosures, purchases may have been made months before the listed disclosure date.

As the first few weeks of March have shown, the purchase price of a security can change drastically in the following days, weeks, or month.

With that in mind, investors should always assess for themselves the attractiveness of any stock mentioned, as well as their individual risk appetite and investing goals.

Top 3 Stocks to buy in Australia.

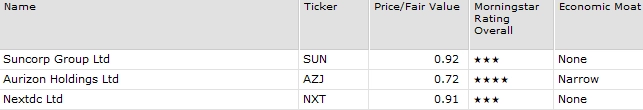

Among funds that reported their holdings as of February 28, 2023, three ASX stock purchases met the above criteria.

All the purchases detailed below were made between January 31, 2023, and February 28, 2023.

Aurizon Holdings (AZJ)

Former state-owned rail freight operator Aurizon was among the companies listed this month as one of Morningstar’s Global Best Stock Ideas. The full list is available to Investor subscribers.

In assessing the company, our analyst says shares in narrow-moat Aurizon are trading at a discount to their fair value estimate.

“The shares offer an attractive yield, underpinned by high-quality rail infrastructure and haulage operations.”

Atkins adds that a considerable downside, which has already been priced into the shares, may prove to be overdone.

“Haulage volume is likely to be weak in the near term because of wet weather, but the medium-term earnings outlook is good as volume recovers, tariffs increase with the Consumer Price Index, and the regulated rail track is allowed higher returns,” he says.

“We think environmental risks are overblown, providing an opportunity for investors to buy a better-than-average company at a discount. A commercially viable alternative to coking coal in the making of new steel appears a long way off. Our analysis suggests risks for investors are skewed to the upside from the current share price,” he adds.

Shares in 4-star Aurizon are trading at around a 30% discount to our fair price estimate.

Suncorp Group (SUN)

Our highest-conviction purchase of the recent reporting period, no-moat insurance provider Suncorp is currently trading with a price-to-fair-value ratio of around 0.92, meaning it is screening close to fair value estimate for the company.

It’s been a difficult month for Suncorp’s share price since the high-conviction buy was recorded: shares are down around 7% in the last four weeks.

However, amid the fallout of the global banking liquidity scare earlier this month, Scott Kelly, portfolio manager at DNR Capital says Suncorp is among the fund’s preferred exposures as it pivots away from the banks.

“Relative to the banks, we prefer the insurers, and we think they provide a meaningful offset to our underweight bank’s position,” he says.

“Our preferred exposures are QBE (QBE) and Suncorp. Both also benefit from higher interest rates through higher yields on their investment books.”

Commenting on the company’s recent performance, Morningstar analyst Nathan Zaia says Suncorp may finally be “getting out from under the storm clouds”, following a recent boost in its cash profit and plans to sell its banking arm.

“The balance sheet remains strong, and we expect management to return proceeds from the sale of the bank to shareholders via a capital return and fully franked special dividends. While we expect Suncorp to remain profitable, we do not expect persistent excess returns on capital over the long term,” he says.

NextDC (NXT)

Data Centre operator NextDC was tracking as undervalued according to fair value estimate up to February this year when an improvement in its share price tipped it back into 3-star, or ‘fairly valued’, territory.

The recent improvements in the company’s share price follow a difficult 2022, in which it fell by almost a third between January and December. Morningstar analyst Matthew Dolgin says the drop was not indicative of a downturn in the firm’s performance or prospects.

“The broad market decline and pressure on real estate investments resulting from higher interest rates both pressured NextDC’s stock during 2022,” Dolgin says.

“Unlike most REITs, however, NextDC does not pay a dividend, so it has not been a stock in which to hide amid low interest rates. Instead, it is a growth stock and we think it has a very manageable debt profile with a leverage ratio below most data centre peers,” he added.

“We don’t expect NextDC’s business to suffer significantly from an economic downturn and think its future prospects are still bright, making stock selloffs potential buying opportunities.”

Hope you liked our article on ‘Top 3 Stocks to buy in Australia‘, Please read our other Article on “Nasdaq vs S&P 500“