In this research report, we will look at Eris Lifesciences Share Price Target by understanding company result and its future growth prospect .

We will look into company business, its declared results and risk if any which investors should know.

Before we go further, please subscribe to our newsletter, so you never miss an article from us when it’s published.

Company Overview:

Eris was incorporated as a public company in February, 2007. It is engaged in manufacturing and marketing of branded finished dosages in the Indian Pharmaceutical Market since 2007.

It has a presence in the high growth chronic and acute therapeutic areas that require high intervention of specialists and super specialists. Its diverse product portfolio comprises of 80+ mother brand groups that are focused primarily on lifestyle related disorders.

The company has drugs across Anti-Diabetes, Cardiovascular, Gastroenterology and Gynecology, Anti-Infectives, Vitamins, and other therapeutic areas.

The company has a manufacturing facility at Guwahati, Assam. It has a pan-India distribution network of over 2,100 stockists and 5,00,000+ chemists.

Products & Services:

Eris has brands in various therapy segments namely Anti Diabetes, Cardiovascular, nutrition, Neuroscience, Gastrointestinal, Gynaecology, Derma, etc. Some of the leading brands of Eris are Glimisave, Eritel, Renerve, Tendia, Olmin, Rabonik, Tayo, Cyblex, Remylin, Zomelis, Metital, etc.

Subsidiaries:

As on Mar’22, the company has a total of 5 subsidiaries.

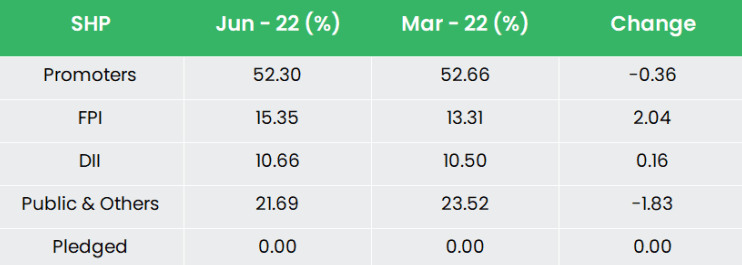

Promoter Holding:

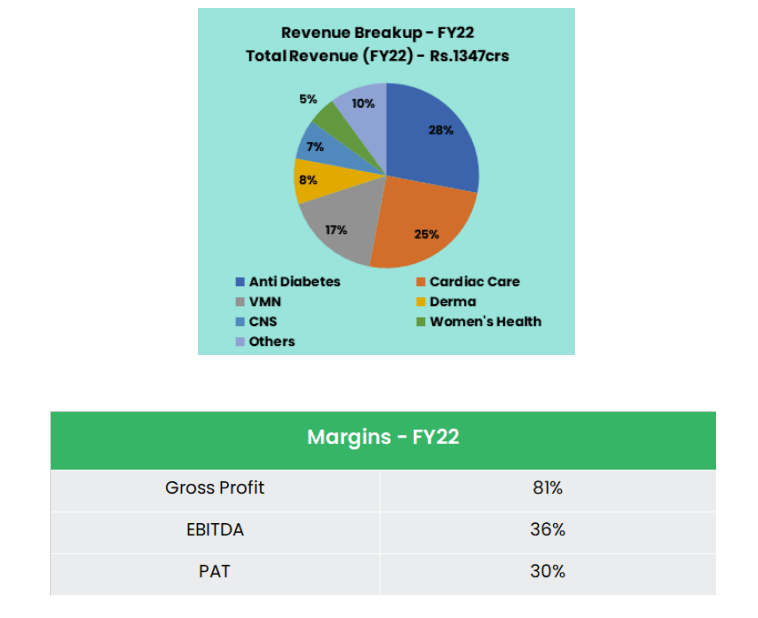

Revenue Breakup & Margin:

Key Rationale:

Anti Diabetes Player:

Eris Life is a strong player in the Anti diabetes therapy with the segment accounted for 28% of FY22 sales. The company remains one of the leading players in the Diabetes market, with a revenue rank of #5 in the covered market and prescription rank of #3 among diabetologists.

The Anti Diabetes Market share of the company as of Jun’22 is around 3.59%. Eris has outperformed the IPM (IPM Pharmaceutical Market) in the Oral Anti Diabetes segment by 7.2%.

ERIS has built an extensive range of products (35+ brands) in the Oral Anti-Diabetes Drug (OAD) category, including technically superior drugs such as DPP4 and SGLT2 inhibitors.

The recent supply agreement with MJ Biopharm would enable further portfolio expansion, led by Insulin/Insulin analogs and GLP1 agonists.

New Launches:

Q4FY22 has been a very significant quarter in terms of strategic new product launches including Drolute, Xsulin and Linares as well launch of a dedicated insulin division with a field-force of 200 personnel.

The Management expects around Rs.200mn sales in the first year from its insulin product launch and for new batches has already taken price hike of 10%.

Acquisition of Oaknet:

The company has recently announced the acquisition (100% equity stake) of Oaknet healthcare at an Equity Valuation of Rs.6.5bn. The acquisition is transacted at ~3.3x of sales.

The deal has been financed with a mix of internal accruals and borrowing. Oaknet is a strong player in domestic dermatology segment with 650MRs having total revenues of ~Rs1.9bn, of which Rs1.2bn comes from derma segment.

Currently, the company enjoys a gross margin of 70% and OPM of 10%. Along with Oaknet, Eris is now present in 87% of the chronic market, which is worth Rs.55,000 crores with a leading presence in the major chronic therapies in the market, namely cardiology, oral diabetes care, insulin, neurology/CNS and dermatology.

Financial Performance:

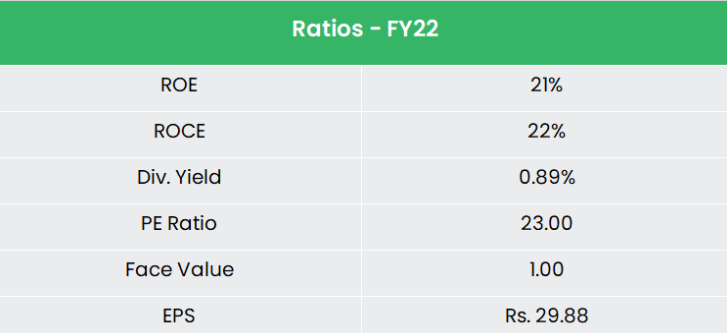

The company has reported a 5yr Average ROE (Return on Equity) of 27% supported by the Tax incentives. The Guwahati plant is eligible for certain tax incentives, incl. income-tax and excise-duty exemptions for 10 years (until FY24 and FY25, respectively), besides certain capital investment and trade subsidies.

Hence, tax rate for the company would continue to remain very low. On the other side, the company maintains a zero-debt position and a cash reserve (incl. Investments) of Rs.572crs.

Eris is one among the highest cash generating cos. in the industry; OCF stood 78% of EBITDA in FY22.

Industry Analysis:

Indian pharmaceutical sector supplies over 50% of global demand for various vaccines, 40% of generic demand in the US and 25% of all medicine in the UK.

Globally, India ranks 3rd in terms of pharmaceutical production by volume and 14th by value. The domestic pharmaceutical industry includes a network of 3,000 drug companies and ~10,500 manufacturing units.

According to the Indian Economic Survey 2021, the domestic market is expected to grow 3x in the next decade. India’s domestic pharmaceutical market is at US$ 42 billion in 2021 and likely to reach US$ 65 billion by 2024 and further expand to reach ~US$ 120-130 billion by 2030.

In the global pharmaceuticals sector, India is a significant and rising player.

India is the world’s largest supplier of generic medications, accounting for 20% of the worldwide supply by volume.

Growth Drivers:

Changing lifestyles leading to the higher prevalence of chronic diseases, resulting in demand for therapies such as Cardiac and Diabetes.

In June 2021, Ms. Nirmala Sitharaman, Minister of Finance and Corporate Affairs, announced an additional outlay of Rs. 197,000 crore (US $26,578.3 million) that will be utilised over five years for the pharmaceutical PLI scheme in 13 key sectors such as active pharmaceutical ingredients, drug intermediaries and key starting materials.

The FDI inflows in the Indian drugs and pharmaceuticals sector reached US$ 1.206 billion between April-December 2021.

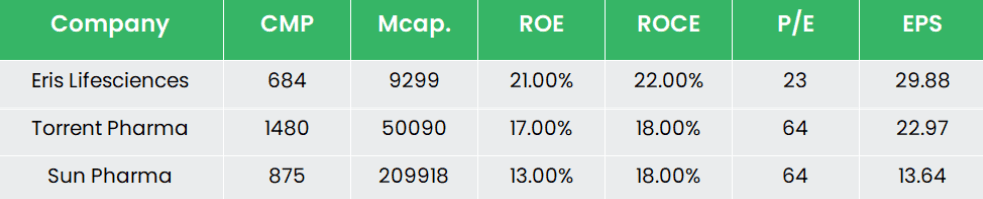

Peer Analysis:

Competitors: Torrent Pharma, Sun Pharma, Abott India, Sanofi India, etc. Eris has the highest EBITDA Margin reported among its peers.

Not only the margins, the return ratios and other fundamentals of Eris are top notch than the others and even trading at a juicy valuation.

Eris Lifesciences Share Price Target:

Company continues to generate strong cash flows. Consolidated operating cash flow was at 78% of EBITDA and consolidated free cash flow was at 53% of EBITDA.

The Company generated around Rs.1100crs of FCF in the last 5 years. ERIS guided at 15% YoY revenue growth on an organic basis and 30% revenue growth with the Oaknet addition in FY23. On an organic basis, it guided at 15% EBITDA growth in FY23.

The growth in EPS on an organic basis is expected to be 11-12% YoY in FY23. The EBITDA Margin is guided at 36% for FY23 on an organic basis. ERIS has a pipeline of 15 launches, including five-to-six major products.

FY23 will see significant investments such as field force expansion; marketing investment for its Diabetes portfolio, including insulin; and commencement of its new facility.

We believe Eris’ focus on lifestyle-related-disease therapies will continue to drive growth in its chronic category.

In the last ten years, Eris clocked a steady revenue and PAT CAGR growth of 17/27%. We believe margin should remain around 35-36% over the next few years, the highest among all domestic formulation companies.

We recommend an ACCUMULATE rating on the stock with a revised Target price (TP) of Rs.800, 22x FY24E EPS.

Risks:

Risk of trade margin capping for generics business – ERIS has forayed into trade generics recently (to contribute ~8% of FY23E sales). This business operates in a dynamic regulatory environment marred by uncertainty over proposed changes related to trade margins.

Regulatory Risk – The Indian Pharmaceutical market is subject to extensive regulations and any failure to comply with the applicable regulations prescribed by the central, state governments and regulatory agencies or failure to obtain or renew any licenses and permits, could impact the business.

Production Risk – Any delay in the launch of new products will impact the revenue and profitability going forward.

Hope you liked our Article on Eris Lifesciences Share Price Target and company Overview , please read our other articles on “Dixon Technologies Share Price Target and Company Overview“.