In this research report, we will look at Dixon Technologies Share Price Target by understanding company result and its future growth prospect . We will look into company business, its declared results and risk if any which investors should know.

Before we go further, please subscribe to our newsletter, so you never miss an article from us when it’s published.

Company Overview:

Dixon Technologies (India) Limited is the largest home grown design focused and solutions company engaged in manufacturing products in the consumer durables, lighting and mobile phones/smart phones markets in India.

Company is the biggest manufacturer of LED TVs in India producing TVs for the brands like Samsung, Panasonic, Xiaomi, TCL, OnePlus and many more.

They also manufacture lighting products for companies like Philips, Havells, Syska, Bajaj, Wipro, Orient and more.

They happen to be the leading contract manufacturer of semi-automatic washing machines for clients like Godrej, Samsung, Lloyd, Panasonic.

The company has 16 Manufacturing units spread across the nation and they offer complete solutions to its customers from the Manufacturing and designing to assembly and delivery support across all the verticals.

Products & Services:

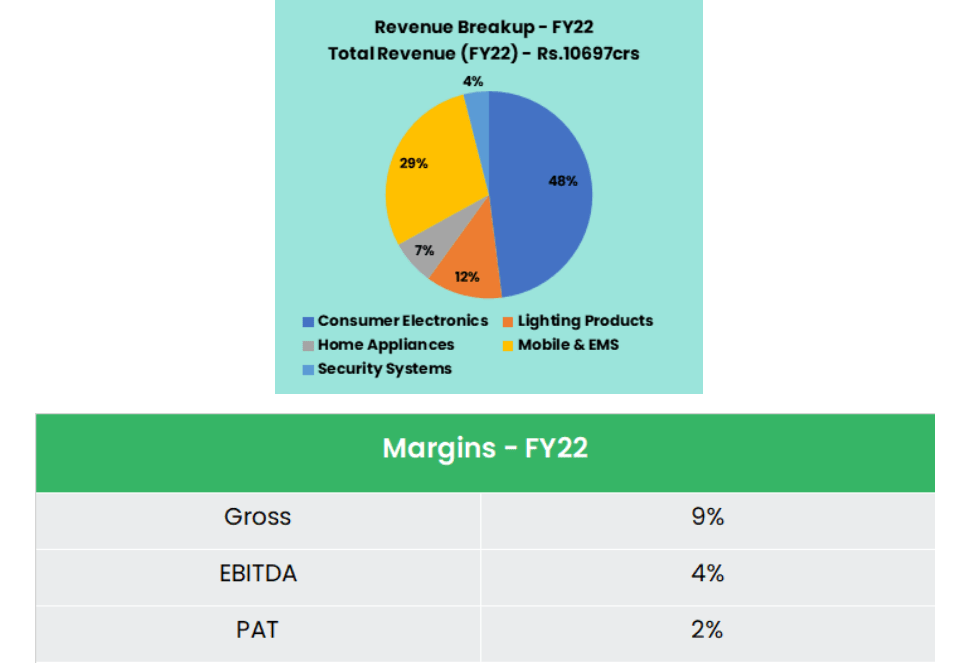

DTIL has operations in consumer electronics (LED TVs), lighting (LED Lights, Ballast, Tube Lights, Battens and Downlighters), home appliances (Washing Machines), Security Surveillance systems and mobile phone & EMS segments and also undertakes reverse logistics operations (Repair & refurbishment Services for LED TVs and Set-top boxes). The company undertakes manufacturing of security surveillance equipment & medical electronics through a JV company.

Subsidiaries, Revenue & Margins:

As on 31st Mar 2022, the Company has a total of 5 subsidiaries and 2 Joint Ventures.

Key Rationale:

Robust Track Record:

DTIL has more than two decades of experience in the EMS (Electronics Manufacturing Services) business. It has an established track record as well as leadership position in the key segments in which it operates, i.e. LED television, lighting, and washing machine.

The company operates on two models namely, Original Equipment Manufacturer (OEM) and Original Designing Manufacturer (ODM). In OEM, Dixon acts as an executioner, they simply assemble the products based on the customers specification.

In ODM, Dixon will produce the product from the scratch including the design and the selection of raw material using it’s in house R&D. However, this model contributes only 9% of the total revenue of the company.

Over the years, the company has augmented its manufacturing capacities alongside acquiring cost competency to become one of the largest and cost-efficient EMS players in the country.

These strengths have helped DTIL in adding new principals as well as maintaining healthy relationship with its clients, resulting in repeat business.

Q1FY23 Revenue:

Revenues were up 53% YoY led by strong growth in the mobile & EMS segments (up 4x YoY) and home appliance segment (up 3.6x YoY).

However, revenues from consumer electronic (TVs) declined 26% YoY, mainly due to higher base and passing of lower input price to customers.

The mobile & EMS segments strong revenue growth is led by positive impact of PLI benefits. Overall PAT up by 150% YoY to ~Rs.46 crs; tracking higher sales and EBITDA margin expansion in Q1.

Diversified Segments:

The company dispatched 7.4 lakh units in Q1FY23 and company expect it to increase 1.1 million units from Q2 onwards in the Consumer electronics segment. The company has the largest capacity in LED televisions in India at 6 million sets which services to more than 35% to the overall Indian requirement.

Company dispatched 3.8 lakhs semi automatic machines and 30,000 units of fully automatic machines in Q1FY23 in the Home applicances segment. The company has added Bosch as an anchor customer in this segment and also manufactures for Lloyd and Croma.

In the Mobile & EMS Segment, the company has ramped up its volumes in the Motorola business and is touching a run rate of 4,00,000 a month.

Dixon achieved a landmark of 1 million units in Q1FY23 for Motorola. The company expect production ramp up of 1.5 million units/ month for the same customers.

Financial Performance:

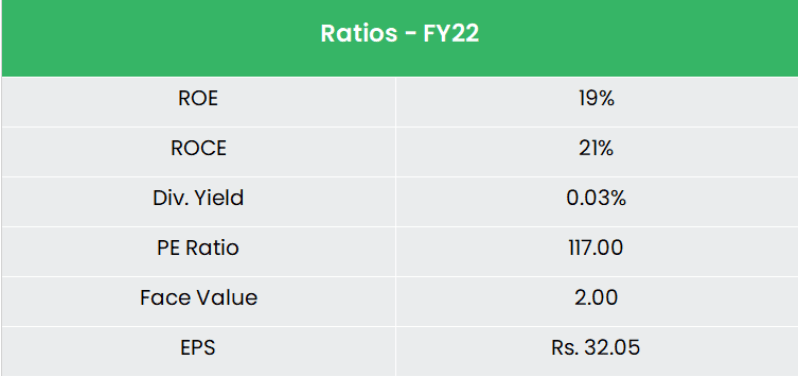

The sales grew at a CAGR of 34% for the period of FY17-22 and the EBITDA grew at a CAGR of 32% for the same period.

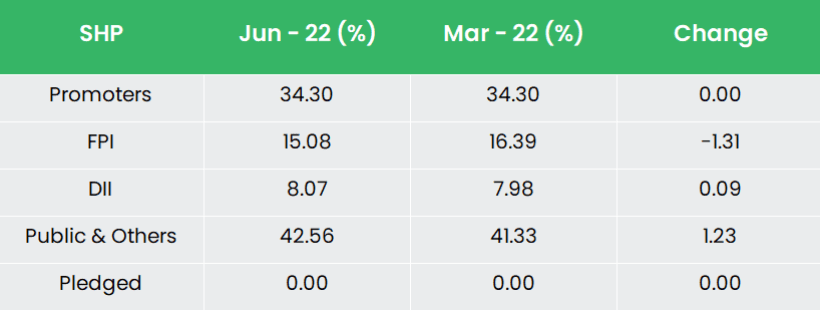

The five year average value of ROE and ROCE stand at 24% and 31% respectively. The company has gross debt of Rs.490 crs and cash of Rs.360 crs by the end of Q1FY23.

The debt-to-equity ratio as of FY22 stands at 0.47x which is less than 0.5x and thus makes the balance sheet healthy.

Industry Analysis:

The Indian consumer durables market is broadly segregated into urban and rural markets and is attracting marketers from across the world.

The sector comprises of a huge middle class, relatively large affluent class and a small economically disadvantaged class.

Appliances and consumer electronics industry stood at US$ 9.84 billion in 2021 is expected to more than double to reach Rs. 1.48 lakh crore (US$ 21.18 billion) by 2025.

As of 2021, the refrigerator, washing machines and air conditioner market in India were estimated around US$ 3.82 billion, US$ 8.43 billion and US$ 3.84 billion, respectively.

The flat panel television (LED, LCD, HD, and UHD) market in India was valued at US 9.05 billion in FY18 and is expected to reach US$ 16.24 billion by FY24, growing at a CAGR of 9.25%.

In 2021, TV shipments grew 24% YoY, with the smart TV market also registering 65% YoY growth.

Growth Drivers:

The Government of India has allowed 100% Foreign Direct Investment (FDI) under the automatic route in Electronics Systems Design and Manufacturing sector.

The PLI scheme, which has been approved for 16 electronics firms, including 10 manufacturers of mobile handsets, would further improve India’s role in the global mobile market and complement the goal of making the country a global mobile production hub for manufacturers.

Apart from increasing penetration across rural and urban areas, the shortening replacement cycle, need for greater mobile phone data, better features and power management is driving sales of phones in the country.

Dixon Technologies Outlook:

Indian EMS industry is valued at $23.5 billion. Dixon currently has a market share of 3-4%, which leaves an opportunity to expand and grow.

The management expects:

- LED TV volumes to reach ~3.6 million units in FY23 as against 2.9 million units in FY22 supported customer additions.

- 5.5 mn units of dispatches to Motorola in FY23 over 2 mn sets in FY22.

- To attain volumes of ~1.6 mn units of semi-automatic washing machines in FY23 as against 1.1 mn units in FY22 owing to new customer acquisition as well as existing relationship with anchor customers

- Benefits of softening commodity prices to reflect on the margins from Q3FY23 (expects segment margin of 9%).

Dixon will be introducing an economy series in washing machines which will be launched by the end of Q2FY23.

The company is also in the final stages of getting a large contract from a big Japanese brand for Fully Automatic Top Loading (FATL) Washing Machine for both domestic and global markets.

Dixon is having final discussions for feature phones with 2 major companies having a large market share in India and is likely to begin production for the same from Q4FY23 onwards

Valuation:

Dixon is a major player in contract manufacturing for consumer electronics and durable goods. Recent product additions and customer acquisitions are likely to sustain its growth prospects.

Additionally, we expect the PLI scheme to benefit the company due to its ability to scale up manufacturing. We recommend a BUY rating in the stock of Dixon Technologies Share Price Target (TP) of Rs.4382, 60x FY24E EPS.

Current Market Price can be checked here .

Risks to Look out for:

Client concentration Risk – DTIL’s revenues are closely linked to the business plan and performance of its principals. A major part of DTIL’ revenues and operating profitability is derived from its top three customers Xiaomi, Samsung and Panasonic.

Raw Material Risk – Any sudden increase in the shortage of semiconductor chips will impact the demand and the margins of the company.

Competitive Risk – The electronic products/EMS industry is characterised by continuous product as well as process innovation and rapid adoption of new technology. Given the risk of technological obsolescence, the industry players are required to undertake continuous upgrades to sustain the competitive advantage. The company faces competition from other EMS players, besides exposure to in-house capacities of brands.

Hope you liked our Article on Dixon Technologies Share Price Target and company Overview , please read our other articles on “TATA Motors Share Price Target 2022 and Company Overview“.