In this research report, we will look at KIMS Healthcare Management Ltd Share Price Target 2022. We will look into company business, its declared results and its future growth prospect.

What KIMS Healthcare Management Ltd Products are ? We will then see what company is doing next to grow in future which will also impact on KIMS Healthcare Management Ltd Share Price Target 2022.

Before we go further, please subscribe to our newsletter, so you never miss an article from us when its published.

KIMS Healthcare Management Ltd Company Overview:

Founded by Dr. B. Bhaskara Rao and headquartered in Hyderabad, KIMS Hospitals is one of the largest corporate healthcare groups in AP and Telangana, providing multidisciplinary integrated healthcare services, with a focus on tertiary and quaternary healthcare at affordable cost.

The Krishna Institute of Medical Sciences (KIMS) is the largest corporate healthcare group in Andhra Pradesh and Telangana with a network of 12 hospitals and over 3600 beds spread across Telangana (Secunderabad, Kondapur, Gachibowli, Paradise Circle, and Karimnagar) and Andhra Pradesh (Nellore, Rajahmundry, Srikakulam, Ongole, Vizag, Anantapur, and Kurnool).

The Group offers a comprehensive bouquet of healthcare services across specialties and super specialties across more than 25 specialties.

The Group’s flagship hospital at Secunderabad is one of the largest private hospitals in India at a single location with a capacity of 1,000 beds.

Products & Services:

The group provides Multi speciality care namely Neurology, Cardiology, Pulmonology, ENT, Ophthalmology, Gastro Intestinal care, Oncology, Skin, Pediatrics, Critical services, Pathology, etc.

Subsidiaries:

As on 31st Mar 2022, the company has a total of 8 subsidiaries and 1 Joint Venture. KIMS Cuddles Pvt. Ltd was a subsidiary and it was dissolved on Nov 30, 2021.

Key Rationale:

Strong Market Position

Through its network of nine hospitals under the “KIMS Hospital” brand, the group has an established presence in the South Indian market.

The group also has a long operational track record of 16 years in the tertiary and the quaternary healthcare segments and also benefits from the strong brand reputation and the extensive experience of the group’s promoters in the healthcare industry.

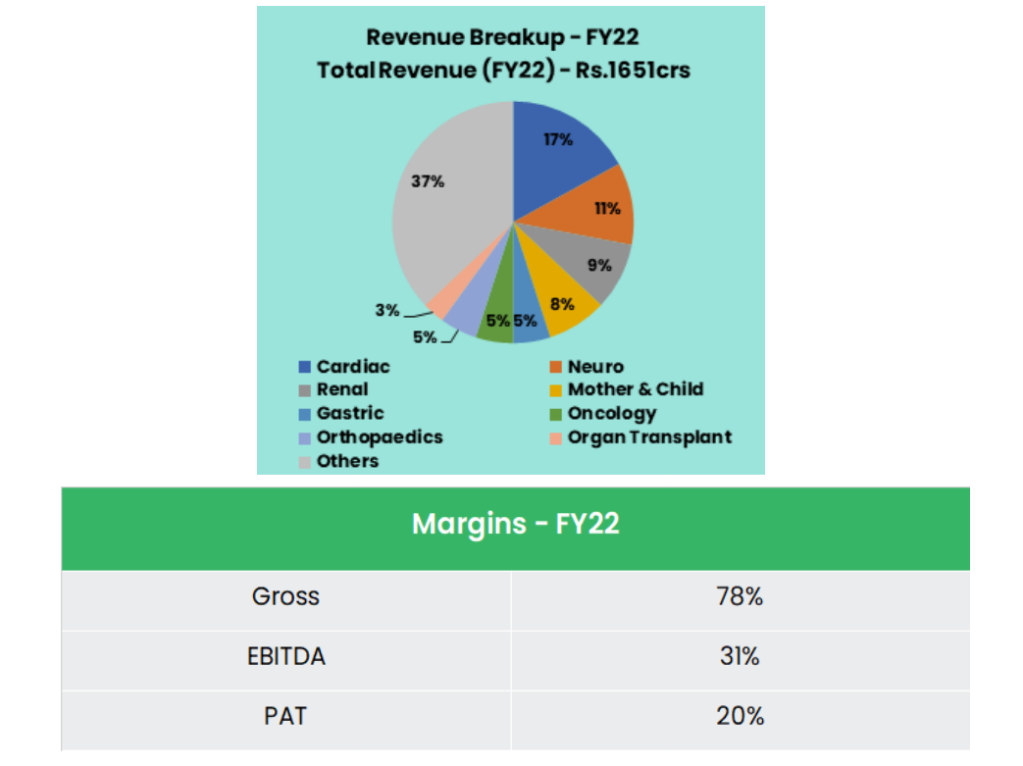

In terms of specialties, cardiac treatments account for the highest share of revenues at ~17%, followed by neuro sciences ~11% and renal sciences ~9%.

The balance is spread across oncology, mother and child, gastric sciences, orthopedics and others.

The group, with a combined bed capacity of 3600+ beds as on March 31, 2022, is one of the leading players in the tertiary care segment in Andhra Pradesh and Telangana.

Affordable Pricing Model:

KIMS Healthcare Management Ltd is focused on offering quality healthcare services at affordable prices, regardless of the market, specialty, or service type.

The company has achieved this by controlling capital and operating expenditure along with a multi-disciplinary approach.

Also, the company is focused on the high volume tertiary care model. KIMS treatment costs across medical procedures are on an average 20-30% lower than other private hospitals, which gives it an edge over peers

New expansion:

Management in its cluster based approached, looking forward to replicate AP and Telangana model in Maharashtra and Karnataka region.

KIMS Healthcare Management Ltd plan to commercialize ~1500 beds over next 4-5 years across Maharashtra and Karnataka region. The expansion will be combination of inorganic + greenfield expansion.

More important company will partner with local doctors/consultant in specific micro market which will help to generate better footfalls and achieve faster break-even.

KIMS Healthcare Management Ltd will have full control of decision making in such partnership. Management intends to add total 800-1000 beds in newly formed Maharashtra cluster which will include Nashik, Nagpur, Mumbai and Pune market. Management sees many greenfield opportunities in Bangalore market specifically in north Bangalore region.

Recently KIMS have landed with a brownfield opportunity in North Bangalore (Mahadevapura) in form of distressed mall where the company has bought 50% ownership in land and building.

Balance 50% to opt on lease with a target to commercialize 350-400 beds within 15-18 months.

Financial Performance:

The company has generated a Revenue and PAT CAGR of 21% and 67% over the period of FY20-22.

Krishna Institute of Medical Sciences Ltd has reported a strong operating profitability (31% in fiscal 2022), despite constant capacity addition, including through acquisitions.

Company has maintained the gross margin of 75%+ for the past 5 years.

Industry Analysis:

Healthcare has become one of India’s largest sectors, both in terms of revenue and employment.

Healthcare comprises hospitals, medical devices, clinical trials, outsourcing, telemedicine, medical tourism, health insurance and medical equipment.

The Indian healthcare sector is expected to record a three-fold rise, growing at a CAGR of 22% between 2016–2022 to reach US$ 372 billion in 2022 from US$ 110 billion in 2016.

By FY22, Indian healthcare infrastructure is expected to reach US$ 349.1 billion. As of 2021, the Indian healthcare sector is one of India’s largest employers as it employs a total of 4.7 million people.

The sector has generated 2.7 million additional jobs in India between 2017-22 – over 500,000 new jobs per year. The hospital industry in India is forecast to increase to Rs. 8.6 trillion (US$ 132.84 billion) by FY22 from Rs. 4 trillion (US$ 61.79 billion) in FY17 at a CAGR of 16–17%.

The Government of India is planning to increase public health spending to 2.5% of the country’s GDP by 2025.

Growth Drivers

In the Economic Survey of 2022, India’s public expenditure on healthcare stood at 2.1% of GDP in 2021-22 against 1.8% in 2020-21.

In Union Budget 2022-23, Rs. 86,200.65 crore (US$ 11.28 billion) was allocated to the Ministry of Health and Family Welfare (MoHFW).

The Indian government is planning to introduce a credit incentive program worth Rs. 500 billion (US$ 6.8 billion) to boost the country’s healthcare infrastructure.

Outlook:

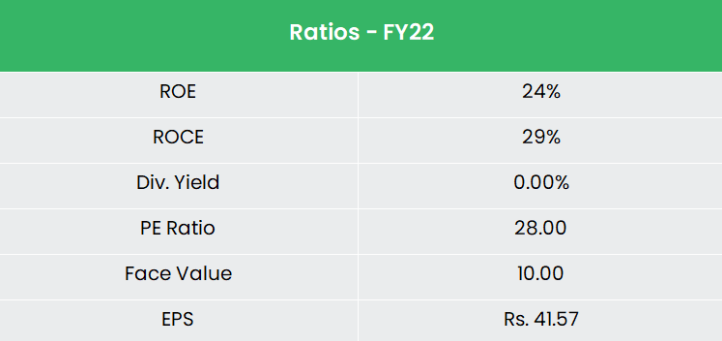

KIMS Healthcare Management Ltd has the highest return ratios due to 1.) Lowest Capex per bed (Rs.36 Lac/bed) and 2.) Highest EBIT margins 27%.

Their Low Capex strategy is a mix of acquiring land in advance and constructs building on their own to reduce costs and another way is acquiring land on a long-term lease with low-cost terms to avoid high rental costs.

KIMS Healthcare Management Ltd intends to increase the current operational beds utilization from 2246 in FY22 to its optimal capacity to 3064 beds considering normalcy and demand environment continues to remain healthy going forward. The company is generating a cash flow of around Rs.350 crs every year.

Hence Management does not see any cash flow mismatch over the next 3 years for capex planned for expansion.

Current ARPOB (Average Revenue Per Operating Bed) is sustainable for FY23 and may increase going forward on improved payor and case mix.

Further company has not taken any price hike over last 2 years which will also see some upward revision.

Valuation:

KIMS Healthcare Management Ltd will continue to benefit from its regional market leadership, strong cash flow generation and sustained focus on operational efficiency and capacity expansion.

We believe KIMS is an attractive play in the booming healthcare services market due to its (a) planned capex, (b) industry-leading occupancy, (c) growth in revenue and margins, and (d) reasonable valuations.

At CMP, the stock trades at 21x of FY24E EPS. We recommend a BUY rating in the stock with the target price (TP) of Rs.1375, 25x FY24E EPS

Hope you liked our Article on Dabur Share Price Target 2022 and company Overview , please read our other articles on “KIMS Share Price Target and Company Overview“.