In this article we will look at details of Campus Activewear Ltd IPO through its business, its holding and its other parameters . We will tell you whether you as an investor should invest or not.

Details you don’t want to miss:

Campus Activewear Ltd IPO Overview:

Campus Activewear Ltd is the largest sports and athleisure footwear brand in India in terms of value and volume in Fiscal 2021.

It was introduced as the brand ‘CAMPUS’ in 2005 and are a lifestyle-oriented sports and athleisure footwear company that offers a diverse product portfolio for the entire family.

Company offer multiple choices across styles, color palettes, price points and an attractive product value proposition.

Company Financials:

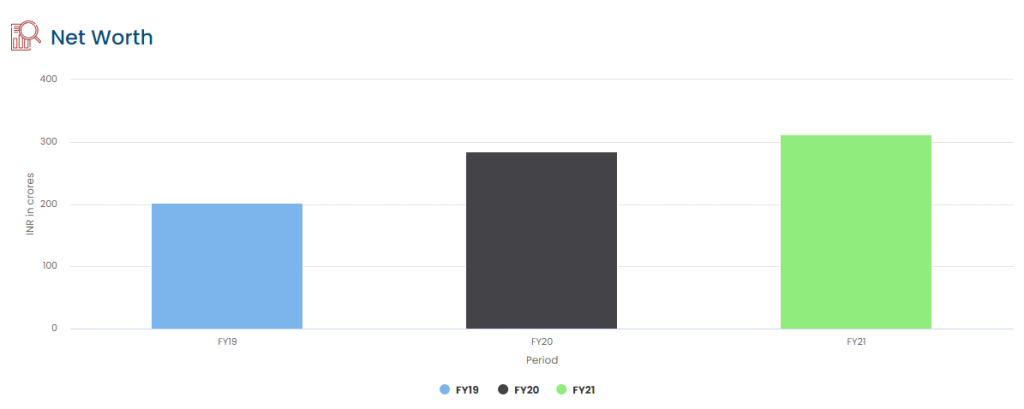

Company net-worth in year FY 2019 was 201.77 crore which in FY 20 was 284.75 which last year was 312.64 Crore.

Strengths & Risks associated:

Top 3 Strengths

- India’s largest sports and athleisure footwear brand and fastest growing scaled sports and athleisure footwear brand with a robust product portfolio across the demand spectrum.

It had an approximately 15% market share in the sports and athleisure footwear industry in India by value for Fiscal 2020, which increased to approximately 17% in Fiscal 2021 (Source: Technopak Report as per Company DRHP).

- India’s largest sports and athleisure footwear brand and fastest growing scaled sports and athleisure footwear brand with a robust product portfolio across the demand spectrum.

It had an approximately 15% market share in the sports and athleisure footwear industry in India by value for Fiscal 2020, which increased to approximately 17% in Fiscal 2021 (Source: Technopak Report as per Company DRHP).

- Difficult to replicate integrated manufacturing capabilities supported by robust supply chain.

It own and operate five manufacturing facilities across India with an installed annual capacity for assembly of 25.60 million pairs as on September 30, 2021 (Source: Company DRHP).

Top 2 Risks:

- Failure to effectively promote or develop the brand could materially and adversely affect business performance and brand perception

The company sells all its products from which they derive all revenues, under the Campus brand. Brand image is an important factor that affects a customer’s purchasing decision (Source: Company DRHP)

- The sports and athleisure footwear industry is highly competitive, and failure to compete effectively, may lead to adverse effects on business, results of operations.

Compete primarily against international sportswear brands, local branded manufacturers and manufacturers from the unorganized sector (Source: Company DRHP).

Industry Trends:

Global perspective of Sports & Athleisure Retail Market:

The global sports and athleisure market is projected to grow at a CAGR of 6-8% during the next five years. It broadly comprises of apparel, footwear, and gears.

While USA is said to be the largest market for this segment, the Asia Pacific countries are expected to be the fastest growing markets in the coming 5 years (Source: Company DRHP)

Sports & Athleisure Retail Market in India:

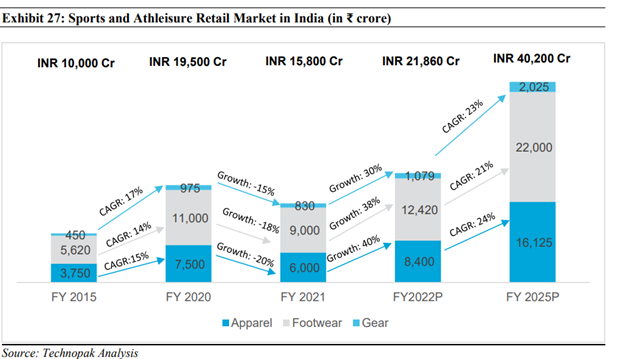

India is mirroring the global trend with respect to sports and athleisure and has outpaced the global growth rate of the segment. It is estimated to be ₹ 19,500 crore (USD 2.6 billion) in FY 2020 and is expected to grow at a rate of approximately 16% by FY 2025, almost doubling in size.

While sports and athleisure footwear has been around since last few decades and has been widely adopted across city tiers since last 2 decades, sports and athleisure apparel has picked up paced only in the last few years.

Gears still remain to be a small category, largely unbranded and highly fragmented. However, players like Decathlon are conditioning consumers to buy the right products and are making them available as a one stop solution(Source: Company DRHP)

Should you invest in IPO or not:

In terms of valuations, the post-issue TTM P/E works out to 93.4x (at the upper end of the issue price band), which is high considering company’s negative PAT CAGR of 17 per cent over FY19-21,

However, Campus has strong brands and a wide range of products, but we believe that these positives are captured in the valuations commanded by the company.

Hope you liked our article, please read our other research report on “Axis Bank“.