In this article, we will look at list of Best Mutual Funds in India 2022 for investing. These funds are based on our extensive research on multiple parameters.

Please do subscribe to our Newsletter so you never miss an article from us when its published.

We have divided our List into Equity, Debt and Equity Oriented Hybrid Funds:

Equity Mutual Funds:

Equity Mutual Funds are mutual fund schemes that invests their assets in stocks of different companies based on the investment objective of the scheme.

These funds are a great investment option for capital appreciation as they hold the potential for long term wealth creation for investors.

Investors looking to invest for long term and wants to gain exposure to the stock market, can choose to invest in equity mutual funds.

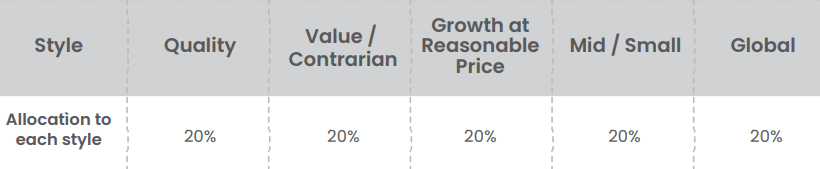

For Building a solid Equity Portfolio, Investors need to follow “5 Finger Framework”, which is based on asset allocation :

“5 Finger Framework” is the best allocation style for diversifying the portfolio. This helps investors put their money in Quality Funds , Value/Contrarian Funds, Growth Funds, Mid/Small Cap Funds and Global Equity Funds which helps them diversify their investment.

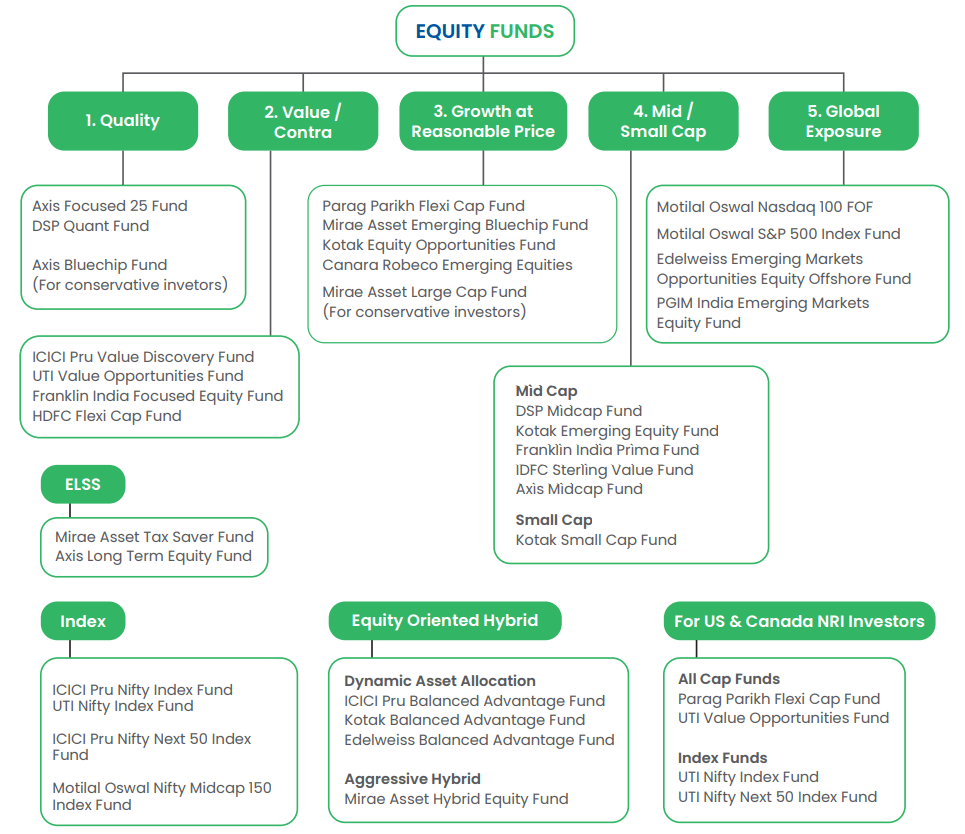

Best Equity Mutual Funds in India:

Here is our list of Best Equity Mutual Funds in India for different Categories.

Quality Equity Fund:

- Axis Focused 25 Fund

- DSP Quant Fund

- Axis Blue-chip Fund (For conservative investors)

Value/Contra Mutual Fund:

1. ICICI Pru Value Discovery Fund

2. UTI Value Opportunities Fund

3. Franklin India Focused Equity Fund

4. HDFC Flexi Cap Fund

Growth Funds at Reasonable Price:

1. Parag Parikh Flexi Cap Fund

2. Mirae Asset Emerging Bluechip Fund

3. Kotak Equity Opportunities Fund

4. Canara Robeco Emerging Equities

5. Mirae Asset Large Cap Fund (For conservative investors)

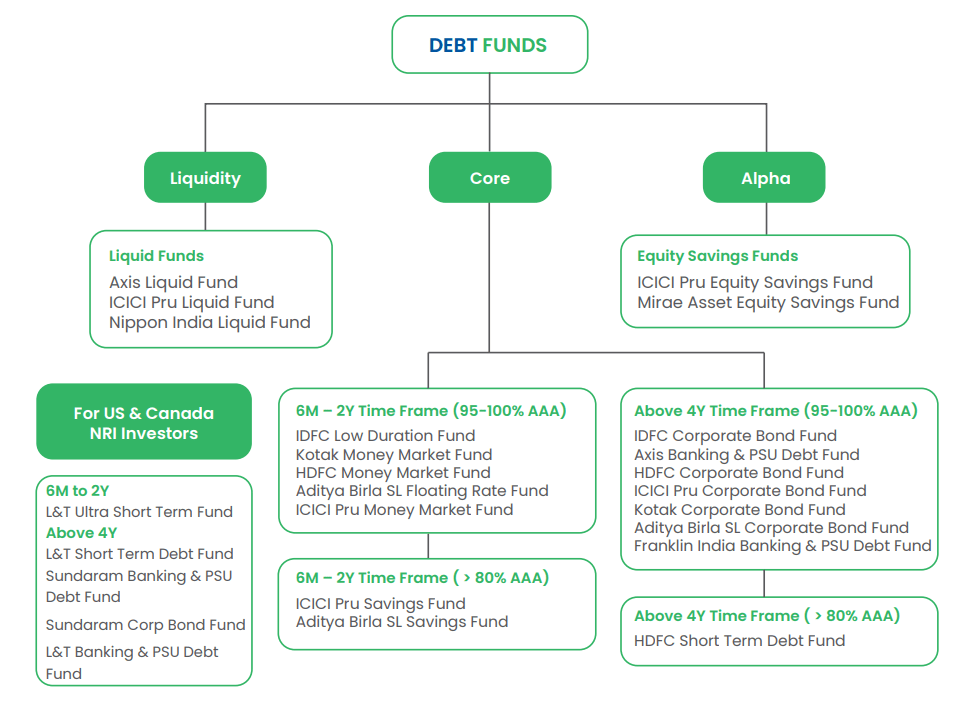

Debt Mutual Fund:

Debt funds are mutual funds that invest in debt securities like Bonds

There are many types of debt funds that invest across the maturity and credit risk spectrum.

Debt funds earn accrual income from coupons and capital gains or losses. Debt Fund NAV are marked up or down due to the changing market yields from time to time.

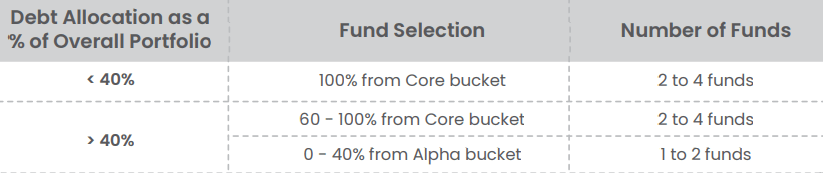

“3 Bucket Strategy” for Building Debt Portfolio.

Debt Investment Strategy

- Liquidity bucket – Includes debt funds that you can use for temporarily parking your surplus cash

- Core bucket – Includes all-season funds that must form the foundation of any portfolio.

Conservative investors can restrict themselves to the core bucket.

- Alpha bucket – Includes funds that can offer higher return potential albeit at a higher risk.

Liquid Funds:

1. Axis Liquid Fund

2. ICICI Pru Liquid Fund

3. Nippon India Liquid Fund

Equity Savings Funds:

1. ICICI Pru Equity Savings Fund

2. Mirae Asset Equity Savings Fund

Best Debt Mutual Funds in India:

Our View on Asset Allocations :

Equity:

We have a positive view from a 5-7 year time frame as we expect strong earnings growth to drive returns.

This expectation is led by Growth in Tech Sector, Salary hikes, Manufacturing Revival, Banks – Improving Asset Quality & gradual pick up in loan growth.

There is a revival in Real Estate, Government’s focus on Infra spending, Early signs of Corporate Capex, Low Interest rates, Favorable Global Growth environment, Consolidation of Market Share for Market Leaders, Strong Corporate Balance Sheets led by Deleveraging and Govt Reforms (Lower corporate tax, Labor Reforms, PLI) etc.

Early signs of a sharp pick up in earnings growth is already visible. But valuations may come under pressure as Global Central banks have started to reduce liquidity and increase interest rates.

Key Risks: Russia-Ukraine Conflict, Increase in Covid cases, Central Bank actions, Global Inflation concerns and Rise in Crude Oil Prices.

- Large Caps: Large caps are better positioned for volatile markets. Prefer Passive over Active Funds for longer time frames given the lower costs and gradual trend of reducing outperformance in large cap active funds. However, Active funds may outperform passive over the next 1-3 years led by:

- Reduction in polarization (i.e. returns getting concentrated across few large stocks)

- Mid caps doing well in an economic recovery (active funds have 10-20% exposure to mid caps)

- Mid Caps: Only for aggressive investors who can withstand higher degree of temporary market declines

- Small Caps: While valuations are slightly above historical averages, the small cap segment does well in an economic recovery phase. However, high-risk appetite and a 5 year plus time horizon required given the relatively higher volatility for the category.

Debt:

We have a positive view on ‘High Credit Quality Lower Duration funds’. RBI continues accommodative stance but rate cut cycle is behind us.

We expect yields to inch up in the future, albeit in a gradual manner as the economy recovers and RBI begins to normalize its earlier pandemic led measures.

Return expectations should be moderated compared to the past few years.

- Overnight Funds: Use for temporary parking / emergency fund and for systematic transfer into equities.

- Liquid Funds : Use for temporary parking / emergency fund.

Equity Oriented Hybrid:

Suited for investors wanting equity exposure but with slightly lower risk appetite.

- Dynamic Asset Allocation Funds : All Seasons Product – Auto adjusts Equity exposure based on valuations. Ideal for lumpsum new money deployment at the current juncture.

- Aggressive Hybrid : Ideal Scenario – 70% Equity: 30% Debt static asset allocation.

Hope you liked our list of Best Mutual Funds in India . If you haven’t started an SIP (Systematic Investment Plan), do start your SIP .

Please do read our other detailed Research Reports on Multiple Companies here .