In this research report, we will look into details of Clean Science and Technology Ltd business, its future growth prospect and also provide Target provide to Investors for their investment/trading .

Please subscribe to our newsletter so you never miss an article from us when its published.

Company Overview:

Clean Science and Technology (Clean Science) was launched in 2003 and is one of the few chemical companies to have developed novel technologies via the use of in-house catalytic processes.

Indeed, some of the company’s approaches are firsts in the globe. Cleaner (fewer effluents) and more cost-effective procedures have helped the company to attain market leadership in each of the recent products it has introduced.

The company’s success is based on its ability to maintain a continuous focus on product discovery, process innovation, catalyst development, large-scale operations (for each product), and backward integration, where necessary.

Company has its plants in Kurkumbh (Maharashtra) and manufactures specialty chemicals such as MEHQ (Monomethyl ether of hydroquinone), guaiacol, 4-methoxy acetophenone (4-MAP) and BHA (Butylated hydroxyl anisole).

Major clients include Bayer AG, SRF, Vinati Organics, etc. CLEAN has two production facilities and the construction of factories in unit 3 has been started

Products:

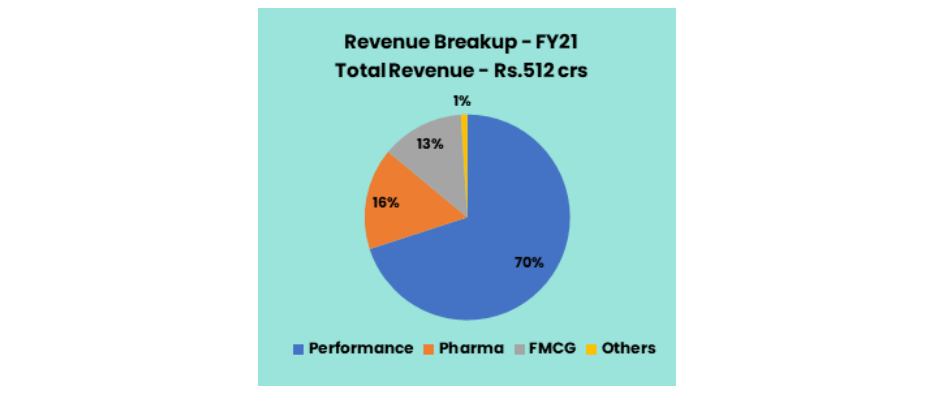

The company produces various products under three segments namely

- Performance chemicals

- FMCG Chemicals

- Pharmaceutical Intermediates

Performance Chemicals – MEHQ, BHA and AP (Ascorbyl Palmitate) are the three major performance chemicals which caters to the end industries as a Polymerization inhibitor in acrylic acids, acrylic esters, Anti oxidants, Infant food formulations, liquid detergents, etc.

FMCG Chemicals – Anisole and 4-MAP are the two major FMCG chemicals which caters to the end industries such as Cosmetics, pharmaceutical & agrochemicals, UV blocker in Sunscreens, etc.

Pharmaceutical Intermediaries – Guaiacol and DCC (Dicyclohexyl Carbodiimide) are the two major pharmaceutical intermediates which caters to the end industries as a Pre-cursor to manufacture APIs for cough syrup, Raw material to produce Vanillin and Reagent in anti-retroviral.

Subsidiaries & Revenue Breakup:

As on March 31, 2021, the Company has three subsidiaries namely Clean Aromatics Private Limited (CAPL), Clean Science Private Limited (CSPL) and Clean Organics Private Limited (COPL).

Key Rationale:

Largest Player:

CLEAN Science is the largest producer of Monomethyl ether of hydroquinone (MEHQ), Butylated Hydroxy Anisole (BHA), and 4-Methoxy Acetophenone (4-MAP) globally.

Furthermore, it has backward integrated into producing Anisole, a key raw material, and has even become the largest producer of Anisole globally.

Particularly, it is the largest manufacturer of MEHQ in the world, accounting for 55% of worldwide capacity. MEHQ is also used as an intermediate to manufacture BHA (Butylated Hydroxy Anisole) for which the company has already undertaken forward integration.

Client Relationship:

The company’s customers comprise direct end-use manufacturers as well as institutional distributors. A majority of revenues is generated from direct sales to customers.

Certain key customers include Bayer AG and SRF for Agro-chemical products, Gennex Laboratories for pharmaceutical intermediates and Vinati Organics for specialty monomer products, Nutriad International NV for animal nutrition.

Some of customers have also been associated with the company for over 10 years as of May 31,2021.

Its products are used as key starting level materials, as inhibitors, or additives by customers for their finished products, for sale in regulated markets.

The customer engagements are therefore dependent on delivering quality products consistently.

It could take potential customers a few years to approve as suppliers, based on quality control systems and product approvals across jurisdictions by multiple regulators.

Q3FY22 Revenue:

The company’s Q3FY22 revenue grew 44% YoY at Rs.181 crs, EBIDTA grew 21% YoY at Rs.76 crs and PAT grew 18% YoY at Rs.58 crs.

The Pharma and FMCG Chemicals segment performed better while the Performance Chemicals segment saw weak performance in the quarter.

The company has suggested that new contracts for 4QFY22 may result in better margins in the quarter. It commenced production of two new products – PBQ (Para benzoquinone) and TBHQ (tert-Butylhydroquinone) during 3QFY22.

The management expects to generate revenue of more than Rs.100 crs from PBQ and TBHQ going forward. PBQ is an import substitute, with CLEAN being the only company in India to manufacture it.

Capex pegged at Rs.150 crs in FY22, of which Rs.110 crs has been spent till date.

Financial Performance:

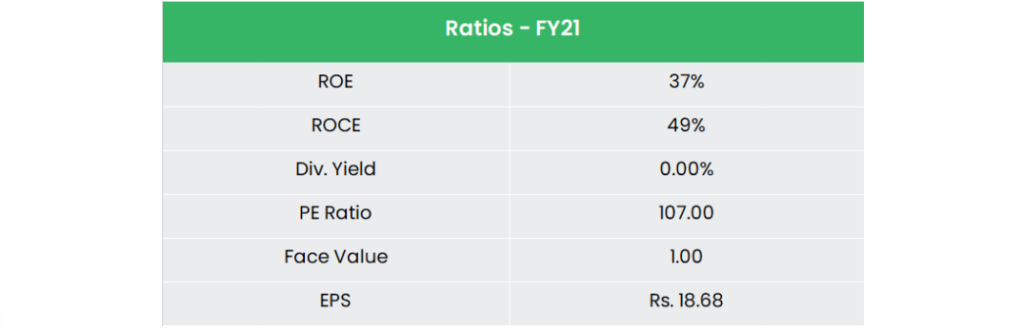

The company’s Revenue and PAT CAGR made a 29% and 60% growth for the past 3 years.

EBITDA Margin has been improved from 31% in FY18 to 51% in FY21 and 45% in 9MFY22.

The company has a strong balance sheet with zero debt and a cash balance of Rs.280 crs at the end of Q3FY22.

Industry Analysis:

The Indian chemicals industry stood at US$ 178 billion in 2019 and is expected to reach US$ 304 billion by 2025 registering a CAGR of 9.3%.

The demand for chemicals is expected to expand by 9% per annum by 2025. The chemical industry is expected to contribute US$ 300 billion to India’s GDP by 2025.

The specialty chemicals constitute 22% of the total chemicals and petrochemicals market in India. The demand for specialty chemicals is expected to rise at a 12% CAGR in 2019-22.

Indian manufacturers have recorded a CAGR of 11% in revenue between FY15 and FY21, increasing India’s share in the global specialty chemicals market to 4% from 3%.

A revival in domestic demand and robust exports will spur a 50% YoY increase in the capex of specialty chemicals manufacturers in FY22 to Rs. 6,000-6,200 crore (US$ 815-842 million).

Revenue growth is likely to be 19-20% YoY in FY22, up from 9-10% in FY21, driven by recovery in domestic demand and higher realizations owing to rising crude oil prices and better exports

Growth Drivers:

100% FDI is allowed under the automatic route in the chemicals sector with few exceptions that include hazardous chemicals. Total FDI inflow in the chemicals (other than fertilizers) sector reached US$ 18.69 billion between April 2000 and June 2021.

The US-China Trade war and Covid-19 pandemic have propelled companies across the globe towards adopting the “China plus one” strategy to diversify supply risk.

This has served as a great opportunity for Indian manufacturers in gaining cost advantage over their Chinese counterparts.

The Government of India is considering launching a production linked incentive (PLI) scheme in the chemical sector to boost domestic manufacturing and exports

Outlook:

CLEAN Science is the world’s biggest manufacturer of four of the seven items it produces, making it a market leader. It has developed solid and long-term ties with its customers.

Several consumers have been with the firm for more than ten years. BHA capacity has been raised by 50%. It is adding an additional line of MEHQ and Guaiacol, which will boost capacity by 50%.

The management said it will add new customers as fresh products are added. Continuing its R&D pursuit.

It forayed into the Hindered Amine Light Stabilizers (HALS) series (estimated global market size of USD 1bn), with CLEAN being the first company to develop the HALS series in India.

Unit III will be the company’s first production line dedicated to the HALS series (expected to be commercialized by Sep’22) while additional production lines would be installed in Unit IV.

CLEAN Science is likely to generate an FCF of Rs.690 crs over FY22-24E, with a capex of Rs.350 crs planned over this period.

Valuation:

CLEAN Science is an integrated player for its key products and is likely to grow at a faster rate than the industry due to its cost advantage as well as introduction of new products.

Hence, we recommend a BUY rating in the stock with the target price (TP) of Rs.2330, 107x FY23E EPS.

Hope you liked our detailed research report on “Clean Science”, do read our research report on “D-Mart“