In this detailed research report of Kajaria Ceramics Share, we will look at the business of Kajaria Ceramics Ltd and understand its future growth prospects. Investors will get the target price on Kajaria Ceramics Share with timeline for their investments.

Before we start, Please subscribe to our Newsletter so you never miss an article from us when its published.

Company Overview :

Kajaria Ceramics Limited (KCL) was incorporated in 1985 as a manufacturer of floor and wall tiles.

It started its operations in 1988 with a capacity of 1 million sq. meter (msm) per annum at its ceramic tiles manufacturing facility at Sikanderabad (Uttar Pradesh).

Since then, the company has expanded its production capacities as well as product range. At present, the company manufactures, outsources and trades ceramic and vitrified tiles under its brand name, Kajaria.

In addition, KCL sells sanitaryware marketed under the Kerovit brand. The company’s manufacturing facilities are at Sikanderabad (Uttar Pradesh), Gailpur and Malootana (Rajasthan) and Srikalahasti (Andhra Pradesh) and have an aggregate capacity of 54.2 msm.

In addition, the company has 16.2 msm capacity under various subsidiaries/joint ventures, which takes the cumulative capacity to 70.4 msm.

Apart from tiles, KCL has a sanitaryware plant at Morbi, Gujarat, and a faucet manufacturing facility at Gailpur, Rajasthan, under its step-down subsidiary Kajaria Bathware Pvt Ltd.

Products:

The company is producing various types of tiles, sanitaryware and plywood under various segments namely Ceramic Wall & Floor Tiles, Polished Vitrified Tiles, Glazed Vitrified Tiles, Bathware and Plywood & Laminates.

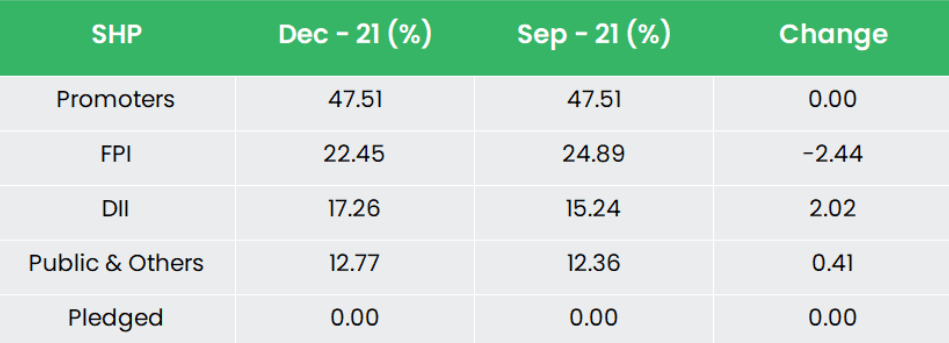

Below is how the holding pattern of company is :

Kajaria Ceramics Subsidiaries:

As on 1st Jan, 2022, the Company had 6 subsidiaries and 1 step down subsidiary.

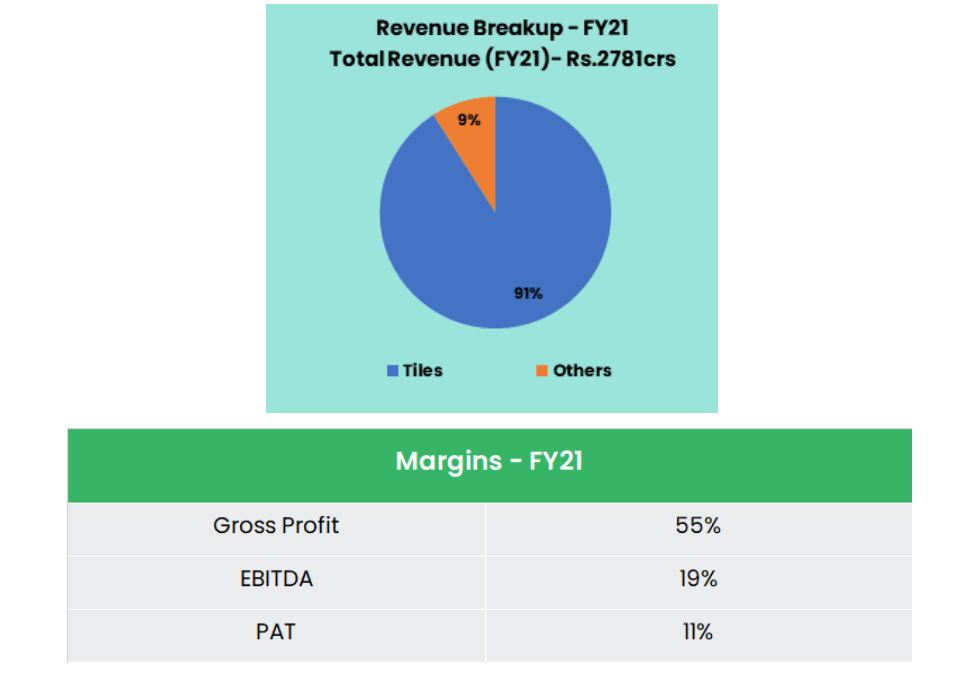

Below is how the revenue and margins are:

Key Rationale:

Leading position in domestic tiles market:

Kajaria Ceramics is the largest player in the domestic tiles industry with a track record of over three decades; it has a well-recognized brand presence and pan-India distribution network.

In terms of geographies, North India is the biggest market for the company. It accounts for 40% of its revenues, followed by the South (25%), West (25%) and East (10%).

Moreover, KCL has an established presence across both the retail and institutional segments. It has retail segment constituting around 70-80% of the revenues.

A steady retail demand and increasing penetration in tier-II and tier-III markets. It have supported a 42% YoY growth in the company’s revenues in 9M FY2022.

Capex and Investment Plans:

The company have around multiple capex plans which are :

- Gailpur plant – Rs.60 crs capex, adding 4.2msm of capacity.

- Srikalahasti plant – Rs.110 crs, adding 3.8msm of capacity.

- Jaxx plant – Rs.80 crs, adding 4.4msm of capacity with revenue potential of Rs.150 crs – 160 crs

- Kajaria Bathware – Rs.0.6 crs, adding 600,000 pieces of capacity with revenue potential of Rs.50 crs – 60 crs.

The board has approved a Rs.210 crs investment in Kajaria Ultima. It will be used to set up a slab manufacturing facility with a production capacity of 5msm p.a. in the state of Gujarat.

This segment has a revenue potential of Rs.400 crs. The board has also approved an Rs.80 crs investment in Kerovit Global Pvt Ltd.

It will be used to set up a sanitaryware manufacturing facility with a capacity of 700,000 pieces p.a. in Gujarat.

Kajaria Ceramics Share Q3 FY22 Results:

KCL’s Q3FY22 revenue surged 27% YoY to Rs.1068 crs (+10% QoQ). It was primarily led by a 14% rise in sale volumes to 25.6msm as urban demand rebounded to normal levels . Smaller Tier2 and Tier3 towns showed strong growth.

Revenue from the tiles business rose 27% YoY to Rs.960 crs, with the company’s own manufacturing. Its subsidiaries and outsourcing businesses contributing Rs.550 crs (+19% YoY), Rs.140 crs (+11%) and Rs.270 crs (+60%) respectively.

Sanitaryware and plywood revenue climbed 33% YoY to Rs.110 crs. Average capacity utilization during Q3FY22 was at ~100% with the pickup in sales.

Management expects utilization to remain high given robust demand for tiles due to a resurgence in construction activities.

Financial Performance:

The company’s products catering to real estate industry. Its average Gross margin has been solidly stood at 61% for the past 5 years.

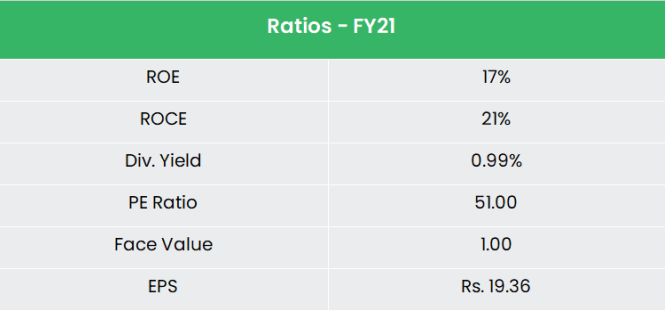

The 5-year average Return on Equity (ROE) of the company is around 18%.

The company’s balance sheet is strong with cash & cash equivalents stood at Rs.565 crs (as on Sep’21). It has a very low Debt-to-Equity ratio of only 0.06x as on the same period.

Industry Analysis:

The global ceramic tiles market has witnessed a period of constant growth over the last 10 years driven by – the rising demand for ceramic tiles in buildings and construction;.

India opened up after Covid 19 and the rapid development of residential and commercial buildings due to population growth,.

There has been an increasing urbanization and rise of per capita income along with technological advancements in this sector that have fueled product innovation and cost efficiencies.

The Indian ceramic tiles market size was valued at $3,720.2 million in 2019. It is projected to reach $7,144.7 million by 2027, growing at a CAGR of 8.6% from 2020 to 2027.

Ceramic tiles market by volume was 821 million square meter (MSM) in 2019, and is projected to reach 1,384 MSM by 2027, growing at a CAGR of 6.9% from 2020 to 2027.

The organized sector consisting of 16 major players, accounts for 40% of the Indian tile industry while the remaining 60% is unorganized.

The residential sector dominates the demand generated for ceramic tiles in India with 70% market share, while the rest of the order comes from the commercial and replacement sectors.

Growth Drivers:

There are nearly 10 million people migrating to the urban area every year in India, which is expected to form 77 new cities with more than 1 million population by 2030.

The Government had announced the creation of 100 additional airports in India by 2024; majority of these airports are to be located in Tier I and II cities with an objective of strengthening connectivity.

FDI in construction development (townships, housing, built-up infra. and construction development projects) and construction (infrastructure) activity sectors stood at US$ 26.14 billion and US$ 25.38 billion, respectively, between April 2000 and June 2021.

Outlook:

Significant rise in gas prices, unfavorable gas price contracts for Morbi (Town in Gujarat) players, noteworthy decline in exports, higher container freight costs and unavailability of containers at desired level have impacted the tiles industry drastically together in the recent times.

The management, however, is hoping for better days going forward with strong domestic demand with rise in real-estate consumption.

The management also endeavors to achieve 15% volume CAGR over the next two to three years – likely to be backed by

a) expected rise in demand from Tier I, II, III cities,

b) incremental demand coming from urban areas,

c) healthy capacity utilisation

d) expected increase in KCL’s capacity.

The revenue growth in FY23 is expected to be 20-22% YoY with some support expected from price hikes. Also, operating margin is likely to be at an elevated level of 18%+ in H2FY22 with better realizations.

Valuation:

Company’s long-term outlook remains promising with strong economic revival despite the supply chain restrictions, increased sales volumes, ramp up of construction activities and low interest rates regime.

Hence, we recommend a BUY rating in the Kajaria Ceramics share with the target price (TP) of Rs.1152, 51x FY23E EPS.

Risks:

Raw Material Risk – KCL’s profitability remains vulnerable to any increase in the prices of raw materials and natural gas as these two components form a major part of the cost structure.

Economical Risk – Building material industry derives its demand from the real estate industry. Hence, any slowdown in the real estate sector will affect KCL. The company’s revenues and cash flows remain vulnerable to the cyclicality in the end-user industry.

Competitive Risk – Tile industry is highly competitive, which restricts players’ ability to pass on cost inflation. While KCL continues to gain market share, it certainly does not influence prices.

Hope you liked our detailed research report on Kajaria Ceramics Share , please read our other research reports on “Gujarat Petronet Ltd“