In this research report, we will look at Gujarat State Petronet Ltd (GSPL) business. We will understand its future growth prospect and provide GSPL share price target for Investors.

GSPL Company Overview:

Incorporated in December 1998, Gujarat State Petronet Ltd (GSPL) is promoted by Government of Gujarat owned company which is primarily engaged in gas trading.

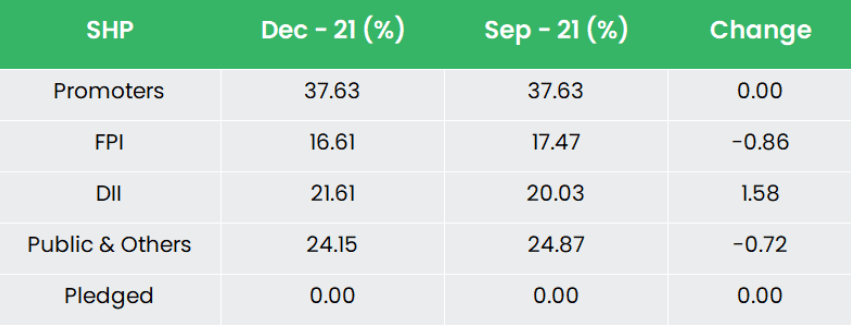

It is driven through pipeline on an open access basis from supply points to demand centers. GSPC held 37.63% equity stake in the company as on June 30, 2021.

Gujarat State Petronet Ltd (GSPL) is India’s second largest Natural Gas Infrastructure and Transmission Company. It owns and operates around 2,711 kms of gas transmission pipeline in the state of Gujarat as on FY2021.

It is also engaged in generation of electricity through Windmills. The transmission network of the company envisages development of systematic and seamless pipeline network. Its spread across Gujarat connecting various suppliers and users.

The suppliers of natural gas include traders, producers and LNG terminals. The users comprise industries such as power, fertilizer, steel, chemical plants and local distribution companies.

Besides, GSPL has set up 52.50 MW Wind Power Project at Maliya (District-Rajkot) and Gorsar & Adodar (District-Porbandar).

GSPL Products:

Gujarat State Petronet Ltd (GSPL) is involved in supplying gas to various customers from several industries.

Customers list includes includes refineries, steel plants, Power plants, Textile companies, Chemical companies, City Gas Distribution (CGD) companies, Fertilizer plants, Petrochemical plants, Glass Industries etc.

Subsidiaries:

GSPL India Gasnet Limited, GSPL India Transco Limited and Gujarat Gas Limited (GGL) are the three subsidiary companies . Sabarmati Gas is an associate company as of Mar’21.

Key Rationale:

Strategic Location:

GSPL commenced its operations with transmission of gas being provided by GSPC.

GSPL has invested significantly in developing its pipeline network, These Pipelines are connected to major gas supply sources in Gujarat.

These Pipeline includes designated collection points near the natural gas fields of Hazira, re-gasified LNG from Shell’s terminal at Hazira.

It also links to Petronet LNG Ltd.’s terminal at Dahej, GSPC LNG’s terminal at Mundra along with the Panna-Mukta-Tapti gas fields.

Gujarat is the primary origination or entry point for both domestic natural gas produced in the Arabian Sea and imported LNG for Western and Northern India.

Owing to its strategic location and oceanic access to LNG exporting countries in the Middle East and Asia.

It is also the highest natural gas consuming state with around 40% of total domestic gas consumption in the country. All these factors translate into steady utilization of GSPL’s transmission pipelines.

Benefits of Subsidiary:

GSPL holds 54.17% stake in GGL which provides synergetic benefits to both the companies as they are part of the same value chain of natural gas business.

CGD is one of the largest categories of industry segments catered to by GSPL which is envisaged to grow further in view of the increased thrust of the government and regulatory authorities to expand the CGD network across the country.

According to the company management, GGL’s business being complementary to GSPL, holding of majority stake in GGL facilitates better synchronization of its natural gas transmission network with GGL’s network.

Furthermore, with Gujarat being the highest natural gas consumption market in India,.

There are synergies between the businesses of GSPL and GGL as CGD network provides last mile connectivity to the end-users of natural gas.

GGL is also one of the largest customers of GSPL with approximately 20% share in its total sales during FY21.

Q3FY22 Revenue:

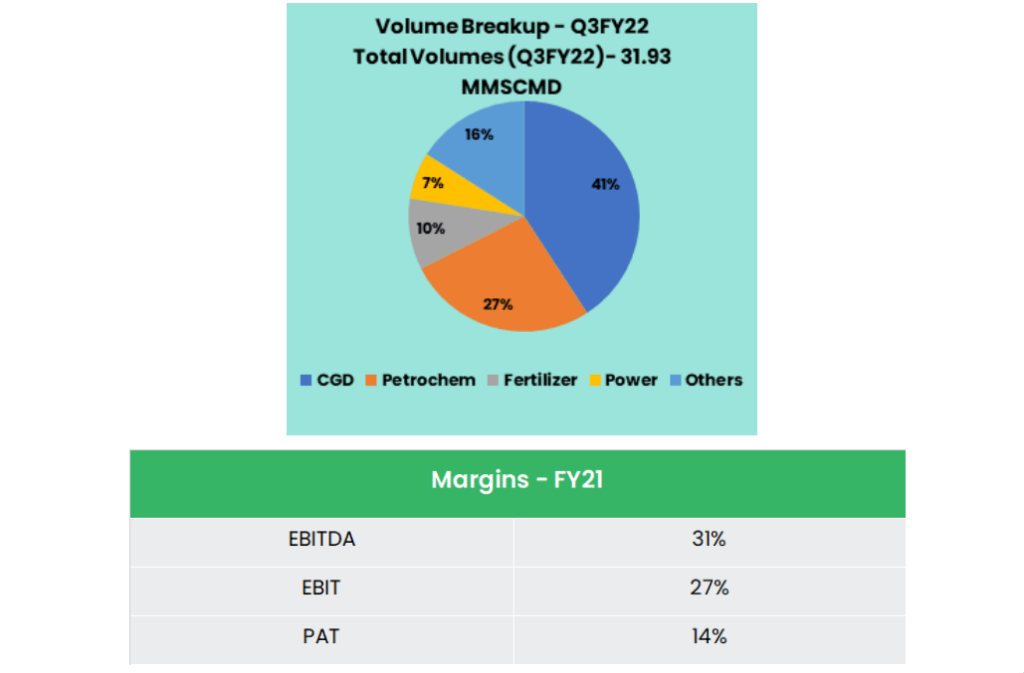

Revenue was down 18.9% YoY to Rs.471 crs on account of volume decline of 18.9% YoY to 31.9 mmscmd. Volume fell 14.8% QoQ.

The company recognized gain of Rs.50.3 crore post transfer of CGD business to its subsidiary, Gujarat Gas.

PAT was at Rs.248 crs, flat YoY City gas distribution and fertilizer sectors’ offtake was flat QoQ while other sectors reported reduced offtake.

CGD offtake was 13 mmscmd, flat QoQ while fertilizer offtake was also steady at 3.2 mmscmd.

Power offtake was 2.1 mmscmd (share in volume mix fell from 14% to 7%) and refining/petrochemical offtake was 8.5 mmscmd (share in volume mix stable at 27%.)

GSPL Financial Performance:

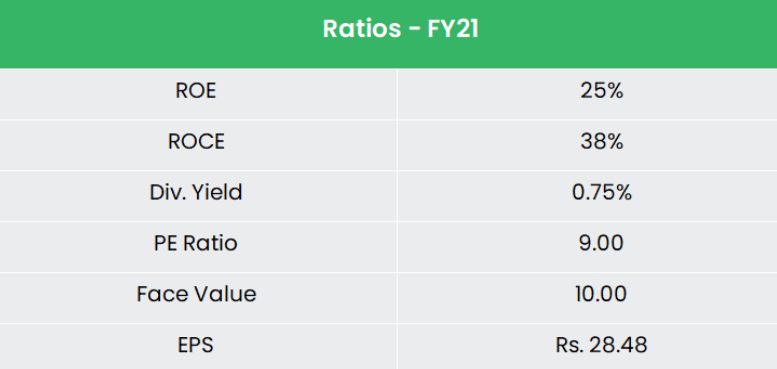

The company’s Revenue and PAT CAGR has been phenomenal with 63% and 28% for the past 5 years.

The balance sheet is strong with cash & cash equivalents stood at Rs.2140 crs (as on Sep’21) which is around 15% of the company’s Market Cap.

The Debt-to-Equity ratio also stays very low with only 0.15x as on Sep’21.

Industry Analysis:

Oil and gas sector is among the eight core industries in India. It plays a major role in influencing decision making for all the other important sections of the economy.

India is the third largest energy and oil consumer in the world after China and the US .

Country is the 4th largest importer of liquefied natural gas (LNG) with 7% from Australia,.

India also imports 44% from Qatar, 15% from Russia and 34% from USA.

It envisages to increase the share of natural gas in the country’s energy mix from 6% to 15% by 2025 .

There is $60 bn of investment planned in the Natural Gas Infrastructure of the country by 2024.

India has 17,000 km of pipelines laid and it envisages to increase this to 30,000 km by 2025 .

Natural Gas consumption is forecast to increase at a CAGR of 4.18% to 143.08 million tonnes by 2040 from 58.10 million tonnes in 2018.

The Natural Gas demand is estimated to grow from 63 bcm in 2019 to 131 bcm in 2030 according to the Stated Policy Scenario as per the India Energy Outlook 2021.

Growth Drivers:

100% FDI is allowed in infrastructure related to marketing of petroleum products and natural gas under automatic route.

According to the International Energy Agency (IEA), India’s medium-term outlook for natural gas consumption remains solid due to rising infrastructure and supportive environment policies.

Industrial consumers are expected to account for ~40% of India’s net demand growth. The demand is also expected to be driven by sectors such as residential, transport and energy.

In February 2021, Prime Minister Mr. Narendra Modi announced that the Government of India plans to invest Rs. 7.5 trillion (US$ 102.49 billion) on oil and gas infrastructure in the next five years.

Outlook:

City Gas Distribution (CGD) is expected to be one of the fastest growing sectors in India which will increase the usage of CNG & PNG.

In the long term, the company will be a beneficiary of increasing gas consumption and its connectivity to new LNG terminals in Gujarat.

Government of India has given major thrust to this sector by pushing expansion of CGD network across the country.

GSPL, being one of the largest players in the gas transmission business, is expected to benefit even as it is expanding its network and sales efforts anticipating future demand.

Increasing volumes backed by increase in demand coupled with expected tariff revision from PNGRB will increase profitability of the company.

GSPL’s robust volume outlook on the back of strong demand from CGD entities and the power sector, visibility of its earnings, stable margins and steady cash flows bring positive view on the stock.

GSPL investments and large exposures in CGD entities like Gujarat Gas (54.4% stake) and Sabarmati Gas (27.5%) would also create value for investors in future.

Valuation:

With a presence across the oil & gas value chain predominantly, the company has also interested in the regasification, transmission and distribution of gas.

GSPL is also the parent company of city gas distributor, Gujarat Gas Ltd.

With strong demand for gas, GSPL’s open-access operating model, significant share in gas transmission business and its strong financial profile makes us positive on the stock.

Hence, we recommend a BUY rating in the GSPL Share with the target price (TP) of Rs.316, 9x FY23E EPS.

Hope you liked our article on “GSPL Share Research Report and Share Target Price”, please read our other article on “Balaji Amines ltd Research Report“