In this blog, we will understand Balkrishna Industries Ltd business and understand the future prospect of the company. We will also look at the share’s target Price which investors can target.

Please subscribe to our newsletter so you get our research report on time delivered right to your email.

NOTE: Irrespective of Russia-Ukraine Conflict and markets down currently, this research report still holds good. Its completely based on the company business and its future growth prospect.

Company Profile:

Balkrishna Industries Ltd. (BKT) started its Off-Highway tire business in For over 30 years, BKT has successfully focused on specialist segments such as agricultural, construction and industrial as well as earthmoving, port and mining, ATV and gardening applications.

Company sells its tires in 160+ countries through its distribution network in America, Europe, India & ROW. The company has been undertaking various actions like setting up warehouses in markets in North America and Europe to be closer to the customer and have a just in time (JIT) system.

Balkrishna Industries Ltd also has strong partnership with OEMs. The company has over 2,700 SKUs. The company currently has four manufacturing units in India, with an overall achievable capacity of 285,000 metric tones (MT) per annum, and a sales distribution network spread across 140 countries.

Balkrishna Industries Ltd.’s latest Bhuj plant has a dedicated capacity to produce large and ultra large all-steel radial mining tires. It has an in-house production unit for tire moulds .

Products:

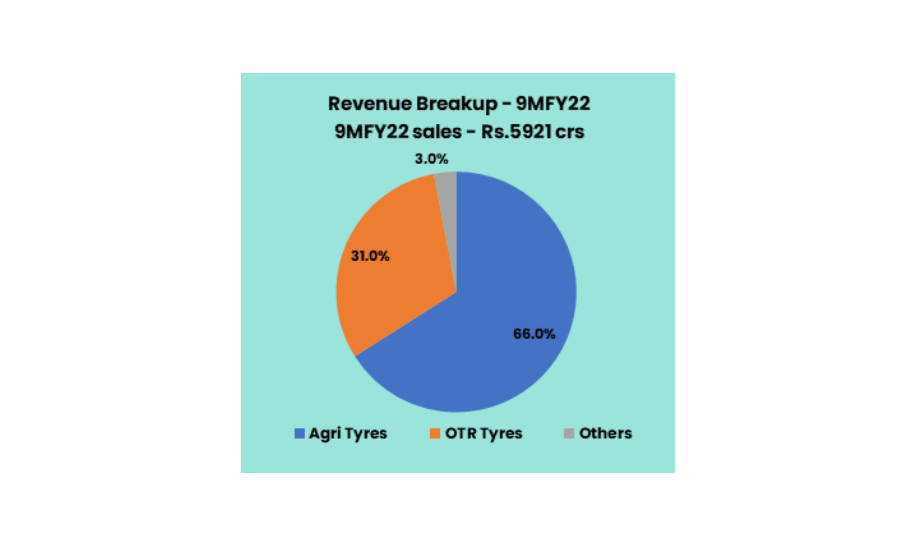

The company’s product portfolio includes three segments namely Agriculture Tires, Industrial Tires and OTR (Off The Road) Tires.

- Agriculture Tires – Tractor, Small tractor, Harvester, Sprayer, Agro truck, Cotton Picker, irrigator, etc.

- Industrial Tires – Loader, Compactor, Military Truck, Mobile Crane, Trailer, etc.

- Off The Road Tires – Rigid Dump Truck, Mining Vehicle, Scraper, Haul Train, Grader, etc.

Subsidiaries:

As on Jan 31, 2022, the company has one domestic and four overseas subsidiaries with one step-down subsidiary.

Key Rationale:

What makes Balkrishna Industries Ltd stand out :

Niche Player:

Balkrishna Industries Ltd has over the years established a strong presence in the highly specialized global OHT market by leveraging on its own low cost advantage, extensive product portfolio (with over 2700 SKUs) supported with state-of-the-art R&D facility and wide distribution network across over 160 countries.

BKT being an Indian company has manufacturing base in India, thus gaining an edge over its global peers in terms of labor cost, which stands at 6-8% of revenues for BKT as compared to companies having operating base in developed nations vis-à-vis Michelin (28%) and Trelleborg (28%).

Besides this factor, proximity to the largest rubber producing nations of the world like Thailand, Malaysia and Indonesia results in significantly lower raw material sourcing and logistics cost as compared to global peers.

Balkrishna Industries Ltd therefore leverages its cost benefits significantly by positioning its products cheaper than leading brands while retaining strong 23% plus EBIT margin/28% plus EBITDA margins (5-yr Avg.).

Strong Moat:

Off Highway Tires (OHT) are significantly different from conventional tires as far as the applications are concerned. The vastly different usage patterns of OHTs like the diverse surfaces on which they operate and applications necessitate unique customized solutions for each situation, contrary to conventional tires.

Due to high degree of customization the OHT industry remains large variety but low volume business by nature.

The tire ranges from 2 to 10 feet high and weighing 15kg to 1000kg per tire which shows a very high range of customization, which is the core for this business.

Many players have entered in this business over past years but could not sustain due to high degree of specialization required by this industry, whereas BKT has created its own identity in the OHT space over a span of three decades.

Besides, this segment is low volumes; and that is the reason why Chinese players have not yet made a mark in this business due their large-scale manufacturing DNA.

Financial Performance:

Balkrishna Industries Ltd (BKT) reported an average performance in Q3FY22. Revenue at Rs.2046 crs were up 36% YoY. EBITDA declined 5% YoY to Rs.480 crs with EBITDA Margin at 22%. But PAT were up 4% YoY at Rs.339 crs supported by a higher other income.

Production run rate to be at current level i.e., 70,000-75,000 with capacity utilization at close to 100%. Production during Q3FY22 was at 70,300 tones and for 9MFY22 was at 2,13,000 tones.

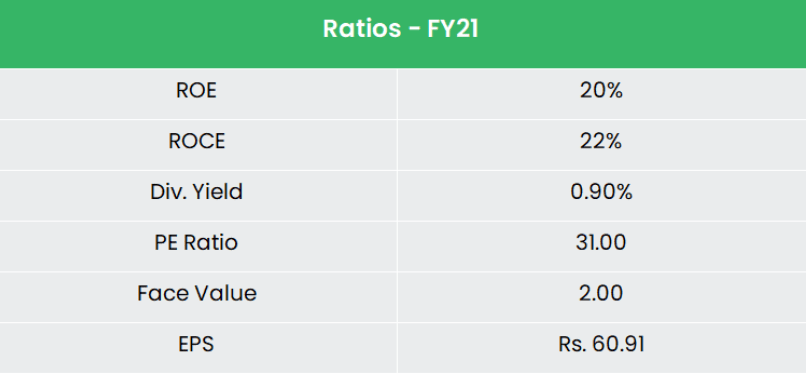

The company generated a Revenue and PAT CAGR of 12% and 21% over the period of 5 years (FY17-21). The company maintained an average EBITDA Margin of 27%+ for the same period of 5 years. As of Dec’21, gross debt stood at Rs.880 crs while cash & cash equivalent stood at Rs.1930 crs.

The management projects cumulative capex of Rs.2250 crs for next 2 years which would amplify the total capacity to 360kMT.

Industry Analysis:

India represents the fourth largest market for tires in the world after China, Europe and the United States. In India, the market is currently being driven by the increasing radicalization of tires, especially in buses and trucks.

Moreover, the tire industry consists of a vast consumer base; they are used in all types of vehicles which include passenger cars, buses, military vehicles, motorcycles, trucks, etc.

The demand for tires is primarily catalyzed from two end-user segments – OEMs and the replacement segment. The replacement market currently dominates the tire market accounting for most of the total sales. The India tire market size reached a volume of 179 million Units in 2020.

After two years of contraction, the Indian tire industry is expected to grow 13-15% in unit terms and 7-9% in tones during the current financial year, according to ICRA.

Looking forward, it is expected that the tire market is to reach a volume of 211 million Units by 2026.

Growth Drivers:

In Union Budget 2021-22, the government introduced the voluntary vehicle scrappage policy, which is likely to boost demand for new vehicles after removing old unfit vehicles currently plying on the Indian roads.

The Union Cabinet outlaid Rs. 57,042 crore (US$ 7.81 billion) for automobiles & auto components sector in production-linked incentive (PLI) scheme under the Department of Heavy Industries.

The Indian government has planned US$3.5 billion in incentives over a five year period until 2026 under a revamped scheme to encourage production and export of clean technology vehicles.

Outlook & Valuation:

Balkrishna Industries Ltd has developed a strong franchise in a highly specialized and large off highway tires (OHT) segment, in which it has 6% global market share.

Over the years, Balkrishna Industries Ltd has been generating robust cash flows and return ratios, and maintained a strong balance sheet across cycles.

BKT’s margins are expected to improve on the back of :

- Higher volumes will likely result in better operational efficiency.

- A superior product mix with higher share of radial tires, would drive margins higher.

- Refurbishment of the Waluj plant will likely aid productivity, quality as well as margins.

- Backward integration at the carbon black plant is expected to increase margins by 50-100bps

- Benefit from rupee depreciation.

With a solid competitive positioning, multiple strategic initiatives currently underway and sufficient capacity built-up, BKT is set to reap the fruits of an expected upcycle.

Despite the buoyant demand, BKT is likely to report sub-optimal performance in coming quarters owing to capacity constraints & cost inflation. The long-term growth catalysts of labor cost advantage, diversified product portfolio, backward integration, strong brand building & higher margins are likely to result in market share gains for the company.

We recommend a BUY rating in the stock with the target price (TP) of Rs.2243, 31x FY23E EPS.

Hope you liked our detailed research report, please read our other research reports “SBI Card – Should you Buy this “