Indian shares and Global stock markets Crash and plunged more than 3 per cent and the rupee saw its worst drop in over three months on Thursday, after Russia attacked Ukraine, sending oil prices higher and stoking inflation worries.

Russian forces fired missiles at several cities in Ukraine and landed troops on its coast on Thursday, officials and media said, after President Vladimir Putin authorized what he called a special military operation.

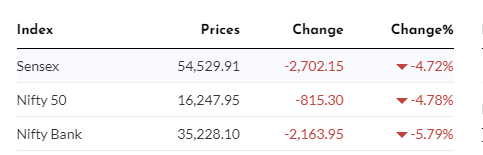

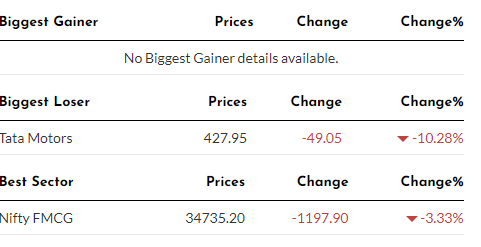

The blue-chip NSE Nifty 50 stock index was down 3.58 percent at 16,451.75 by 11.58am UAE time and the S&P BSE Sensex was 3.48 percent lower at 55,242.88, after falling as much as 3.6 per cent in its steepest drop since mid-April, 2021.

At the day’s low, the Indian stock market was among the worst performers in Asia. The Nifty and the Sensex are set for their seventh day of losses, their worst run since March 2020.

The rupee weakened as much as 1 per cent to 75.325 against the dollar, versus Wednesday’s close of 74.555.

Inflation-related concerns on higher crude prices, and geopolitical tensions have led to safe-haven buying for the dollar index and is keeping the rupee under pressure, said Gaurang Somaiya, FX analyst at Motilal Oswal Financial Services.

UAE airlines cancel services to Ukraine, while Air India flight turns around after conflict erupts Airlines advised to stop flying over all of Ukraine Oil soars past $100/b for first time since 2014 as Russia-Ukraine crisis escalates

Indian rupee plunges against the UAE dirham as Ukraine crisis worsens, to weaken further Russia-Ukraine:

“The looming risk of this (Ukraine) crisis is no more there, it is a reality today,” said Aishvarya Dadheech, a fund manager at Ambit Asset Management.

Nifty’s volatility index, which indicates the degree of volatility traders expect over the next 30 days in the Nifty 50, climbed to its highest since June 2020.

Oil prices, which breached $100 a barrel for the first time since 2014, added to selling pressure in India, the world’s third-largest importer of oil.

Global Market

UAE stocks in the red : Investor pressure on UAE stocks was unrelenting as they weighed the uncertainties created by the Russia and Ukraine situation.

The DFM was down 2.87 per cent with 23 stocks seeing red. Hit hard was Emaar, a drop of 4.55 per cent, and the DFM operator was lower by 4.27 per cent.

Investors are clearly tracking what’s been happening on markets elsewhere. The downbeat mood did not spare anyone, whether it’s real estate or airlines.

On ADX, the drop is around the 1.51 per cent market, with total value of trades at Dh777.39 million.

“It’s a risk-off attitude that everyone is taking, and it also opens up some opportunities for a bit of profit taking too,” said an analyst.

Some of the key Abu Dhabi blue chips were ripe for a partial sell-off. The Russia trigger just provided that.”

Internationally, S&P 500 and Nasdaq 100 contracts slid about 2.5 per cent and 3 per cent respectively, signaling the latter, tech-heavy gauge may end up in a bear market.

European futures shed over 4.5 per cent and an Asia-Pacific equity gauge fell to the lowest since 2020. Shares slumped in Moscow after a trading suspension was lifted.

Korea’s Kospi was down 2.6 per cent, Japan’s Nikkei was lower by 1.8 per cent, while Hong Kong’s Hang Seng shed 3.24 per cent.

The flight to safety saw the U.S. 10-year Treasury yield fall below 1.90%. Gold hit the highest since early 2021.

Markets pared back bets rate increases by the Federal Reserve in 2022, with about six 25-basis-point hikes expected.

Investors remain worried that Fed tightening could choke the expansion in the world’s largest economy.

The escalation by Russia “will spur further risk-off moves into safe-haven assets, considering that the situation will remain volatile with retaliation measures coming from Western powers,” said Jun Rong Yeap, a strategist at IG Asia Pte, adding “upside risks to inflation just got elevated.”

In cryptocurrencies, Bitcoin slid below $35,000 amid risk aversion. Second-largest token Ether also suffered heavy losses. Those moves suggest the most speculative areas of markets faces a painful period ahead.

Overall, more volatility is likely in the near term, but history suggests markets like the S&P 500 move into positive territory in the next 30 and 90 days after the initial shock, said Mahjabeen Zaman, head of investment specialists at Citigroup in Sydney.