In this blog, we will do complete analysis of Rossari Biotech Share and give you 5 reasons why you should be invested in this.

Company Overview:

Established as the partnership firm, ‘Rossari Labtech’, it was subsequently renamed as ‘Rossari Biotech Limited’ and converted to a limited company in 2009.

Rossari Biotech (RBL) is one of the leading specialty chemicals manufacturing companies in India, providing customized solutions to specific industrial and production requirements of customers primarily in the FMCG, apparel, poultry and animal feed industries through diversified product portfolio comprising home, personal care & performance chemicals, textile specialty chemicals and animal health & nutrition products.

Within the three verticals, it has over 3,500 products catering to diverse end-user industries. Its manufacturing facility at Silvassa has a current annual installed capacity of 2,52,000 MTPA, which includes the newly commissioned unit at Dahej (Gujarat) with an annual capacity of 1,32,000 MTPA from March 2021. It also has two, state-of-the-art R&D laboratories at its Silvassa plant and at IIT Mumbai.

Products:

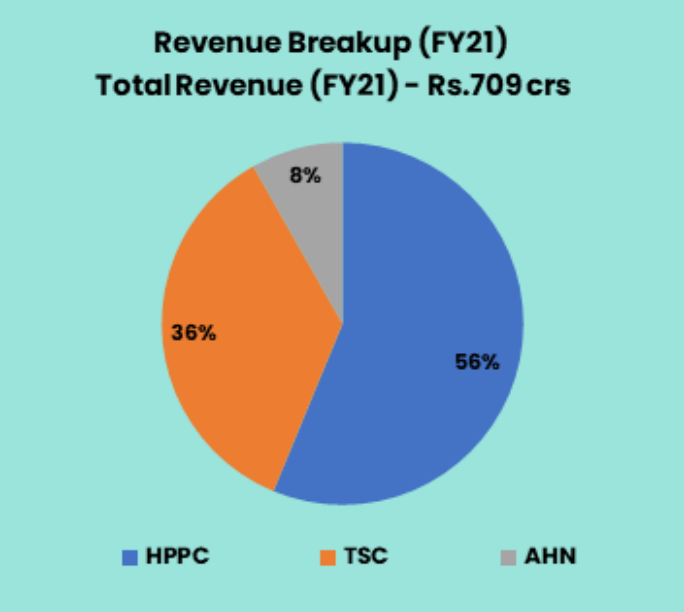

The Company currently provides a wide range of products in three segments namely Home, Personal care & Performance Chemicals (HPPC); Textile Specialty Chemicals (TSC) and Animal Health & Nutrition products (AHN).

HPPC – Manufactures products from acrylic polymers, which are used in soaps and detergents, paints, ceramics and tiles, water treatment chemicals, and pulp and paper industries. It also produces institutional cleaning chemicals used at hospitals, airports and other facilities.

TSC – Diversified products range in this segment which company caters to the entire textile value chain right from fibre, yarn to fabric, wet processing and garment processing.

AHN – Manufactures and sells poultry feed supplements and additives, pet grooming and pet treats.

Subsidiaries:

As of March 31, 2021, the company has two subsidiaries namely Rossari Personal Care Products Private Limited and Buzil Rossari Private Limited.

Key Rationale

- Largest Sales Force – Rossari Biotech has competency in four chemistries used for textile chemicals, but it has successfully applied its learnings into the new industries of HPPC, which has expanded its addressable market multifold. This was done without compromising on margins, balance sheet or ROIC. It is a sales-driven organization unlike peers, which are focused on manufacturing. Rossari’s product innovation, formulations and applications are derived from customer requirements, or problem solving. Company therefore needs to be close to customers, hence its technical sales force is one of the largest in the industry. The company has a wide customer base of over 500 clients comprising reputed institutional players as well as distributors. The company has been able to maintain long-term relationships with its customers, enjoying over five years of association with more than 25% of its customer base.

- Strong growth from every segment – Home, Personal and Performance Chemical’s (HPPC) revenue increased more than 169% YoY and +78% QoQ to Rs.236 crs in Q2FY22. Performance was aided by the demand surge in FMCG sales. Additionally, anti-viral and hygiene portfolio sales registered solid momentum during the quarter. Textile Specialty Chemicals (TSC) and Animal Health and Nutrition (AHN) segments also performed strongly. TSC’s revenue were up +61% YoY and +47% QoQ to Rs.110 crs driven by healthy recovery in sales supported by end user industry demand and steady performance in the export markets. AHN’s also saw strong consumption resulting in revenue growth of +148% YoY and +61% QoQ to record Rs.39 crs. Demand outlook remains positive for all the segments.

- Unitop and Tristar acquisitions to boost H2FY22 – Rossari completed both Unitop Chemicals (26th Aug-21) and Tristar Intermediates (1st Sept-21) acquisitions in the latest quarter. Both reported decent performances, Rossari’s consolidated number included approximately one month of contribution from these acquisitions. Unitop clocked revenues of Rs.27 crs and EBITDA of Rs.4-4.25 crs while Tristar clocked revenue of Rs.12 crs and EBITDA of Rs.1-1.5 crs. These acquisitions will widen Rossari’s product portfolio and develop synergies through technology exchange and cross-selling opportunities. Newly acquired companies had little higher working capital cycle, which will be regularized going forward. It is expected that decent revenue contribution from these acquisitions will be seen from H2FY22.

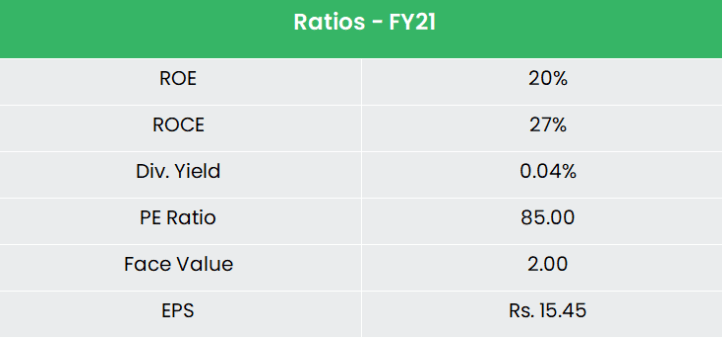

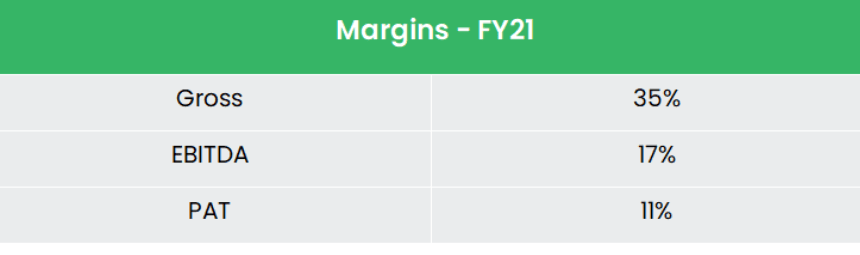

- Financial Performance – Rossari has developed its business with well managed operations. It has delivered revenue CAGR of 11% over FY19-21. PAT CAGR reported at 20% and average 16% of EBITDA margin reported during the same period. Fundamentally, it is one of the best companies as compared with its peers. It has reported healthy ROCE of 27% in FY21. The company also has a healthy balance sheet with zero debt in it.

Industry Analysis:

The chemicals industry can be classified into two broad segments – basic and specialty. Specialty chemicals are more likely to be prepared and processed in batches. The 10 segments cumulatively constitute a market of US$237 billion in 2018 globally and are expected to grow at 5.4% CAGR to US $308 billion by 2023.

Paints & coating additives and construction chemicals are expected to be the fastest growing segments with growth of 6.5% CAGR over this five-year period. The Indian specialty chemicals industry is driven by both domestic consumption and exports.

Home & personal care chemicals, water chemicals, construction chemicals, etc, are areas where specialty chemicals find applications. The Indian home care ingredients market was valued at US$1.2 billion in 2015 and grew to US$1.6 billion in 2018, registering a CAGR of 10.8%.

The India cleaning chemicals market is expected to reach US$2.6 billion by 2023 at a CAGR 9.8% in value terms. The Indian market for personal care ingredients grew at 16.2% CAGR over the last four years and is expected to grow at 15% to US$2.6 billion by 2023.

Growth Drivers:

100% FDI is allowed under the automatic route in the chemicals sector with few exceptions that include hazardous chemicals.

Total FDI inflow in the chemicals (other than fertilizers) sector reached US$ 18.06 billion between April 2000 and September 2020. Under the Union Budget 2021-22, the government allocated Rs.233.14 crs (US$ 32.2 million) to the Department of Chemicals and Petrochemicals.

Speciality chemical industry is gaining on account of the China+1 strategy followed in the international space combined with the Anti-dumping duty on some chemical imports in India.

Outlook:

Rossari has been a major player in textile segment (Indian market worth $1.2 bn). Further expansion in HPPC and AHN business has helped Rossari to diversify its business that moves around its four core competencies. It is gaining greater market share in the three segments by way of pull marketing and inorganic growth.

Fast adoption of green products across the industry is a favorable growth opportunity for Rossari, thus, it generally collaborates with customers to co-create tailor made green products. Recently, it has completed its greenfield expansion at Dahej facility (installed capacity of 132500 MTPA) which is fully operational since Mar’21.

Further, brownfield expansion at Silvassa facility with the additional capacity of 20000 MTPA (total installed capacity of 120000 MTPA). This provides positive outlook on company’s revenue growth. Near term capital investment is expected to be nil, as it has recently completed its capex investment cycle

Risks:

Acquisition Risk – Rossari has recently acquired various companies. Any failure in the integration process of these acquisitions may negatively impact Rossari’s financials and deviate from our expected business growth.

Raw Material Risk – RBL’s primary raw materials are acrylic acid, surfactants and silicone oil. The prices of some raw materials is linked to a formula based on the international prices of crude oil. Any increase in crude prices would have an impact on cost of production.

Delay in scaling up – Any delay in scaling up of business lines like AHN/industrial cleaning will impact earnings visibility over longer time horizon and impact market valuation.

Valuation & Share Price Target:

While there are established global peers in all the segments that Rossari Biotech Share operates in, direct competition is very limited on account of the company’s sharp focus on customer-driven strategy and formulation & application focus.

In all the segments, there is a long runway for growth for Rossari since market participation is low and the company offers differentiated product applications. Hence, we think that Rossari Biotech Share will get target price (TP) of Rs.1500, 85x FY22E EPS.

Hope you liked our Analysis of Rossari Biotech Share, Please read our other articles on “ETF Vs Mutual Fund Vs Index Fund“