We know the big players Ethereum, Cardano, BSC, Polkadot. But there’s a newcomer to the fray that you have to know about. This one is going to shift the way you think about blockchain and smart contracts . It could make you a ton of money along the way. I am talking about Solana and in this blog, I will discuss on Solana and its Price Prospects and compare Solana vs Ethereum.

Smart Contract Space is the one, I’m the most interested in all of Crypto. It allows for a decentralized Internet, which will be Peer-to-Peer censorship resistant . For people, it’s a future that I want to live in.

Solana is one of the hottest projects out right now. The projects actually ran by founder and CEO Anatoly Yakovenko, who in fact actually helped develop the technology found in all our smartphones during his twelve years at Qualcomm, according to CrunchBase.

Solana launched its main net in March 2020 of last year. However, its origins can be traced as far back as 2017 to a white paper published by Yakovenko.

Despite not being the CEO of Solana, Sam Bankman Fried, the CEO of both Alameda Research and Trading Platform FTX, has been an early force helping push Solana blockchain development.

Lets compare Solana vs Ethereum in Blockchain approach.

Solana uses a different approach to how blockchains work, utilizing time.

It integrates a decentralized clock inside its blockchain, something unique that’s never been done before.

Solana also utilizes a special proof of state based consensus mechanism known as the Tower BFT, which has a component within based on what’s known as Proof of History.

When talking about Solana, you have to reference the uniqueness of PoH .

Essentially, this is a process of time stamping transactions when they’re added to a new Solana block.

A new block on Solana is generated every 400 Milliseconds in comparison to Ethereum’s blocks that are 15 seconds.

Compare that with Bitcoins, Bitcoin is roughly ten minute block times.

Solana uses proof of history as one of its means of security to prevent against double spend transaction attacks.

Handling of transactions

Solana is able to process 50,000 to 65,000 transactions per second has a theoretical transaction limit of over 70,000 transactions per second. In comparison, Ethereum can only handle approximately 30 transactions per second.

However, Ethereum 2.0 plans to be able to execute 1000 transactions per second, but that’s not going to be ready for at least another year.

As Ethereum has faced delay after delay. To further put that into perspective, Bitcoin one can handle around 4 to 5 transactions per second.

So Solana is saying it can handle 70,000 transactions at this current time without sharding is absolutely insane.

Smart Contracts and Decentralized Applications

Now, what’s more, Solana supports smart contracts and decentralized applications exactly like Ethereum does.

Solana also uses proof of state consensus, which is what Ethereum is having trouble transitioning to. That may be why some people call Solana the eth-killer.

A lot of things have been called that none of that yet, but Solana is the latest to be added to that list. In addition to the PoH consensus mechanism, Solana has also implemented 7 key innovations to make the Solana network possible.

Sam Bingman Fried’s Alameda Research recently established ties with Ren’s virtual machine and the goal of bringing more DeFi assets into the Solana blockchain ecosystem.

Ren acts as a bridge between various blockchain assets through a custodial node.

RenVM isn’t the only project that Alameda Research has helped on Solana.

FTX and Alameda Research also created the Serum Foundation. Serum is a noncustodial spot and derivatives exchange so you can trade with leverage.

Also, unlike traditional decentralized exchanges, Solana runs on an on-chain central limit order book that’s hosted on Solana’s main Net.

Serum will support cross chain asset swaps, decentralized stablecoins, decentralized Oracles and non-custodial wrapped coins such as Bitcoin, Bitcoin Cash, BSV, Litecoin, Zcash, Ethereum and all ERC 20s .

Serum will decentralize the entire DeFi space with its initiatives.

When you look at Solana, you should see that it’s Almeda’s high throughput blockchain and they will keep pumping money into this project. They do it all the time if you know about them.

But Besides all made of, Solana has also partnered with Civic & Chain Link ,according to Binance Research.

Solana has achieved interoperability with its Wormhole Bridge, which allows users to transfer value cross chain between Ethereum and Solana by turning your ERC-20 tokens into Solana’s equivalent SPL.

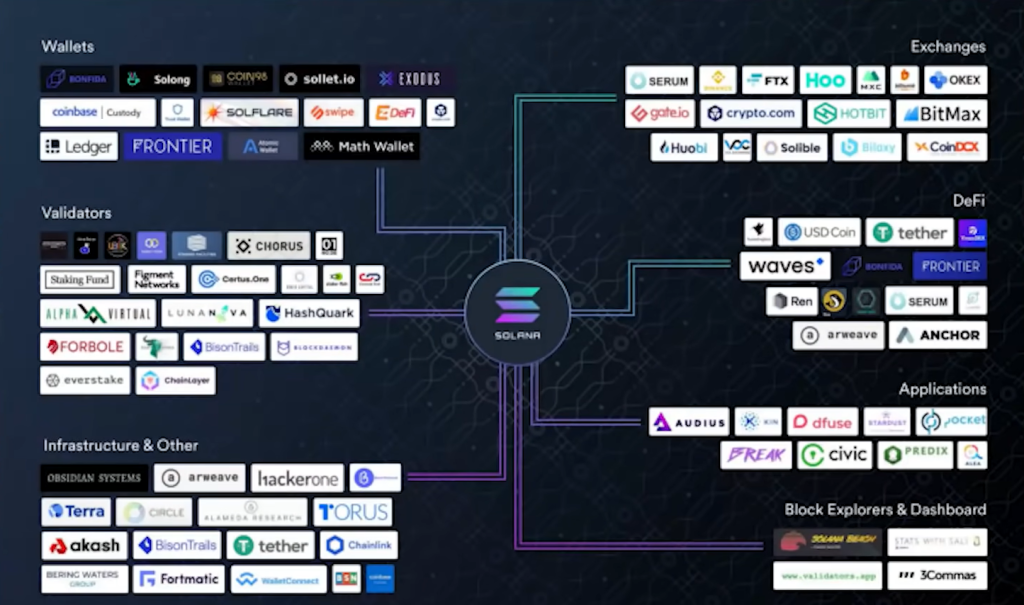

Solana’s ecosystem is booming. You guys can see here on this image just how big it is now.

Although this image is only a small taste of what’s to come and doesn’t include a number of current projects being built on Solana’s network.

According to the Solana Ecosystem Tracker, there are only 100 different projects from exchanges to blockchains to apps building on Solana right now. If this doesn’t show you how early we are into cryptocurrency in general, I don’t know what will now we’re briefly going to cover some of the projects we feel should be highlighted.

Besides Serum, another project to look out for on Solana is Raydium a DeFi protocol and automated market maker. You may know this initial AMM. That’s what it stands for.

The protocol leverages the central order book of the serum decentralized exchange to allow snap of the finger fast trades and share liquidity as well as other features for earning yield.

Next, we have Civic, which previously built a decentralized identity ecosystem, enabling identity verification in a safe and cost effective way.

Using their digital identification platform, you can create your own virtual identity and store it together with personal information on the device.

Now there’s even a developer building a video game on Solana called Star Atlas, which combines blockchain mechanics with traditional game mechanics. The Solana team consists of developers who formerly worked for Qualcomm, Google, Apple, Microsoft, and Dropbox.

Because of this, Solana is based on similar database technologies used by some of the big tech Giants.

Solana is an absolute monster and we are actually going to be investing in Solana starter projects a lot.

You don’t want to miss Solana. Definitely don’t sleep on this one.

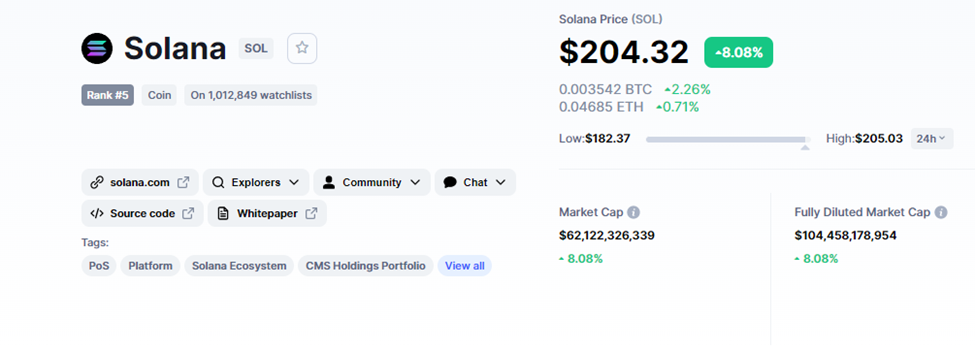

Over the last couple of months since the start of 2021, it’s risen over 1000%.

Solana SOL is currently ranked in the top 5 on CoinMarketCap with a market cap of around $62 billion in a current evaluation of $204.

So how high do I think Solana can go?

Well if we compare Solana market cap to likes of Cardano or Ethereum, which are also smart contract blockchains, Solana still has a lot of running potential, in my opinion. Now this is my approach to Solana vs Ethereum.

With All this buzzing ecosystem just getting started ,Sky’s the limit.

We can see Solana get an easy 10X by the end of this Bull run.

Even from where it is right now, however, I think it should be stated that Solana is becoming a longer term hold, moving up there with Ethereum, Bitcoin, Cardano and Polkadot.

Definitely keep this one on your radar. I think a $500 Solana is definitely in play for this Bull run.

Hope you liked our Article on “Solana vs Ethereum” . Read our other article on ‘Best NFT Stocks‘