Before we look at our list of Best ETFs Available in UK 2022, lets us understand What ETFs are and how they help.

What are ETFs

ETFs are a great way of investing in a portfolio of companies or other types of investments in a relatively passive way, whether you’re interested in investing in a particular sector, whether you want to track a particular index, whether you’re interested in groups of commodities or any other mixed bag of investments, ETFs allow you to do this relatively easily.

Investing money into an ETF means you don’t have to actively manage your portfolio. You don’t have to do frequent trades. You don’t have to worry about ensuring that the distribution of the companies in your portfolio is quite right.

The ETF will do all of that for you for a relatively modest fee and there are some really great options out there.

For example, S&P 500 Index is really good which became very popular over the last couple of years because of their level of performance.

However, the big issue is that S&P 500 ETFs, as well as many other ETFs, are not actually available in the UK and Europe, even though they are available in the US because of differences in regulation around how these ETFs report their data.

Also an important point to note, People should not go and invest in CFDs (Contract For Difference) if they don’t know what they’re doing and if they don’t know how CFDs work.

Just to explain what CFDs are , to invest in ETFs that you can’t invest directly into, you can invest in them through buying a CFD that has no leverage . You’re buying a CFD with no leverage, which is sort of against the point of CFDs in the first place.

Of course, you’re not buying the actual stocks, but you get to benefit in exactly the same way as if you were buying into those portfolios. The one feed that does apply that I wanted to mention is that there is a spread of 0.09%, which is essentially a cost of buying in and buying out indirectly, but that is really low for the privilege of being able to invest in things that otherwise you really can’t .

Now let’s get into the list. There’s going to be five different ETFs in our list of “Best ETFs Available in UK 2022” .

Best ETFs Available in UK 2022

Number 5:

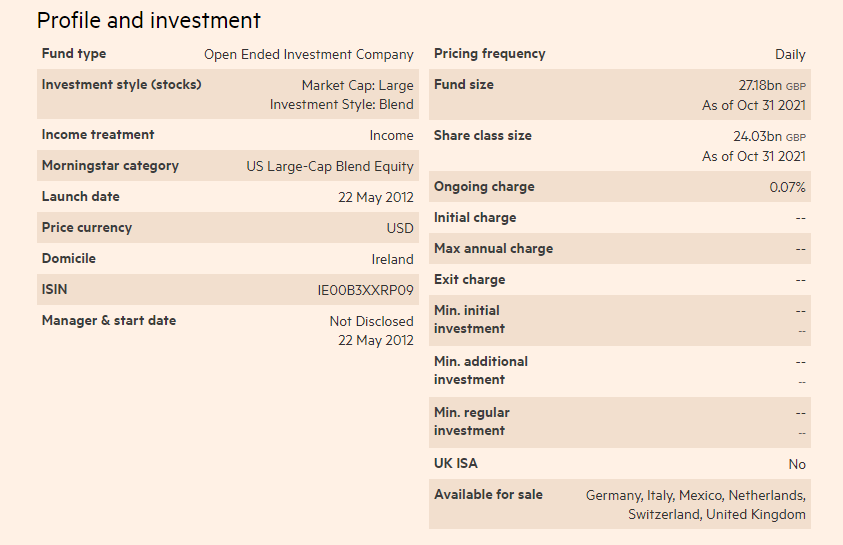

I have the most obvious option in this list, which you might have read about in other ETF lists, which is the Vanguard S&P 500 UCITS ETF (VUSD). This is a Vanguard portfolio which mimics the S&P 500 Index. It is basically the list of the 500 largest companies in the US .

You get to go and invest into that portfolio for a very low fee of just 0.07%. I like to keep about 10% of my portfolio invested in reasonably robust index based ETFs.

Now, the big reason why I like to invest in this ETF is because as it stands, the entire world is relying on tools, products and services produced by big American companies including Apple, Microsoft, Google as well as Amazon and Facebook, dominating the relative spheres within which they operate as well.

Now, having a portfolio that is heavily centered on all of these innovative companies for a very low fee, given the growth that all these companies are experiencing and the entire sector is experiencing something that I really like, and that’s why this is the first one in my list.

Number 4:

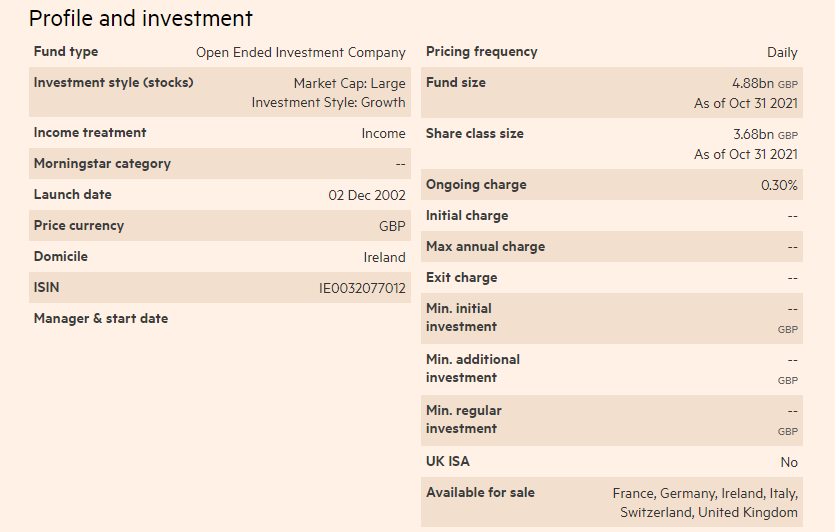

Now, although the S&P 500 is heavily based on tech, if you’re wanting to go even deeper, there is another ETF that I really like, which is the investor Nasdaq 100 ETF. It is the Invesco EQQQ ticker symbol.

As with Vanguard S&P 500 ETF that I just mentioned, there are two versions of the EQQB which goes in pounds and the EQQQ which goes in dollars.

EQQQ focuses on the largest non-finance companies that trade on Nasdaq and Nasdaq is basically where most of, in fact, pretty much all the big US tech Giants are listed.

This means that we have a much higher exposure to those tech Giants by investing in this ETF. One really big reason I like it is because some tech specific ETFs actually exclude some of the bigger tech companies for example, exclude Google and Amazon, even though I quite like having some of my money invested in those. One of the reason why this particular one is really good for me.

It’s not specific for tech.

It does have some diversification in it. Although tech is going to be by far the biggest component of this index, the fees are a little bit expensive, it is 0.3% but I think the ability to go and invest in those companies relatively straightforwardly, like they allow you to is good enough for that fee.

Number 3 :

Next on my list, the iShares MSCI, Emerging Markets ticker EEM. This is a bit of a different kind of ETF. It invests in companies in emerging countries all over the world.

This fund has a lot of big Asian tech manufacturers, ones that maybe people haven’t heard of. But once they actually produce a lot of the chips and a lot of the tech that goes into technology that many people have heard off and I really like the fact that they go and invest in the people who the big tech companies hire to do their actual work.

I think it’s nowhere near its potential just yet.

This ETF frequently returns double digit growth, but it can also return really strong downturn as well. It is much more volatile than some of the other ones. The expense ratio is 0.7% which is a bit costly but I think is really good based on the performance that this ETF is delivering. I think it can deliver more in the future.

Number 2:

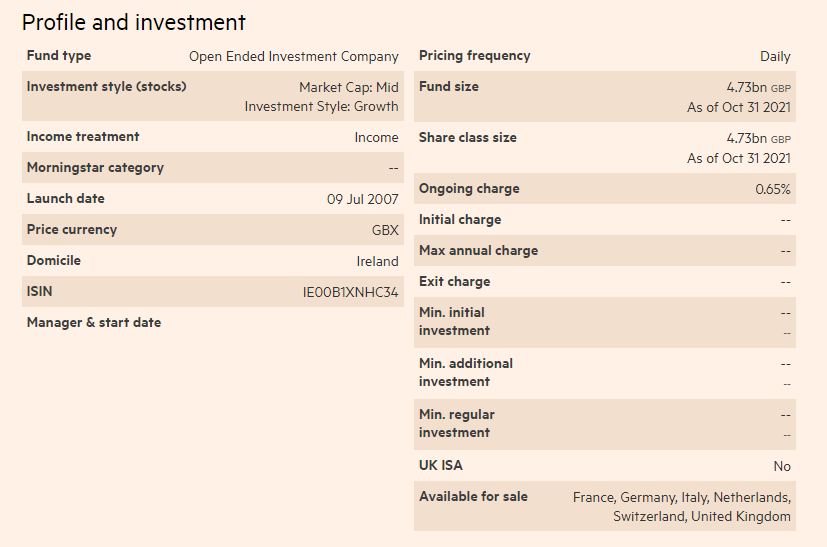

Next, let’s go to the iShares Global Clean Energy INRG this is a very different ETF to all the other ones I’m going to talk about. This Fund is a relatively small portfolio.

It only has 30 companies or thereabouts that are focused on delivering clean energy, and this one might sound somewhat altruistic.. It’s nice to invest in clean energy, it’s good for the future, it’s good for the environment. And that might be partly true. But there’s also a big financial sense in this as well.

Countries all over the world are becoming much more focused on clean energy. They’re much more focused on improving their environment. They’re much more focused on going carbon neutral in all of these things. Denmark has just announced the big island that they’re building where they’re going to be producing a colossal amount of renewable energy on this island to power them and neighboring countries as well.

This is something that’s going to be growing massively over the coming years, and I think even decades, and as a result, this is a way for me to invest in all the big companies that are playing in the space without having to know that much about the energy sector, which I don’t.

It allows me to go and invest in it for a relatively modest 0.65% fee, it is a bit expensive, but this fund has growth potential here, which I think, is so high that that fee is actually warranted

Number 1:

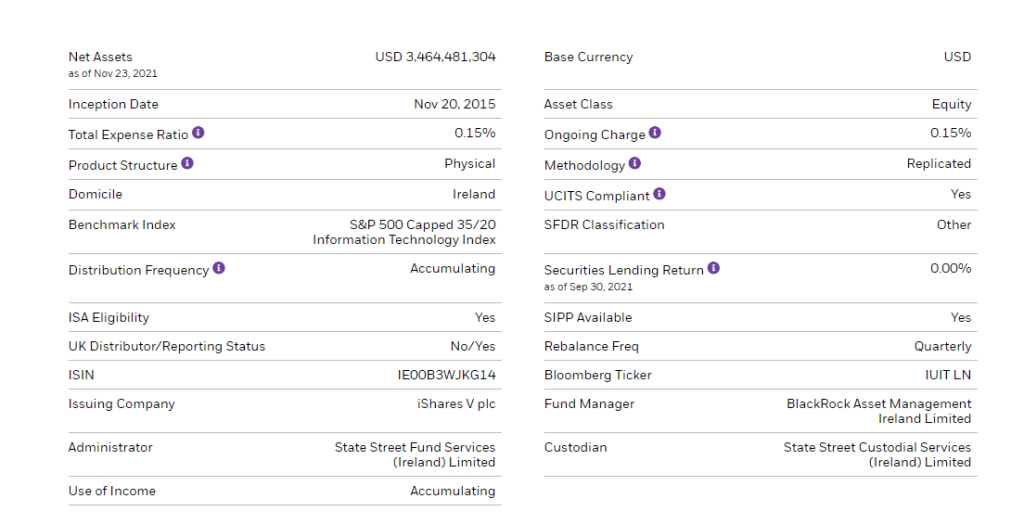

Next on my list of “Best ETFs Available in UK 2022”, the iShares S&P 500 information technology sector ticker UCITS. This one picks some tech companies from S&P 500, which targets high growth. The definition of tech here is limited.

As I mentioned earlier, it doesn’t include all the companies that maybe some people would attribute to be tech. For example, Apple and Microsoft are both in this one, but Google, Tesla and Amazon are not.

There is also definitely an element of overexposure in this ETF, for sure, while some other funds may have as much as 10% in some cases, 12% in the top company with an ETF here, Apple and Microsoft combined have over 40% share in this ETF between them.

Despite the very high volatility, this ETF can really deliver three of the last four years average returns of 40% of their vows, which is insane.

The fee is just 0.15% which is also really nice.

Hope you liked the list of Best ETFs Available in UK 2022 . Please read our other articles on https://equitygyan74899394.wordpress.com/2021/11/18/top-metaverse-companies-for-investment/