ETFs are really good for the investor that wants to buy and hold to grow their money passively and not pay a ton in fees. Growth ETFs are a category of ETFs that are designed to outperform the market so that you can go to the moon in the safest way possible 😊 . Before we look at the list of “5 Best Growth ETF 2022”, lets understand about Growth ETFs.

Growth ETS, are designed to invest in a basket of stocks whose underlying companies have the potential for rapid growth, as opposed to stocks whose prices are relatively undervalued.

In this Blog, I’m going to give you a brief overview of growth ETFs . We will see the 5 Best Growth ETF 2022 that you can add to your existing portfolio for more appreciation and upside.

If you’re new to investing or just trying to build your first portfolio, having one of these funds to complement your core holdings could be a pretty good option.

Let’s go over to growth ETFs and understand what they are:

Pros of Growth ETFs :

- This includes having an investment that actually outperforms the market with higher upside potential.

- It’s also better for younger investors to be invested since you’re so far away from retirement age and you’re not really seeking income or dividends. They’re taking on more risk to get those potential upsides.

Cons of Growth ETFs:

- There is a higher chance that you actually might lose some of your investment with a growth ETF, especially on a bad year.

- The other Con is that gross stocks generally reinvest all their profits into the company themselves so that they can grow even further, they’re not really paying you dividends or income. It’s not really good for somebody who is nearing their retirement age. If you are buying growth stocks, it’s important to combine them with value ETS. So that way you’re creating an appealing risk to return profile.

There is also an advantage that ETFs have over index funds or mutual funds that isn’t really talked about.

ETFs are a little bit more tax efficient than index funds or mutual funds, that’s because in those funds, the mutual fund manager typically has to rebalance those index funds themselves, and when they do so, they incur capital gains, and they have to pass those capital gains onto their shareholders. In an ETF, that doesn’t really happen, so that’s not a consideration you even have to make.

For that reason, an ETF has slightly more tax advantage than an index fund.

Now let’s get on with the list of Best Growth ETF 2022.

Number 5:

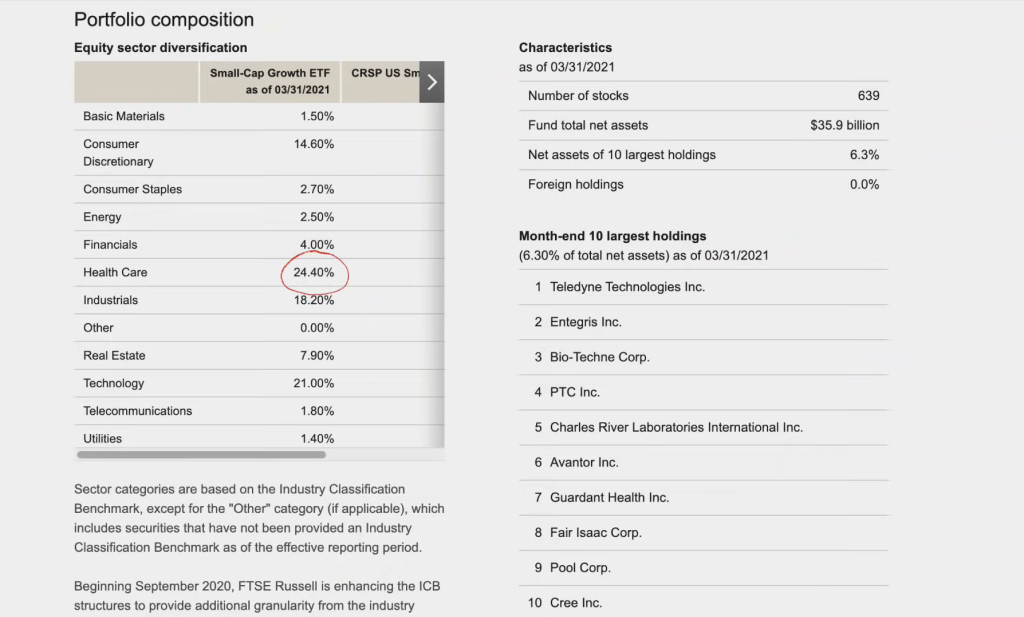

The Vanguard Small Cap Growth ETF, ticker symbol VBK. This is a fund that tracks over 639 different small cap stocks.

A small cap company, by definition, is known as a company that has between a market cap of 300 million and $2 billion. They’re smaller companies with bigger potentials of upside.

This particular funds breakdown is 24.4% of their holdings are actually in health care, followed by industrials technology and then consumer discretionary companies. What I do like about this one is that not any one of the holdings represents more than 0.67% of the fund’s total assets. That means, in the event that one of the companies in the fund actually goes bankrupt, it doesn’t really threaten the rest of your entire investment because you still have 638 different stocks to kind of hold that ETF up.

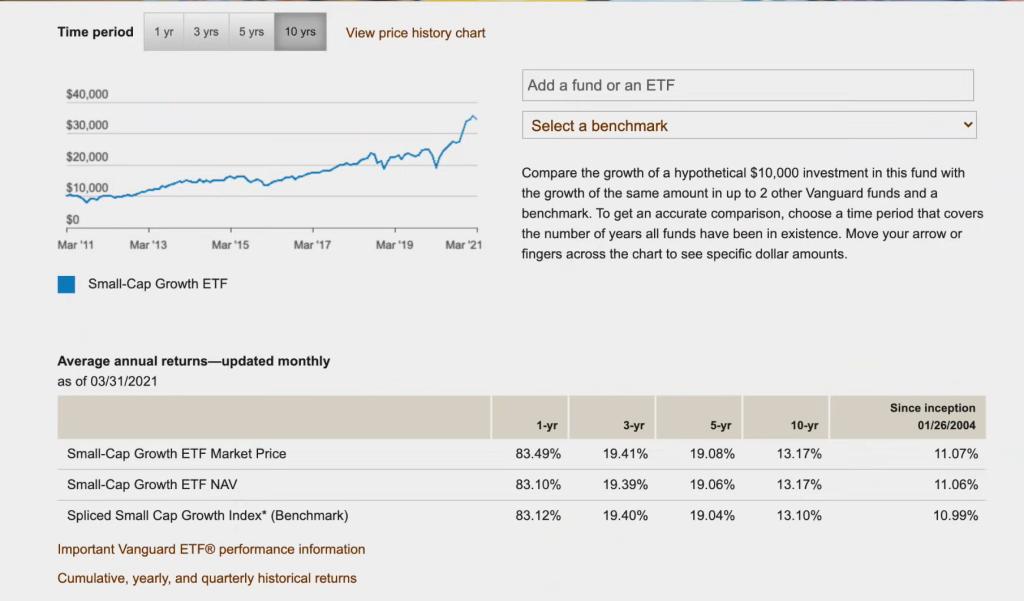

The return since this fund was created in 2004 has been roughly 11% annualized, and in the last three years has returned about 19%.

Vanguard ETFs are some of the cheapest on the market. So this one has an expense ratio of 0.7%. So that means it’s about $7 in fees for every $10,000 you have invested per year. The downside of this fund is that it’s definitely more volatile than some of the other funds on today’s list.

It has a lot of small companies with a lot of boom or bust potential. It’s also important to note that some of the companies that are in this current fund are actually mid to large cap companies because initially when they were introduced in the fund, they are small cap companies, but they have since grown , so in the future they actually might get excluded from the fund.

Number 4 :

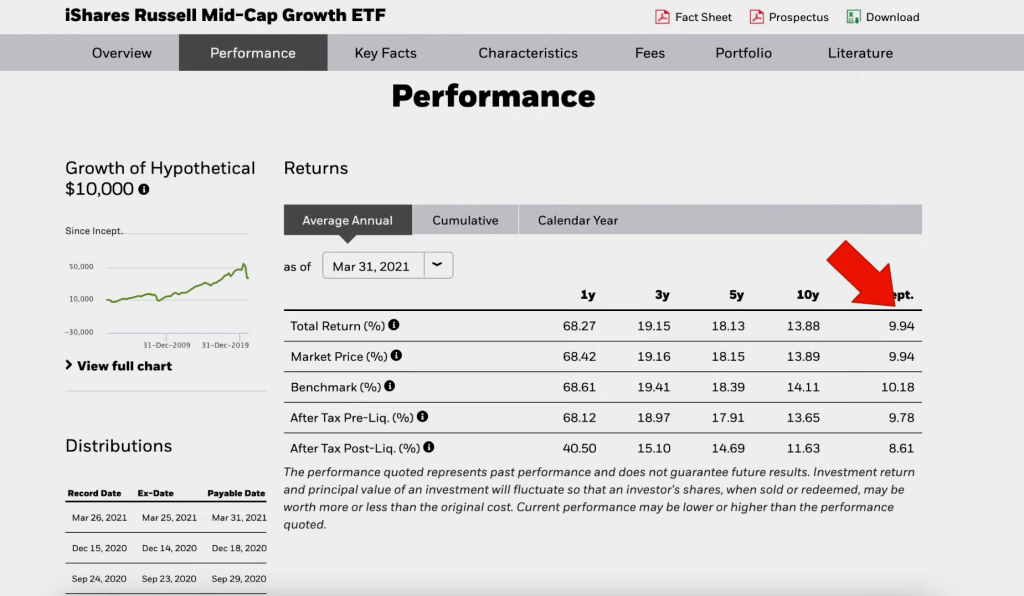

iShares Russell Midcap Growth ETF, ticker symbol IWP. This ETF is like the Big Brother to VBK, which is the fund that I just talked about above at Number 5, but it essentially follows the same investing approach just for midsized companies instead. Mid Cap company, by definition, is one that’s between $2 and $10 billion in market capitalization.

This fund in particular encompasses over 356 different stocks. Its largest sectors are it healthcare and industrials and not a single holding represents more than 1.43% of the entire fund.

In terms of its top ten holdings, we are starting to see some more familiar names. For example, it owns great companies like Chipotle DocuSign and even Spotify for its performance. Since it was created, it’s been returning about 9.9% annualized, but in the last three years it’s been returning about 19% expense ratio wise. It’s about 0.24%. So it’s a little bit higher than a Vanguard fund would be.

Number 3:

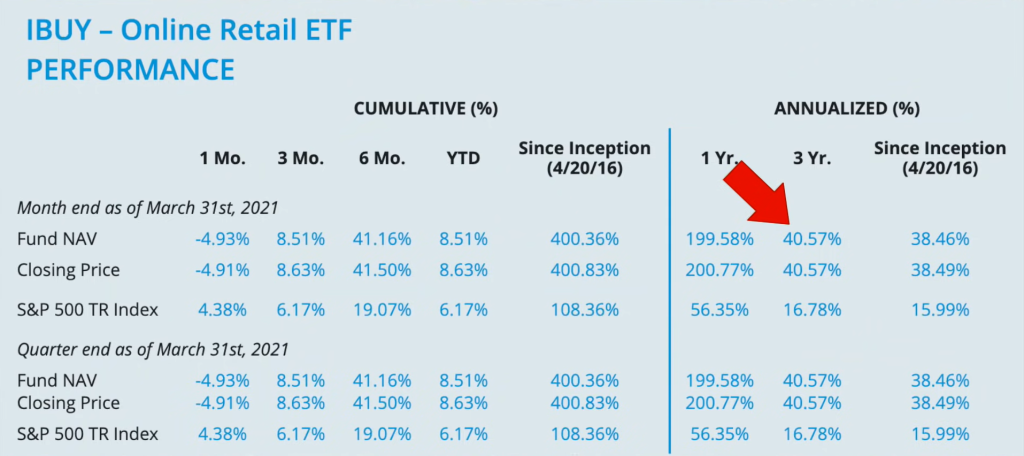

The next ETF on our list is ticker symbol IBUY or the Amplify Online retail ETF. This is a growth ETF that doesn’t really focus on a specific market cap size, but it actually focuses on companies that generate their primary income through online sales. So according to their website, in fact, it’s a basket of publicly traded companies that obtained 70% or more of their revenue from online or virtual sales.

This one only has 58 holdings, so it’s not as diversified as some of the other ETFs on our list, but the top holdings include really big names such as Etsy, Lyft, TripAdvisor and Groupon.

This fund is also way more expensive than any of the other ETS on this list, with an expense ratio of 0.65%, which is almost 9 times the Vanguard average, which is pretty pricey. So for that amount that we’re paying in fees, we better be seeing a good return. Since the inception of this fund, the return of this fund is crazy. It’s almost to 38% already.

The three year return is even more impressive at 40.57%.

A Word of Caution: This fund has potential for volatility because it’s really dependent on how the economy is doing. Economy is doing really great right now and lot of people are spending their money online and also in retail stores which is making this fund perform.

But if the economy ever has a pullback or recession, we actually might see this fund performed poorly. Personally, I only see online sales growing year over year, especially in the long term.

Number 2:

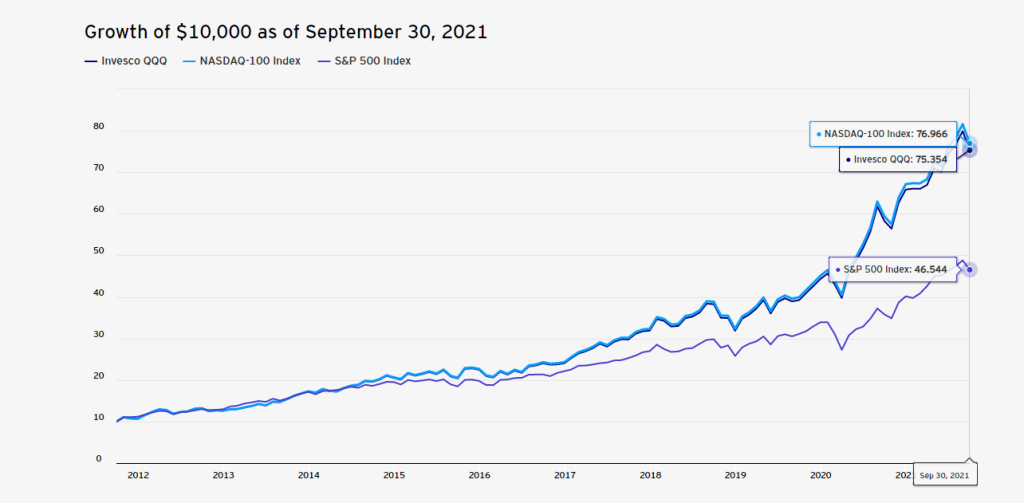

The second ETF on my list of Best Growth ETF 2022 is the popular QQQ by Invesco. If you don’t know what QQQ is, it’s one of the most recordable and solid ETFs out there.

It’s the second most traded ETF in the US based on average daily volume. It also lets you access Nasdaq’s 100 largest nonfinancial companies in a single investment.

The return of this fund since it was created is about 9.38% . For the past three years it’s 27.34%, and its expense ratio is 0.2%, which is pretty reasonable. The top holdings include Apple, Microsoft and Amazon. Of those three top holdings, they actually represent 30% of the fund’s total assets.

QQQ in the past year has actually returned over 48% in the last year versus the S&P 500 ETF . It has returned about 19% even though It has some overlapping holdings.

We actually do see that the return has been pretty favorable for QQ in the past year.

Number 1:

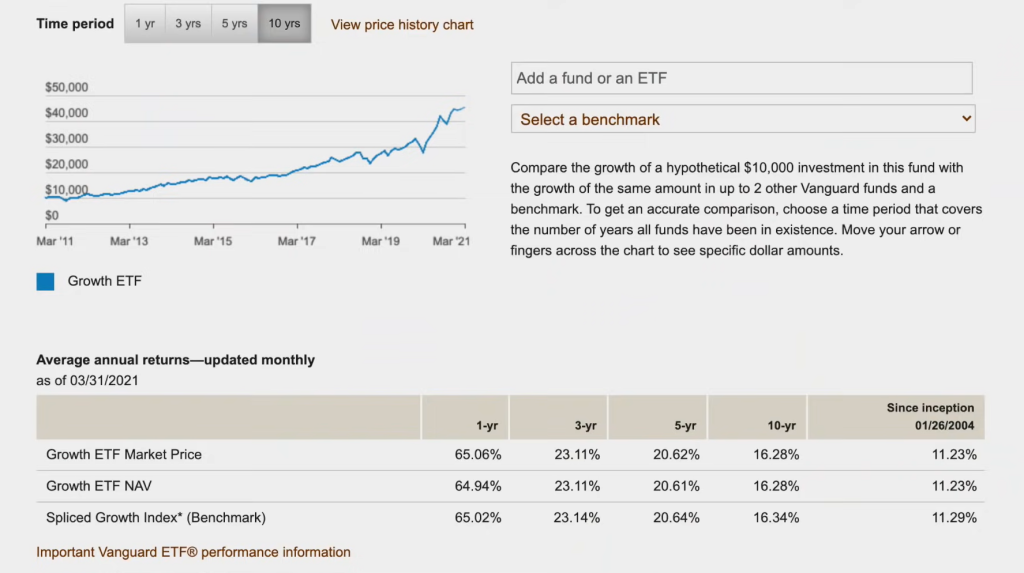

My number one pick for the growth ETF today is actually, the Vanguard Growth ETF Ticker symbol VUG. This is a fund that’s comprised of 260 different stocks out there. Most notably, they’re targeting growth and mostly large cap stocks.

The weightings are done by the size of companies. The top ten holdings actually account for 45% of the total assets of this fund. The top three holdings are also Apple, Amazon and Microsoft. The expense ratio is a mere 0.04%. That’s only $4 of fees for every $10,000 you have invested. It’s actually the cheapest ETF on today’s list. Now, in terms of its return, it’s actually performed pretty well since it was created around 11% average analyzed returns, and in the past three years .

I like this fund in particular because it has a lot of upside . It still has a lot of diversification and safety because it’s mostly investing in large cap growth companies. It’s not the riskiest pick in today’s list like Ticker symbol IBUY.

If you’re able to get that return with IBUY, then great. But we re looking for a solid, more stable pick, then VUG is your best bet.

Hope you Liked our Article today on “Best Growth ETF 2022” , Please read our other article on “Top Metaverse Companies for Investment”https://equitygyan74899394.wordpress.com/2021/11/18/top-metaverse-companies-for-investment/