The Metaverse, it’s coming, but what is the metaverse? What are “Top Metaverse Companies for Investment”.

Lets Look to answer all these questions about Metaverse in this blog and find out different ways to invest in our “Top Metaverse Companies For Investment”.

Recently, Mark Zuckerberg announced that Facebook were changing its name to Meta Platforms or just META, and that the ticker symbol would be changed to MVRS on December 1st. He then put out an hour long video on how he envisions what the Metaverse is going to look like and how augmented and virtual reality are going to change the way we experience the digital world.

Metaverse Vision:

The Metaverse in his vision, where the physical world would meet the digital world. We are going to talk about exactly what that means in today’s blog. Now, whether or not you think this will actually happen is one thing. But given that 10000 employees or 20% of Facebook’s workforce is working on AR and VR devices, the reality of such is probably going to come true.

Facebook also seemingly has an unlimited amount of money, so Facebook has been estimated to be spending $5 billion per year on metaverse related development and also acquired idealists back in 2014 for $2 billion. That’s a lot of money over the past seven years, I personally do think that some version of the Metaverse will eventually come into existence. It’s not a matter of if , more of a matter of when.

While the Metaverse in general is not owned by Facebook, clearly Mark is trying to stake claim of it by changing the company’s name to Meta.

Today we’ll go into detail on what the Metaverse actually is, what it’ll look like, and we’ll also cover how to get in early into different ETFs and stocks that could play a big role in the eventual metaverse.

What exactly is the Metaverse?

I’ll try to explain it in the most simple way that I can . The Metaverse can be best described as the next major iteration of the internet, just like how the mobile internet was built upon the traditional internet from the 90s and early 2000s. It’s basically a world of endless, interconnected virtual worlds where people can work, socialize and play.

Using VR, augmented reality and other devices, there are a few main features of the metaverse that we should call out.

Main Features of Metaverse:

Number 1:

There will be no limits or lanes. The Metaverse will never be off. It’ll never be down for maintenance updates or server restarts. People will be able to log in or out whenever they desire without ever having to load or save their data. Everyone will experience the metaverse at the same time and live synchronously.

The Metaverse aims to be where everything takes place in one instance and millions of people will be able to interact with each other in a digital slash physical world.

Number 2:

The second major feature is that there will be in an economy. With so many people spending time in this digital air and VR world, both businesses and individuals will be able to sell goods and services within the metaverse. Think of your favorite brand selling digital goods within the metaverse.

For example, Louis Vuitton might be selling a digital bag that your digital avatar can hold. I’m sure users will also be able to create their own small businesses to within the metaverse.

So, for example, a popular business started in almost every type of online multiplayer game is usually a user who ran casino. So in this way, attention is being monetized, and the more attention that goes into the Metaverse, the more opportunities for transactions are going to happen.

Number 3:

The third feature is that there’s going to be unlimited potential for user created content. So while there will certainly be corporations and businesses creating experiences and content within the Metaverse,

Individual users will have a large influence over the majority of the metaverse content. A user created content model also allows the Metaverse to be highly scalable and always be relevant to the latest trends. In addition to user created content, many companies such as Nike and Microsoft have already jumped aboard the growing hype surrounding the Metaverse.

In late October, Nike filed 7 trademarks with the U.S. Patent Office for basically downloadable virtual goods retail store services featuring virtual goods, non-downloadable virtual footwear, etc. So we can already see some institutional adoption from companies for digital goods within the Metaverse.

Number 4:

And that actually brings me to my next point number 4, which is everything will be compatible in both the digital and physical environments. Augmented reality and virtual reality are going to be crucial parts of the metaverse. What comes to mind right now is Amazon’s Air View . With Amazon’s Air View, Customers can preview products in their home virtually before they complete their purchase.

This concept isn’t so foreign to us right now, but it could be very well present in the Metaverse. Another interesting application is that in the metaverse, goods will be tradable with other goods using the same platform, regardless of community or branding.

For example, imagine a universe where you could trade something like a valuable Fortnite skin for something that goes in your digital home, maybe like a digital couch. Basically, all barriers are going to be brought down, and that’s what the Metaverse is all about.

All right, so now that you know a little bit about the Metaverse, how can we invest in the metaverse, especially now because it is still quite early? The Metaverse is probably still a few years away, but there are going to be companies and stocks, which are going to be vital to its growth.

Let’s talk about the market opportunity now

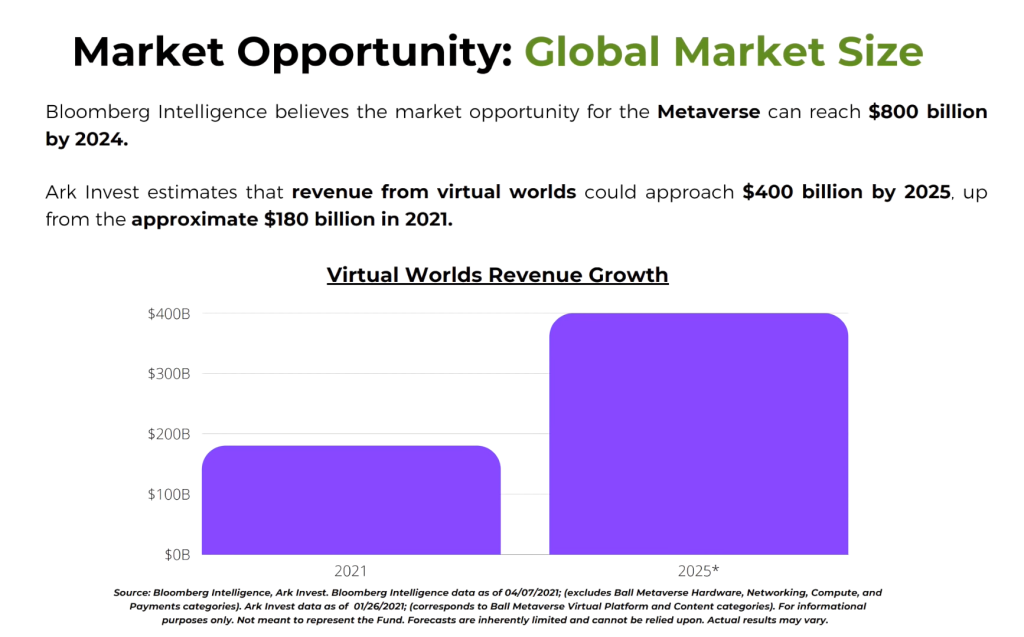

According to Bloomberg, the global metaverse market could reach $800 billion by 2024. Now you can also add on the opportunity of metaverse infrastructure in the market opportunity, so firms such as Roundhill Investments project a $2.5 trillion opportunity by 2030.

If you add all those together to give you some context here, the entire energy category has a market cap of $2.95 trillion dollars, and the entire real estate market is worth about $1.8 billion. Whether or not the metaverse actually grows to that big of a size, time will actually tell.

There are two main ways of investing into the Metaverse now:

- Number one, you could invest in the content creation side or the infrastructure side of the Metaverse

- Number two. If you’re looking for an easy on compressing investment into the metaverse, you could just buy an ETF.

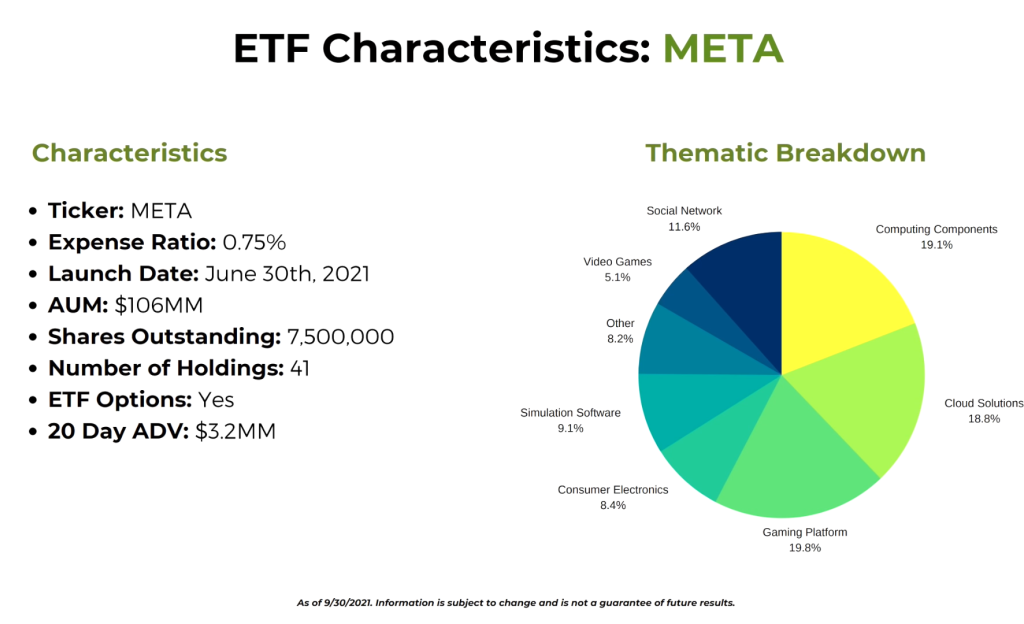

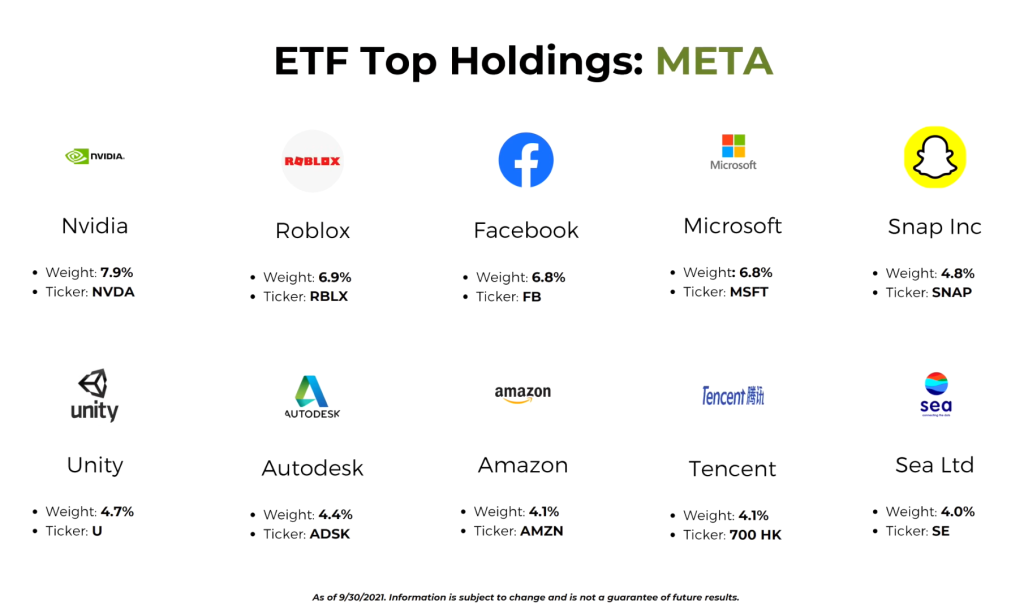

So I know that Roundhill Investments offers an ETF called the Meta ETF, which is designed to offer you exposure to companies that are actively involved in the Metaverse.

Now, in terms of the typical companies that the ETF is buying into, some include infrastructure companies, for example, Cloudflare and Nvidia, or gaming engines for virtual worlds such as Unity and Roblox.

If you’re bullish on just the metaverse in general, you could look into the meta ETF. Their expense ratio, however, is quite high at 0.7%. Since this ETF is launched just this year in June, we are actually not too sure of how it’s going to be doing in terms of performance quite yet.

If you would like to invest in this space, though, another easy alternative you have is just to look at what the meta ETF invests into and pick and choose selective stocks that could fit into your overall investment thesis and portfolio.

“Top Metaverse Companies For Investment”

I think that are worth highlighting that you could look into for the Metaverse specifically now

Number 1:

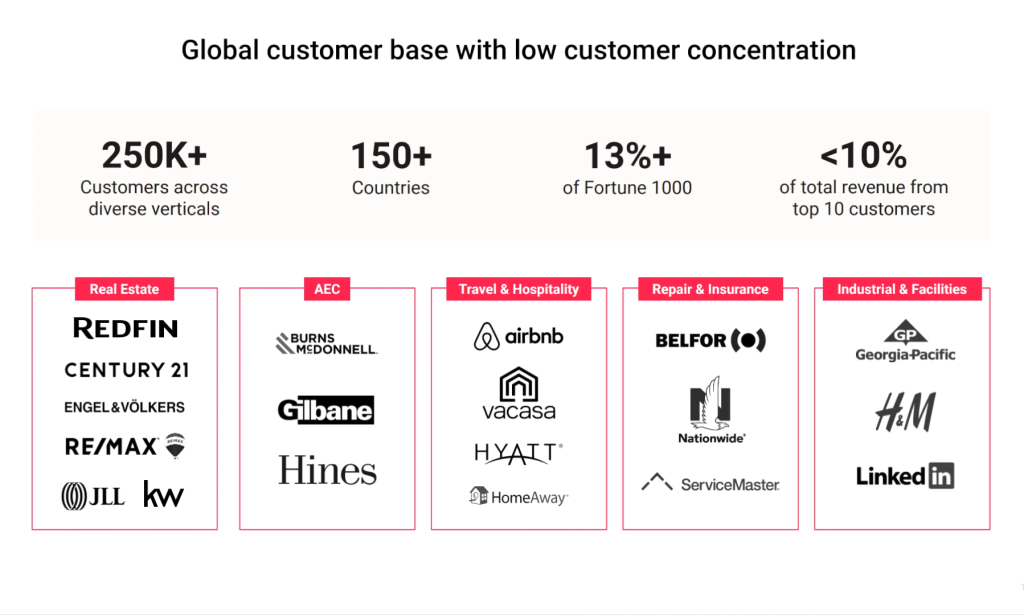

The first company I want to talk about is Matterport, so Matterport is a leading spatial company that digitizes the real world. The current business revolves around capturing real estate with cameras, digitizing the data and then turning those data into 3D models. Realtors can then use these models and showcase them to clients without ever having to step into a home.

One of the biggest challenges that the Metaverse is going to have is the need to digitize and import every physical aspect of the real world into a virtual environment. So that’s where Matterport comes in. It could be one of the biggest players in the Metaverse space within 10 years, as it currently dominates the growing market for the 3D digital transformation of the physical world to the digital world. So unless a competitor just comes along and does it better, I don’t see Matterport being matter less as in, it won’t matter anymore.

Matterport already has a portfolio of 38 patents and 28 pending patents, so any new competitors will have a very hard time entering the industry. It currently generates 52 percent of their revenue through SAS or subscription as a service, and a strong component of Matterport is its diversified customer base, with less than 10 percent of their total revenue derived from the top customers and 330000 customers across all verticals.

Matterport have a partnership with Facebook, a.k.a. Meta, and Matterport is partnering with Meta A.I. Research to develop A.I. systems for the physical and digital world.

If you are bullish on Matterport for the long term, that could actually be a buying opportunity.

Number 2:

The next stock you could look for our “Top Metaverse Companies For Investment” into is Unity. Unity offers software where developers can create and monetize their games on 20 different platforms, including Windows, Android, iOS, PlayStation and more. Approximately 60 percent of air and VR games are currently created on the unity platform. While the majority of their revenue comes from the gaming industry, Unity is looking to expand into other industries.

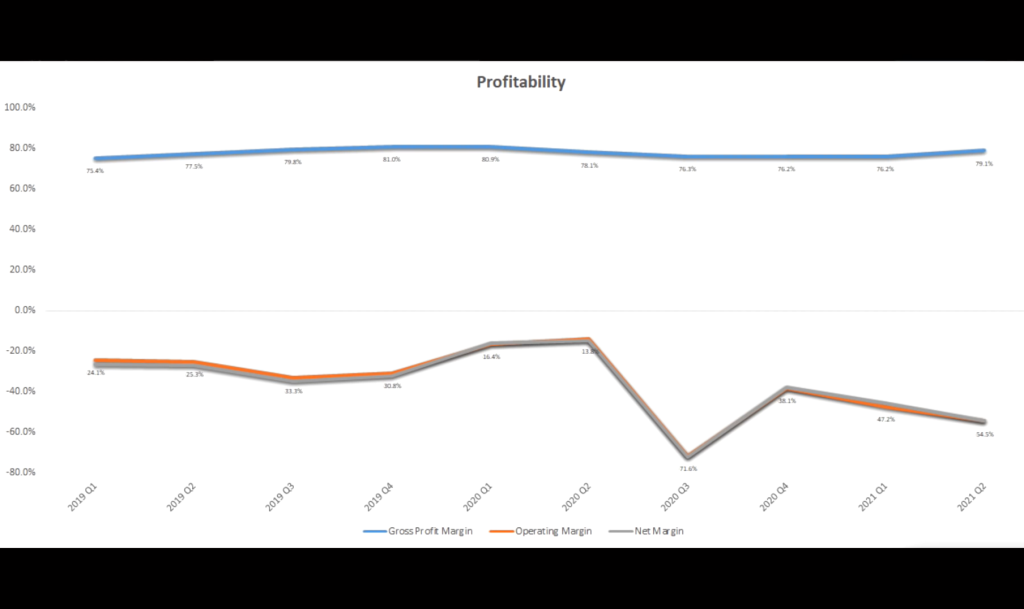

In the second quarter of 2021, Unity acquired Metaverse Technologies, which is a 3D optimization software company. The acquisition means that professional creators can actually more easily and quickly import 3D data into unity and optimize the models for real time development. Now, Unity has some valuation and profitability concerns. Currently, Unity generates revenue like crazy, basically increasing year over year up into the right. Their gross margins remain high at around 80 percent.

Their operating margins are in the red because of R&D costs basically they’re spending a lot of money on investing in themselves which is probably a good thing but in the short-term their metrics may look poor while they might not make a profit for some sometime .

Unity has a cash cushion of round $1.6 billion that they can use to cover the losses in the meantime . Guardian evaluation to stock currently reflects high growth expectations.

Unity has a growing Revenue at a compounded annual growth rate of around 142% over the past three years but analysts actually expect that to be closer to 29.3% for the next 10 years. With those growth rates the current valuation might actually be deserve the average analyst price Target is currently between $116 to $130 per share.

Conclusion:

Both of these companies Unity and Matterport should have some sort of impact on the metaverse and are under our Top Metaverse Companies For Investment list .

Hope you liked this Article on “Top Metaverse Companies For Investment” , Do read our other research Report on “Best Monthly Dividend ETFs” https://equitygyan74899394.wordpress.com/2021/11/16/best-monthly-dividend-etf-2022/