In this article, we will look at Best Index Funds in India which investors can target for long term investment. These Passive Funds will outperform the actively managed Mutual Funds by a large Margin.

Please subscribe to our newsletter so you never miss an article when its published.

Overview:

Over the last 2-3 decades, there has been a drastic shift in the investment pattern in India. In the 1990 and 2000, people used to invest their money mostly in LIC policies, FDs, physical gold and real estate.

A very small percent of people would invest in stock market. Mutual funds were a very new concept in the 2000s, but in the last few years there has been a huge shift in investment pattern where the young generation is now focusing on stocks and mutual fund for wealth creation.

There have been multiple factors for this shift in investment pattern. Lets look at Top Index Funds for Long Term Investment .

One of the major reasons is increasing awareness among investors regarding stock market and mutual fund.

Today investors understand that India is a growing economy and it makes sense to invest in the Indian economy for wealth creation.

Moreover, the interest rates on FD have fallen drastically, so FDs are not looking lucrative anymore. If you are a salaried person or a business owner who does not have enough time for research, it makes sense to keep major exposure in mutual funds.

Until a couple of years ago, people used to invest in active funds. But now investors have realized the importance of index funds because it is getting really difficult for active funds to beat the index.

What is an Index Fund & How its different:

In this article, I want to focus on one of the emerging categories in mutual fund that is Index Funds.

In fact, many people claim that index fund or passive investment is the future of investment.

Now what is an index fund? An index fund is basically a fund that simply replicates an index.

For example, if an index fund replicates Nifty 50, then it would have all 50 stocks in the portfolio that are part of Nifty 50 and it would be in the same exact allocation.

If Infosys has 5% weights in Nifty 50 by market cap then 5% of your investment would be invested in Infosys and so on.

Types of Index in India.

There are a lot of indexes in India. For example, you have Sensex, Nifty 50, Nifty Next 50, Nifty Midcap 150, Nifty Small Cap 250 and few others. There are multiple index funds within each category in this blog .

I will try to help you understand why index funds are the future of mutual fund and then I will share my list of Top Index Funds for Long Term Investment .

How Index Fund will Change the Investment returns

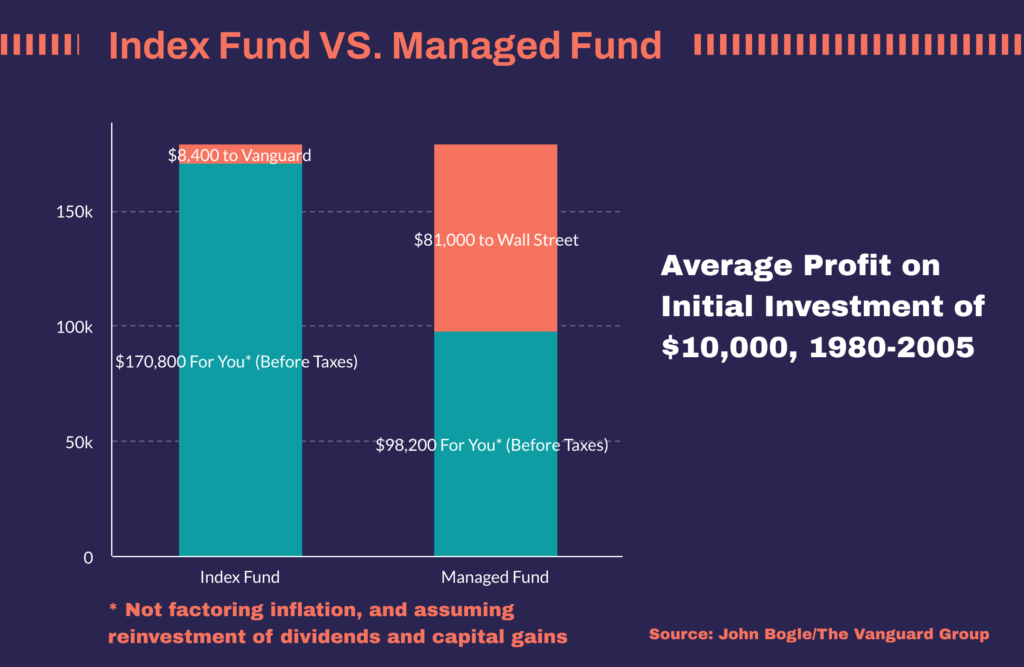

The reason why people say that index funds are the future of mutual fund is because it has been proven in developed countries like us that in the long run active funds are not able to beat the benchmark.

Active funds are basically the funds where the fund manager selects the stock from his or her choice and keep buying and selling stocks actively.

The ultimate goal of each active fund is to beat the benchmark.

If you look at the last few years, more than half of the mutual fund in the large cap category in India are not able to beat the benchmark.

Lets look at Top Index Funds for Long Term Investment.

One of the major reason is high expense ratio, active fund charges an expense ratio in the range of 0.5% to 1.5% for direct plan, whereas majority of index funds have very low expense ratio, some of them have expense ratio below 0.5%.

There is almost a gap of 1% in the expense ratio of active funds and index funds. This 1% gap might look very small, but in the long term this 1% can create a huge difference as it is charged every year.

In the future as Indian economy becomes more efficient, it would be even more difficult for active funds to beat the index and hence index fund would be a better option due to their lower expense ratio.

Criteria of Fund Selection:

I have shortlisted the index fund mainly on three parameters.

- Expense Ratio: Expense ratio is a fee for managing the fund. Lower the expense ratio better it is for investors.

- Tracking Error: Tracking error is the difference between the index return and actual return from the index fund. Replicating the index again lower the tracking error better it is.

- AUM size: High AUM size suggests confidence of investors in the fund. Although since index funds are relatively newer in India, the AUM size is not that high.

Also, there are a lot of new funds being launched in the market and hence they have low AUM. I haven’t considered relatively new funds with lower AUM in my list of top five funds.

Between Sensex and Nifty 50,I prefer Nifty based index fund as they are more diversified with top 50 stock. There are many index fund in Nifty 50 category.

List of Best Index Funds in India:

5. UTI Nifty 50 Index fund.

It basically replicates the top 50 stocks in Nifty 50 category. It is one of the oldest index fund in India and it was launched in January 2013.

Its fund size is Rs 4210 crore, which is the highest in Nifty 50 index fund category. In terms of return. UTI Nifty index fund has given a CGI return of 14.7% in the last five years.

Its expense ratio is 0.2% and tracking error is also one of the lowest with 0.02% cracking error in last one year in terms of sector allocation 37.2% allocation is in the financial sector, 17.3% in technology sector and 12.1% is in energy sector.

The top three holdings include your Reliance, HDFC Bank and Infosys. Now this would be more or less the same in all major Nifty 50 based index fund as essentially everyone is trying to replicate the same Nifty index.

The major differentiator here is expense ratio and tracking error, so lower the expense ratio and tracking error better it is and UTI Nifty Index fund has one of the lowest expense ratio and cracking errors so far in the Nifty 50 index fund category.

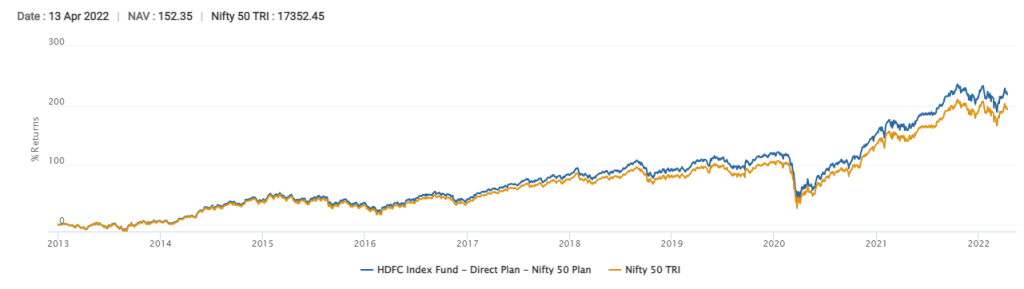

4. HDFC Index Fund Nifty 50:

It is also one of the oldest index fund and was launched in January 2013. Its fund size is Rs3343 crore which is the second highest in Nifty 50 index fund category in terms of returns.

HDFC Index Fund Nifty 50 plan has given a CAGR return of 13.99% in the last five years.

Its expense ratio is also 0.2% and tracking error is also one of the lowest with 0.03% tracking error in last one year in terms of allocation.

Again financial technology and energy are the top three sectors and Reliance, HDFC and Infosys are top 3 holding.

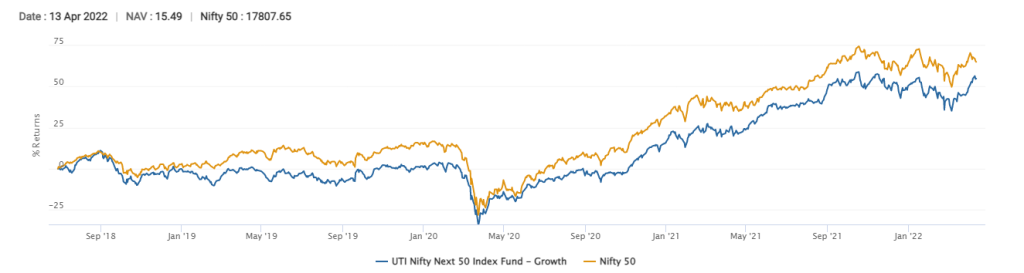

3. UTI Nifty Next 50 Index Fund

UTI Nifty Next 50 Index Fund is from Nifty Next 50 category. Now the reason why I prefer this category is first it remains stocks ranking from 51 to 100 in terms of market cap.

These are the stocks that are not as large as Nifty 50 but have the potential to grow and move into Nifty 50 category. Second important reason is diversification.

Nifty 50 index has 37% weightage of financial stocks so Nifty 50 Index is more skewed towards financial sector.

However, Nifty next 50 index is nicely balanced in terms of sector allocation with consumer goods sector having highest allocation with 18.8% weightage.

The second highest allocation is a financial sector with 17.3% allocation. This is followed with Pharma and then consumer services sector within Nifty next 50 category.

It is one of the best performing fund in Nifty Next 50 category with a fund size of around Rs 1097 Crore and 3 year average CAGR return of 10.86%.

Although the return of Nifty next 50 index is lower as compared to Nifty 50. But I believe that Nifty next 50 category will perform much better in the long term so it is good to have exposure in Nifty next 50 index.

UTI Nifty Next 50 index has an expense ratio of 0.32% and tracking error of 0.19% in last one year.

Its top three sectors include financials, consumer goods and health care and top three stocks include Adani Enterprise, Info Edge and Apollo Hospitals.

2. Axis Nifty 100 Index Fund:

Axis Nifty 100 Index Fund is a combination of Nifty 50 and Nifty Index 50 fund. So you can either invest in Nifty 50 index fund or Nifty Next 50 index fund individually, or you can invest in Nifty 100 index fund together.

Only difference is that when you invest individually, you can decide how much percentage you want to invest in Nifty 50 and Nifty Next 50. For example, you can invest 50% in Nifty 50 and 50% in Nifty Next 50 category.

When you invest in Nifty 100 index fund, around 85% of the money is invested in Nifty 50 companies and the remaining only 15% is invested in Nifty index 50 companies.

This is because Nifty 50 has a very high market cap and hence they have a weightage of 85% in Nifty 100 fun and only 15% weightage is for Nifty next 50 access.

Axis Nifty 100 index fund has a fund size of rupees 477 crore. Expense ratio is 0.16% and tracking errors of 0.27% in the last one year.

The top three sectors in excess Nifty and include financials technology and energy and top three companies include Reliance , HDFC bank and Infosys.

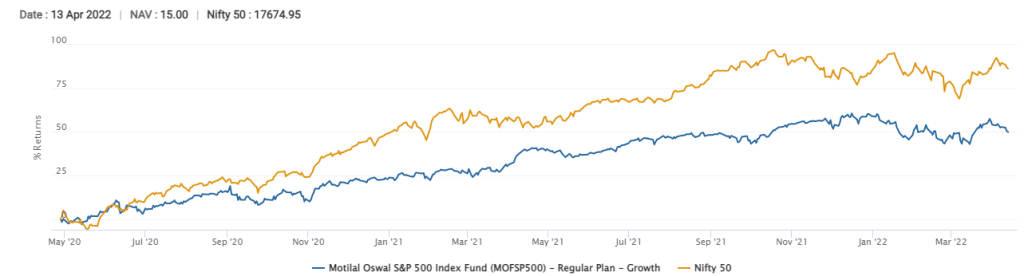

1. Motilal Oswal S&P 500 Index Fund

Number One fund in my list is not from Indian market. It is an index fund that replicates the US stock market.

Personally I like to have some exposure in US stock as it provides diversification and help me to invest in some of the top notch companies of the world.

Now there are mainly two categories of US based Index Part Nasdaq 100 and S&P 500. Nasdaq 100 represent top 100 listed companies in the US and S&P 500 represent the top 500 companies.

I personally prefer top 500 companies although recently Nasdaq 100 has outperformed S&P 500 but it was mainly due to outperformance of selected technology stocks.

But in the long term I prefer the S&P 500 index that includes the top 500 companies in the US and my number one pick in the category is your Motilal Oswal S&P 500 Index Fund.

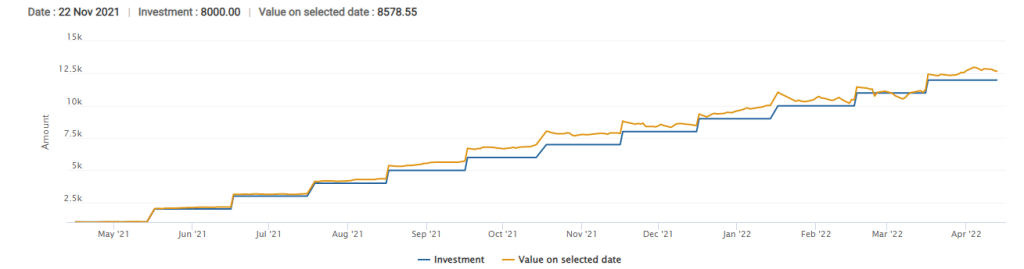

This fund has an AUM of Rs 1621 crore and has given a return of 34% in last one year. We don’t have five year data as it is a relatively newer fund.

Its expense ratio is 0.4% and tracking error is 5% in last one year.

Well the tracking error is too high but unfortunately we don’t have many options in this category in India.

I had published my Top list of S&P 500 Funds in India to invest for investors who prefers to invests mainly in US Markets.

Hope you liked our researched report on Best Index Funds in India , Please do read our other articles on Top Nifty 50 Equal Weight Index Fund .