What is an ESG Fund:

Before we start with “Best ESG Funds to Invest in India” , lets understand what ESG Fund is .

ESG i.e. ( Environment, Social, and Governance) Funds invests in companies demonstrating sustainable practices across Environment, Social, and Governance (ESG) theme. These are the companies that can be called green. They have less carbon footprint and they keep on decreasing the carbon footprint making the earth a livable place.

Why ESG Funds Came in Existence :

After World came together in Paris during The Paris Agreement, often referred to as the Paris Accords or the Paris Climate Accords, an international treaty on climate change, adopted in 2015. ESG Funds got much-required traction. Every country on the planet is working to reduce its carbon footprint and make the earth livable. Every Corporate Company is working towards it, making their Company come in the Zero Carbon Emitting Company list.

These Companies qualify for ESG Funds. ESG Funds invest only in these companies making them candidates for further investment from Fund Houses.

Why You Should Consider Investing in ESG Funds :

- World is Changing : Flood risk and sea level rise, privacy and data security, demographic shifts, and regulatory pressures – new risk factors for investors. Modern investor may re-valuate traditional investment approaches.

- Growth : Sustainable companies are expected to have lower risk and deliver sustainable growth

By Now you Would have understood, ESG Funds and these underlying companies are the Future. Going Down the line 10-20 Years, Most Countries and Companies will have to undergo Zero Carbon Emitting Process. The prospect of ESG Funds is far more than what it looks like today.

ESG Fund Benchmark in India:

- Nifty 100 ESG TRI (Benchmark) :

To form part of the NIFTY100 ESG Index, stocks should qualify the following eligibility criteria:

- Stocks should form part of NIFTY 100

- Companies should have an ESG score

- Companies with a controversy category 4 and 5 will be excluded (scale: 1-5, category of 1 being least controversial)

- Companies engaged in the business of tobacco, alcohol, controversial weapons and gambling operations shall be excluded.

Best ESG Funds to Invest in India :

1. Axis ESG Equity Fund (axis-esg-equity-fund):

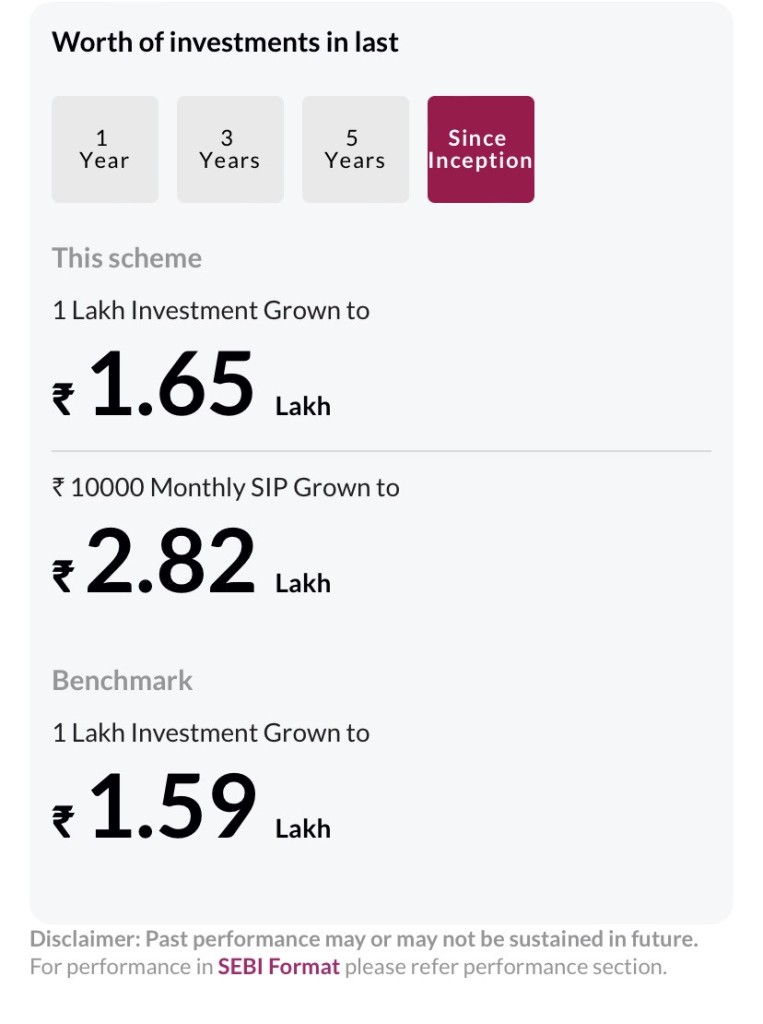

An Open-ended equity scheme investing in companies demonstrating sustainable practices across Environment, Social and Governance (ESG) theme. Return It has generated since inception :

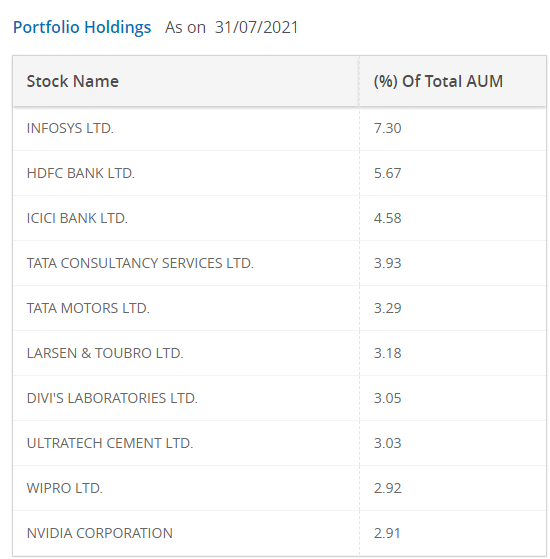

Holdings:

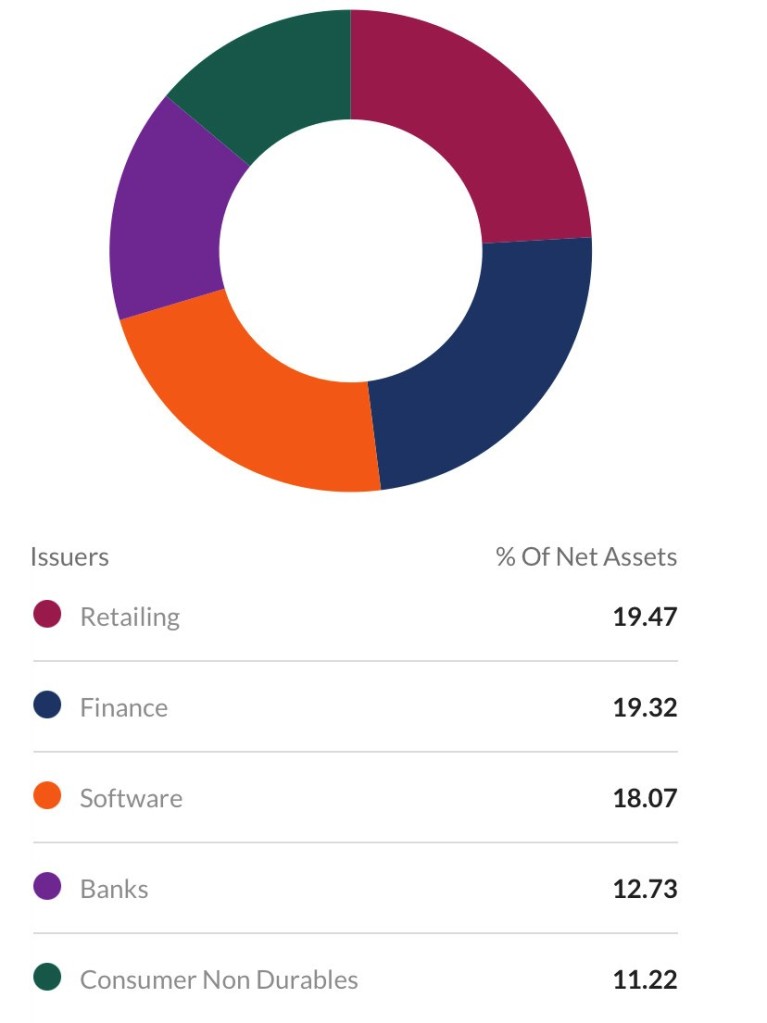

Top 5 Issuers :

2. SBI Magnum Equity ESG Fund(sbi-magnum-equity-esg-fund):

SBI Magnum Equity ESG Fund invests in companies following the Environmental, Social, and Governance (ESG) criteria.

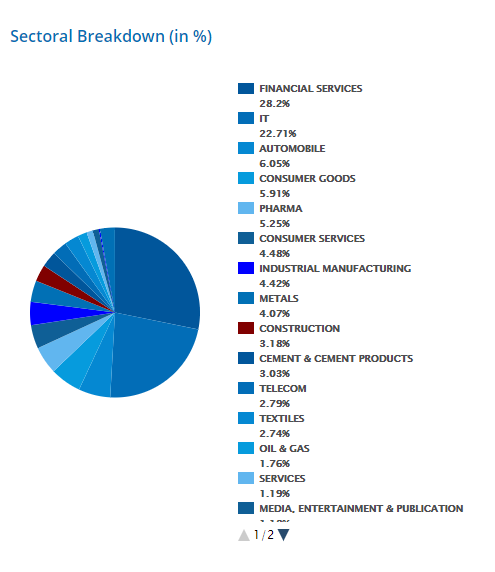

Sectoral Breakdown:

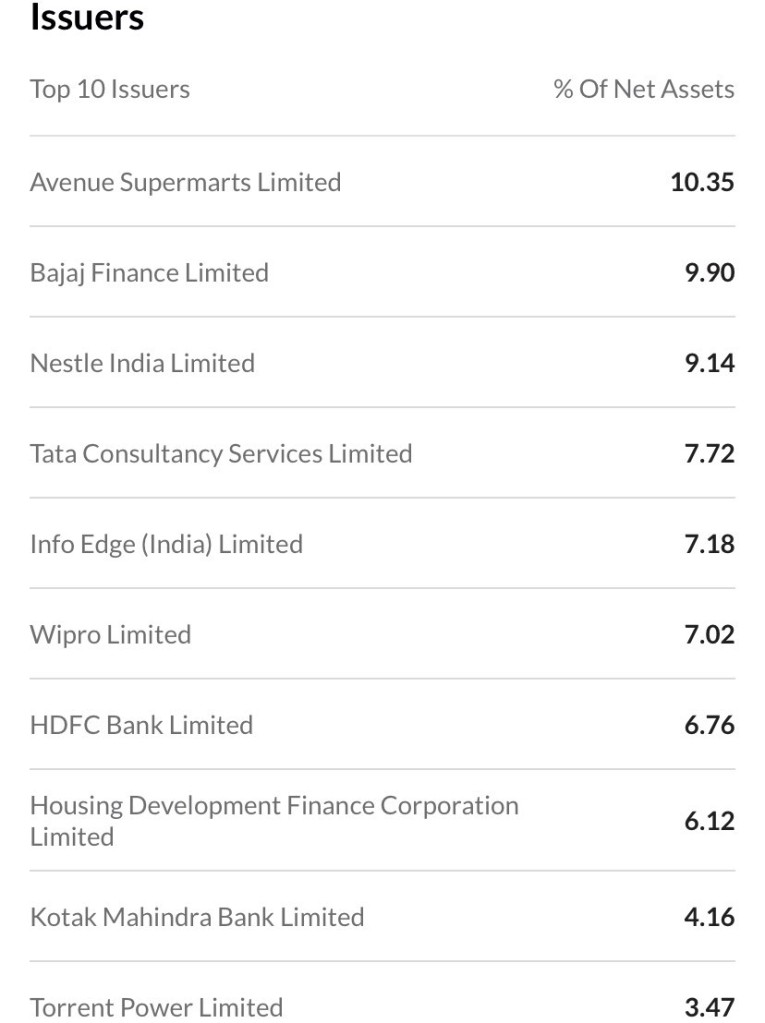

Top 10 Issuers :

Companies under ESG Funds are scrutinized and should follow the below requirements:

- Companies are scored across parameters from Governance, Social & Environmental aspects of the company’s management of its affairs.

- Active weights of a security are determined by the ESG scores. A positive score will enable a positive active weight, and vice-versa.

- ESG Fund invests 80-100% in equity & equity related instruments following ESG criteria and 0-20% can be invested in other equities and/or debt & money market instruments.

By Now you would have understood that ESG Funds are future of investment and you should have at-least one fund in your portfolio . Start with Best ESG Funds to Invest in India.

Please read our article on “Top 10 Fundamentally Strong Stocks to Invest in”: https://equitygyan74899394.wordpress.com/2021/10/22/top-10-fundamentally-strong-stocks-in-india-2021/

Talk to our Advisors and get your Investment plan Today.